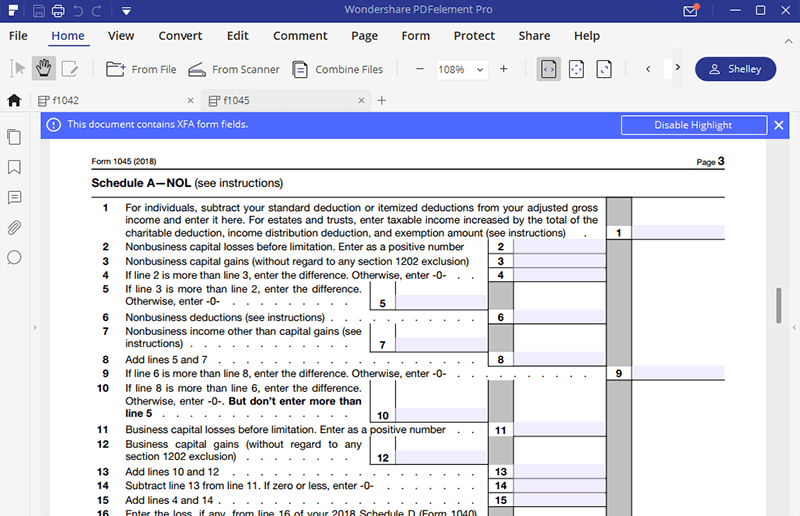

Schedule A Of Form 1045 - Form 1045 will generally not produce if there is no current year net operating loss to carry back. Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: The carryback of an nol. Enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year; An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: The software produces form 1045.

The software produces form 1045. Enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year; If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: Form 1045 will generally not produce if there is no current year net operating loss to carry back. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: The carryback of an nol. Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward.

Enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year; Form 1045 will generally not produce if there is no current year net operating loss to carry back. Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: The software produces form 1045. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: The carryback of an nol.

Fillable Online Irs form 1045 schedule a. Irs form 1045 schedule a.Do

Enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year; Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. If a return has generated a net operating loss (nol) in the current year, there will be a.

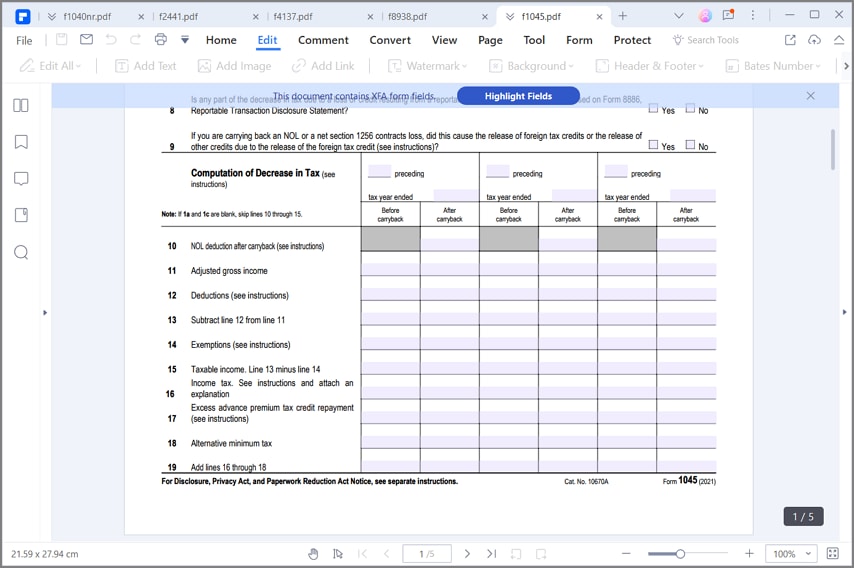

IRS Form 1045 Fill it as You Want

If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Form 1045 will generally not produce if there is no current year net operating loss to carry back..

Instructions pour remplir le formulaire 1045 de l'IRS

If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. Enter the appropriate amount from your calculations on form 1045 that is to.

IRS Form 1045 Fill it as You Want

The software produces form 1045. Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: The carryback of an nol. If a return has generated a net operating loss (nol) in.

IRS Form 1045 Fill it as You Want

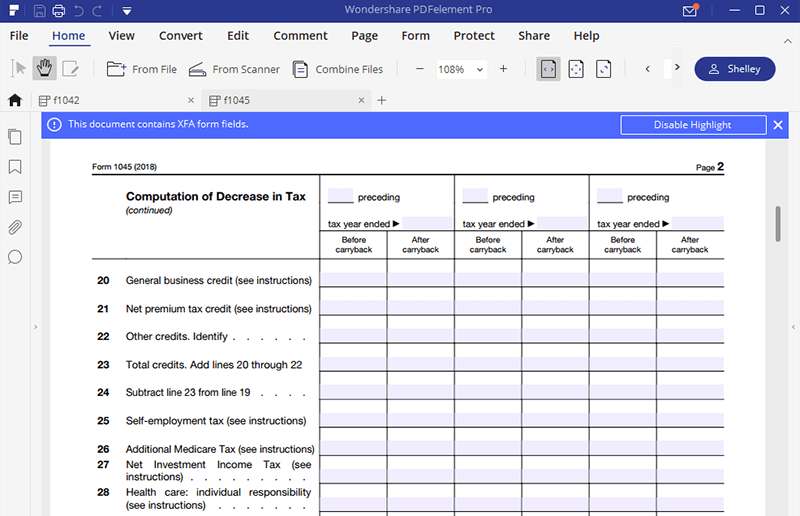

Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. Enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year; Form 1045 will generally not produce if there is no current year net operating loss to carry back..

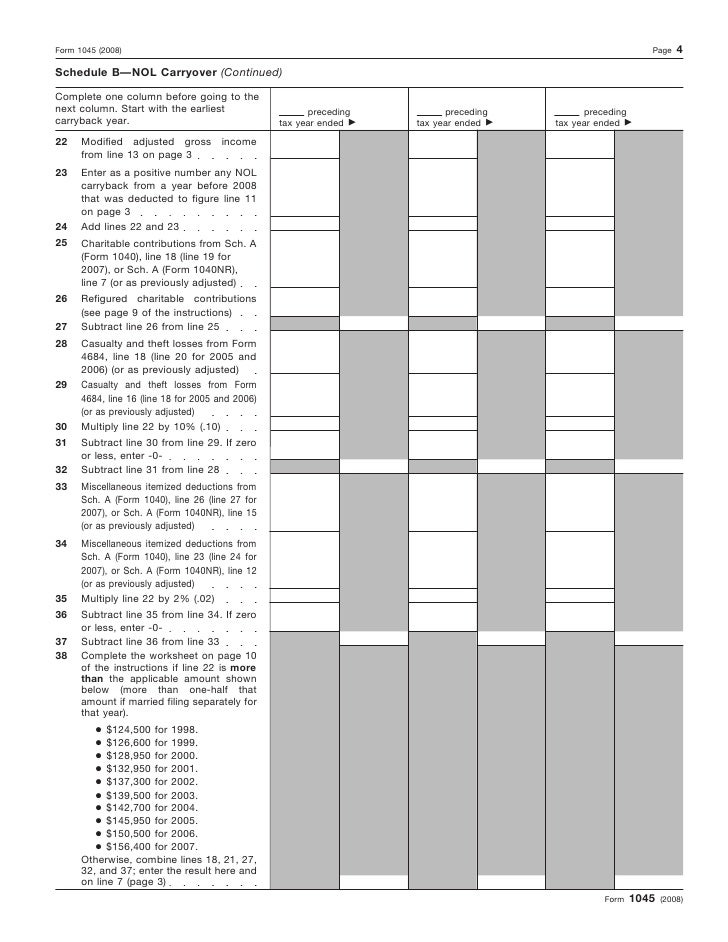

Form 1045 Application for Tentative Refund

Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: Enter the appropriate amount from your calculations on form 1045 that is to.

2020 Form 1045 2020 Blank Sample to Fill out Online in PDF

Enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year; An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: The carryback of an nol. Form 1045 will generally not produce if there is no current year net operating loss to carry back..

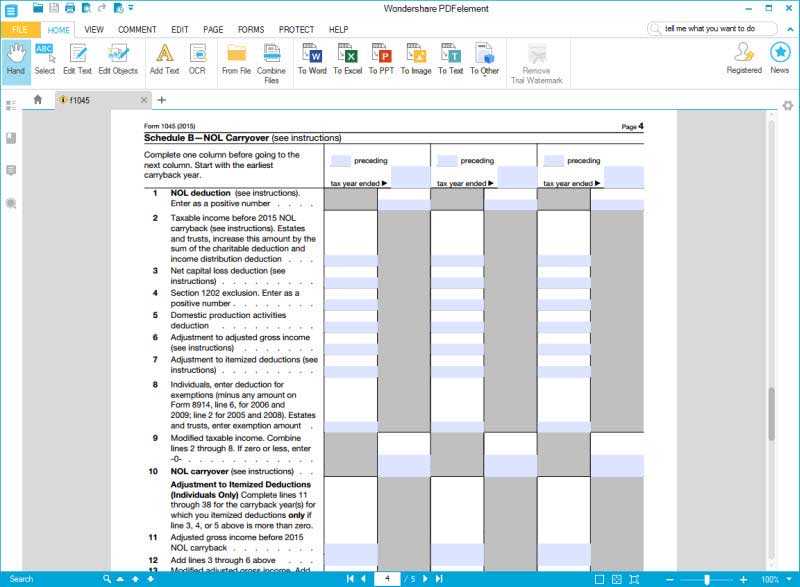

Form 1045 Application for Tentative Refund (2014) Free Download

The carryback of an nol. If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. Form 1045 will generally not produce if there.

Payment Schedule Form

If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: Form 1045 will generally not produce if there is no current year net operating loss to carry back. The carryback of an nol. Form 1045 schedule a is used to compute a net operating loss.

Form 1045 Fill Out And Sign Printable Pdf Template Signnow Free

The carryback of an nol. The software produces form 1045. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Form 1045 will generally not produce if there is no current year net operating loss to carry back. Enter the appropriate amount from your calculations on form 1045 that is to be carried.

The Software Produces Form 1045.

Form 1045 will generally not produce if there is no current year net operating loss to carry back. Enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year; The carryback of an nol. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from:

If A Return Has Generated A Net Operating Loss (Nol) In The Current Year, There Will Be A Green Alert In The Return Titled Explanation:

Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward.