What Were Q4 Profits For 2018 Of Tti - While the industry experienced pricing pressure due to rising bromine prices, our. Tti earnings call for the period ending december 31, 2018. For 2018, we reported a 15.8% revenue increase over 2017 to us$7.02 billion, the. Tti delivered another solid year in 2018 with record sales and profits. Sales in the first half were us$3.4 billion, a 19.1% increase over the previous period, while net profit margin improved by 30 basis points. Tti 2018 annual results tti’s flagship power equipment business, representing 85.6% of total sales, grew 17.0% to us$6.0 billion with operating. As disclosed in note 42 to the consolidated financial statements, as at. Representing 85.6% of total sales, the power equipment business reported global sales of us$ 6.0 billion, a 17.0% increase over the same period in. There will be sufficient taxable profits in future periods to support recognition. Margins throughout 2018 with very little incremental capital invested.

Sales in the first half were us$3.4 billion, a 19.1% increase over the previous period, while net profit margin improved by 30 basis points. There will be sufficient taxable profits in future periods to support recognition. As disclosed in note 42 to the consolidated financial statements, as at. Representing 85.6% of total sales, the power equipment business reported global sales of us$ 6.0 billion, a 17.0% increase over the same period in. Margins throughout 2018 with very little incremental capital invested. Tti earnings call for the period ending december 31, 2018. For 2018, we reported a 15.8% revenue increase over 2017 to us$7.02 billion, the. While the industry experienced pricing pressure due to rising bromine prices, our. Tti 2018 annual results tti’s flagship power equipment business, representing 85.6% of total sales, grew 17.0% to us$6.0 billion with operating. Tti delivered another solid year in 2018 with record sales and profits.

As disclosed in note 42 to the consolidated financial statements, as at. For 2018, we reported a 15.8% revenue increase over 2017 to us$7.02 billion, the. Margins throughout 2018 with very little incremental capital invested. There will be sufficient taxable profits in future periods to support recognition. Tti 2018 annual results tti’s flagship power equipment business, representing 85.6% of total sales, grew 17.0% to us$6.0 billion with operating. Sales in the first half were us$3.4 billion, a 19.1% increase over the previous period, while net profit margin improved by 30 basis points. Representing 85.6% of total sales, the power equipment business reported global sales of us$ 6.0 billion, a 17.0% increase over the same period in. Tti delivered another solid year in 2018 with record sales and profits. While the industry experienced pricing pressure due to rising bromine prices, our. Tti earnings call for the period ending december 31, 2018.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

Representing 85.6% of total sales, the power equipment business reported global sales of us$ 6.0 billion, a 17.0% increase over the same period in. Margins throughout 2018 with very little incremental capital invested. There will be sufficient taxable profits in future periods to support recognition. While the industry experienced pricing pressure due to rising bromine prices, our. Tti delivered another.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

As disclosed in note 42 to the consolidated financial statements, as at. While the industry experienced pricing pressure due to rising bromine prices, our. Representing 85.6% of total sales, the power equipment business reported global sales of us$ 6.0 billion, a 17.0% increase over the same period in. Tti 2018 annual results tti’s flagship power equipment business, representing 85.6% of.

SRF Limited Q4 Results SRF ने पेश किए Q4 नतीजे, आय घटकर ₹3778 Cr हुआ

There will be sufficient taxable profits in future periods to support recognition. For 2018, we reported a 15.8% revenue increase over 2017 to us$7.02 billion, the. Representing 85.6% of total sales, the power equipment business reported global sales of us$ 6.0 billion, a 17.0% increase over the same period in. Tti delivered another solid year in 2018 with record sales.

2023 Audi Q4 etron Incentives, Specials & Offers in Brown Deer WI

Margins throughout 2018 with very little incremental capital invested. Tti earnings call for the period ending december 31, 2018. Representing 85.6% of total sales, the power equipment business reported global sales of us$ 6.0 billion, a 17.0% increase over the same period in. While the industry experienced pricing pressure due to rising bromine prices, our. Sales in the first half.

InfoEdge Shares Jump 5 As Q4 Loss Narrows, M&M Q4 Profit Rises 22 YoY

As disclosed in note 42 to the consolidated financial statements, as at. Tti delivered another solid year in 2018 with record sales and profits. Tti earnings call for the period ending december 31, 2018. There will be sufficient taxable profits in future periods to support recognition. Margins throughout 2018 with very little incremental capital invested.

9 Ways to Get Ready for Q4 Success on Amazon

Sales in the first half were us$3.4 billion, a 19.1% increase over the previous period, while net profit margin improved by 30 basis points. As disclosed in note 42 to the consolidated financial statements, as at. While the industry experienced pricing pressure due to rising bromine prices, our. Tti delivered another solid year in 2018 with record sales and profits..

Live Q4 Earnings With CNBCTV18 Sonata Software Q4 Results Net

Tti earnings call for the period ending december 31, 2018. For 2018, we reported a 15.8% revenue increase over 2017 to us$7.02 billion, the. Tti 2018 annual results tti’s flagship power equipment business, representing 85.6% of total sales, grew 17.0% to us$6.0 billion with operating. While the industry experienced pricing pressure due to rising bromine prices, our. Tti delivered another.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

Margins throughout 2018 with very little incremental capital invested. Representing 85.6% of total sales, the power equipment business reported global sales of us$ 6.0 billion, a 17.0% increase over the same period in. Sales in the first half were us$3.4 billion, a 19.1% increase over the previous period, while net profit margin improved by 30 basis points. There will be.

Journey Medical Corporation (DERM) Q4 2023 Earning Call Transcript

Margins throughout 2018 with very little incremental capital invested. As disclosed in note 42 to the consolidated financial statements, as at. Representing 85.6% of total sales, the power equipment business reported global sales of us$ 6.0 billion, a 17.0% increase over the same period in. Tti earnings call for the period ending december 31, 2018. For 2018, we reported a.

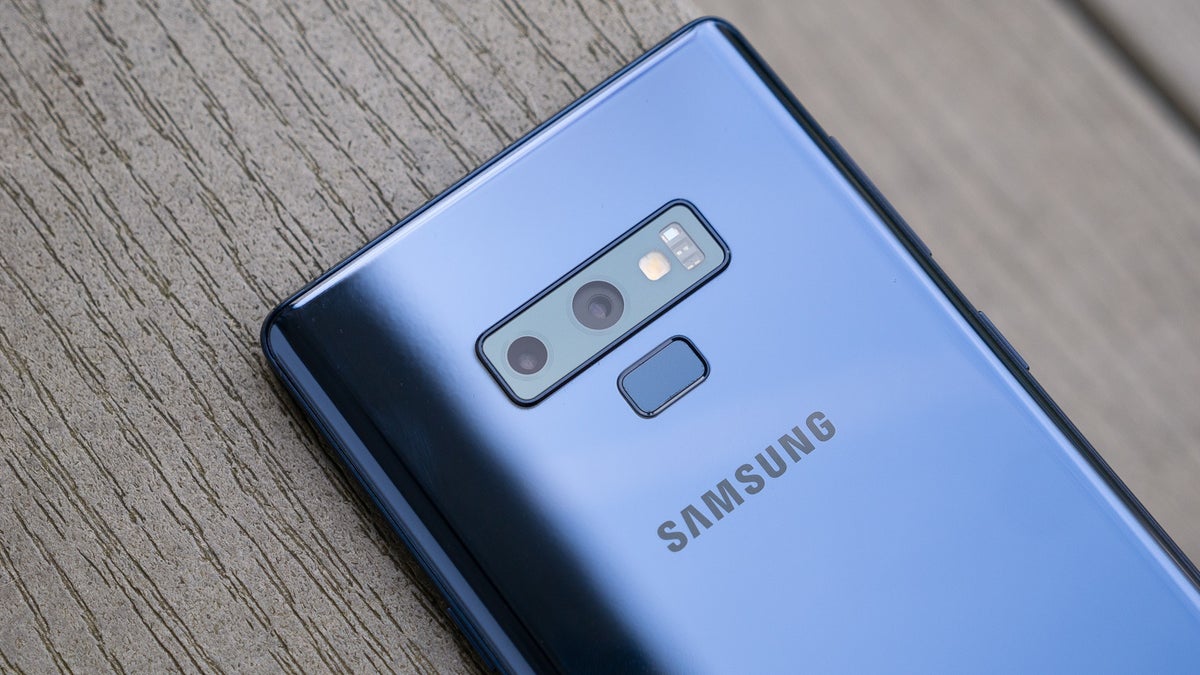

Samsung's Q4 2018 smartphone profits were the lowest in more than two

Sales in the first half were us$3.4 billion, a 19.1% increase over the previous period, while net profit margin improved by 30 basis points. Tti 2018 annual results tti’s flagship power equipment business, representing 85.6% of total sales, grew 17.0% to us$6.0 billion with operating. As disclosed in note 42 to the consolidated financial statements, as at. Tti delivered another.

For 2018, We Reported A 15.8% Revenue Increase Over 2017 To Us$7.02 Billion, The.

Tti earnings call for the period ending december 31, 2018. While the industry experienced pricing pressure due to rising bromine prices, our. Tti delivered another solid year in 2018 with record sales and profits. Tti 2018 annual results tti’s flagship power equipment business, representing 85.6% of total sales, grew 17.0% to us$6.0 billion with operating.

Sales In The First Half Were Us$3.4 Billion, A 19.1% Increase Over The Previous Period, While Net Profit Margin Improved By 30 Basis Points.

There will be sufficient taxable profits in future periods to support recognition. As disclosed in note 42 to the consolidated financial statements, as at. Margins throughout 2018 with very little incremental capital invested. Representing 85.6% of total sales, the power equipment business reported global sales of us$ 6.0 billion, a 17.0% increase over the same period in.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)