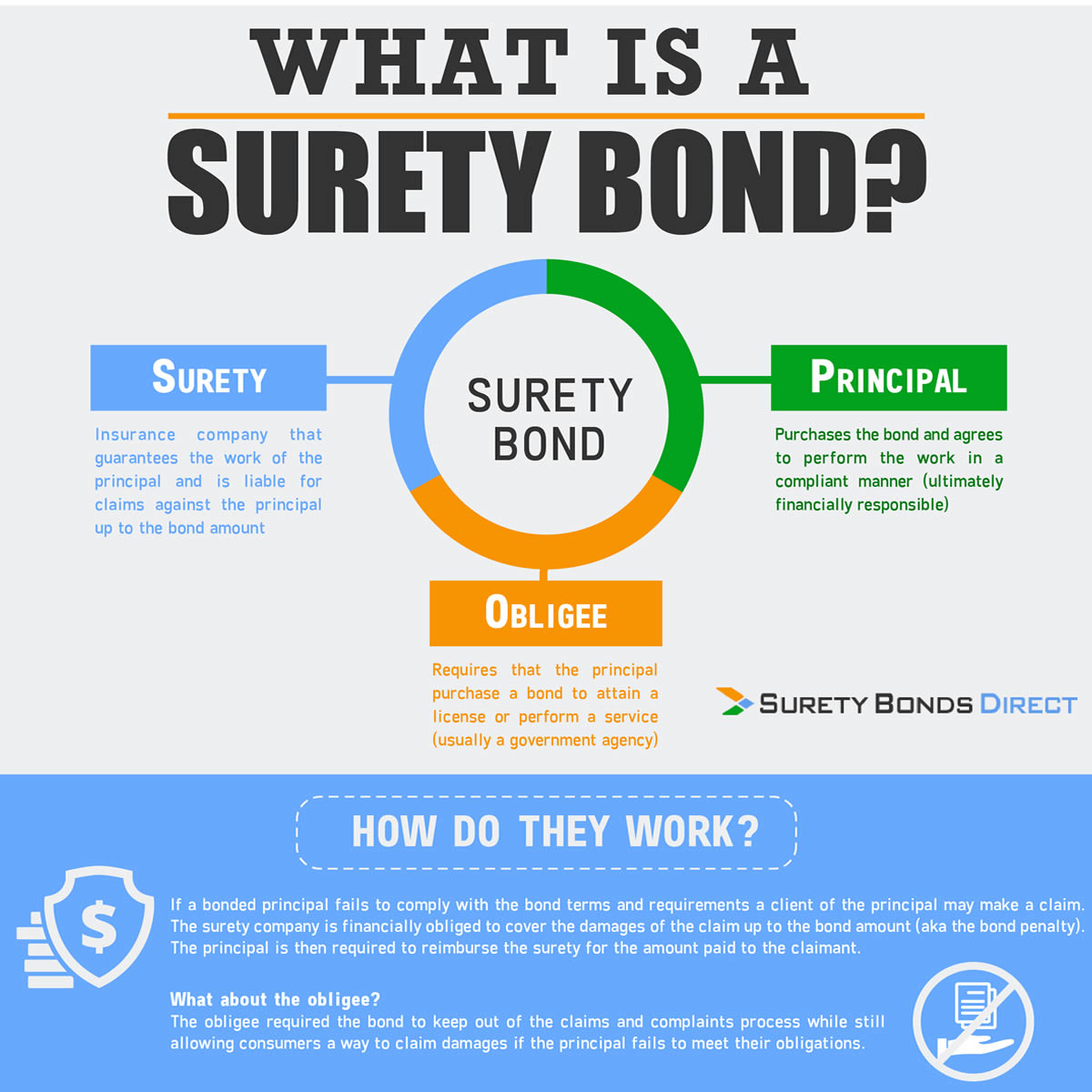

Surety Bond Coverage - Some surety bonds provide coverage for, or ensure compliance with, local, state, or federal licensing and permit requirements. Learn more about surety bonds, how they work, why they are used and how to get one from the experts at the. Sureties can be made by issuing surety bonds, which are legal contracts obligating one party to pay if the other fails to live up to the agreement. A surety is a promise that financial. Primarily, a surety bond imbues confidence in the transaction, as it assures the obligee that contractual obligations will be met. A surety bond, sometimes called business bond insurance, is a contract among three parties guaranteeing that work will be completed according to requirements. A surety bond is a promise to be liable for a debt, default or failure of another. Other surety bonds guarantee payment of tax or other financial.

Other surety bonds guarantee payment of tax or other financial. Primarily, a surety bond imbues confidence in the transaction, as it assures the obligee that contractual obligations will be met. Sureties can be made by issuing surety bonds, which are legal contracts obligating one party to pay if the other fails to live up to the agreement. A surety bond is a promise to be liable for a debt, default or failure of another. Some surety bonds provide coverage for, or ensure compliance with, local, state, or federal licensing and permit requirements. A surety is a promise that financial. A surety bond, sometimes called business bond insurance, is a contract among three parties guaranteeing that work will be completed according to requirements. Learn more about surety bonds, how they work, why they are used and how to get one from the experts at the.

A surety bond, sometimes called business bond insurance, is a contract among three parties guaranteeing that work will be completed according to requirements. Primarily, a surety bond imbues confidence in the transaction, as it assures the obligee that contractual obligations will be met. A surety bond is a promise to be liable for a debt, default or failure of another. Sureties can be made by issuing surety bonds, which are legal contracts obligating one party to pay if the other fails to live up to the agreement. Other surety bonds guarantee payment of tax or other financial. A surety is a promise that financial. Learn more about surety bonds, how they work, why they are used and how to get one from the experts at the. Some surety bonds provide coverage for, or ensure compliance with, local, state, or federal licensing and permit requirements.

Surety Bond What Is It? — Insurance Agent’s Guide to Surety

A surety is a promise that financial. A surety bond, sometimes called business bond insurance, is a contract among three parties guaranteeing that work will be completed according to requirements. Other surety bonds guarantee payment of tax or other financial. Sureties can be made by issuing surety bonds, which are legal contracts obligating one party to pay if the other.

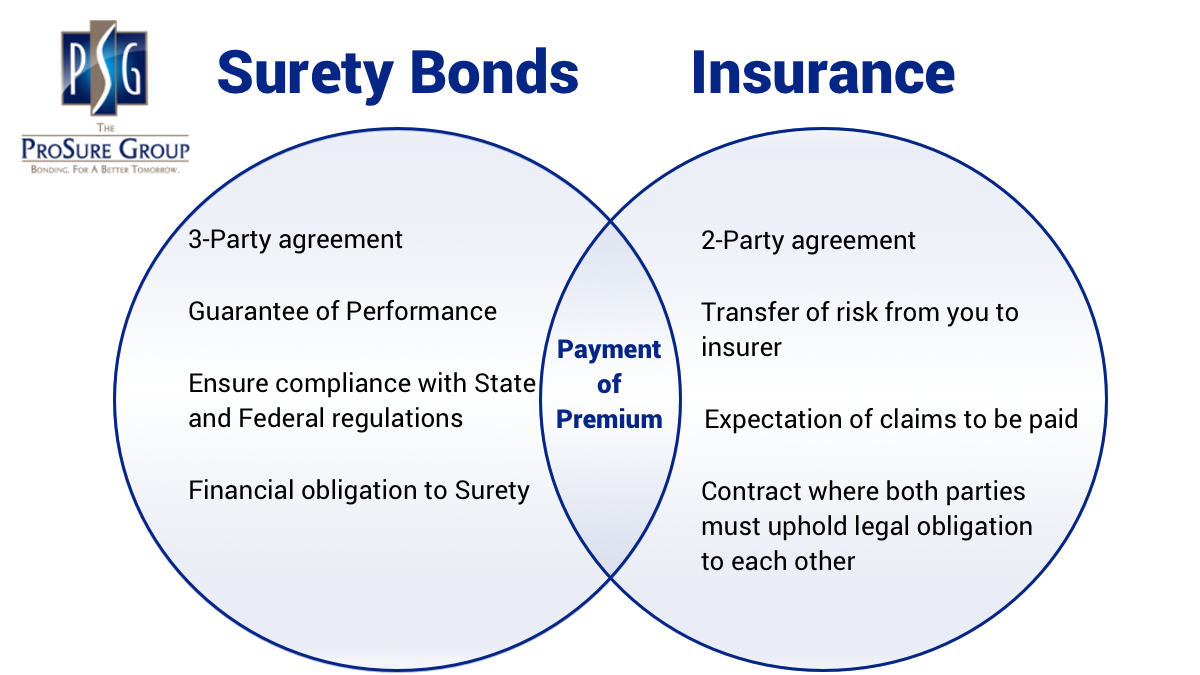

Difference Between a Surety Bond and Insurance Qor Tuba

Sureties can be made by issuing surety bonds, which are legal contracts obligating one party to pay if the other fails to live up to the agreement. A surety bond is a promise to be liable for a debt, default or failure of another. Learn more about surety bonds, how they work, why they are used and how to get.

Llc principal definition likosshift

Some surety bonds provide coverage for, or ensure compliance with, local, state, or federal licensing and permit requirements. A surety is a promise that financial. Other surety bonds guarantee payment of tax or other financial. A surety bond is a promise to be liable for a debt, default or failure of another. Primarily, a surety bond imbues confidence in the.

Surety Bond Coverage Changes Mohawk Global

A surety bond is a promise to be liable for a debt, default or failure of another. Learn more about surety bonds, how they work, why they are used and how to get one from the experts at the. Other surety bonds guarantee payment of tax or other financial. A surety is a promise that financial. Primarily, a surety bond.

The Importance of Insurance Coverage for Bonds • Pedersen & Sons

A surety bond is a promise to be liable for a debt, default or failure of another. Learn more about surety bonds, how they work, why they are used and how to get one from the experts at the. Other surety bonds guarantee payment of tax or other financial. Some surety bonds provide coverage for, or ensure compliance with, local,.

Surety Bond Coverage

Learn more about surety bonds, how they work, why they are used and how to get one from the experts at the. A surety bond is a promise to be liable for a debt, default or failure of another. A surety is a promise that financial. Some surety bonds provide coverage for, or ensure compliance with, local, state, or federal.

Surety Bond Basics Understanding Bond Terms BondExchange

Primarily, a surety bond imbues confidence in the transaction, as it assures the obligee that contractual obligations will be met. Some surety bonds provide coverage for, or ensure compliance with, local, state, or federal licensing and permit requirements. A surety is a promise that financial. Other surety bonds guarantee payment of tax or other financial. A surety bond is a.

Understanding Surety Bond Collateral Requirements BondExchange

Other surety bonds guarantee payment of tax or other financial. A surety bond, sometimes called business bond insurance, is a contract among three parties guaranteeing that work will be completed according to requirements. Learn more about surety bonds, how they work, why they are used and how to get one from the experts at the. A surety bond is a.

What Does Bonded Mean In Construction FerkeyBuilders

Some surety bonds provide coverage for, or ensure compliance with, local, state, or federal licensing and permit requirements. Sureties can be made by issuing surety bonds, which are legal contracts obligating one party to pay if the other fails to live up to the agreement. Learn more about surety bonds, how they work, why they are used and how to.

Differences between Surety Bonds and Insurance

Some surety bonds provide coverage for, or ensure compliance with, local, state, or federal licensing and permit requirements. Primarily, a surety bond imbues confidence in the transaction, as it assures the obligee that contractual obligations will be met. A surety bond, sometimes called business bond insurance, is a contract among three parties guaranteeing that work will be completed according to.

A Surety Bond Is A Promise To Be Liable For A Debt, Default Or Failure Of Another.

Sureties can be made by issuing surety bonds, which are legal contracts obligating one party to pay if the other fails to live up to the agreement. Learn more about surety bonds, how they work, why they are used and how to get one from the experts at the. Primarily, a surety bond imbues confidence in the transaction, as it assures the obligee that contractual obligations will be met. Some surety bonds provide coverage for, or ensure compliance with, local, state, or federal licensing and permit requirements.

A Surety Bond, Sometimes Called Business Bond Insurance, Is A Contract Among Three Parties Guaranteeing That Work Will Be Completed According To Requirements.

Other surety bonds guarantee payment of tax or other financial. A surety is a promise that financial.