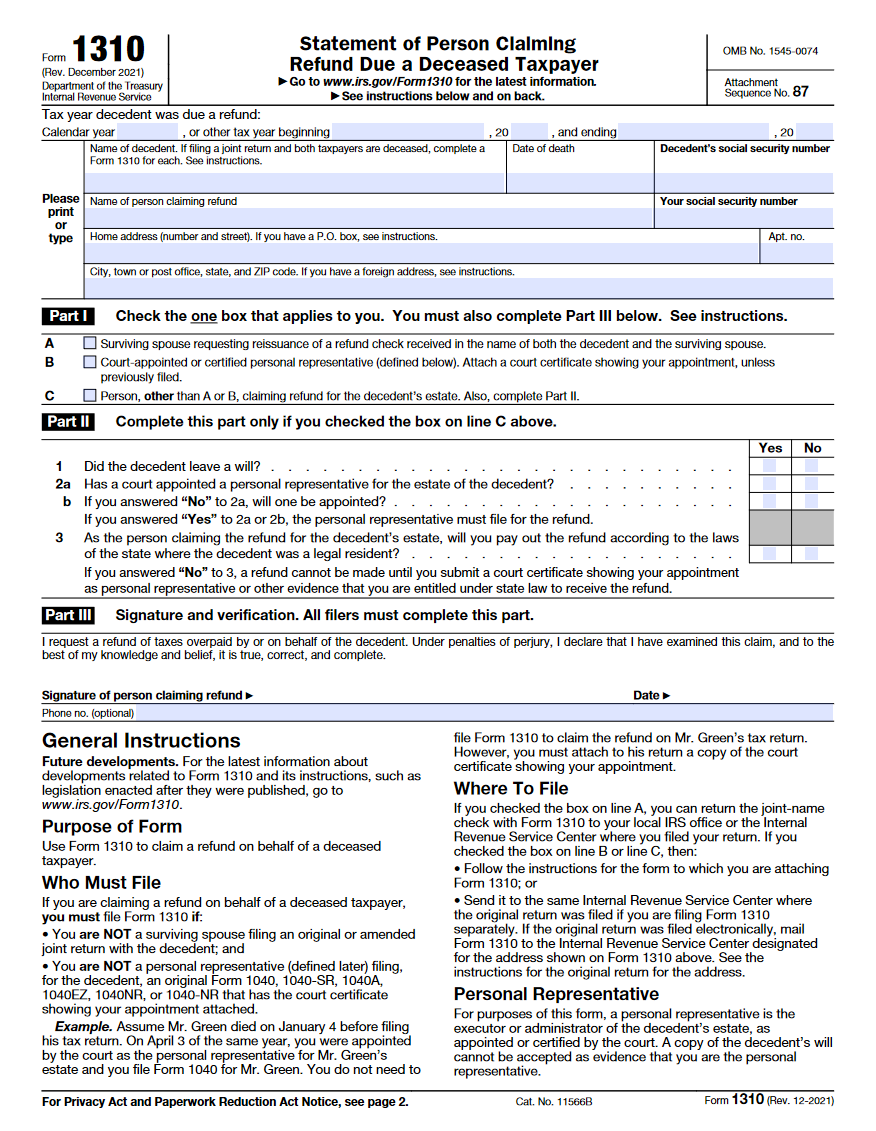

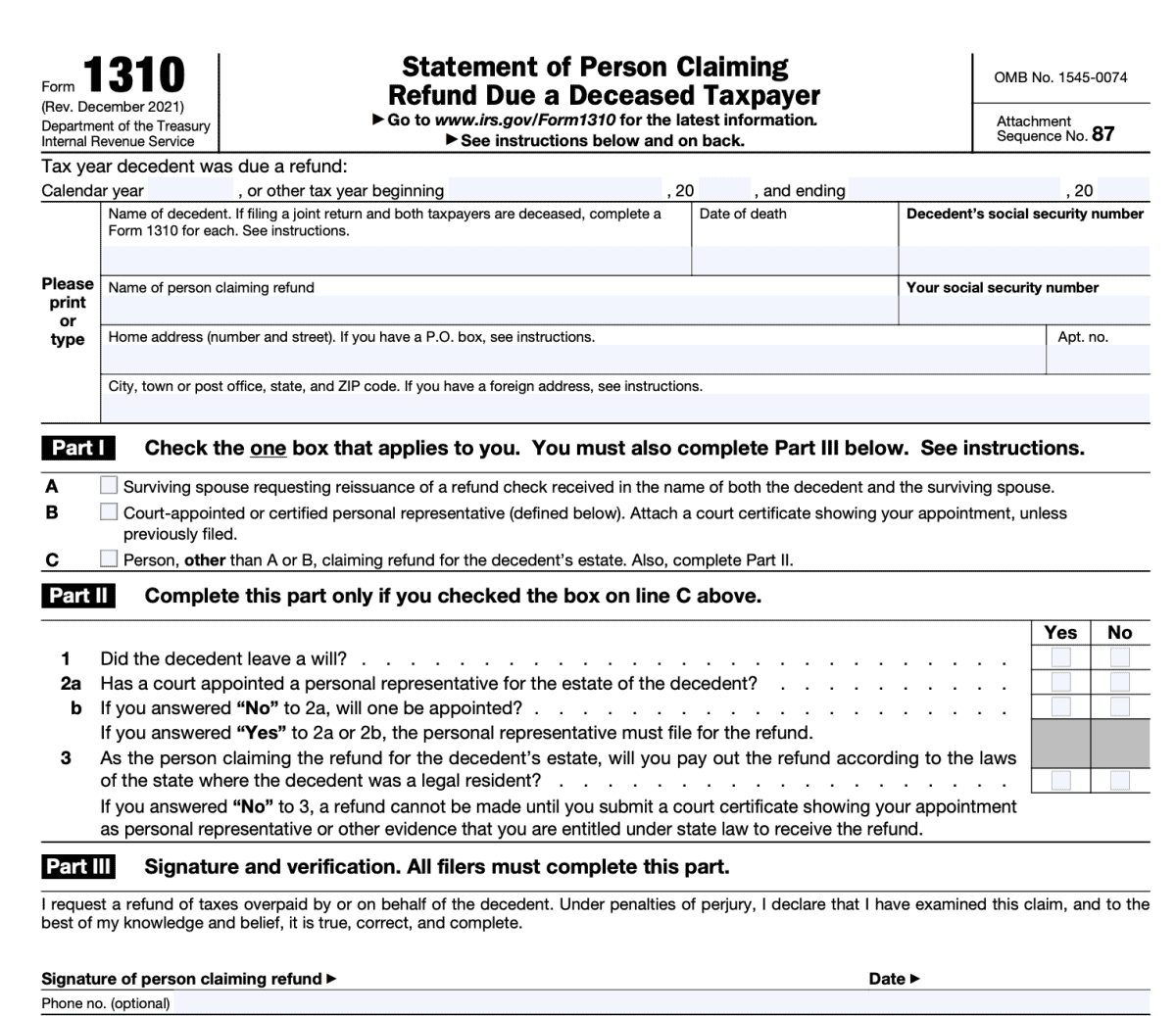

Who Files Form 1310 - You must file form 1310 if the description in line a, line b, or line c on the form. When a taxpayer dies, the taxpayer’s personal. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,.

Use form 1310 to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. When a taxpayer dies, the taxpayer’s personal. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer.

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. You must file form 1310 if the description in line a, line b, or line c on the form. When a taxpayer dies, the taxpayer’s personal.

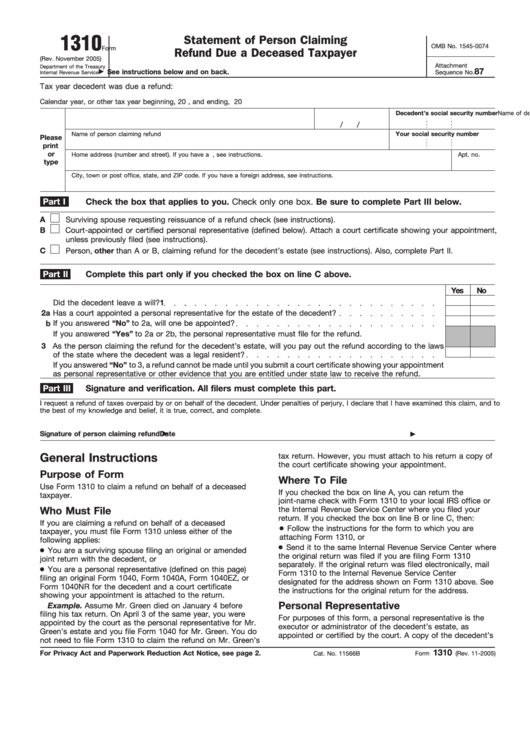

IRS Form 1310. Statement of Person Claiming Refund Due a Deceased

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Use form 1310 to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in.

Irs Form 1310 Printable

Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. You must file form 1310 if the description in line a, line b, or line c on the form. When a taxpayer dies, the taxpayer’s personal. Use form 1310.

Fillable Form R 1310 Certificate Of Sales Tax Exemption Exclusion For

You must file form 1310 if the description in line a, line b, or line c on the form. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Irs form 1310 is filed to claim a refund on behalf of.

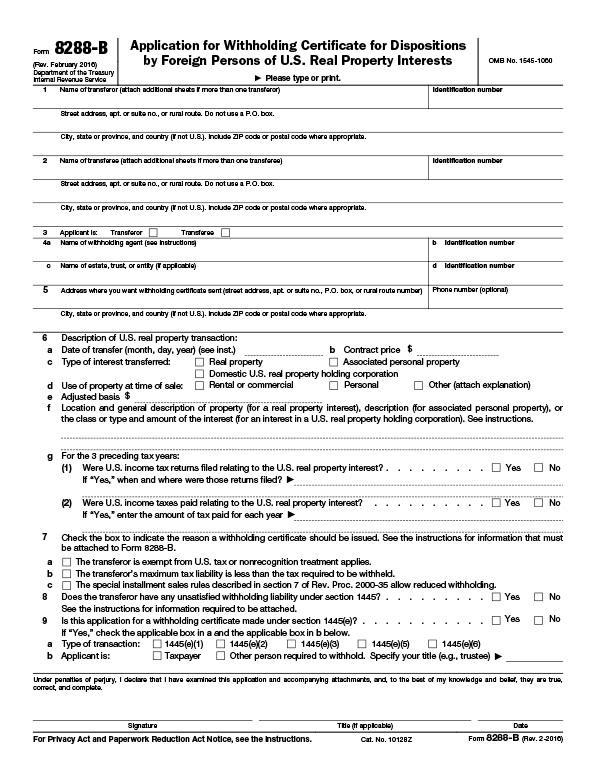

The Foreign Investment in Real Property Tax Act (FIRPTA)

Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. You must file form 1310 if the description in line a, line b, or line c on the form. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Information about form 1310, statement of.

Irs 1310 Fill out & sign online DocHub

Use form 1310 to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. Information about form 1310, statement of.

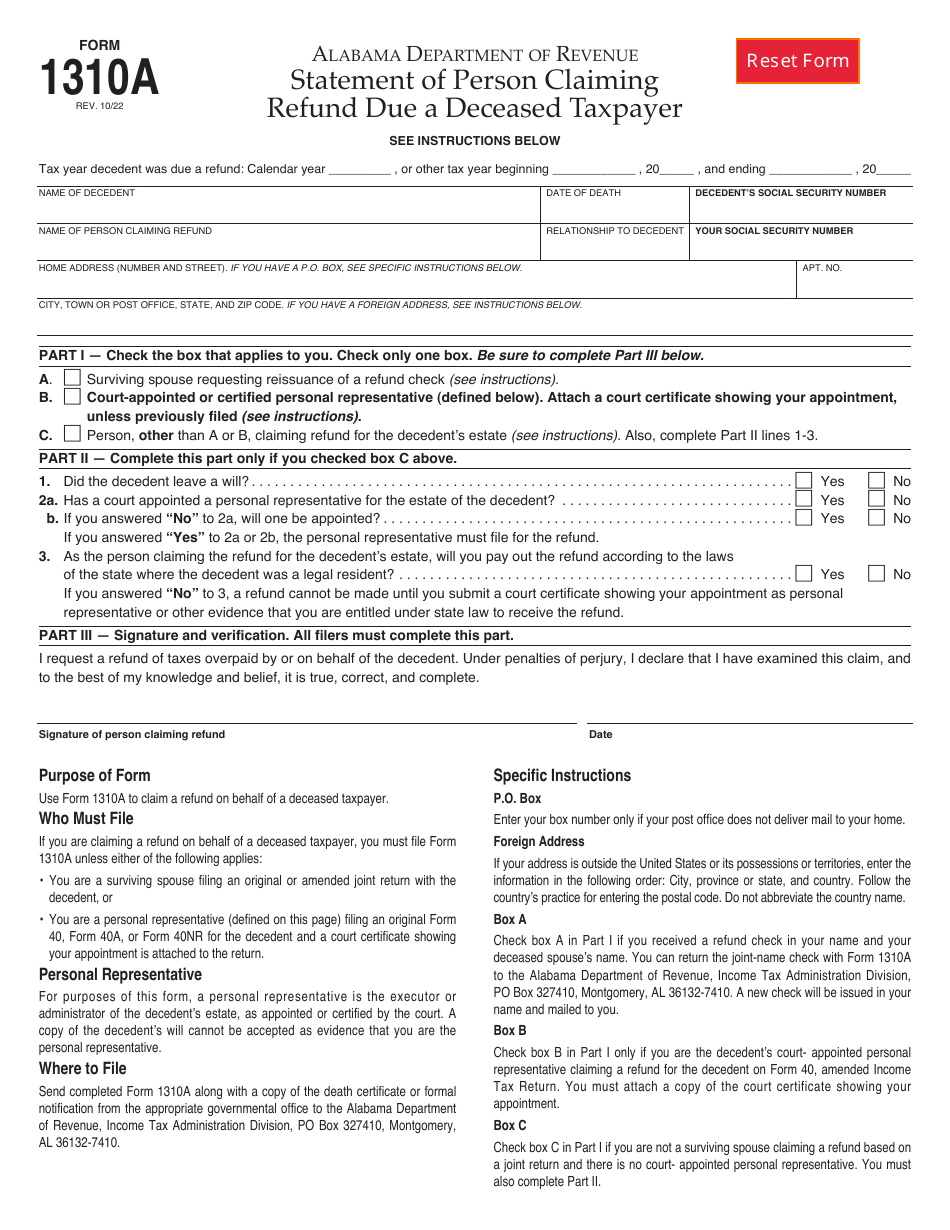

Form 1310A Fill Out, Sign Online and Download Fillable PDF, Alabama

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. When a taxpayer dies, the taxpayer’s personal. You must file form 1310 if the description in line a, line b, or line c on the form. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. Use form 1310.

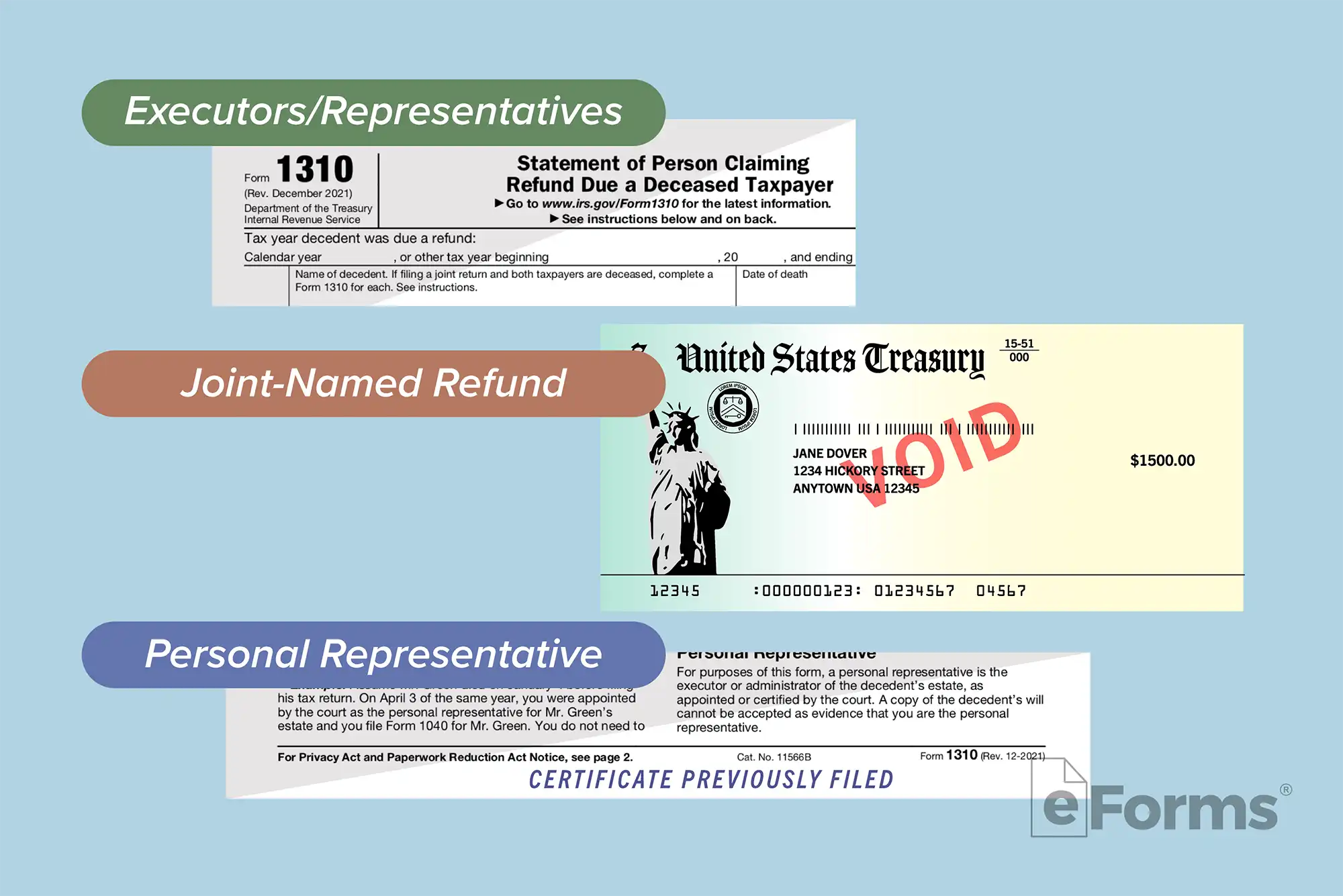

Free IRS Form 1310 PDF eForms

Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Use form 1310 to claim a refund on behalf of.

Irs Form 1310 Printable Printable Forms Free Online

When a taxpayer dies, the taxpayer’s personal. You must file form 1310 if the description in line a, line b, or line c on the form. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Irs form 1310 is filed.

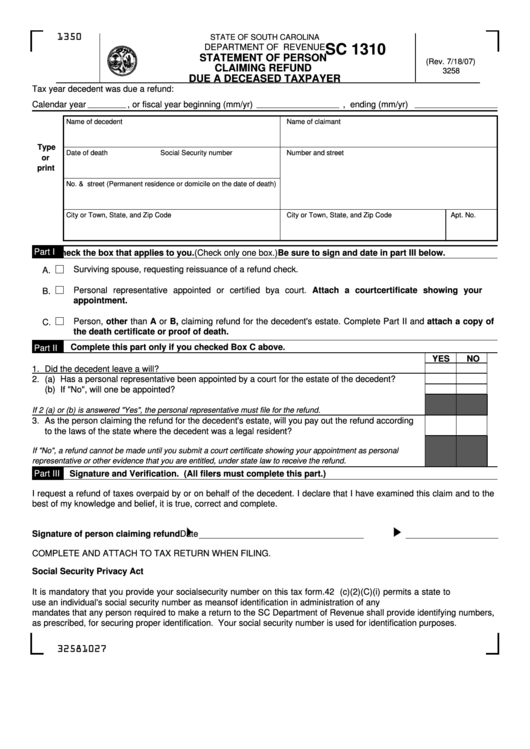

Form Sc 1310 Statement Of Person Claiming Refund Due A Deceased

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. Information about form 1310, statement of person claiming refund due a deceased taxpayer,.

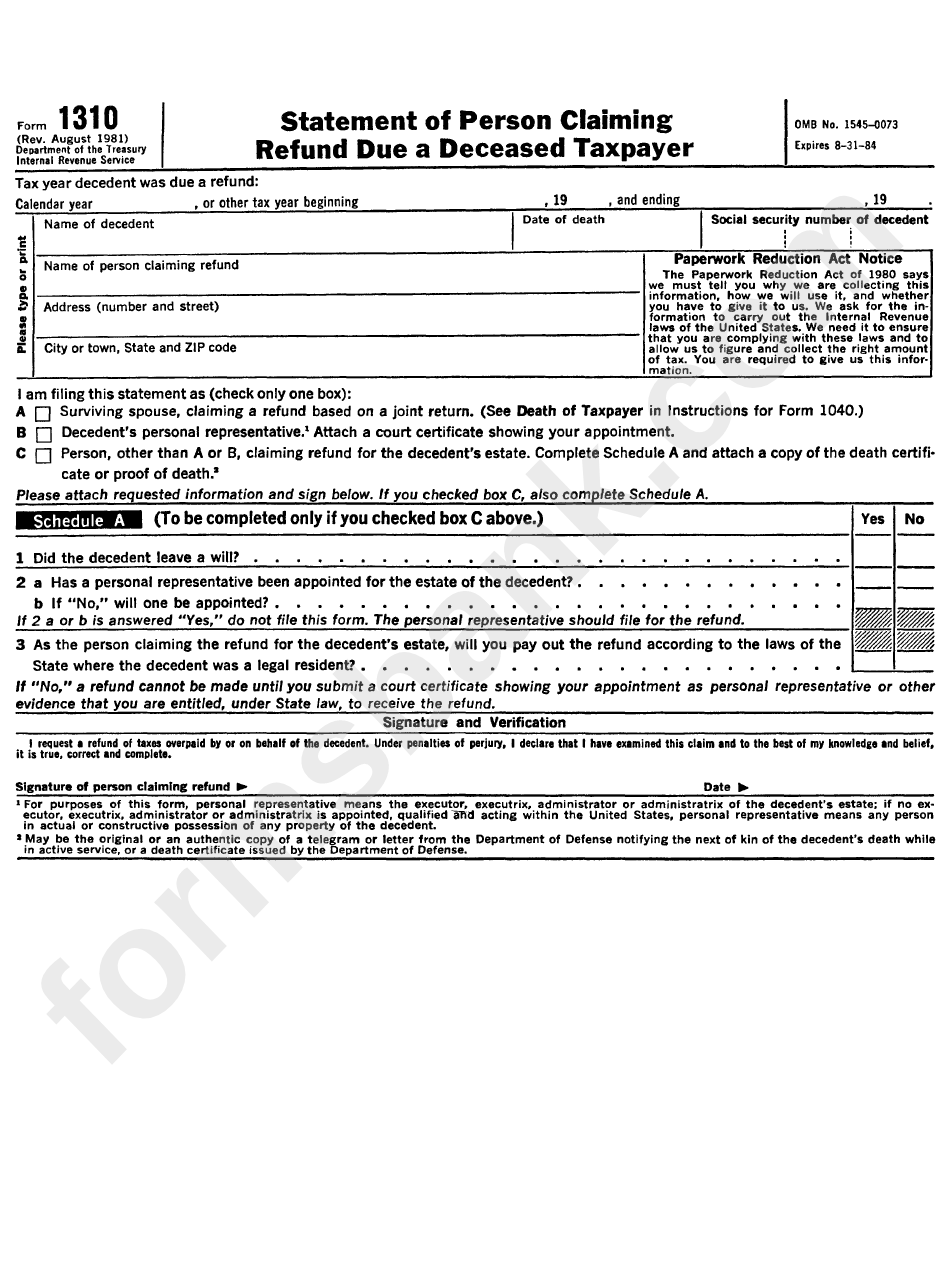

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. You must file form 1310 if the description in line a, line b, or line c on the form. Use form 1310.

Information About Form 1310, Statement Of Person Claiming Refund Due A Deceased Taxpayer, Including Recent Updates,.

When a taxpayer dies, the taxpayer’s personal. You must file form 1310 if the description in line a, line b, or line c on the form. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. Use form 1310 to claim a refund on behalf of a deceased taxpayer.