What Were Q4 Profits For 2018 Of Hclp - For q1, the partnership expects total sales volumes in the range of 2.4. As of june 30, 2018, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common. Moving to depreciation, depletion and including the amortization of intangibles, dd&a totaled $9.8 million for the fourth quarter of 2018 compared.

Moving to depreciation, depletion and including the amortization of intangibles, dd&a totaled $9.8 million for the fourth quarter of 2018 compared. For q1, the partnership expects total sales volumes in the range of 2.4. As of june 30, 2018, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common.

As of june 30, 2018, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common. Moving to depreciation, depletion and including the amortization of intangibles, dd&a totaled $9.8 million for the fourth quarter of 2018 compared. For q1, the partnership expects total sales volumes in the range of 2.4.

Thursday November 15, 2018, Today Stock Market Short Term Stock Trading

As of june 30, 2018, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common. For q1, the partnership expects total sales volumes in the range of 2.4. Moving to depreciation, depletion and including the amortization of intangibles, dd&a totaled $9.8 million for the fourth quarter of 2018 compared.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

For q1, the partnership expects total sales volumes in the range of 2.4. As of june 30, 2018, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common. Moving to depreciation, depletion and including the amortization of intangibles, dd&a totaled $9.8 million for the fourth quarter of 2018 compared.

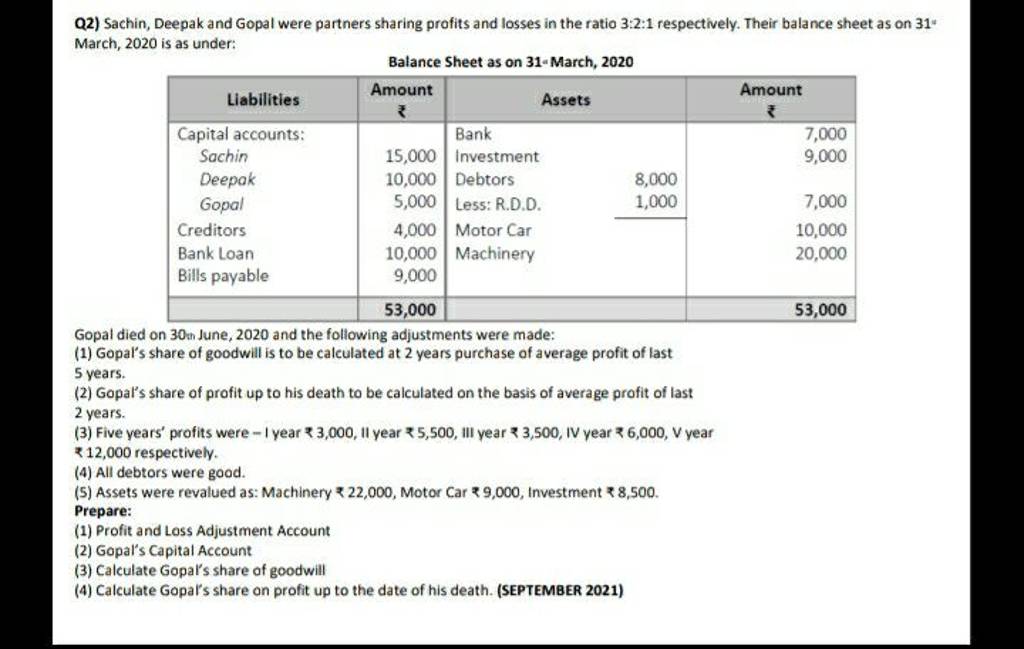

Q2) Sachin, Deepak and Gopal were partners sharing profits and losses in

For q1, the partnership expects total sales volumes in the range of 2.4. Moving to depreciation, depletion and including the amortization of intangibles, dd&a totaled $9.8 million for the fourth quarter of 2018 compared. As of june 30, 2018, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common.

KARATE FINAL PUTRA 60KG ASIAN GAMES 2018 ANTARA Foto

For q1, the partnership expects total sales volumes in the range of 2.4. Moving to depreciation, depletion and including the amortization of intangibles, dd&a totaled $9.8 million for the fourth quarter of 2018 compared. As of june 30, 2018, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common.

2023 Audi Q4 etron Incentives, Specials & Offers in Brown Deer WI

For q1, the partnership expects total sales volumes in the range of 2.4. As of june 30, 2018, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common. Moving to depreciation, depletion and including the amortization of intangibles, dd&a totaled $9.8 million for the fourth quarter of 2018 compared.

level cleared /1subscription =1motivation YouTube

As of june 30, 2018, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common. Moving to depreciation, depletion and including the amortization of intangibles, dd&a totaled $9.8 million for the fourth quarter of 2018 compared. For q1, the partnership expects total sales volumes in the range of 2.4.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

As of june 30, 2018, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common. Moving to depreciation, depletion and including the amortization of intangibles, dd&a totaled $9.8 million for the fourth quarter of 2018 compared. For q1, the partnership expects total sales volumes in the range of 2.4.

Samsung's Q4 2018 smartphone profits were the lowest in more than two

Moving to depreciation, depletion and including the amortization of intangibles, dd&a totaled $9.8 million for the fourth quarter of 2018 compared. For q1, the partnership expects total sales volumes in the range of 2.4. As of june 30, 2018, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common.

They were only looking out for their own best interest! This decision

As of june 30, 2018, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common. For q1, the partnership expects total sales volumes in the range of 2.4. Moving to depreciation, depletion and including the amortization of intangibles, dd&a totaled $9.8 million for the fourth quarter of 2018 compared.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

As of june 30, 2018, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common. For q1, the partnership expects total sales volumes in the range of 2.4. Moving to depreciation, depletion and including the amortization of intangibles, dd&a totaled $9.8 million for the fourth quarter of 2018 compared.

For Q1, The Partnership Expects Total Sales Volumes In The Range Of 2.4.

As of june 30, 2018, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common. Moving to depreciation, depletion and including the amortization of intangibles, dd&a totaled $9.8 million for the fourth quarter of 2018 compared.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)