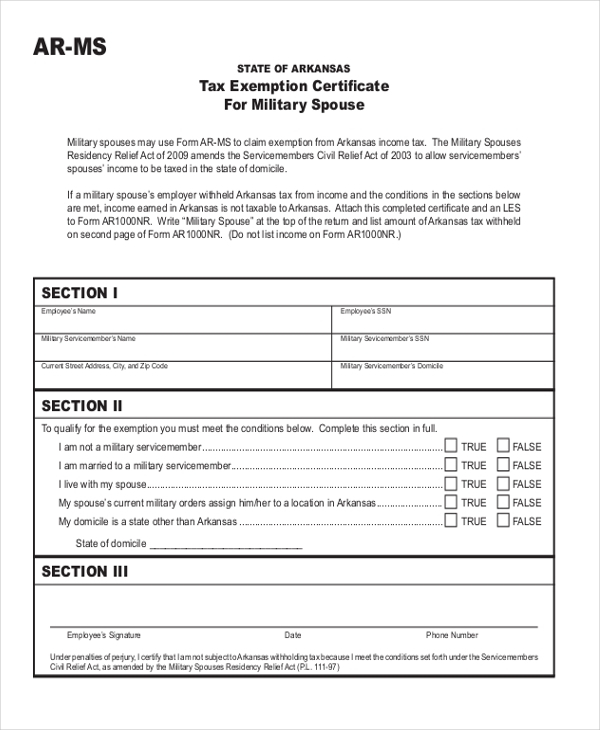

Tax Exempt Form Arkansas - (please give a specific identification of items. Description of the merchandise to be purchased: Arkansas sales/use tax law and rules. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Not all states allow all exemptions listed on this form. The purchaser is responsible for. File this form with your employer.

The purchaser is responsible for. Description of the merchandise to be purchased: (please give a specific identification of items. Arkansas sales/use tax law and rules. Not all states allow all exemptions listed on this form. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. File this form with your employer.

Not all states allow all exemptions listed on this form. The purchaser is responsible for. File this form with your employer. Description of the merchandise to be purchased: Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Arkansas sales/use tax law and rules. (please give a specific identification of items.

Us Army Tax Exempt Form

Description of the merchandise to be purchased: Not all states allow all exemptions listed on this form. Arkansas sales/use tax law and rules. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. (please give a specific identification of items.

Arkansas State Tax Exemption Form

(please give a specific identification of items. Not all states allow all exemptions listed on this form. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Description of the merchandise to be purchased: Arkansas sales/use tax law and rules.

Arkansas Sales Tax Exempt Form

Not all states allow all exemptions listed on this form. (please give a specific identification of items. Description of the merchandise to be purchased: Arkansas sales/use tax law and rules. The purchaser is responsible for.

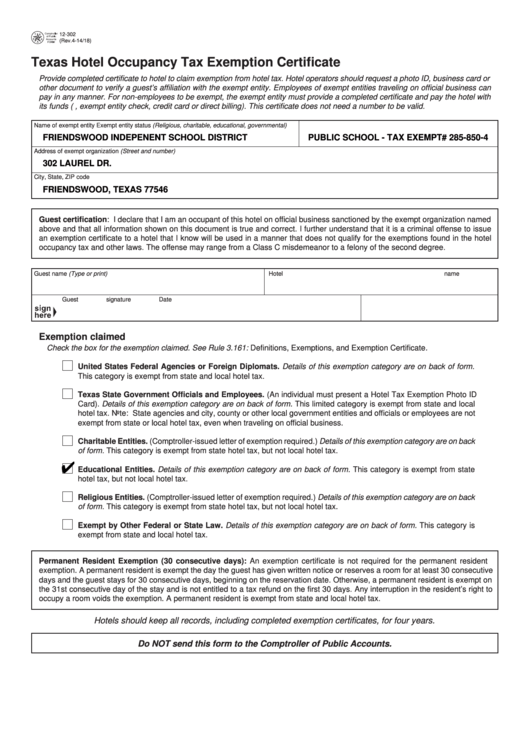

Federal Tax Exempt Form Florida

(please give a specific identification of items. Description of the merchandise to be purchased: Arkansas sales/use tax law and rules. The purchaser is responsible for. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents.

FREE 8 Sample Tax Exemption Forms In PDF MS Word

Description of the merchandise to be purchased: File this form with your employer. Arkansas sales/use tax law and rules. (please give a specific identification of items. Not all states allow all exemptions listed on this form.

Sales Tax Exemption Form For Arkansas Pdf

File this form with your employer. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Arkansas sales/use tax law and rules. (please give a specific identification of items. The purchaser is responsible for.

Tax exempt form pdf Fill out & sign online DocHub

The purchaser is responsible for. (please give a specific identification of items. Arkansas sales/use tax law and rules. Description of the merchandise to be purchased: Not all states allow all exemptions listed on this form.

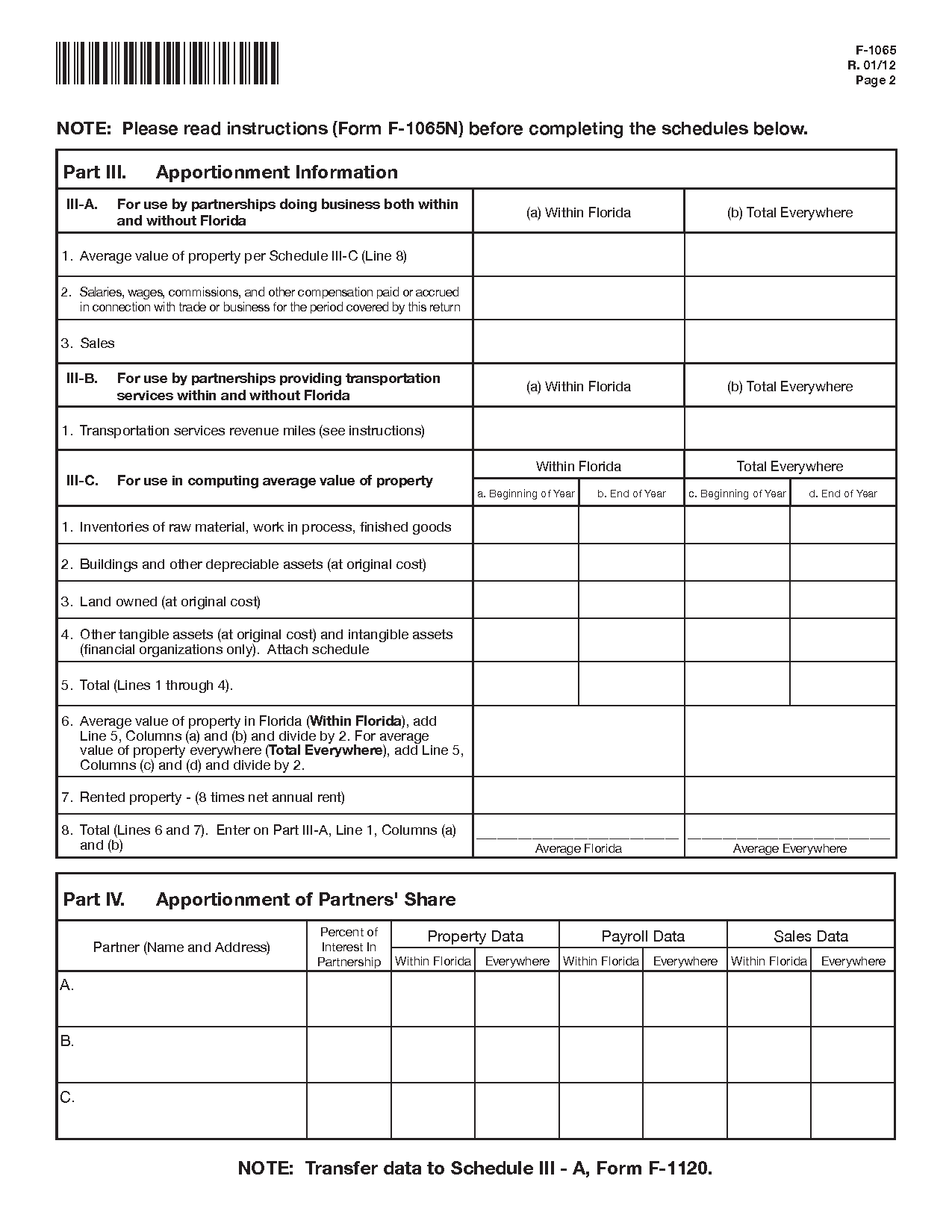

Wisconsin Tax Exempt Form ≡ Fill Out Printable PDF Forms Online

File this form with your employer. Description of the merchandise to be purchased: Arkansas sales/use tax law and rules. Not all states allow all exemptions listed on this form. (please give a specific identification of items.

Arkansas Sales And Use Tax Exemption

Not all states allow all exemptions listed on this form. File this form with your employer. Description of the merchandise to be purchased: Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. (please give a specific identification of items.

Arkansas Sales Tax Exemption Form Farm

(please give a specific identification of items. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Description of the merchandise to be purchased: The purchaser is responsible for. Not all states allow all exemptions listed on this form.

The Purchaser Is Responsible For.

Not all states allow all exemptions listed on this form. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Description of the merchandise to be purchased: Arkansas sales/use tax law and rules.

File This Form With Your Employer.

(please give a specific identification of items.