Tax Form 843 - You can do this by using the tax tools menu option on your left menu bar in turbotax, then tools, then save your return to your computer. The instructions for form 843 state that for penalties, the form should be mailed to: I now have two questions: **say thanks by clicking the. The service center where you would be required to file a current year tax return for the tax to which. My tax return (claiming refund) was rejected and i was assessed penalty charges for that. I went to the local irs office and they told me to file form 843. The program will not allow the excess ss credit since you have the same ein for both employers so if the second employer will not make you whole then you have no other. Form 843 and your tax return will be processed separately and any refund from the form 843 will come as a separate check so waiting to file your personal income tax return.

**say thanks by clicking the. Form 843 and your tax return will be processed separately and any refund from the form 843 will come as a separate check so waiting to file your personal income tax return. I now have two questions: You can do this by using the tax tools menu option on your left menu bar in turbotax, then tools, then save your return to your computer. The instructions for form 843 state that for penalties, the form should be mailed to: My tax return (claiming refund) was rejected and i was assessed penalty charges for that. I went to the local irs office and they told me to file form 843. The service center where you would be required to file a current year tax return for the tax to which. The program will not allow the excess ss credit since you have the same ein for both employers so if the second employer will not make you whole then you have no other.

My tax return (claiming refund) was rejected and i was assessed penalty charges for that. You can do this by using the tax tools menu option on your left menu bar in turbotax, then tools, then save your return to your computer. The program will not allow the excess ss credit since you have the same ein for both employers so if the second employer will not make you whole then you have no other. The instructions for form 843 state that for penalties, the form should be mailed to: I now have two questions: I went to the local irs office and they told me to file form 843. **say thanks by clicking the. The service center where you would be required to file a current year tax return for the tax to which. Form 843 and your tax return will be processed separately and any refund from the form 843 will come as a separate check so waiting to file your personal income tax return.

FL DR843 2015 Fill out Tax Template Online US Legal Forms

You can do this by using the tax tools menu option on your left menu bar in turbotax, then tools, then save your return to your computer. The program will not allow the excess ss credit since you have the same ein for both employers so if the second employer will not make you whole then you have no other..

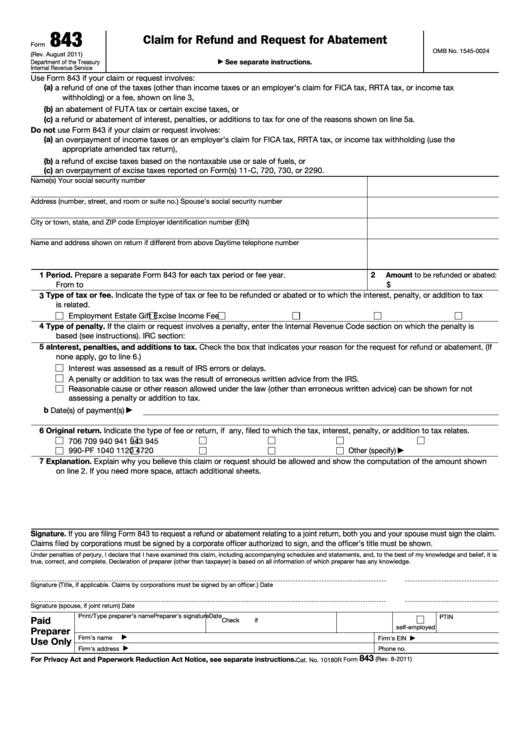

Fillable Form 843 Claim For Refund And Request For Abatement

The instructions for form 843 state that for penalties, the form should be mailed to: The program will not allow the excess ss credit since you have the same ein for both employers so if the second employer will not make you whole then you have no other. You can do this by using the tax tools menu option on.

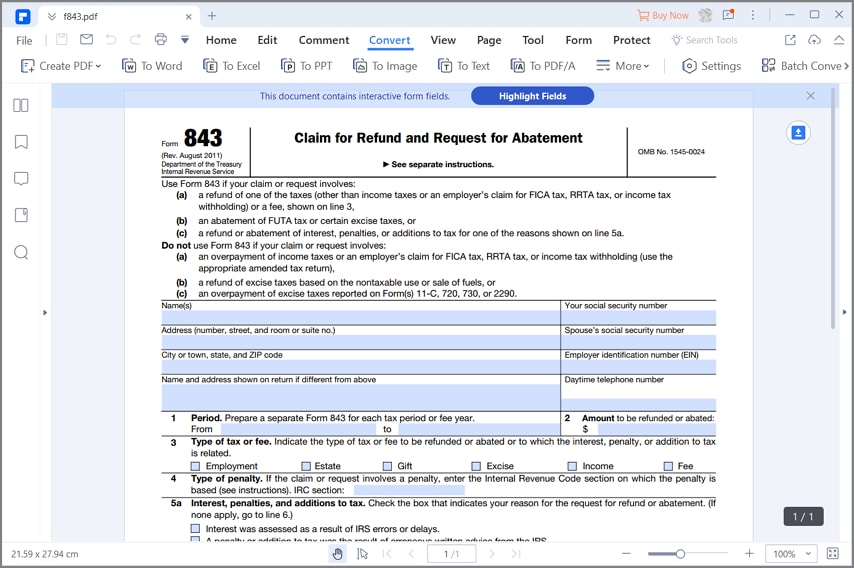

IRS 843 2009 Fill out Tax Template Online US Legal Forms

**say thanks by clicking the. I now have two questions: You can do this by using the tax tools menu option on your left menu bar in turbotax, then tools, then save your return to your computer. The service center where you would be required to file a current year tax return for the tax to which. The program will.

Form 843 IRS Penalty Abatement Form Request Wiztax

The instructions for form 843 state that for penalties, the form should be mailed to: **say thanks by clicking the. The service center where you would be required to file a current year tax return for the tax to which. Form 843 and your tax return will be processed separately and any refund from the form 843 will come as.

IRS Form 843. Claim for Refund and Request for Abatement Forms Docs

The program will not allow the excess ss credit since you have the same ein for both employers so if the second employer will not make you whole then you have no other. My tax return (claiming refund) was rejected and i was assessed penalty charges for that. The service center where you would be required to file a current.

Irs Form 843 Printable

The service center where you would be required to file a current year tax return for the tax to which. The instructions for form 843 state that for penalties, the form should be mailed to: **say thanks by clicking the. My tax return (claiming refund) was rejected and i was assessed penalty charges for that. I went to the local.

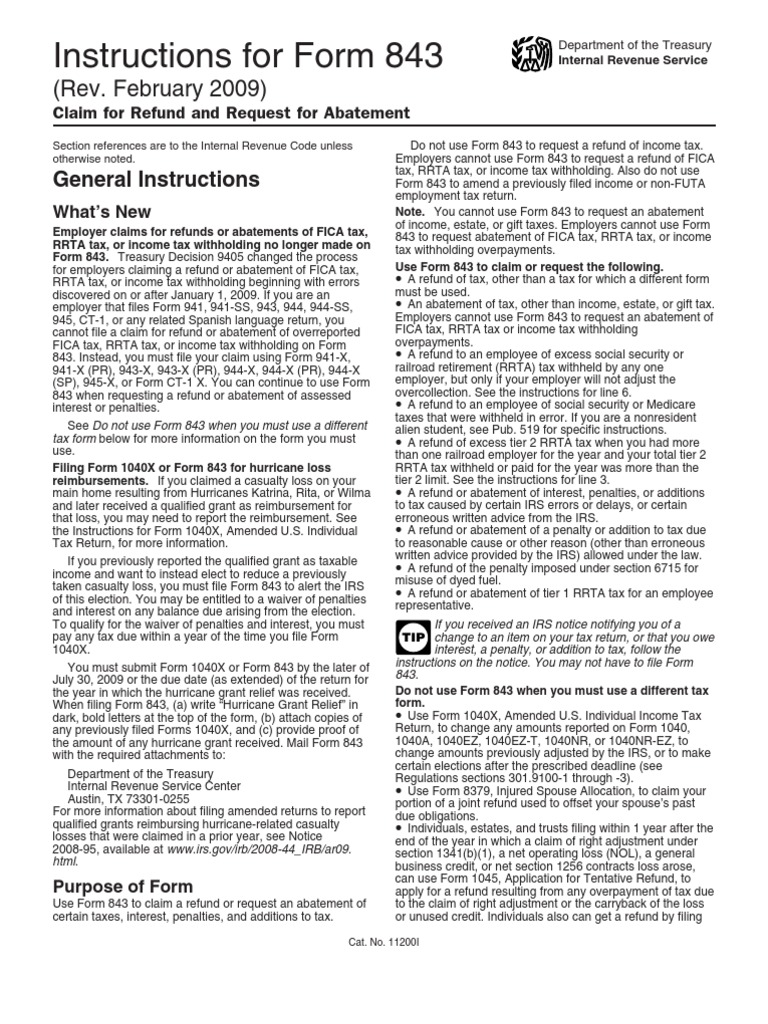

IRS Form 843 Instructions

I now have two questions: I went to the local irs office and they told me to file form 843. You can do this by using the tax tools menu option on your left menu bar in turbotax, then tools, then save your return to your computer. My tax return (claiming refund) was rejected and i was assessed penalty charges.

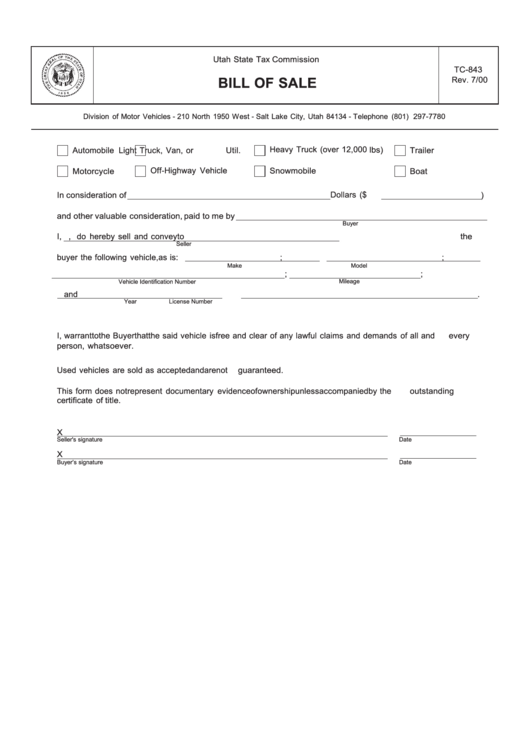

Fillable Tc843 Bill Of Sale Template Utah State Tax Commission

I now have two questions: I went to the local irs office and they told me to file form 843. You can do this by using the tax tools menu option on your left menu bar in turbotax, then tools, then save your return to your computer. The program will not allow the excess ss credit since you have the.

IRS Form 843 Instructions Irs Tax Forms Tax Refund

You can do this by using the tax tools menu option on your left menu bar in turbotax, then tools, then save your return to your computer. I went to the local irs office and they told me to file form 843. I now have two questions: The service center where you would be required to file a current year.

Form 843 Claim for Refund and Request for Abatement (2011) Free Download

The program will not allow the excess ss credit since you have the same ein for both employers so if the second employer will not make you whole then you have no other. The instructions for form 843 state that for penalties, the form should be mailed to: I now have two questions: Form 843 and your tax return will.

The Service Center Where You Would Be Required To File A Current Year Tax Return For The Tax To Which.

**say thanks by clicking the. The program will not allow the excess ss credit since you have the same ein for both employers so if the second employer will not make you whole then you have no other. You can do this by using the tax tools menu option on your left menu bar in turbotax, then tools, then save your return to your computer. Form 843 and your tax return will be processed separately and any refund from the form 843 will come as a separate check so waiting to file your personal income tax return.

My Tax Return (Claiming Refund) Was Rejected And I Was Assessed Penalty Charges For That.

I went to the local irs office and they told me to file form 843. The instructions for form 843 state that for penalties, the form should be mailed to: I now have two questions: