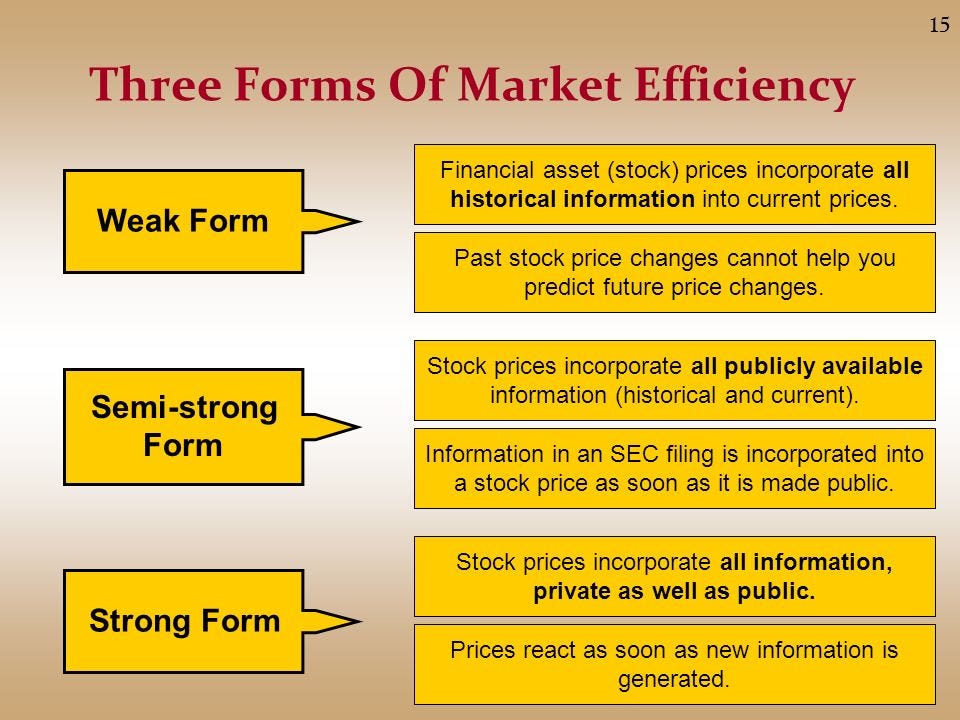

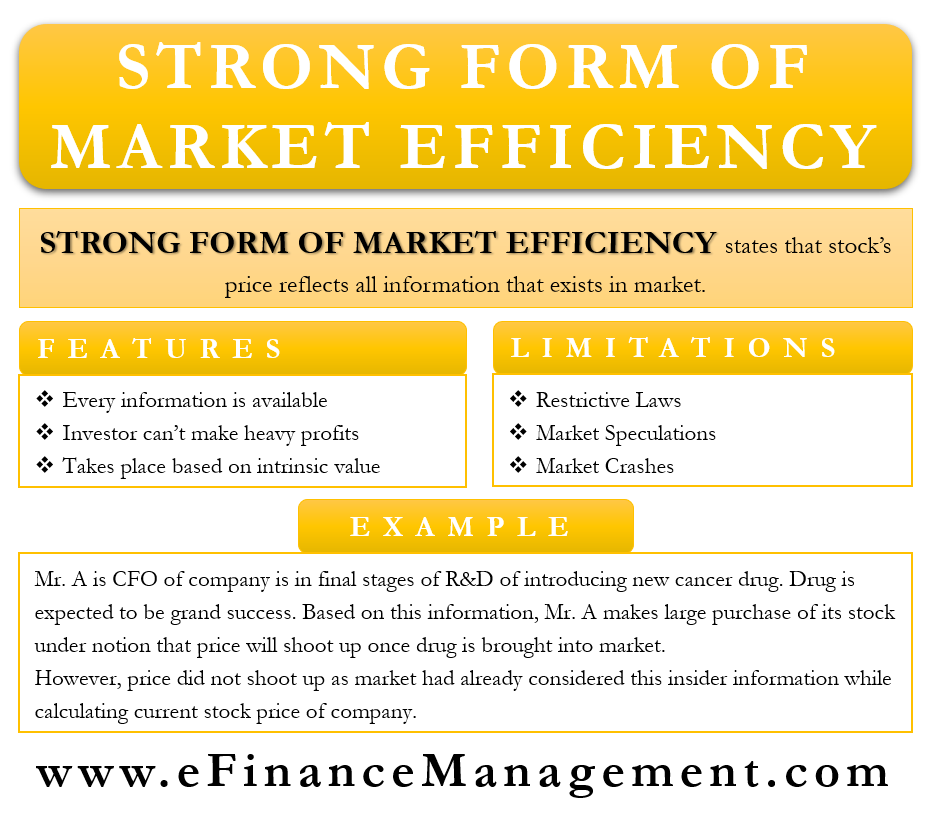

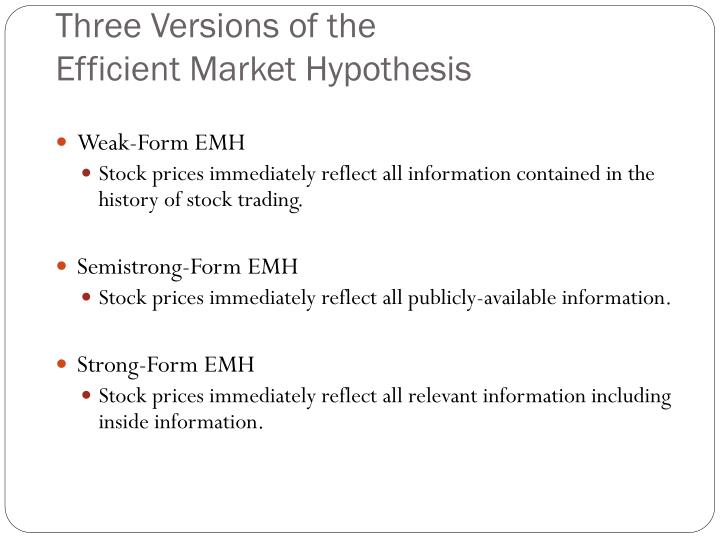

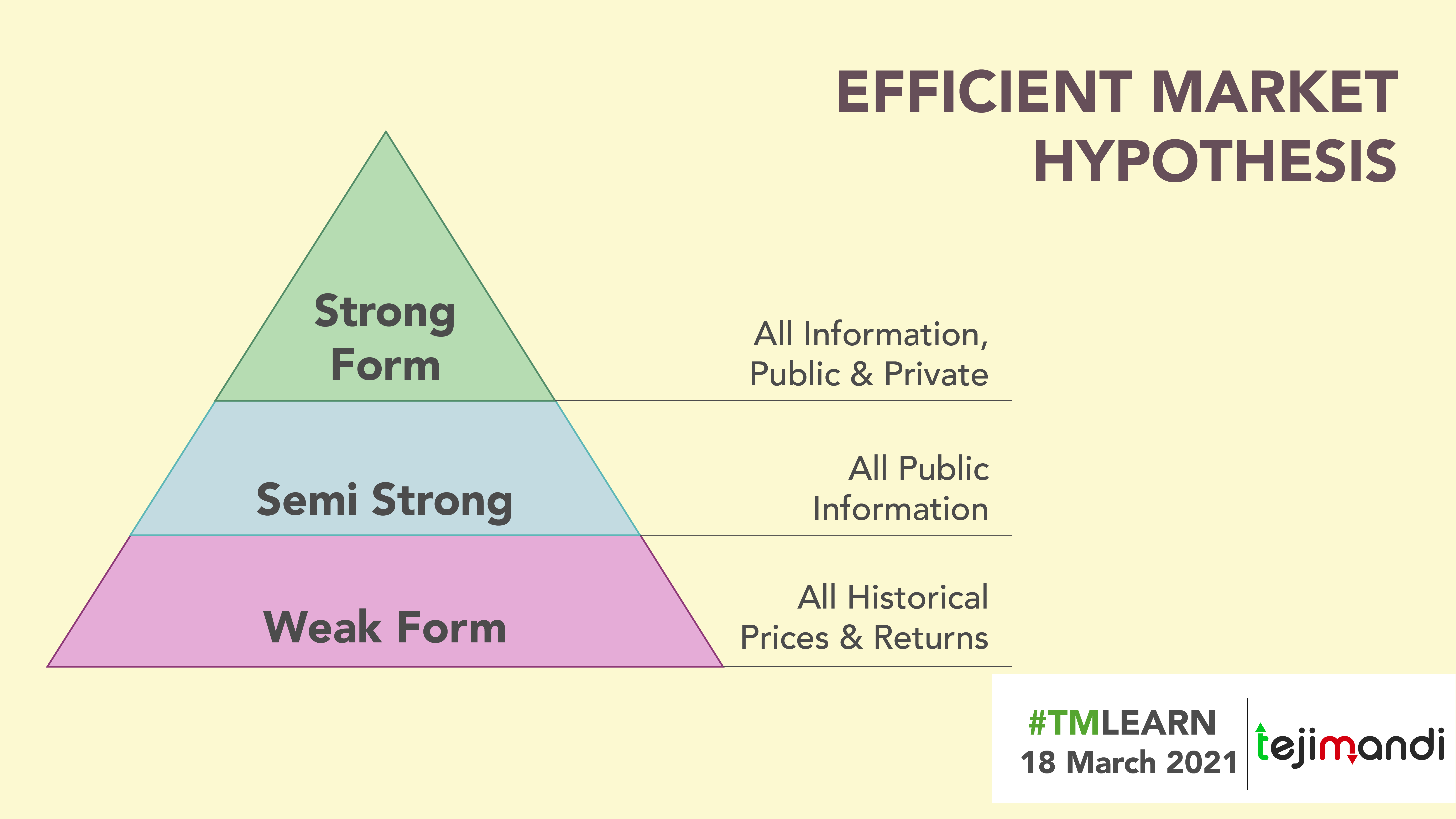

The Strong Form Of The Efficient Market Hypothesis States That - Prices reflect all public information. Past price data is positively. The strong form of the efficient market hypothesis states that: The strong form efficient market hypothesis suggests that share prices reflect all information, both public and private, and no investor,.

Past price data is positively. The strong form of the efficient market hypothesis states that: Prices reflect all public information. The strong form efficient market hypothesis suggests that share prices reflect all information, both public and private, and no investor,.

Past price data is positively. Prices reflect all public information. The strong form of the efficient market hypothesis states that: The strong form efficient market hypothesis suggests that share prices reflect all information, both public and private, and no investor,.

🔍 Are markets efficient? Compounding Quality

The strong form of the efficient market hypothesis states that: Prices reflect all public information. Past price data is positively. The strong form efficient market hypothesis suggests that share prices reflect all information, both public and private, and no investor,.

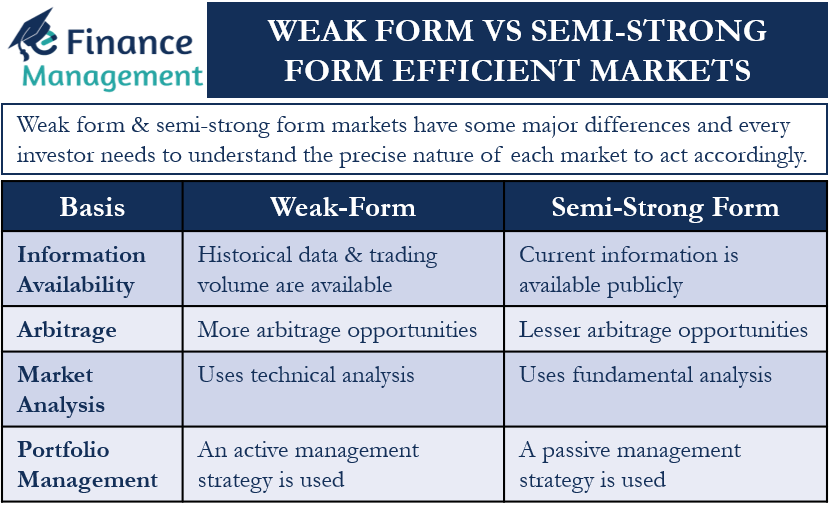

WeakForm vs SemiStrong Form Efficient Markets eFM

The strong form efficient market hypothesis suggests that share prices reflect all information, both public and private, and no investor,. The strong form of the efficient market hypothesis states that: Prices reflect all public information. Past price data is positively.

Strong, SemiStrong, and Weak Efficient Market Hypothesis QMR

The strong form efficient market hypothesis suggests that share prices reflect all information, both public and private, and no investor,. Past price data is positively. Prices reflect all public information. The strong form of the efficient market hypothesis states that:

If the Efficient Market Hypothesis Holds Investors Should Expect Ty

Prices reflect all public information. The strong form of the efficient market hypothesis states that: Past price data is positively. The strong form efficient market hypothesis suggests that share prices reflect all information, both public and private, and no investor,.

What is the Efficient Market Hypothesis (EMH)? IG International

Prices reflect all public information. The strong form of the efficient market hypothesis states that: Past price data is positively. The strong form efficient market hypothesis suggests that share prices reflect all information, both public and private, and no investor,.

Derivatives Definition, Types Forwards, Futures, Options, Swaps, etc

Past price data is positively. The strong form of the efficient market hypothesis states that: The strong form efficient market hypothesis suggests that share prices reflect all information, both public and private, and no investor,. Prices reflect all public information.

😂 Significance of efficient market hypothesis. Efficient Market

Past price data is positively. The strong form of the efficient market hypothesis states that: Prices reflect all public information. The strong form efficient market hypothesis suggests that share prices reflect all information, both public and private, and no investor,.

SemiStrong Form Efficiency Definition and Market Hypothesis LiveWell

Prices reflect all public information. The strong form efficient market hypothesis suggests that share prices reflect all information, both public and private, and no investor,. The strong form of the efficient market hypothesis states that: Past price data is positively.

Financial Theories Guide Option Alpha

The strong form of the efficient market hypothesis states that: The strong form efficient market hypothesis suggests that share prices reflect all information, both public and private, and no investor,. Prices reflect all public information. Past price data is positively.

Efficient market hypothesis A unique market perspective

Past price data is positively. Prices reflect all public information. The strong form of the efficient market hypothesis states that: The strong form efficient market hypothesis suggests that share prices reflect all information, both public and private, and no investor,.

Prices Reflect All Public Information.

The strong form of the efficient market hypothesis states that: The strong form efficient market hypothesis suggests that share prices reflect all information, both public and private, and no investor,. Past price data is positively.