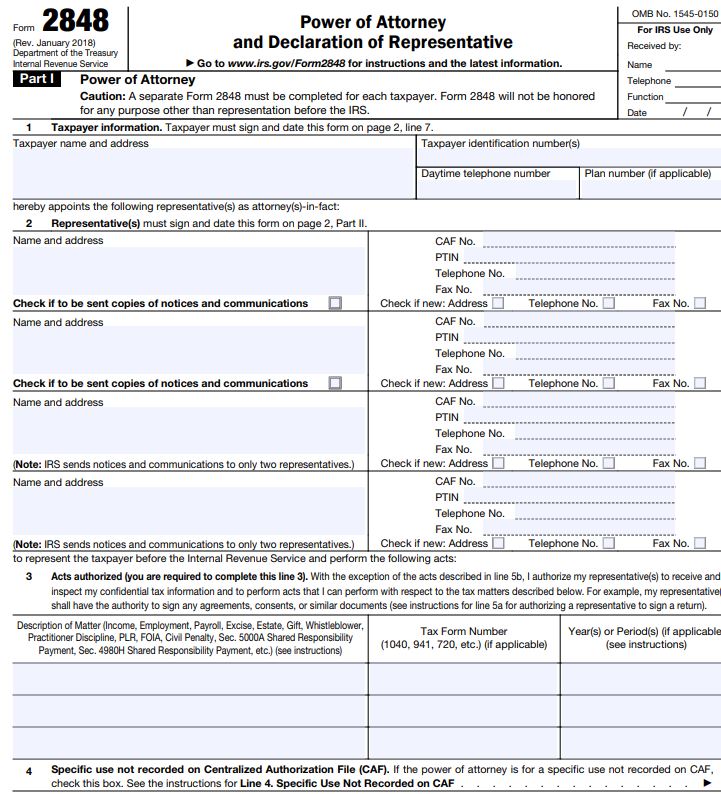

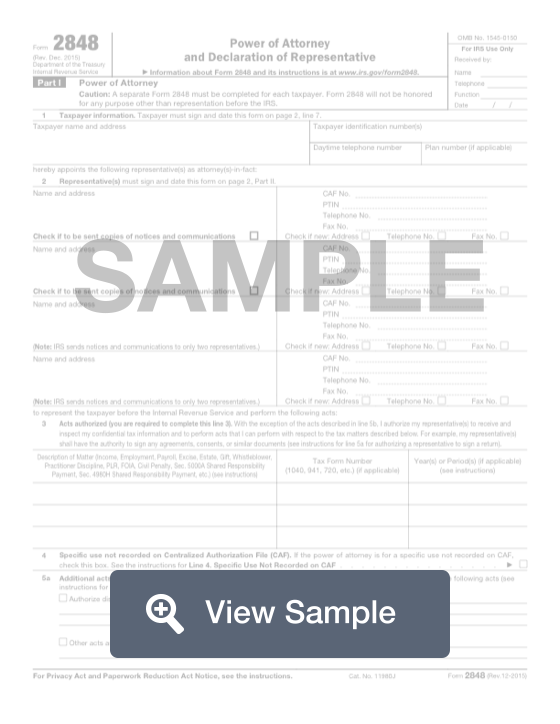

What Is Form 2848 - You must sign and date the form, and the. Information about form 2848, power of. Use form 2848 to authorize an individual to represent you before the irs. Form 2848 is used to appoint a representative to act on your behalf before the irs for various tax matters. See substitute form 2848, later, for information about using a power of. Form 2848 is used to authorize an eligible individual to represent another person before the irs. However, if you want to delegate, the irs requires you to file form 2848 to give someone specific.

Information about form 2848, power of. Form 2848 is used to authorize an eligible individual to represent another person before the irs. However, if you want to delegate, the irs requires you to file form 2848 to give someone specific. See substitute form 2848, later, for information about using a power of. You must sign and date the form, and the. Form 2848 is used to appoint a representative to act on your behalf before the irs for various tax matters. Use form 2848 to authorize an individual to represent you before the irs.

See substitute form 2848, later, for information about using a power of. You must sign and date the form, and the. Use form 2848 to authorize an individual to represent you before the irs. However, if you want to delegate, the irs requires you to file form 2848 to give someone specific. Form 2848 is used to appoint a representative to act on your behalf before the irs for various tax matters. Information about form 2848, power of. Form 2848 is used to authorize an eligible individual to represent another person before the irs.

Instructions for Form 2848 IRS Tax Lawyer

See substitute form 2848, later, for information about using a power of. Information about form 2848, power of. Form 2848 is used to authorize an eligible individual to represent another person before the irs. Use form 2848 to authorize an individual to represent you before the irs. You must sign and date the form, and the.

Form 2848 [PDF] Download Fillable IRS Power Of Attorney

You must sign and date the form, and the. Form 2848 is used to appoint a representative to act on your behalf before the irs for various tax matters. See substitute form 2848, later, for information about using a power of. Use form 2848 to authorize an individual to represent you before the irs. However, if you want to delegate,.

Purpose of IRS Form 2848 How to fill & Instructions Accounts Confidant

Use form 2848 to authorize an individual to represent you before the irs. Form 2848 is used to authorize an eligible individual to represent another person before the irs. You must sign and date the form, and the. However, if you want to delegate, the irs requires you to file form 2848 to give someone specific. See substitute form 2848,.

Iowa Form 2848 Instructions Form example download

Use form 2848 to authorize an individual to represent you before the irs. Information about form 2848, power of. Form 2848 is used to authorize an eligible individual to represent another person before the irs. See substitute form 2848, later, for information about using a power of. Form 2848 is used to appoint a representative to act on your behalf.

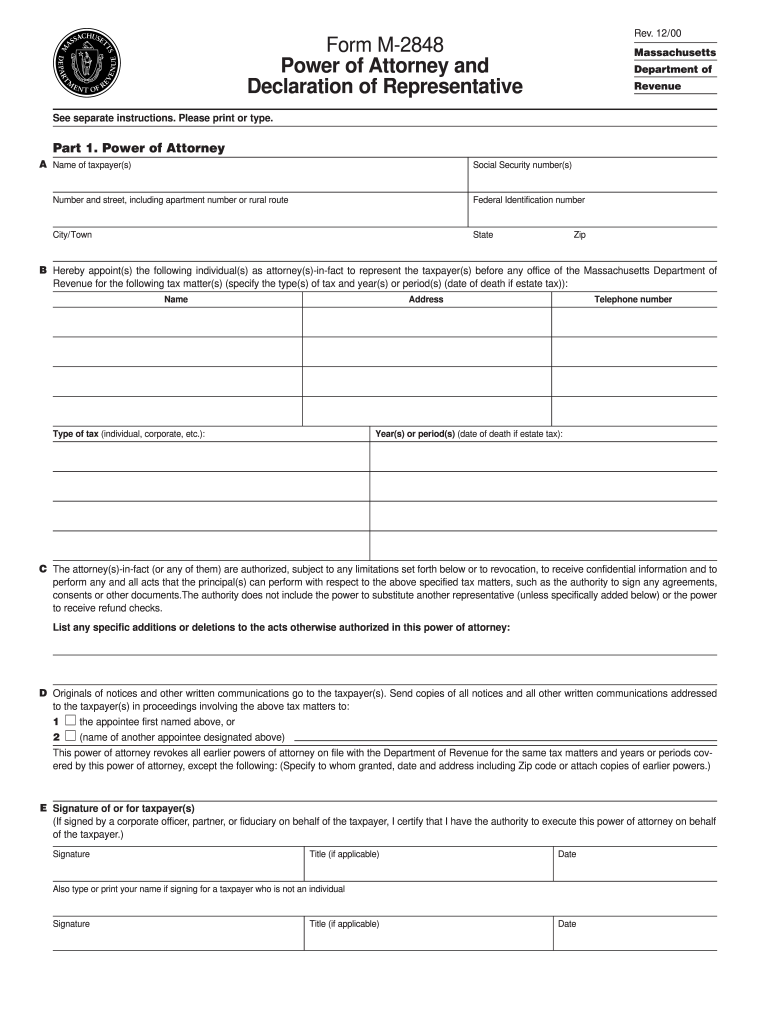

M 2848 Fill in Form Fill Out and Sign Printable PDF Template

Form 2848 is used to authorize an eligible individual to represent another person before the irs. However, if you want to delegate, the irs requires you to file form 2848 to give someone specific. See substitute form 2848, later, for information about using a power of. Form 2848 is used to appoint a representative to act on your behalf before.

Form 2848 Example PDF

See substitute form 2848, later, for information about using a power of. Form 2848 is used to authorize an eligible individual to represent another person before the irs. Information about form 2848, power of. Form 2848 is used to appoint a representative to act on your behalf before the irs for various tax matters. However, if you want to delegate,.

Form 2848 Edit, Fill, Sign Online Handypdf

Use form 2848 to authorize an individual to represent you before the irs. Information about form 2848, power of. Form 2848 is used to appoint a representative to act on your behalf before the irs for various tax matters. See substitute form 2848, later, for information about using a power of. You must sign and date the form, and the.

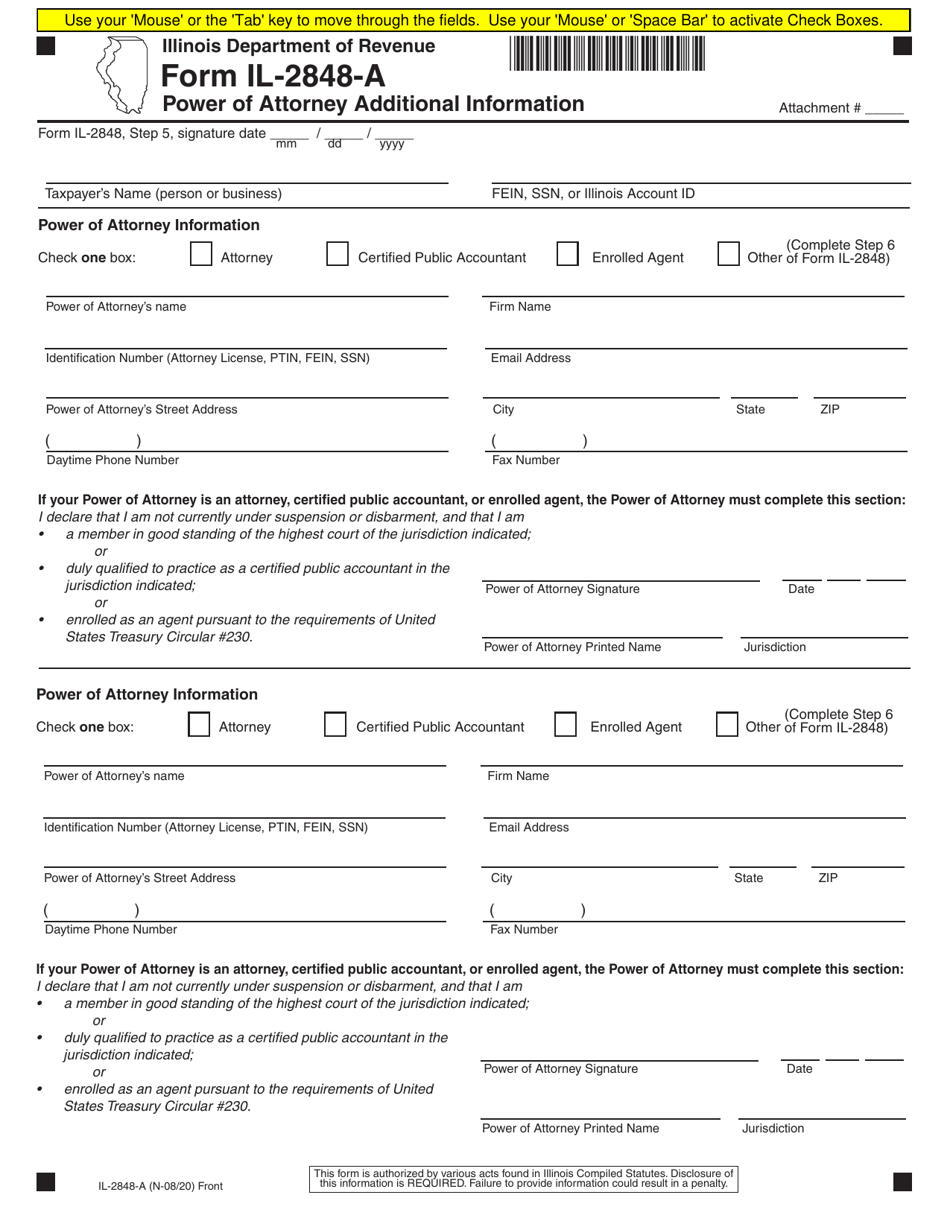

Form IL2848A Fill Out, Sign Online and Download Fillable PDF

Form 2848 is used to authorize an eligible individual to represent another person before the irs. You must sign and date the form, and the. Use form 2848 to authorize an individual to represent you before the irs. Information about form 2848, power of. However, if you want to delegate, the irs requires you to file form 2848 to give.

ICANN Application for TaxExempt Status (U.S.) Form 2848 Page 2

See substitute form 2848, later, for information about using a power of. Form 2848 is used to appoint a representative to act on your behalf before the irs for various tax matters. However, if you want to delegate, the irs requires you to file form 2848 to give someone specific. Form 2848 is used to authorize an eligible individual to.

Form 2848 Fill Out Online IRS Power of Attorney Instructions FormSwift

You must sign and date the form, and the. However, if you want to delegate, the irs requires you to file form 2848 to give someone specific. Use form 2848 to authorize an individual to represent you before the irs. Form 2848 is used to appoint a representative to act on your behalf before the irs for various tax matters..

See Substitute Form 2848, Later, For Information About Using A Power Of.

Form 2848 is used to appoint a representative to act on your behalf before the irs for various tax matters. Form 2848 is used to authorize an eligible individual to represent another person before the irs. You must sign and date the form, and the. However, if you want to delegate, the irs requires you to file form 2848 to give someone specific.

Information About Form 2848, Power Of.

Use form 2848 to authorize an individual to represent you before the irs.

![Form 2848 [PDF] Download Fillable IRS Power Of Attorney](https://www.pdffiller.com/preview/429/367/429367563/big.png)