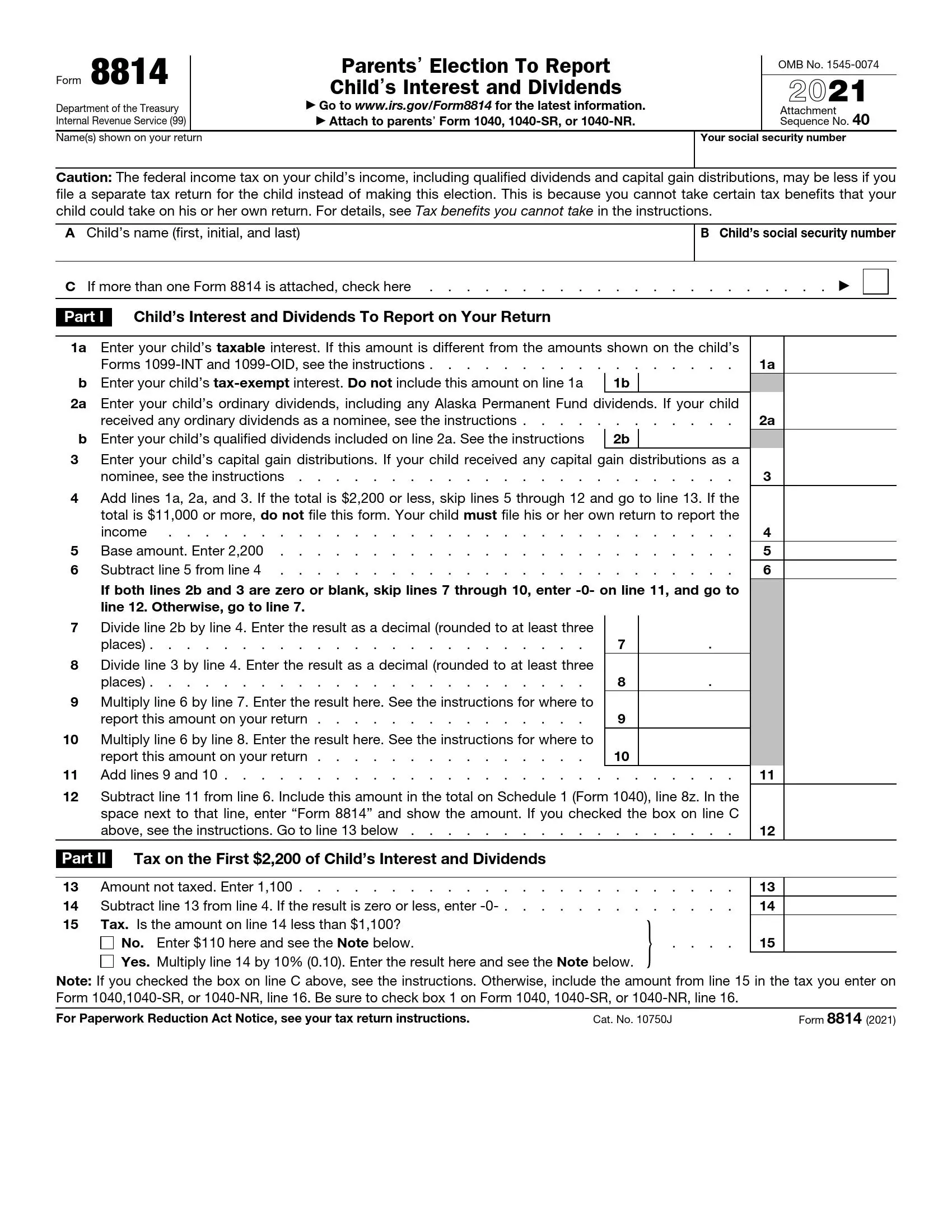

What Is Form 8814 Used For - Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use to. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. What is irs form 8814? If you choose this election, your child may not have. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. The form will help you calculate the.

Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use to. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. If you choose this election, your child may not have. The form will help you calculate the. What is irs form 8814?

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. What is irs form 8814? Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use to. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. The form will help you calculate the. If you choose this election, your child may not have. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating.

IRS Form 8814 What Is It & Who Is Required To File? SuperMoney

Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. If you choose this election, your child may not have. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and. If the child doesn't qualify for a form 8814 election, file form 8615 with.

Form 8814 All in One Guide 2024 US Expat Tax Service

The form will help you calculate the. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating. What is irs form 8814? If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Irs form 8814, parents’ election to report child’s.

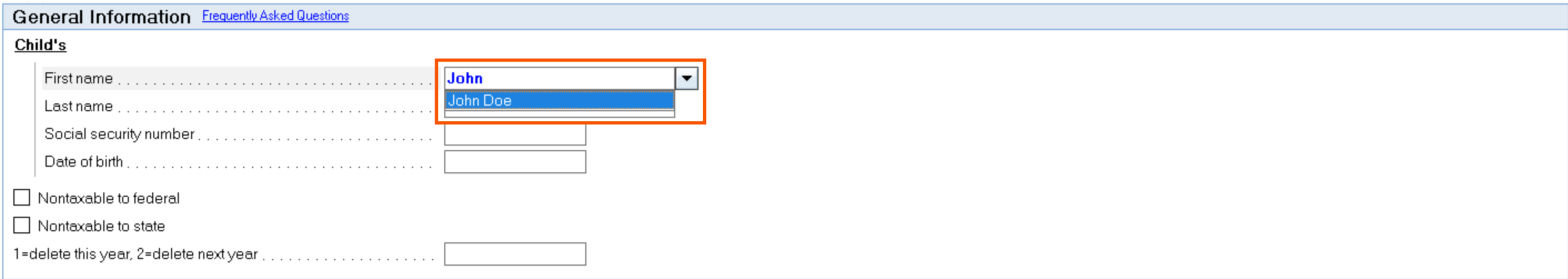

Generating Form 8814 in Lacerte

The form will help you calculate the. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. If you choose this election, your child may not have. What is irs form 8814? Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and.

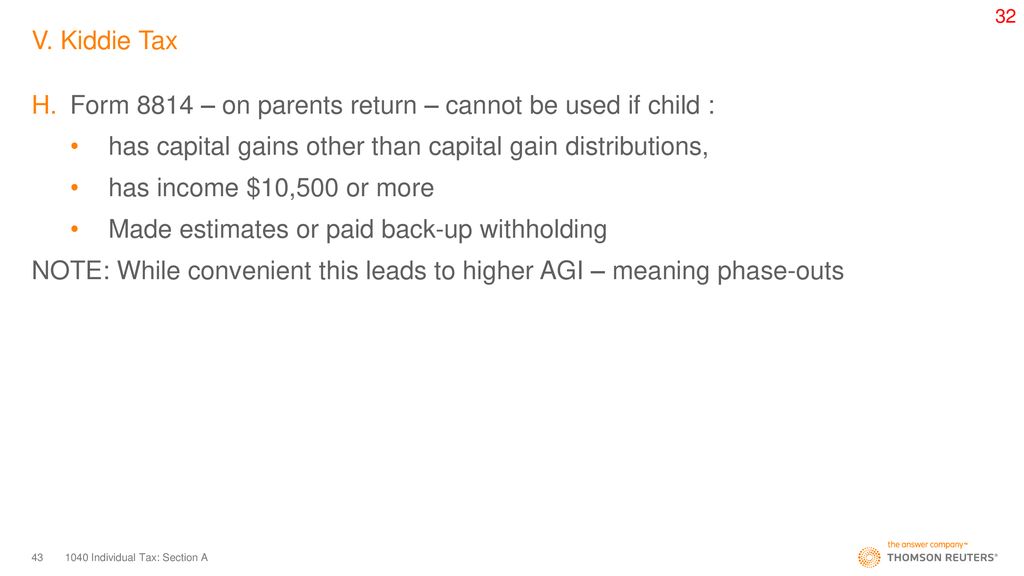

1040 Individual Tax Section A ppt download

Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use to. What is irs form 8814? The form will help you calculate the. If the child doesn't qualify for a form 8814 election, file.

IRS Form 8814 Instructions Your Child's Interest & Dividends

The form will help you calculate the. What is irs form 8814? Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. If you choose this election, your child may not have. Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax.

IRS Form 8814 (Kiddie Taxes) How to Complete YouTube

The form will help you calculate the. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may.

8814 Form 2024

Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use to. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and. If you choose this election,.

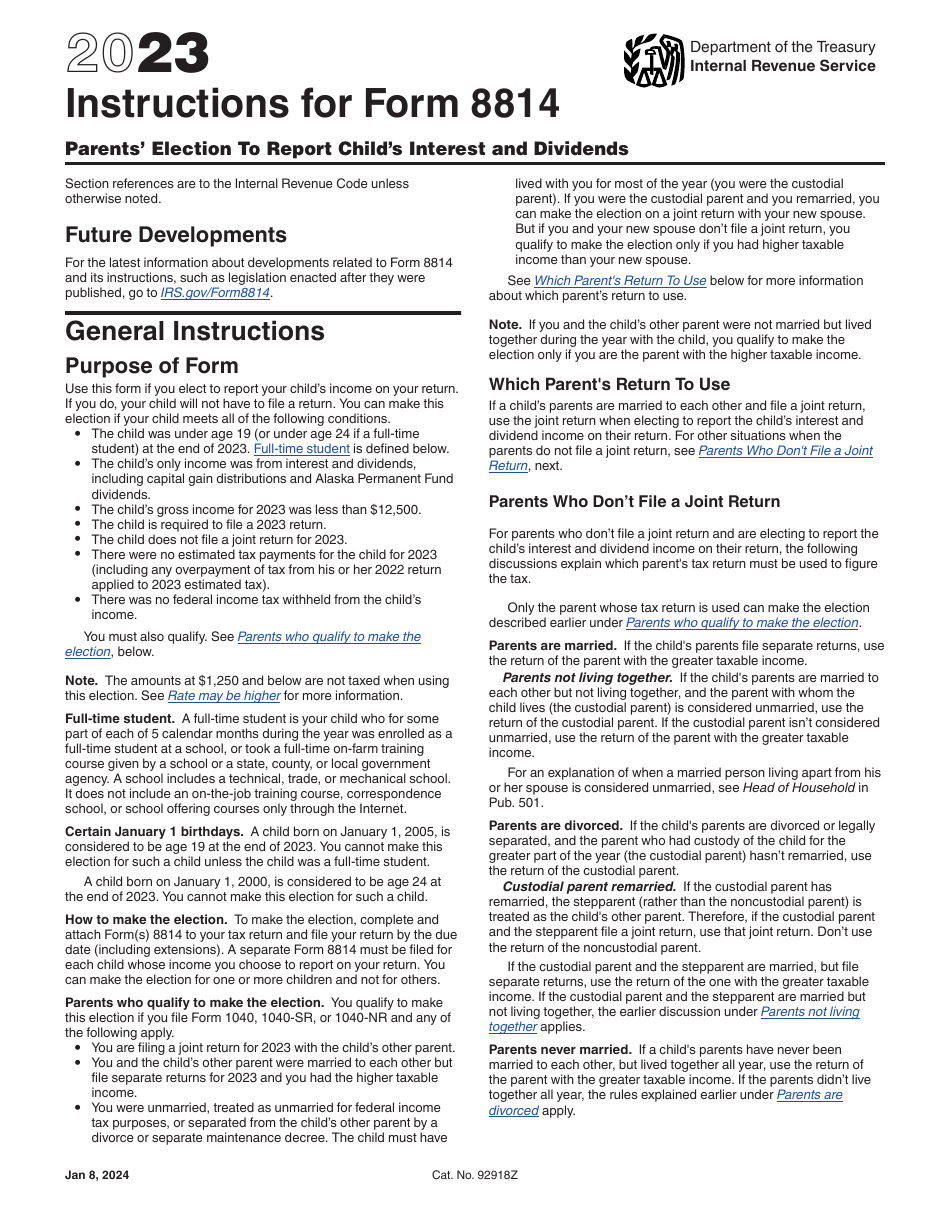

Download Instructions for IRS Form 8814 Parents' Election to Report

Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and. What is irs form 8814? If you choose this election, your child may not have. Irs form 8814, parents’ election.

IRS Form 8814 ≡ Fill Out Printable PDF Forms Online

The form will help you calculate the. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. What is irs form 8814? Irs form 8814 allows parents to report their child’s unearned income—such as.

U.S. TREAS Form treasirs88142001

Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Irs form 8814, parents’ election to report child’s interest and dividends, is the tax form parents may use to. What is irs form 8814? If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return..

Form 8814 Will Be Used If You Elect To Report Your Child's Interest/Dividend Income On Your Tax Return.

Irs form 8814 allows parents to report their child’s unearned income—such as dividends, interest, or capital gains—on their own tax return, eliminating. What is irs form 8814? If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and.

Irs Form 8814, Parents’ Election To Report Child’s Interest And Dividends, Is The Tax Form Parents May Use To.

If you choose this election, your child may not have. The form will help you calculate the.