Revenue Recognition Principle - What is the revenue recognition principle? It is a cornerstone of. Revenue recognition is a generally accepted accounting principle (gaap) that stipulates how and when revenue is to be recognized. The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company’s financial. The revenue recognition principle states that you should only record revenue when it has been earned, not when the related cash is. In accounting, the revenue recognition principle states that revenues are earned and recognized when they are realized or realizable, no matter when cash is received. What is the revenue recognition principle?

The revenue recognition principle states that you should only record revenue when it has been earned, not when the related cash is. What is the revenue recognition principle? Revenue recognition is a generally accepted accounting principle (gaap) that stipulates how and when revenue is to be recognized. In accounting, the revenue recognition principle states that revenues are earned and recognized when they are realized or realizable, no matter when cash is received. What is the revenue recognition principle? It is a cornerstone of. The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company’s financial.

It is a cornerstone of. Revenue recognition is a generally accepted accounting principle (gaap) that stipulates how and when revenue is to be recognized. The revenue recognition principle states that you should only record revenue when it has been earned, not when the related cash is. The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company’s financial. In accounting, the revenue recognition principle states that revenues are earned and recognized when they are realized or realizable, no matter when cash is received. What is the revenue recognition principle? What is the revenue recognition principle?

Here’s What Your Nonprofit Needs to Know About New Revenue Recognition

What is the revenue recognition principle? The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company’s financial. The revenue recognition principle states that you should only record revenue when it has been earned, not when the related cash is. In accounting, the revenue recognition principle states that revenues.

Revenue Recognition Principles, Criteria for Recognizing Revenues

The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company’s financial. It is a cornerstone of. In accounting, the revenue recognition principle states that revenues are earned and recognized when they are realized or realizable, no matter when cash is received. Revenue recognition is a generally accepted accounting.

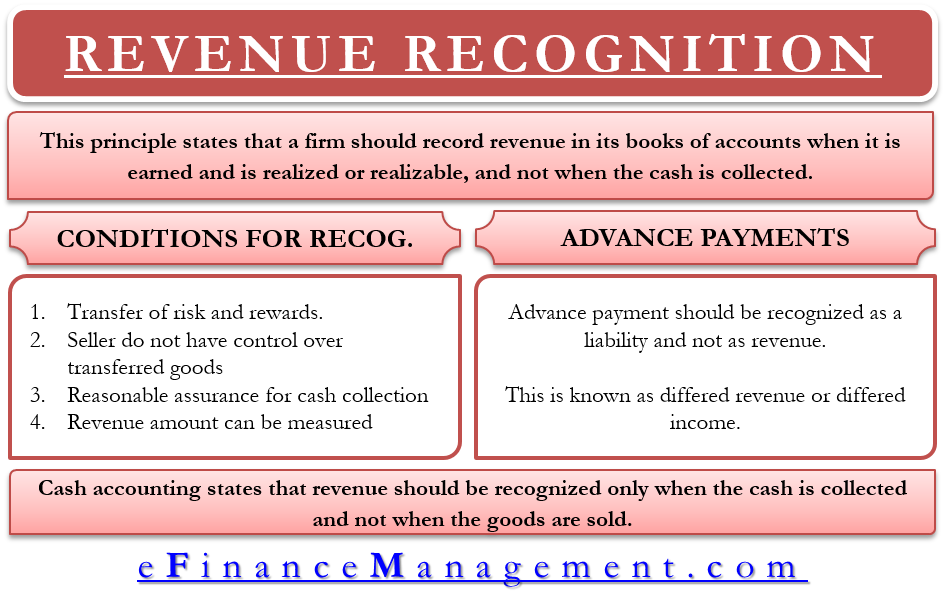

Revenue Recognition Principle Examples eFinanceManagement

It is a cornerstone of. What is the revenue recognition principle? What is the revenue recognition principle? In accounting, the revenue recognition principle states that revenues are earned and recognized when they are realized or realizable, no matter when cash is received. Revenue recognition is a generally accepted accounting principle (gaap) that stipulates how and when revenue is to be.

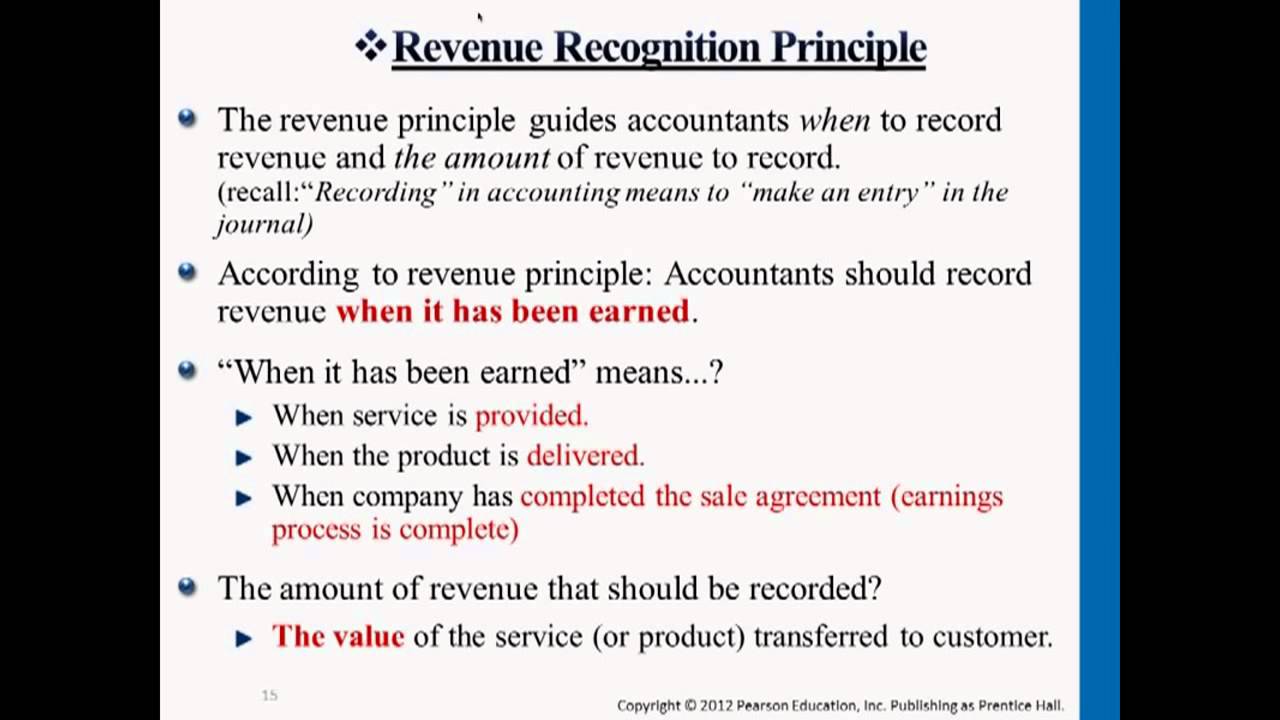

Revenue Recognition Principle and Matching Principle Accounting video

The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company’s financial. In accounting, the revenue recognition principle states that revenues are earned and recognized when they are realized or realizable, no matter when cash is received. What is the revenue recognition principle? Revenue recognition is a generally accepted.

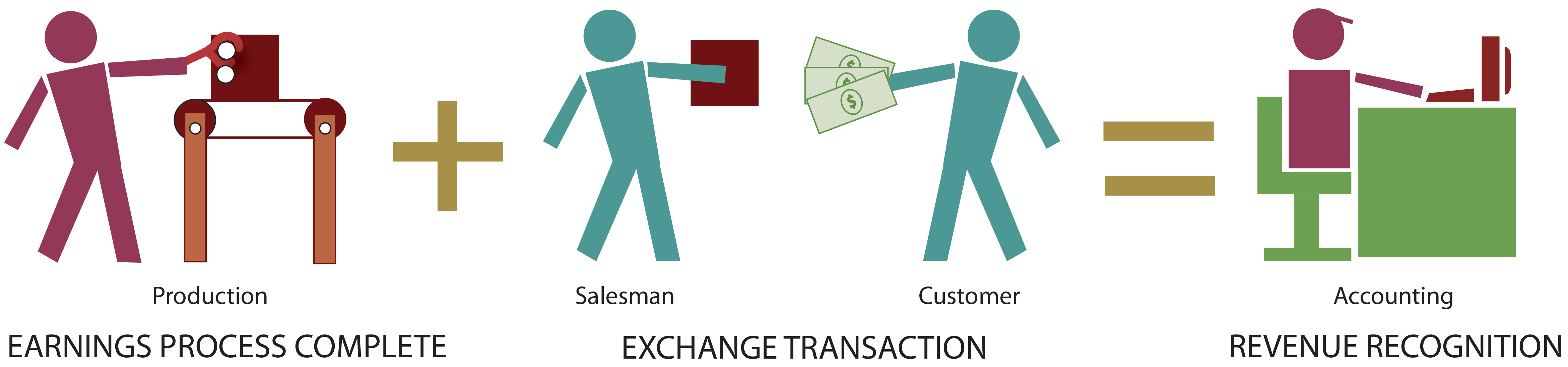

Basic Elements Of Revenue Recognition

The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company’s financial. In accounting, the revenue recognition principle states that revenues are earned and recognized when they are realized or realizable, no matter when cash is received. It is a cornerstone of. Revenue recognition is a generally accepted accounting.

Revenue Recognition Principle Professor Victoria Chiu YouTube

What is the revenue recognition principle? It is a cornerstone of. In accounting, the revenue recognition principle states that revenues are earned and recognized when they are realized or realizable, no matter when cash is received. The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company’s financial. What.

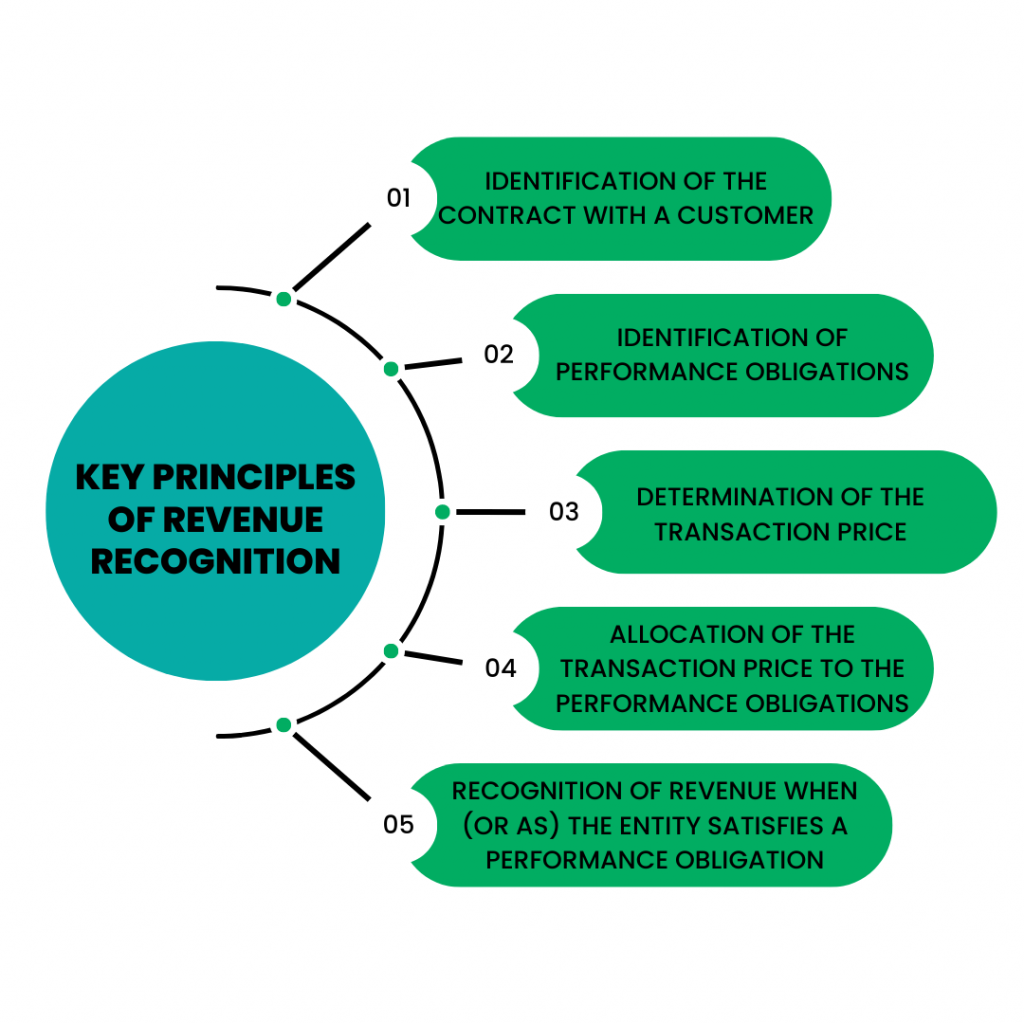

Revenue Recognition Key Principles Of The Backbone of Accurate

In accounting, the revenue recognition principle states that revenues are earned and recognized when they are realized or realizable, no matter when cash is received. It is a cornerstone of. The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company’s financial. What is the revenue recognition principle? The.

Revenue Recognition What It Means in Accounting and the 5 Steps

The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company’s financial. The revenue recognition principle states that you should only record revenue when it has been earned, not when the related cash is. Revenue recognition is a generally accepted accounting principle (gaap) that stipulates how and when revenue.

Revenue Recognition Principle YouTube

The revenue recognition principle states that you should only record revenue when it has been earned, not when the related cash is. What is the revenue recognition principle? The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company’s financial. It is a cornerstone of. What is the revenue.

Revenue Recognition Principles Datarails

In accounting, the revenue recognition principle states that revenues are earned and recognized when they are realized or realizable, no matter when cash is received. What is the revenue recognition principle? It is a cornerstone of. Revenue recognition is a generally accepted accounting principle (gaap) that stipulates how and when revenue is to be recognized. The revenue recognition principle dictates.

The Revenue Recognition Principle Dictates The Process And Timing By Which Revenue Is Recorded And Recognized As An Item In A Company’s Financial.

In accounting, the revenue recognition principle states that revenues are earned and recognized when they are realized or realizable, no matter when cash is received. What is the revenue recognition principle? It is a cornerstone of. The revenue recognition principle states that you should only record revenue when it has been earned, not when the related cash is.

Revenue Recognition Is A Generally Accepted Accounting Principle (Gaap) That Stipulates How And When Revenue Is To Be Recognized.

What is the revenue recognition principle?

:max_bytes(150000):strip_icc()/Revenuerecognition-f7a78c38114c47399302a7b8073aa31c.jpg)