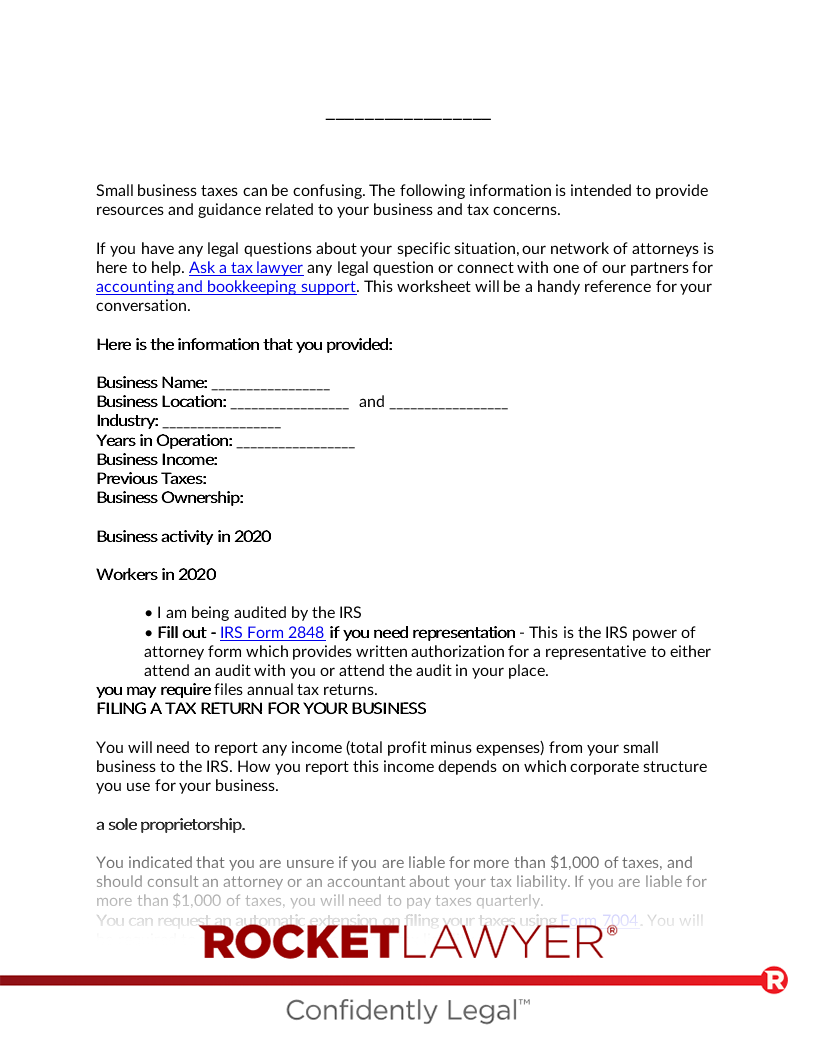

Small Business Tax Worksheet - In order for an expense to be deductible, it must be considered an ordinary and necessary expense. This small business tax preparation checklist breaks down the six basics of filing small business taxes and includes a downloadable checklist to stay on top of your small business tax prep needs—including what tax forms to file and. The irs will otherwise presume you are. When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re. Do not use retail value. This publication does not cover the topics listed in the following table. This publication has information on business income, expenses, and tax credits that may help you, as a small business owner, file your income tax return. The purpose of this worksheet is to help you organize your tax deductible business expenses. You may include other applicable expenses. Download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post.

This publication does not cover the topics listed in the following table. Do not use retail value. This publication has information on business income, expenses, and tax credits that may help you, as a small business owner, file your income tax return. The purpose of this worksheet is to help you organize your tax deductible business expenses. This small business tax preparation checklist breaks down the six basics of filing small business taxes and includes a downloadable checklist to stay on top of your small business tax prep needs—including what tax forms to file and. You may include other applicable expenses. In order for an expense to be deductible, it must be considered an ordinary and necessary expense. The irs will otherwise presume you are. When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re. Download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post.

Do not use retail value. If your business has no income, the burden on you will be to show you were actively engaged in a trade or business. When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re. This publication has information on business income, expenses, and tax credits that may help you, as a small business owner, file your income tax return. The irs will otherwise presume you are. This small business tax preparation checklist breaks down the six basics of filing small business taxes and includes a downloadable checklist to stay on top of your small business tax prep needs—including what tax forms to file and. In order for an expense to be deductible, it must be considered an ordinary and necessary expense. Download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. The purpose of this worksheet is to help you organize your tax deductible business expenses. This publication does not cover the topics listed in the following table.

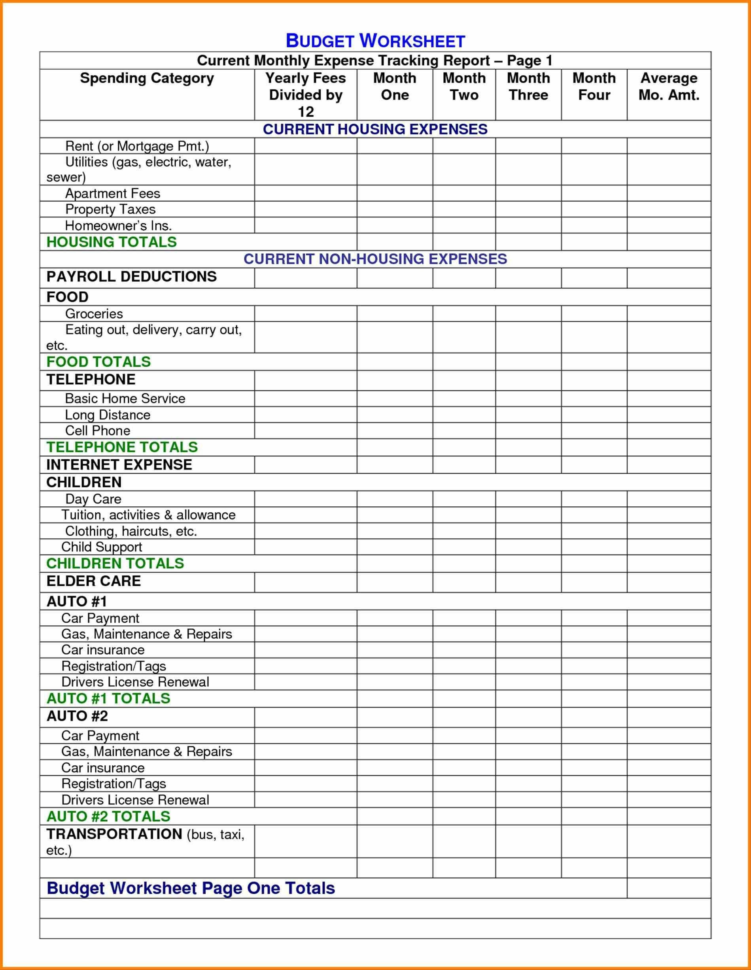

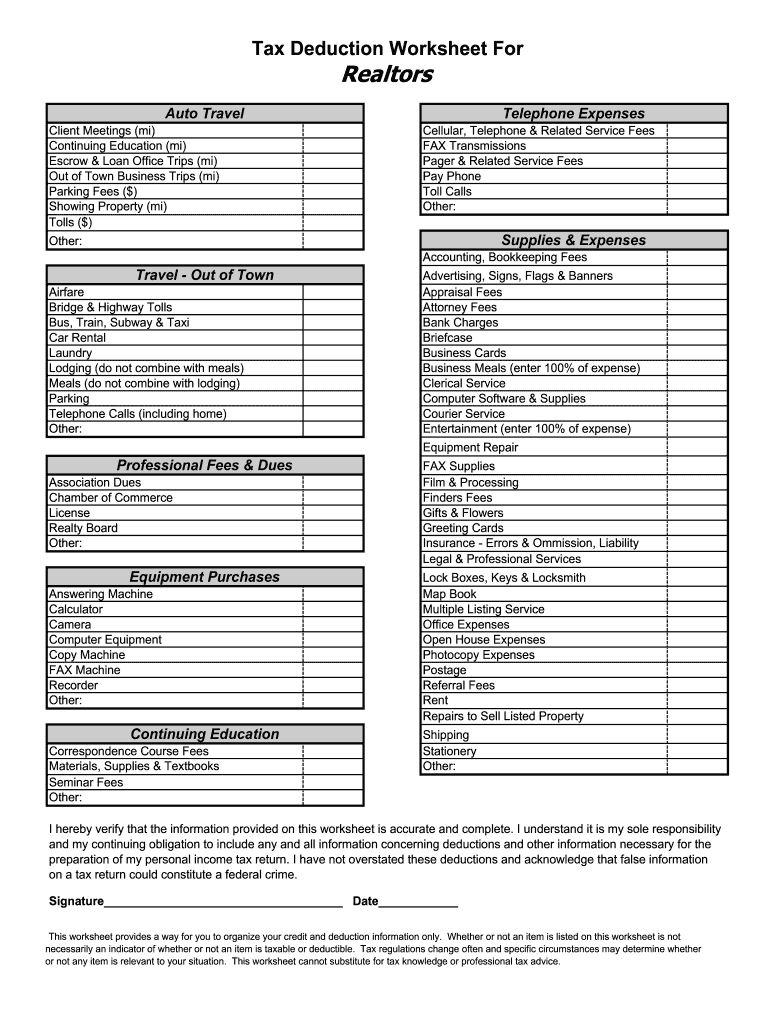

Tax Spreadsheet For Small Business for Small Business Tax Spreadsheet

You may include other applicable expenses. Do not use retail value. This publication has information on business income, expenses, and tax credits that may help you, as a small business owner, file your income tax return. The irs will otherwise presume you are. In order for an expense to be deductible, it must be considered an ordinary and necessary expense.

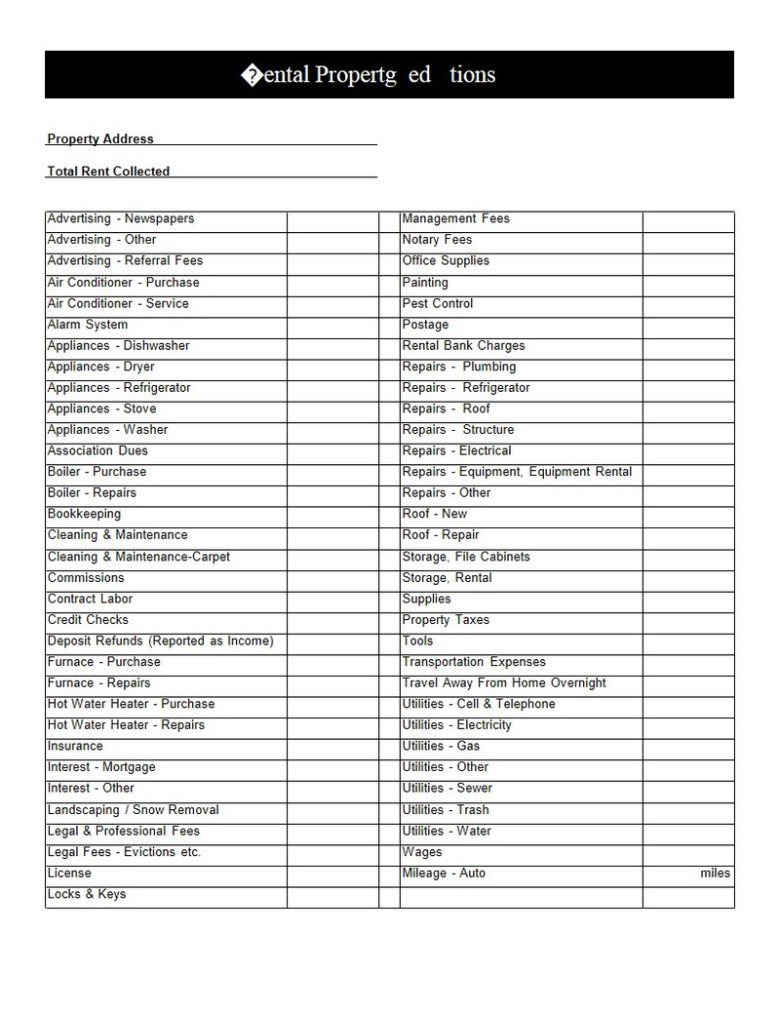

Rental Property Tax Deductions Worksheet New Tax Prep —

Do not use retail value. When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re. Download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. In order for an expense to be deductible, it must be considered an ordinary.

Small Business Tax Deductions Worksheet The Best Worksheets Image

If your business has no income, the burden on you will be to show you were actively engaged in a trade or business. When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re. You may include other applicable expenses. The irs will otherwise presume you are. This publication has information on business income,.

Small Business Tax Kit Printable and Editable. Includes Business

If your business has no income, the burden on you will be to show you were actively engaged in a trade or business. Do not use retail value. The irs will otherwise presume you are. The purpose of this worksheet is to help you organize your tax deductible business expenses. This publication does not cover the topics listed in the.

Free Small Business Tax Worksheet Free to Print, Save & Download

When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re. The purpose of this worksheet is to help you organize your tax deductible business expenses. You may include other applicable expenses. If your business has no income, the burden on you will be to show you were actively engaged in a trade or.

HOW TO ORGANIZE YOUR SMALL BUSINESS TAXES ( free printables!) Use

When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re. If your business has no income, the burden on you will be to show you were actively engaged in a trade or business. You may include other applicable expenses. This publication has information on business income, expenses, and tax credits that may help.

Small Business Tax Deductions Worksheet

In order for an expense to be deductible, it must be considered an ordinary and necessary expense. If your business has no income, the burden on you will be to show you were actively engaged in a trade or business. The purpose of this worksheet is to help you organize your tax deductible business expenses. The irs will otherwise presume.

Small Business Tax Deductions Worksheet 2022

You may include other applicable expenses. When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re. The irs will otherwise presume you are. Do not use retail value. If your business has no income, the burden on you will be to show you were actively engaged in a trade or business.

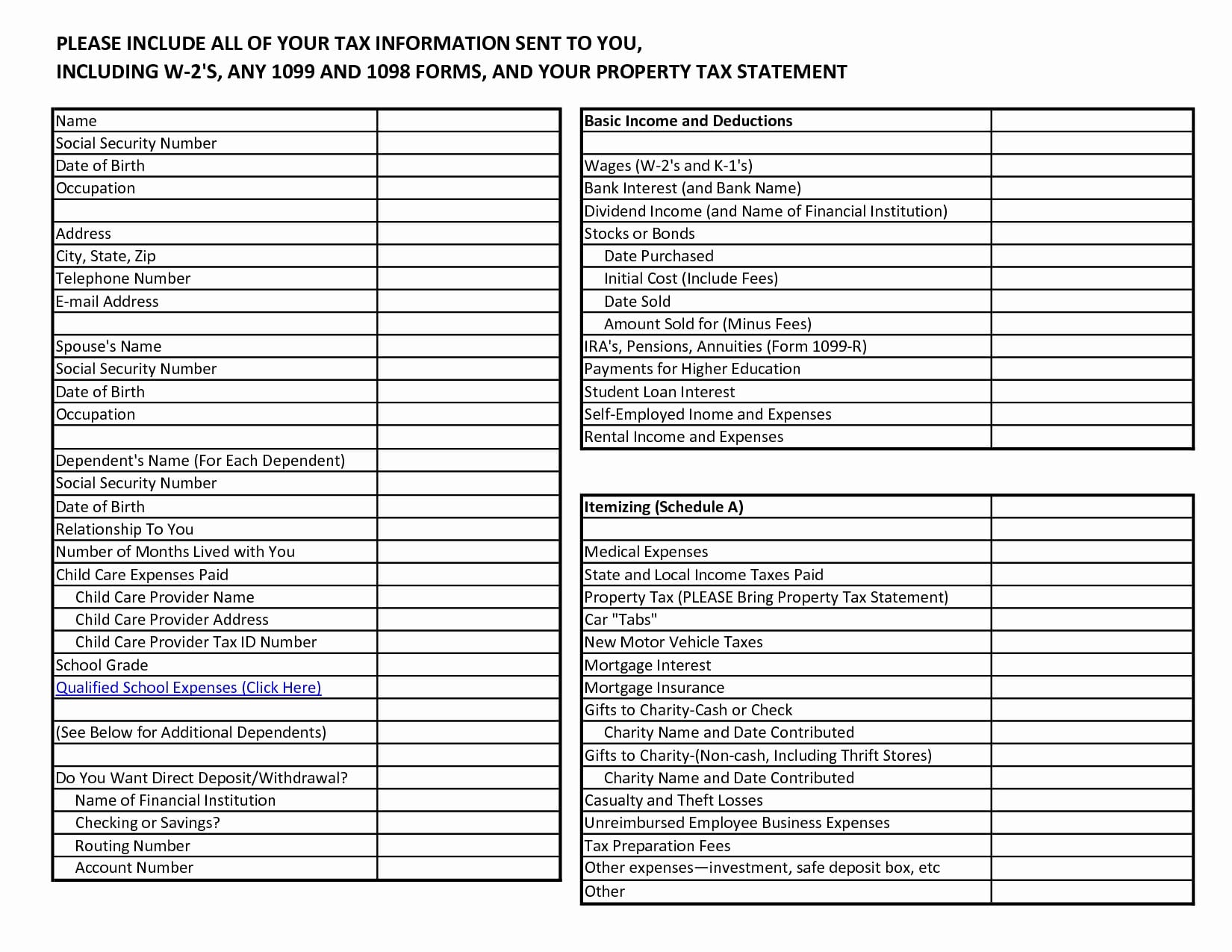

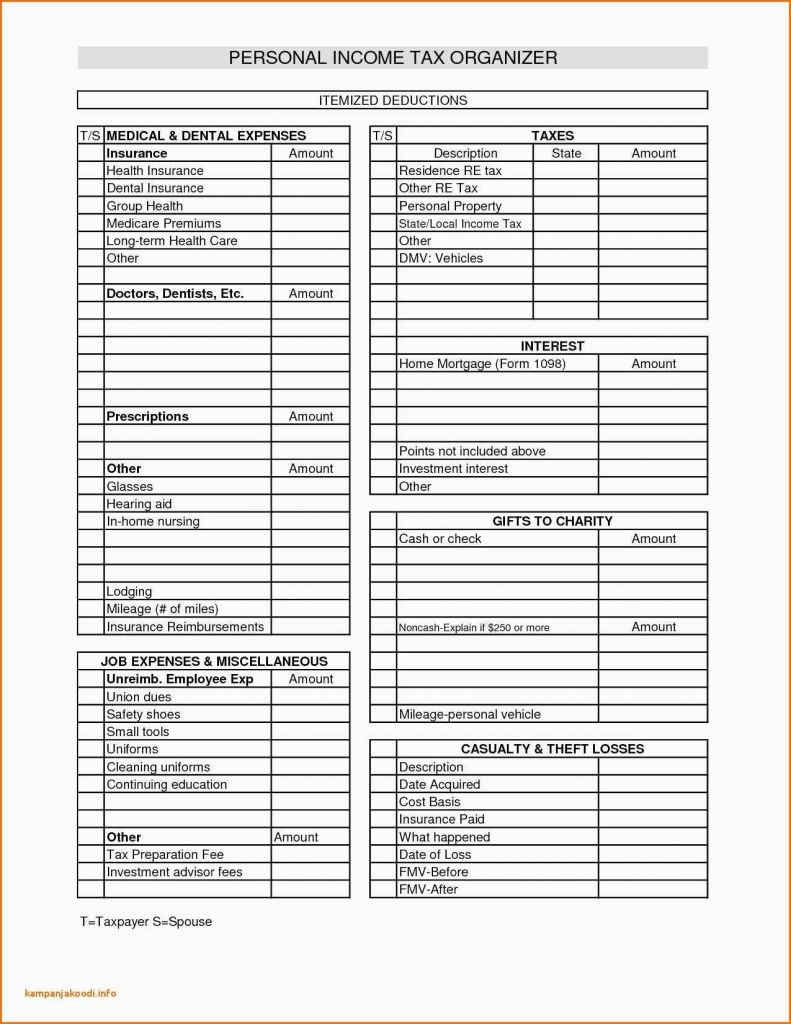

A List Of Itemized Deductions

If your business has no income, the burden on you will be to show you were actively engaged in a trade or business. This small business tax preparation checklist breaks down the six basics of filing small business taxes and includes a downloadable checklist to stay on top of your small business tax prep needs—including what tax forms to file.

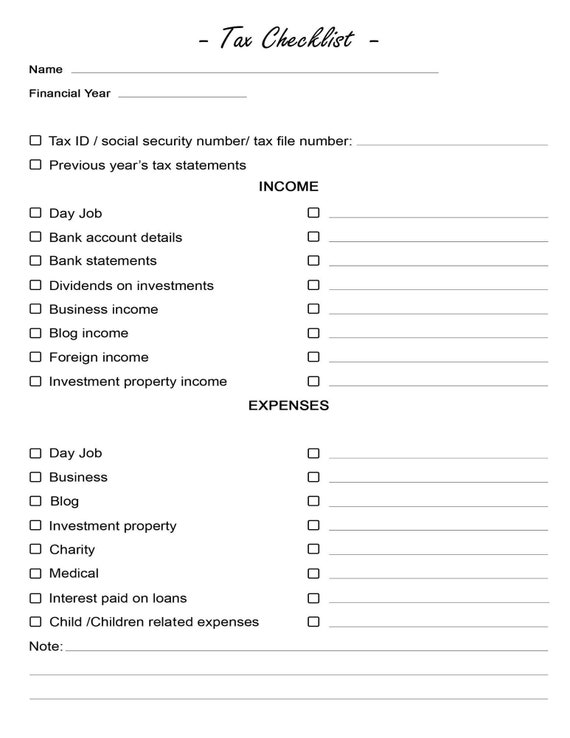

Printable Tax Checklist for Personal Small Business Etsy

In order for an expense to be deductible, it must be considered an ordinary and necessary expense. When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re. Download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. The purpose.

Download Our Free 2022 Small Business Tax Deductions Worksheet, And We’ll Walk You Through How To Use It Right Now In This Blog Post.

Do not use retail value. You may include other applicable expenses. When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re. The irs will otherwise presume you are.

The Purpose Of This Worksheet Is To Help You Organize Your Tax Deductible Business Expenses.

In order for an expense to be deductible, it must be considered an ordinary and necessary expense. This publication has information on business income, expenses, and tax credits that may help you, as a small business owner, file your income tax return. If your business has no income, the burden on you will be to show you were actively engaged in a trade or business. This small business tax preparation checklist breaks down the six basics of filing small business taxes and includes a downloadable checklist to stay on top of your small business tax prep needs—including what tax forms to file and.