Partner Basis Worksheet - A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. Here is the worksheet for. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details. To help you track basis,. Therefore, for all partners, ultratax cs uses the total of all liabilities on. The following information refers to the partner’s adjusted basis worksheet in a partnership return. The 1065 basis worksheet is calculated using only the basis rules.

A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. To help you track basis,. The 1065 basis worksheet is calculated using only the basis rules. Here is the worksheet for. The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details. Therefore, for all partners, ultratax cs uses the total of all liabilities on. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. The following information refers to the partner’s adjusted basis worksheet in a partnership return. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest.

Therefore, for all partners, ultratax cs uses the total of all liabilities on. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. Here is the worksheet for. To help you track basis,. The following information refers to the partner’s adjusted basis worksheet in a partnership return. The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details. The 1065 basis worksheet is calculated using only the basis rules.

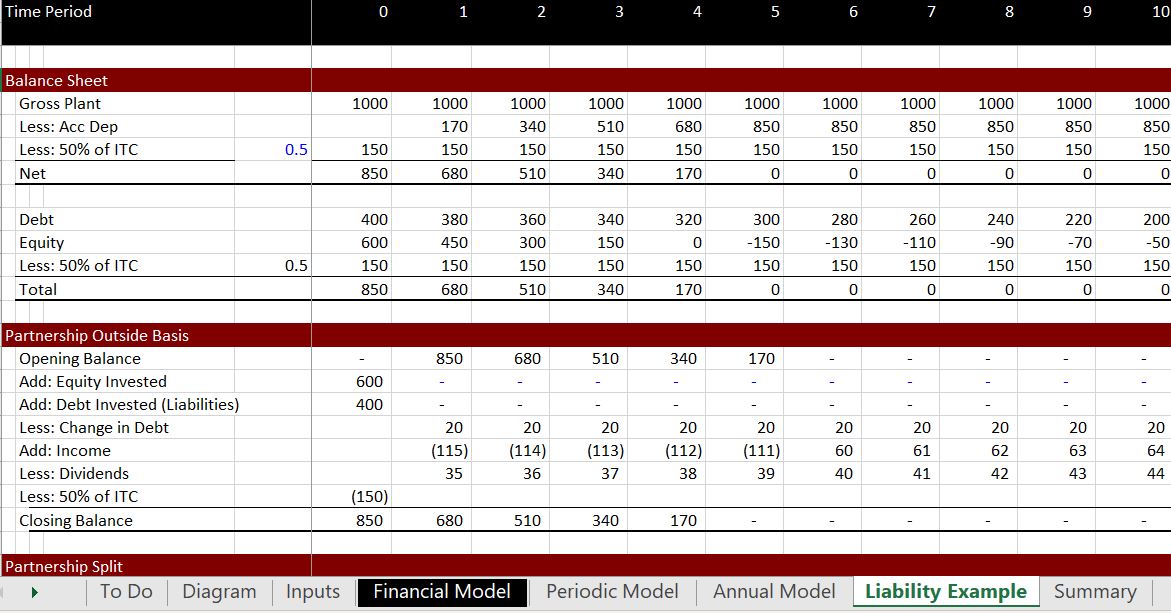

Partner Basis Worksheet Template Excel

To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. To help you track basis,. Here is the worksheet for. The 1065 basis worksheet is calculated using only the basis rules. A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity.

Partner Basis Worksheet Template Excel

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. Therefore, for all partners, ultratax cs uses the total of all liabilities on. Here is the.

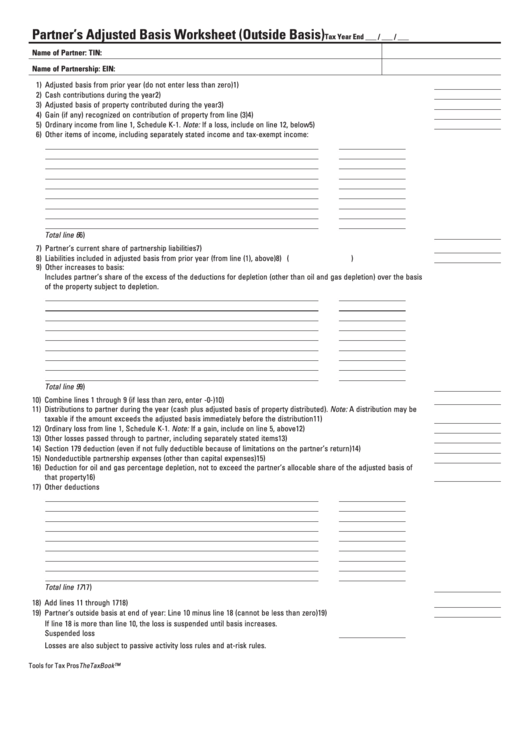

Fillable Partner'S Adjusted Basis Worksheet (Outside Basis) Template

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details. Here is the worksheet for. The following information refers to the partner’s adjusted basis worksheet in a partnership return..

Partner Basis Worksheet Template Excel

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. To help you track basis,. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. The 1065 basis worksheet is calculated using only the basis rules..

Partner Basis Worksheet Excel

A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. Therefore, for all partners, ultratax cs uses the total of all liabilities on. To help you track basis,. The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details. The adjusted partnership basis will be used.

Partnership Basis Worksheet Excel

Here is the worksheet for. To help you track basis,. The 1065 basis worksheet is calculated using only the basis rules. A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest.

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

Here is the worksheet for. A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. The following information refers to the partner’s adjusted basis worksheet in a partnership return. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. Therefore, for all.

Partner's Adjusted Basis Worksheets

Here is the worksheet for. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. The following information refers to the partner’s adjusted basis worksheet in a partnership return. To assist the partners in.

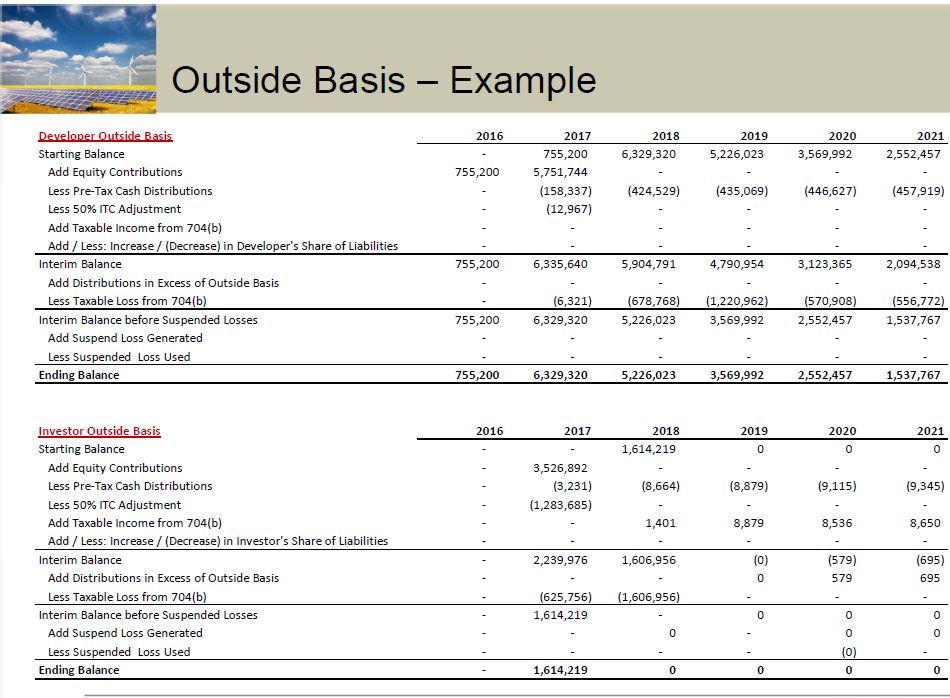

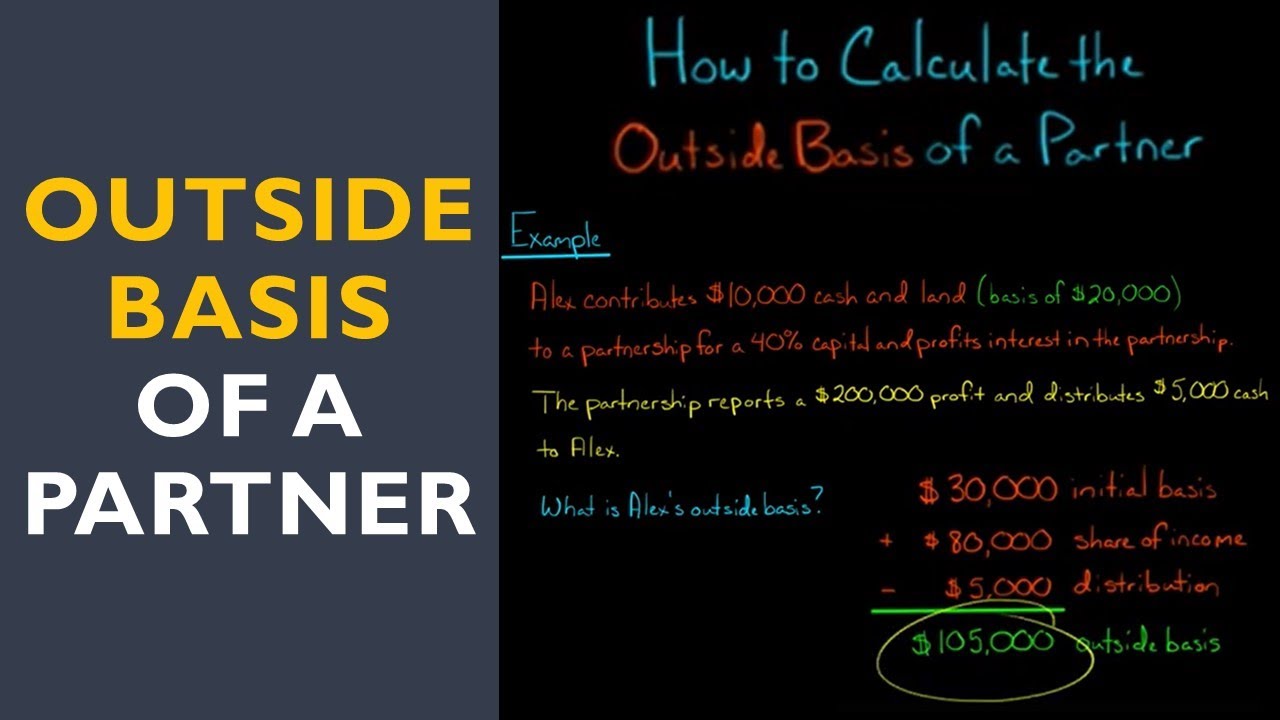

How To Calculate Outside Basis In Partnership

Here is the worksheet for. A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. The following information refers to the partner’s adjusted basis worksheet in a partnership return. Therefore, for all partners, ultratax cs uses the total of all liabilities on. The adjusted partnership basis will be used to figure your gain or loss.

Partner Basis Worksheet Template Excel

The worksheet for adjusting the basis of a partner’s interest in the partnership has been changed to provide more details. A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. The following information refers.

The Following Information Refers To The Partner’s Adjusted Basis Worksheet In A Partnership Return.

Therefore, for all partners, ultratax cs uses the total of all liabilities on. The 1065 basis worksheet is calculated using only the basis rules. A partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. Here is the worksheet for.

The Worksheet For Adjusting The Basis Of A Partner’s Interest In The Partnership Has Been Changed To Provide More Details.

To help you track basis,. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the.