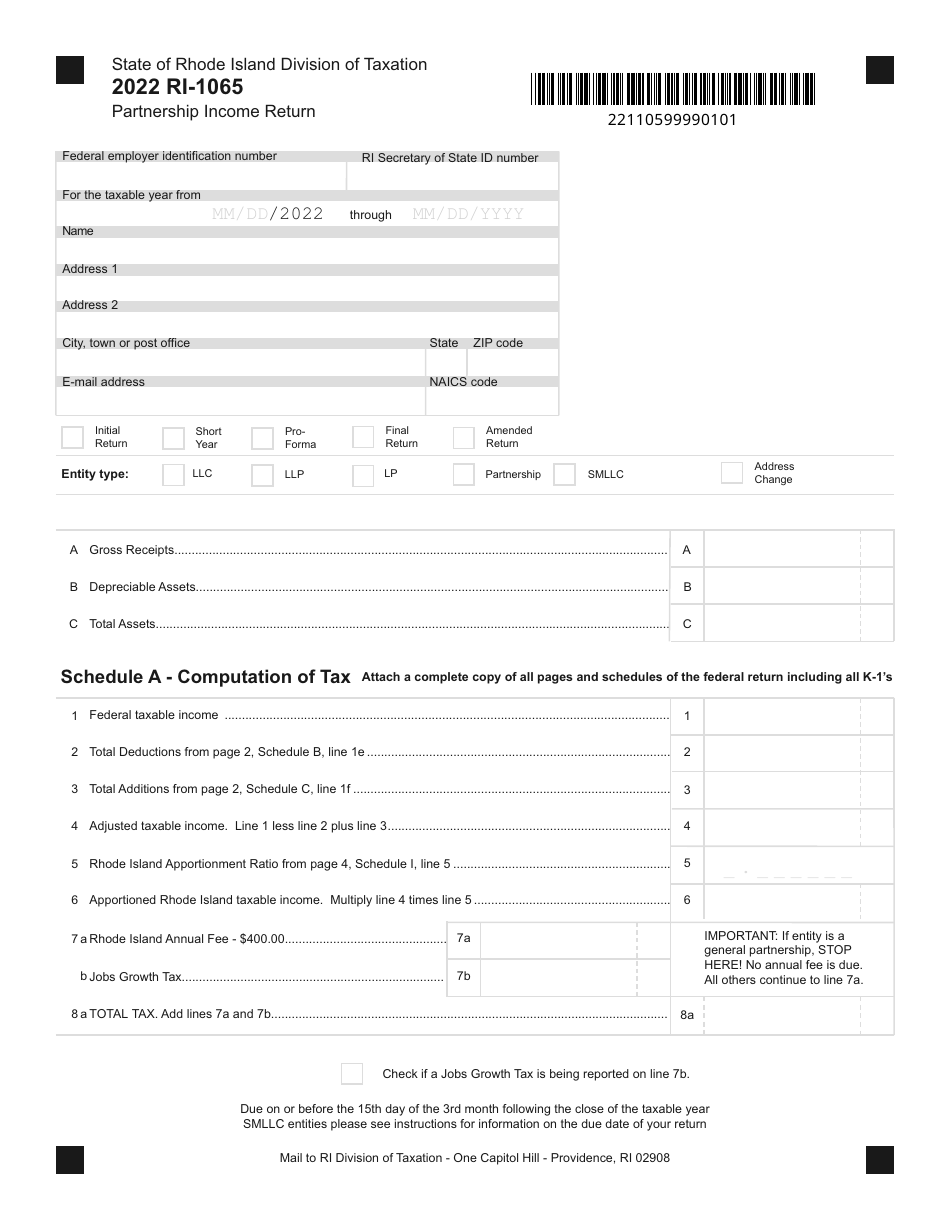

Ri Form 1065 - Apportioned rhode island taxable income. 40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island. Rhode island does not follow the irs return perfection period. If the electronic return cannot be corrected and retransmitted, the taxpayer must. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. The new sole proprietor check box is.

40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island. If the electronic return cannot be corrected and retransmitted, the taxpayer must. The new sole proprietor check box is. Apportioned rhode island taxable income. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. Rhode island does not follow the irs return perfection period. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit.

The new sole proprietor check box is. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit. Rhode island does not follow the irs return perfection period. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. If the electronic return cannot be corrected and retransmitted, the taxpayer must. 40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island. Apportioned rhode island taxable income.

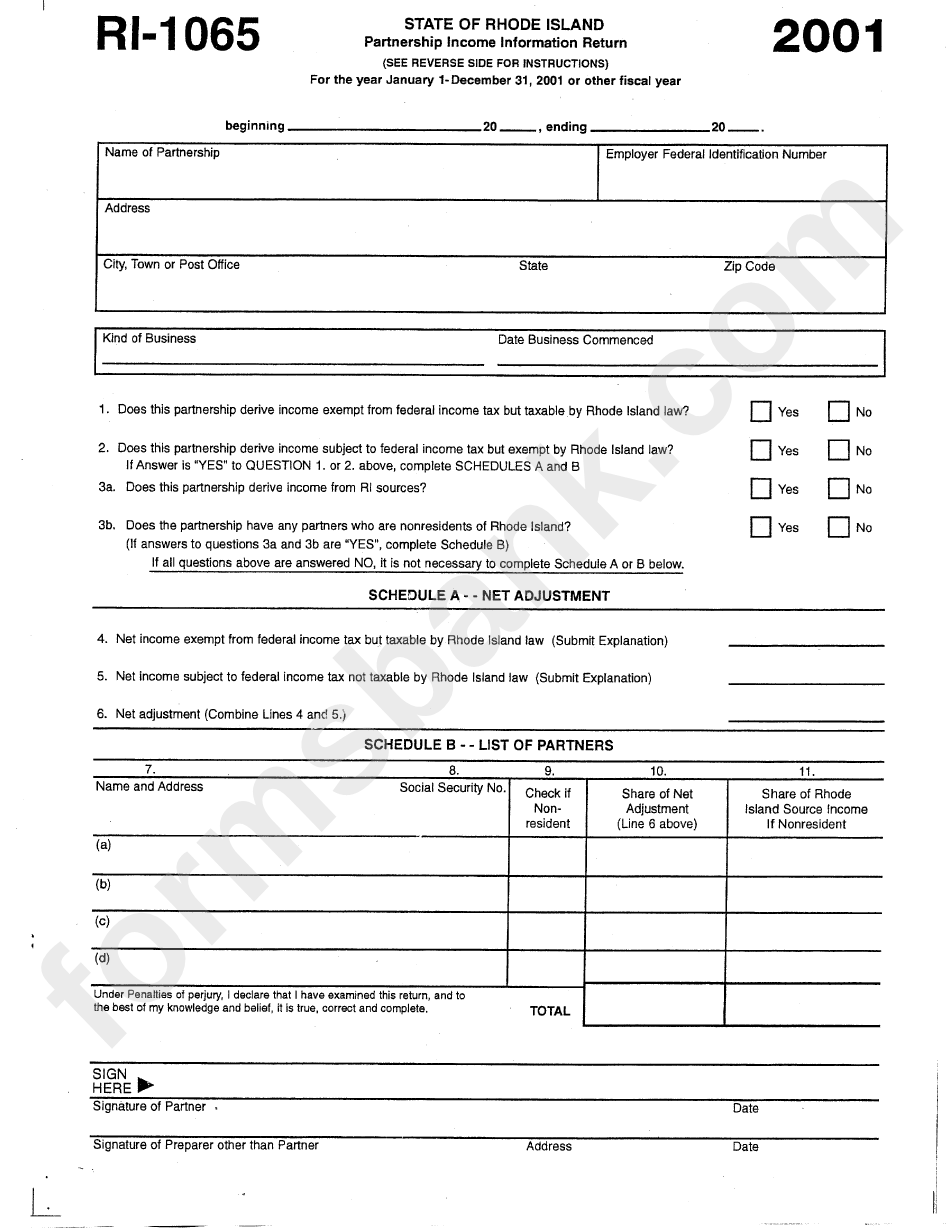

Form Ri1065 Partnership Information Return printable pdf download

Apportioned rhode island taxable income. If the electronic return cannot be corrected and retransmitted, the taxpayer must. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. Rhode island does not follow the irs return perfection period. In accordance with changes signed into law.

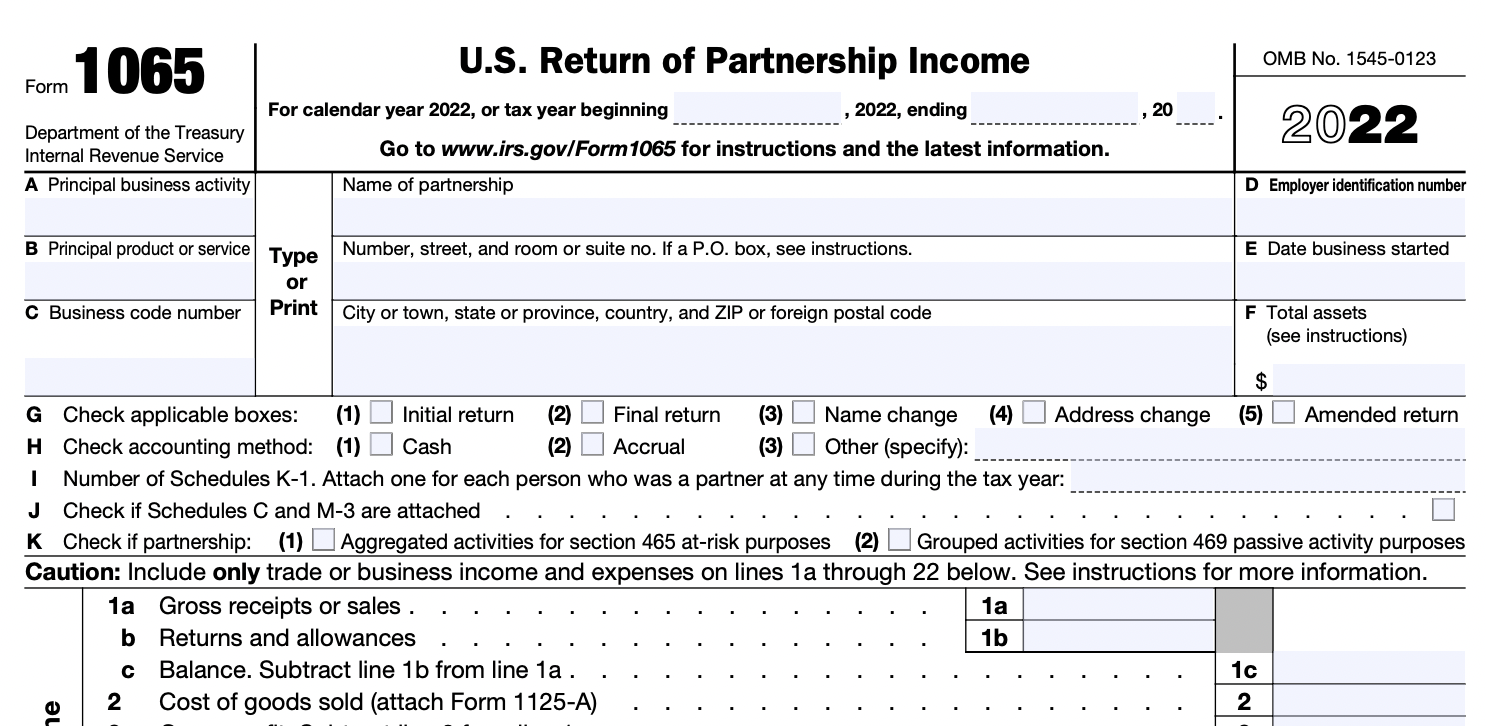

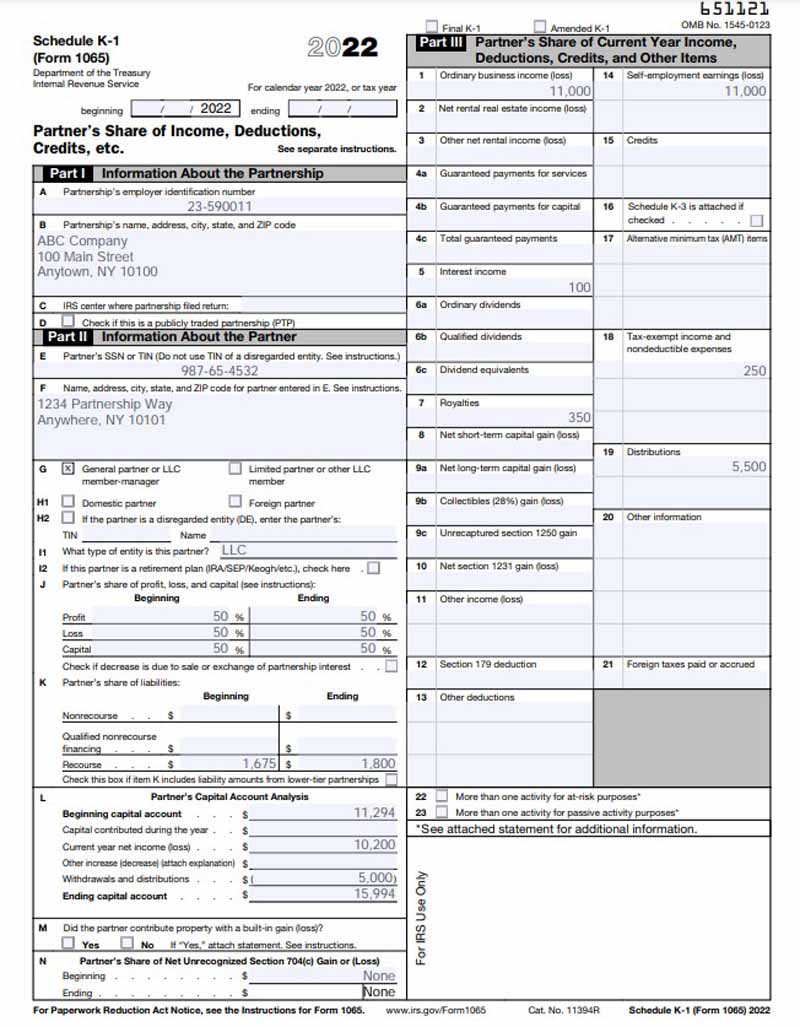

IRS Form 1065 Overview & StepbyStep Guide by Richard Nickson Issuu

40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island. The new sole proprietor check box is. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. If the electronic return cannot be corrected and.

1065 Form Generator ThePayStubs

In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit. 40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island. The new sole proprietor check box is. Rhode island does not follow the irs.

How to Fill Out Form 1065 for 2021. StepbyStep Instructions YouTube

Apportioned rhode island taxable income. Rhode island does not follow the irs return perfection period. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit. 40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode.

How to Fill Out Form 1065 for 2023. StepbyStep Instructions for

Rhode island does not follow the irs return perfection period. 40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. Apportioned rhode island taxable income..

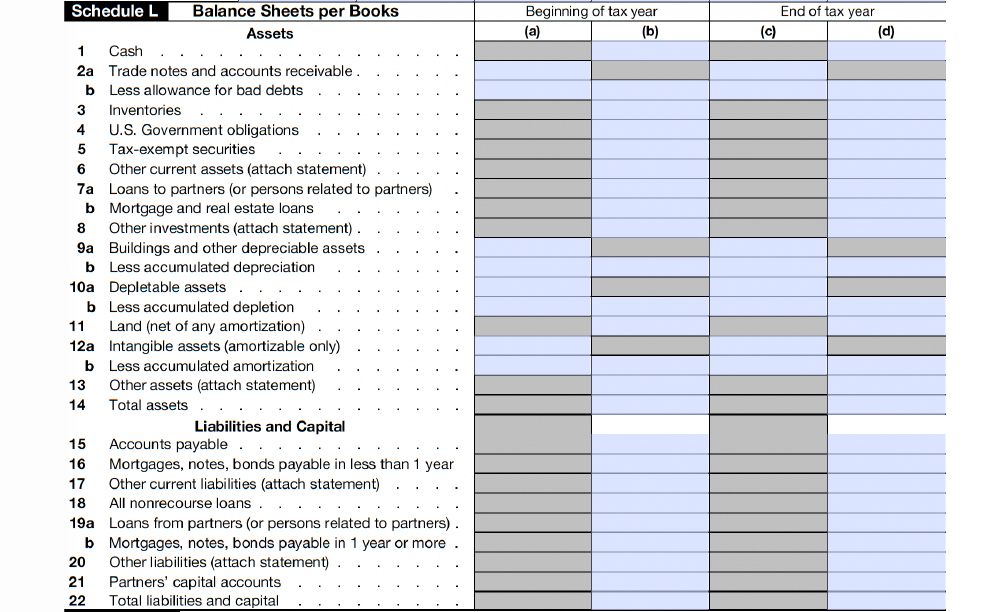

Form 1065 Instructions U.S. Return of Partnership

Rhode island does not follow the irs return perfection period. If the electronic return cannot be corrected and retransmitted, the taxpayer must. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit. Apportioned rhode island taxable income. 40 rows learn about the minimum.

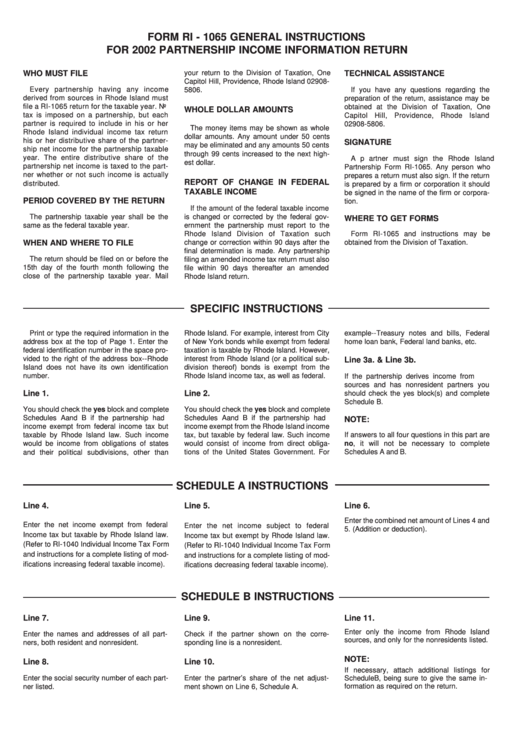

Form Ri 1065 General Instructions For 2002 Partnership

Rhode island does not follow the irs return perfection period. If the electronic return cannot be corrected and retransmitted, the taxpayer must. Apportioned rhode island taxable income. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. In accordance with changes signed into law.

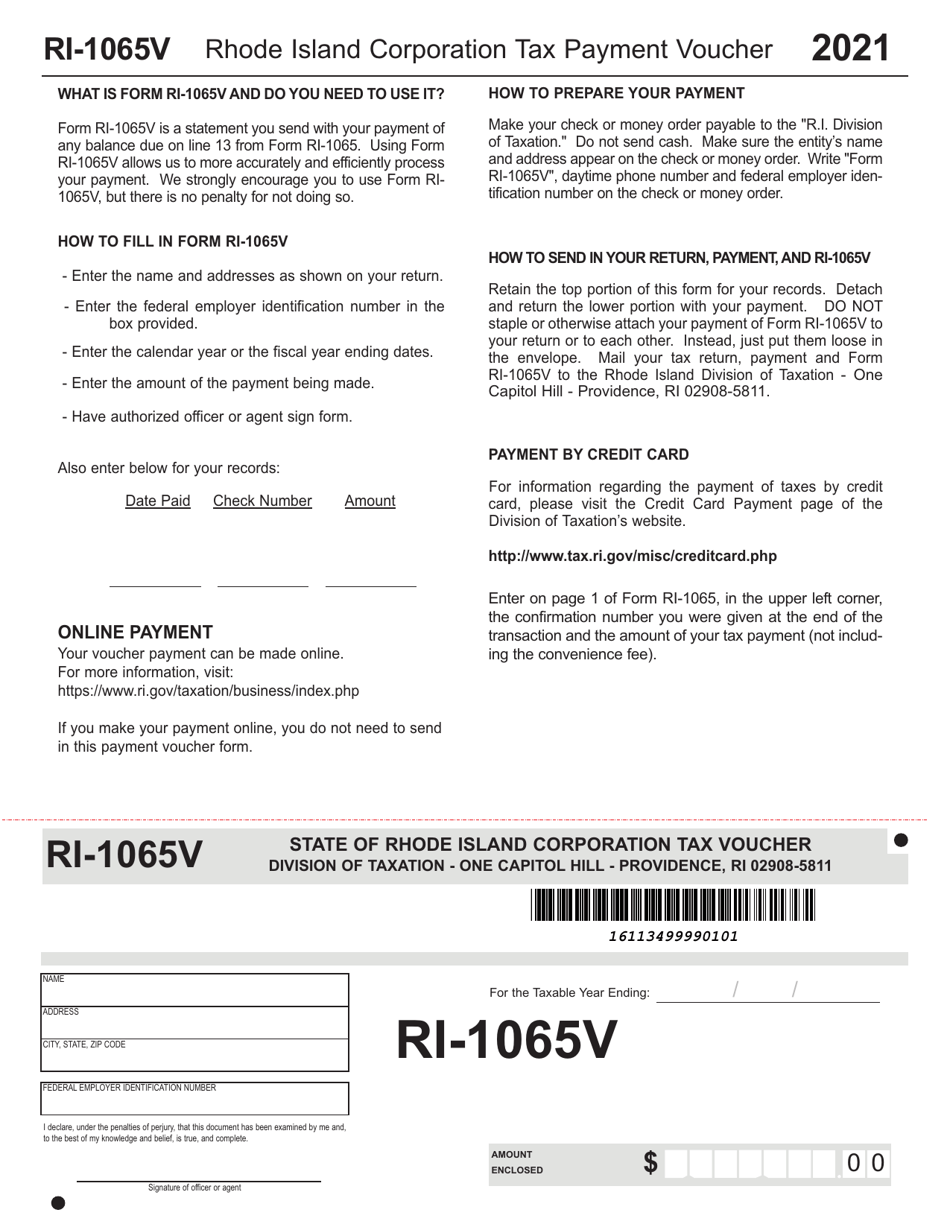

Form RI1065V 2021 Fill Out, Sign Online and Download Fillable PDF

Rhode island does not follow the irs return perfection period. 40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island. The new sole proprietor check box is. If the electronic return cannot be corrected and retransmitted, the taxpayer must. Download or print the 2023 rhode island (partnership income tax return to.

Form RI1065 Download Fillable PDF or Fill Online Partnership

Apportioned rhode island taxable income. The new sole proprietor check box is. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023).

2023 Form 1065 Printable Forms Free Online

If the electronic return cannot be corrected and retransmitted, the taxpayer must. Apportioned rhode island taxable income. Rhode island does not follow the irs return perfection period. In accordance with changes signed into law in june of 2022, a larger business registrant will be required to use electronic means to file returns and remit. 40 rows learn about the minimum.

Rhode Island Does Not Follow The Irs Return Perfection Period.

40 rows learn about the minimum annual tax requirements and filing deadlines for different business structures in rhode island. Apportioned rhode island taxable income. Download or print the 2023 rhode island (partnership income tax return to be filed by llcs, llps, lps and partnerships) (2023) and other income tax forms. If the electronic return cannot be corrected and retransmitted, the taxpayer must.

In Accordance With Changes Signed Into Law In June Of 2022, A Larger Business Registrant Will Be Required To Use Electronic Means To File Returns And Remit.

The new sole proprietor check box is.