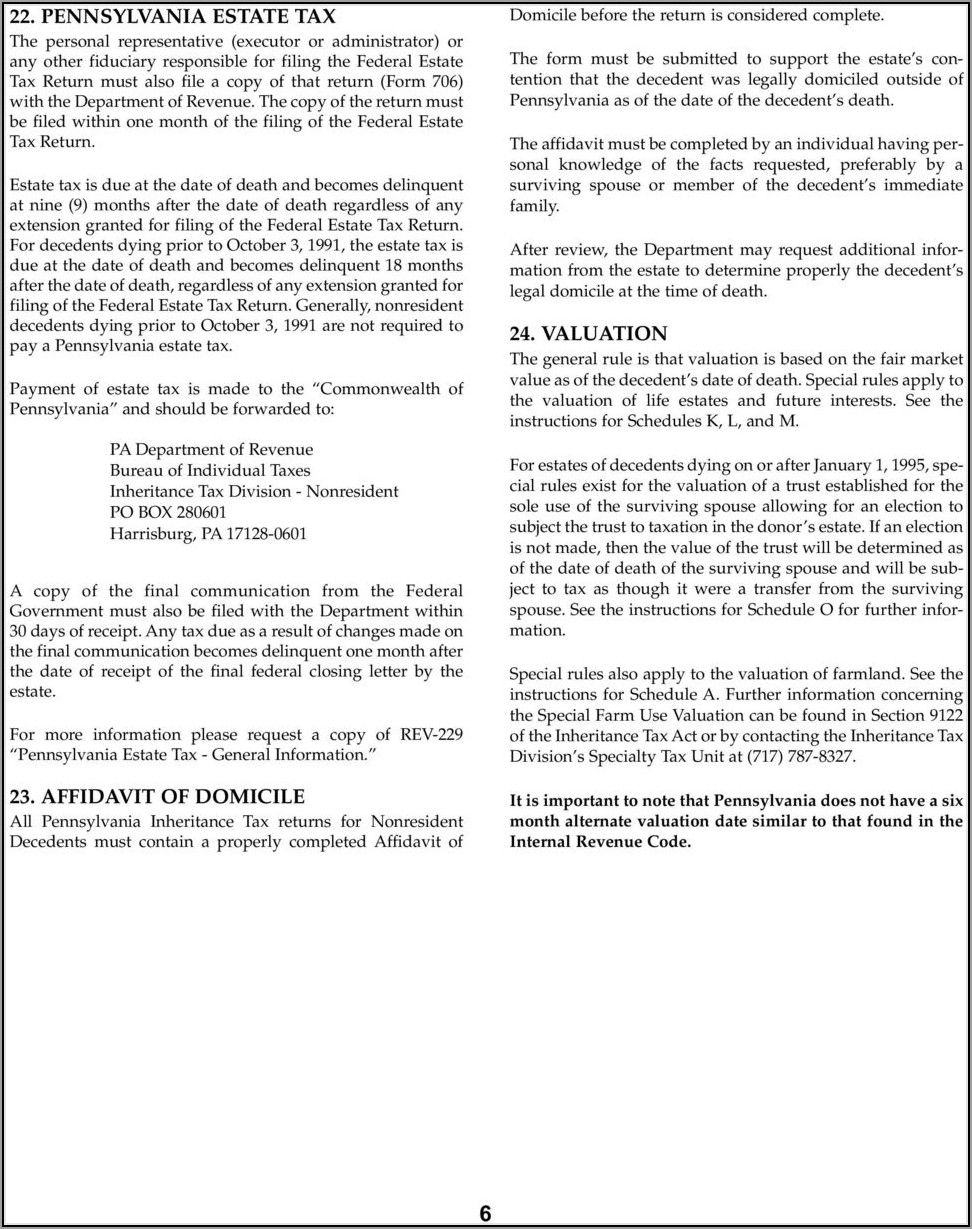

Ohio Inheritance Tax Waiver Form - To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. The ohio department of taxation (the department) no longer requires a tax release or inheritance tax waiver form (et 12/13/14). When it comes to filing taxes on an inherited estate in ohio, there are a few steps that must be taken. Please direct 12 and 14 to the county. The first step is for the executor. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Learn about the ohio estate tax, its rates, deductions, credits, and filing requirements. Find out how to apply for an extension of time to pay. Please direct 12 and 14 to the county. The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain.

Learn about the ohio estate tax, its rates, deductions, credits, and filing requirements. The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. Please direct 12 and 14 to the county. Please direct 12 and 14 to the county. When it comes to filing taxes on an inherited estate in ohio, there are a few steps that must be taken. The ohio department of taxation (the department) no longer requires a tax release or inheritance tax waiver form (et 12/13/14). Find out how to apply for an extension of time to pay. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. The first step is for the executor.

To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Please direct 12 and 14 to the county. When it comes to filing taxes on an inherited estate in ohio, there are a few steps that must be taken. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Learn about the ohio estate tax, its rates, deductions, credits, and filing requirements. The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. Please direct 12 and 14 to the county. The ohio department of taxation (the department) no longer requires a tax release or inheritance tax waiver form (et 12/13/14). The first step is for the executor. Find out how to apply for an extension of time to pay.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

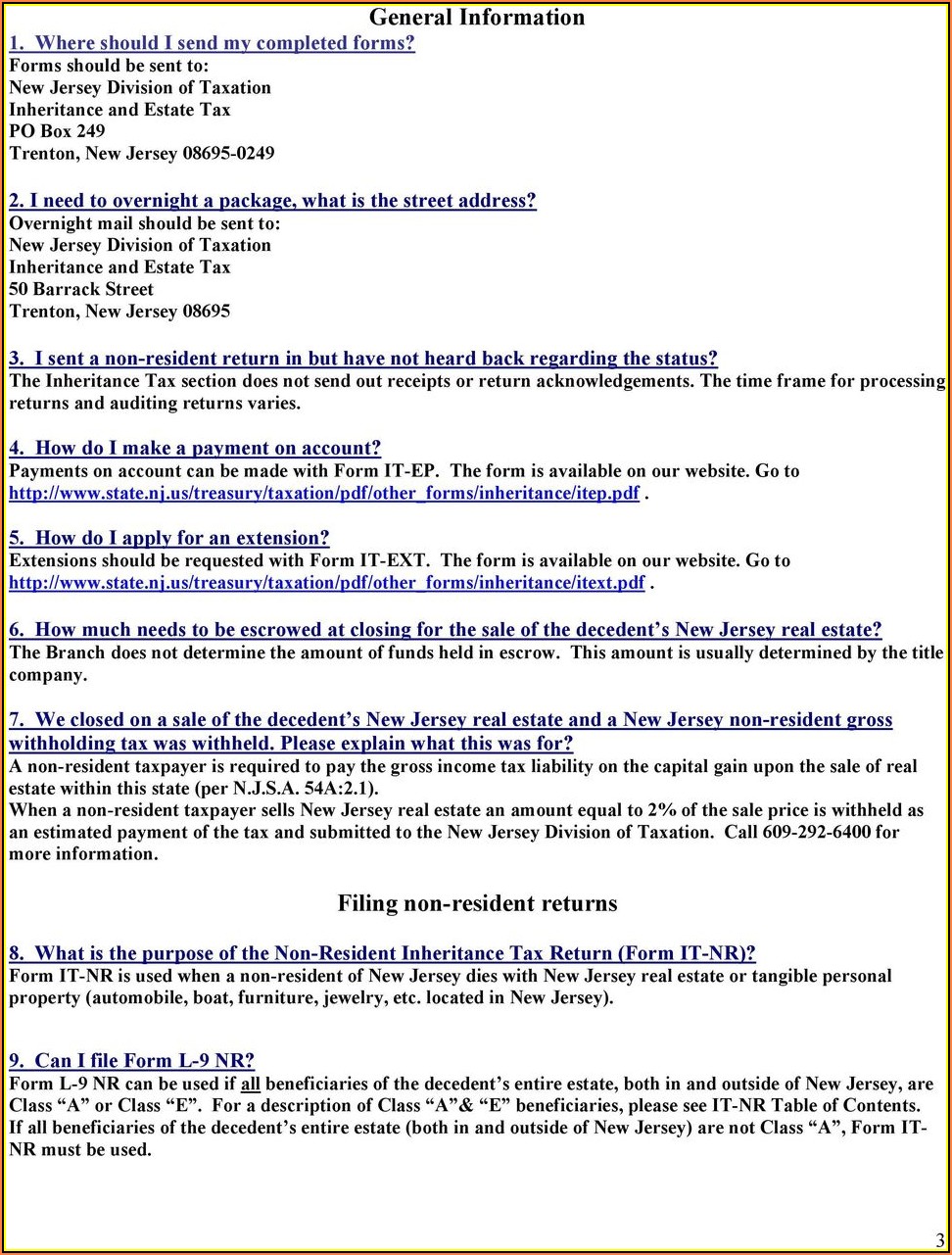

Find out how to apply for an extension of time to pay. The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. Please direct 12 and 14 to the county. The ohio department of taxation (the department) no longer requires a tax release or inheritance tax waiver form.

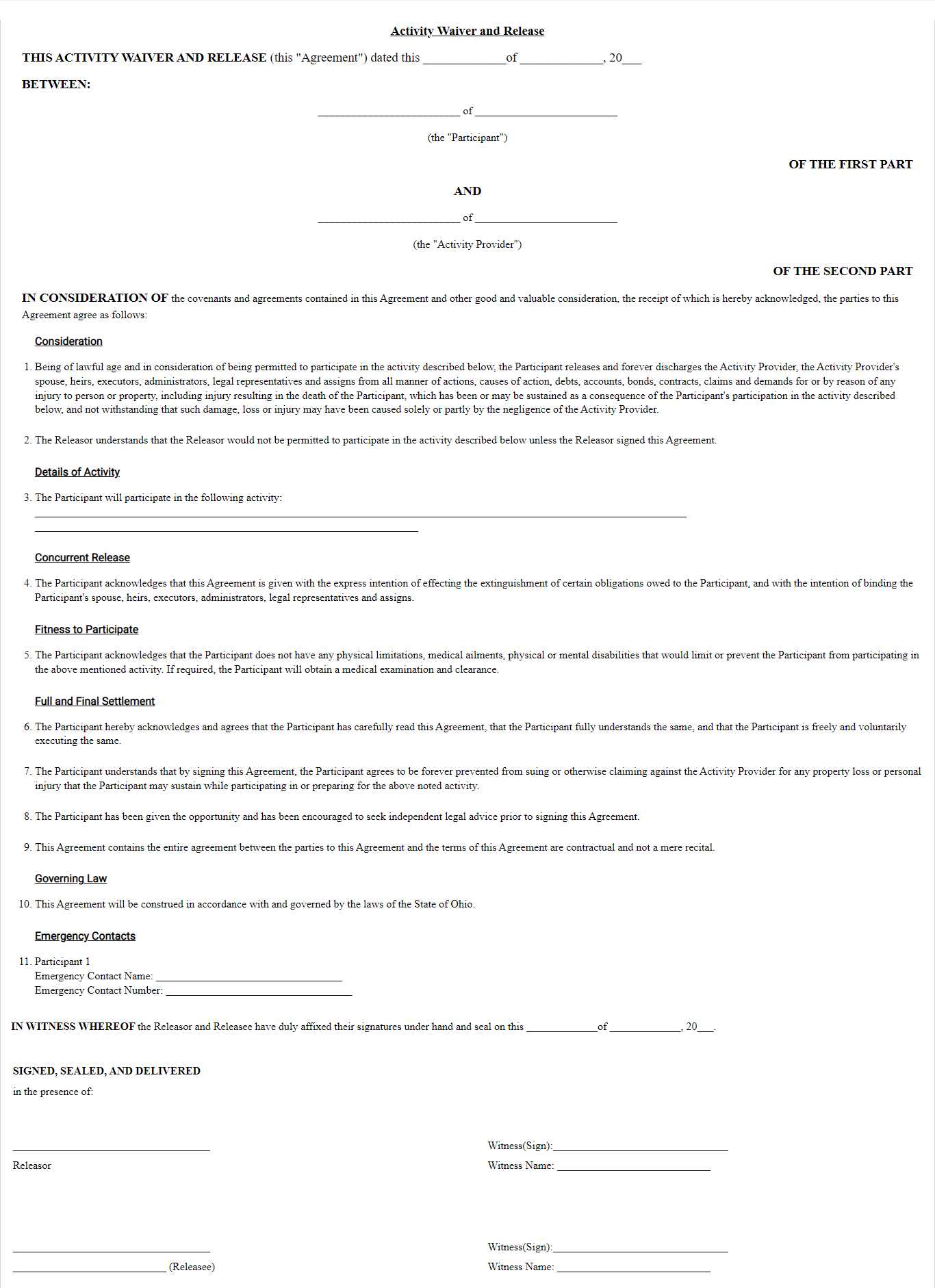

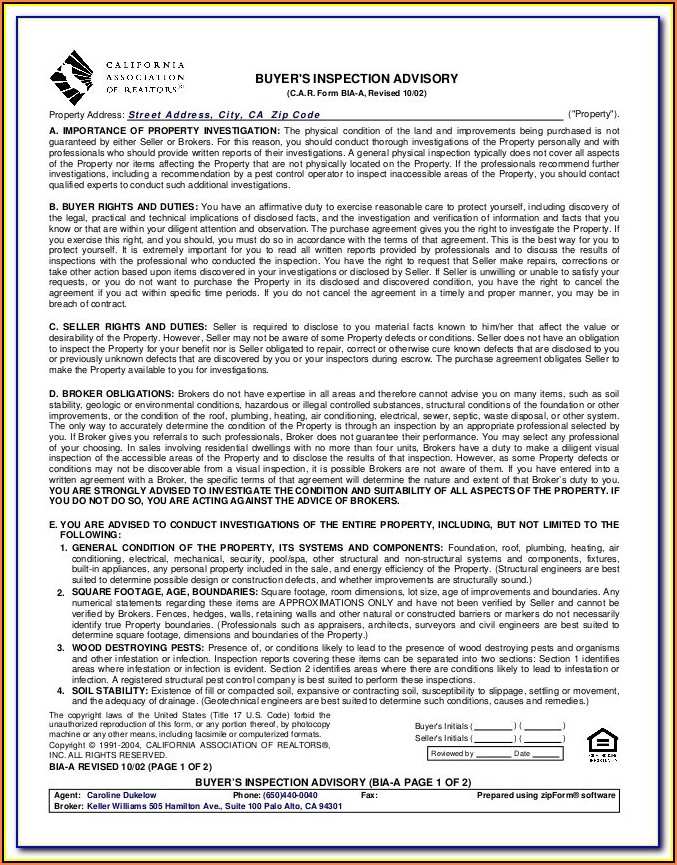

Free Ohio Release / Waiver Form Template Forms.Legal

The ohio department of taxation (the department) no longer requires a tax release or inheritance tax waiver form (et 12/13/14). To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. The first step is for the executor. Find out how to apply for an extension of time to pay. Please direct.

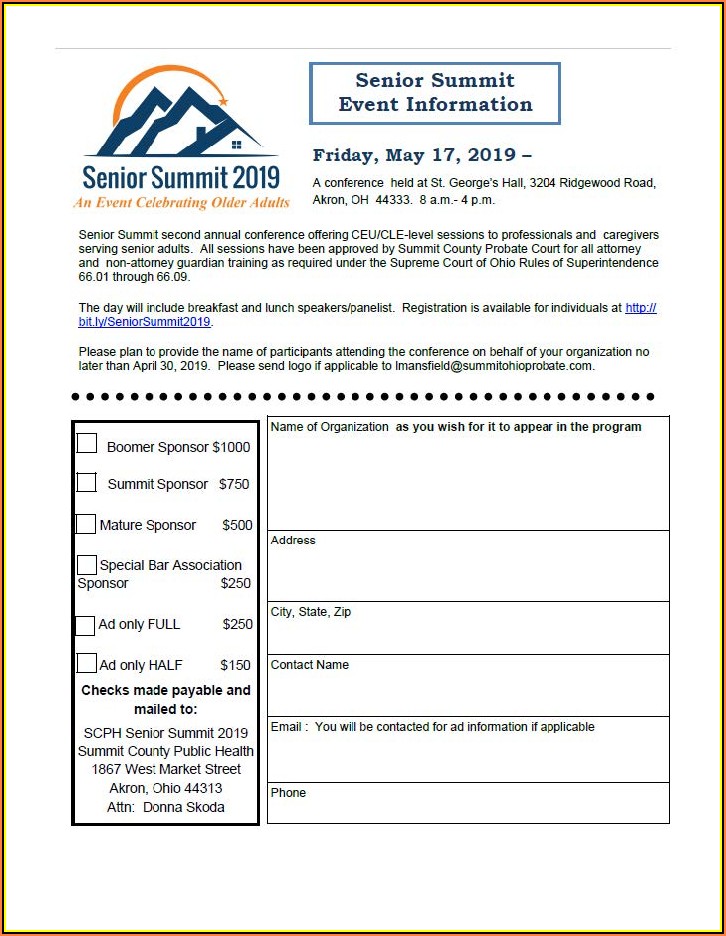

Inheritance Tax Waiver Form Missouri Form Resume Examples Ze12OJAKjx

Please direct 12 and 14 to the county. The first step is for the executor. Find out how to apply for an extension of time to pay. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Learn about the ohio estate tax, its rates, deductions, credits, and filing requirements.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

Please direct 12 and 14 to the county. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Please direct 12 and 14 to the county. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Find out how to apply for.

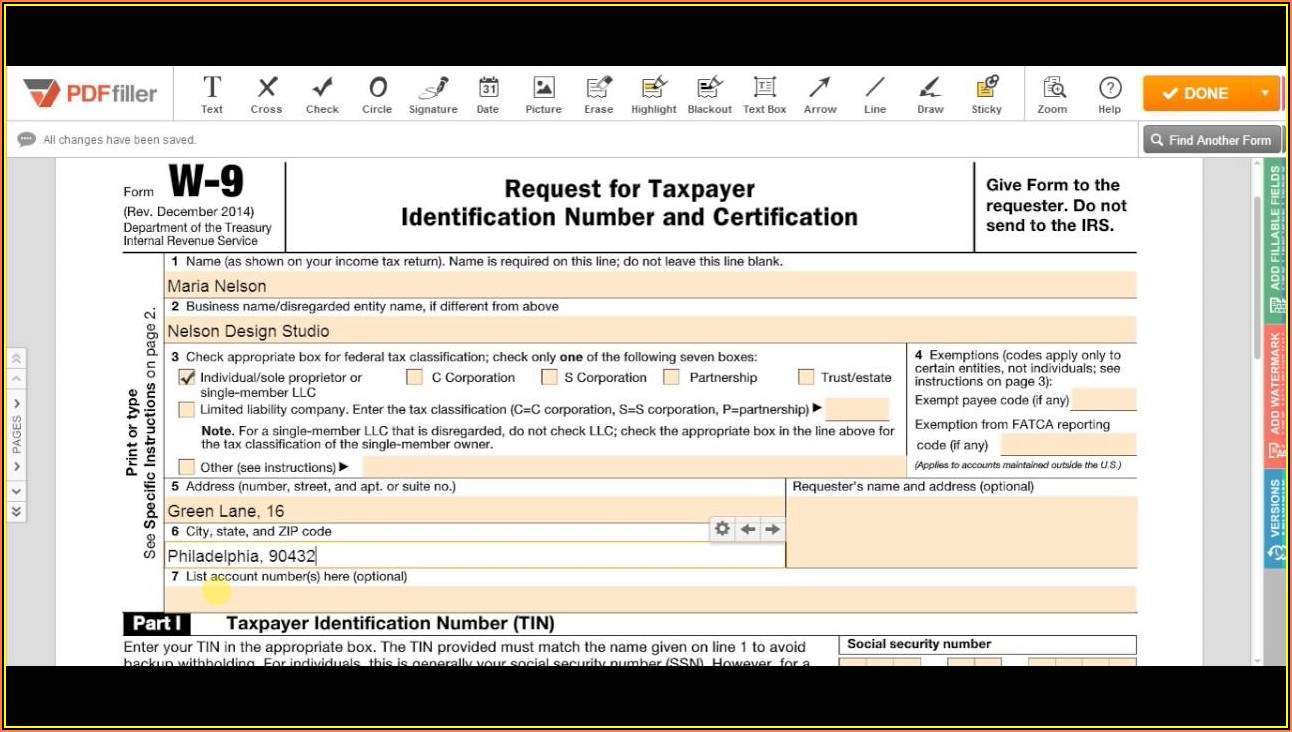

Nys inheritance tax waiver form Fill out & sign online DocHub

When it comes to filing taxes on an inherited estate in ohio, there are a few steps that must be taken. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Please.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

Learn about the ohio estate tax, its rates, deductions, credits, and filing requirements. Please direct 12 and 14 to the county. Please direct 12 and 14 to the county. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. The ohio department of taxation (the department) no longer requires a tax.

Inheritance Tax Waiver Form New York State Form Resume Examples

The ohio department of taxation (the department) no longer requires a tax release or inheritance tax waiver form (et 12/13/14). The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. When it comes to filing taxes on an inherited estate in ohio, there are a few steps that.

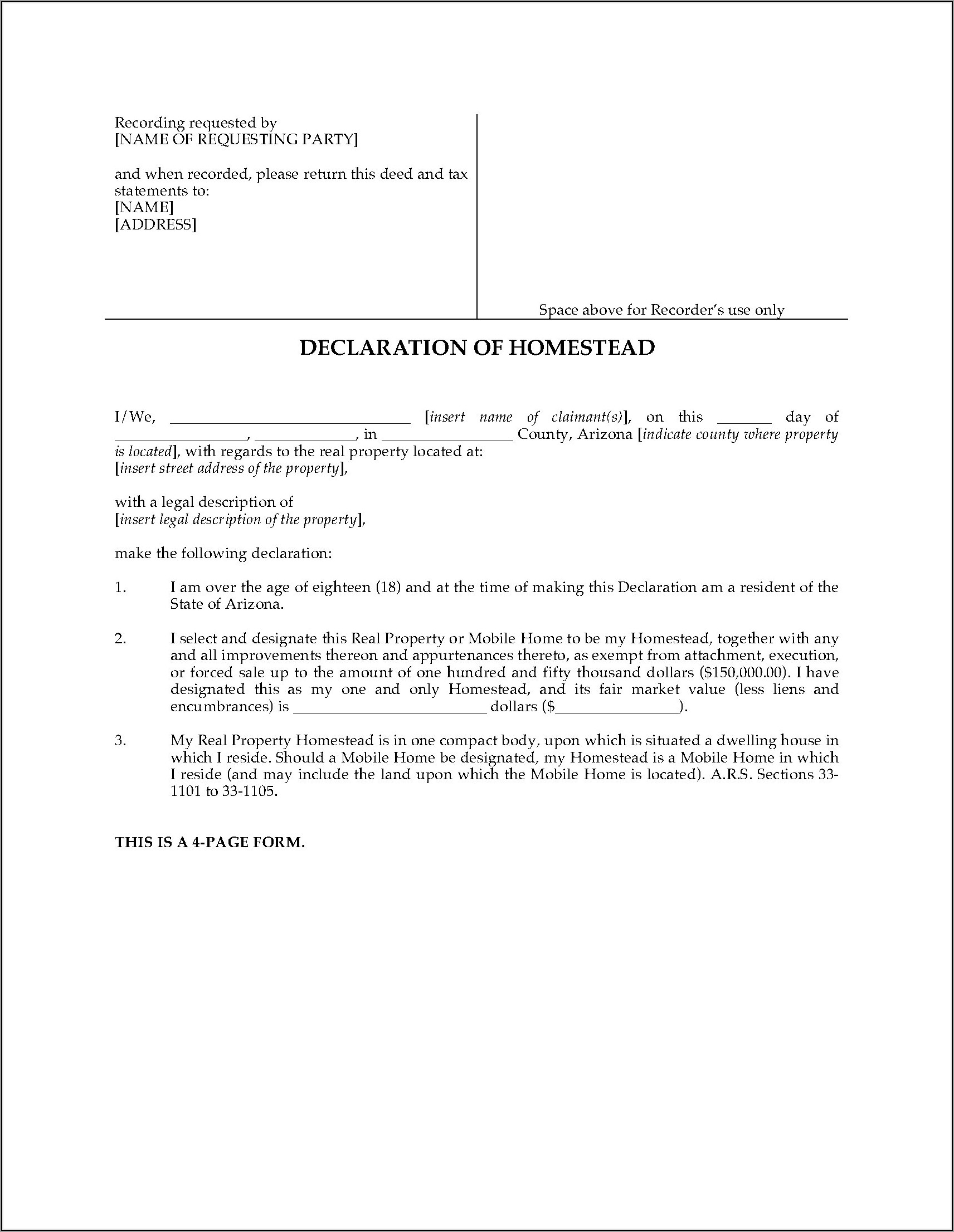

Inheritance Tax Waiver Form Az Form Resume Examples N8VZwyM2we

Please direct 12 and 14 to the county. When it comes to filing taxes on an inherited estate in ohio, there are a few steps that must be taken. The first step is for the executor. The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. To obtain.

Fillable Online Ohio Inheritance Tax Waiver Form. Ohio Inheritance Tax

The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. Please direct 12 and 14 to the county. To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. Learn about the ohio estate tax, its rates, deductions, credits, and.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

When it comes to filing taxes on an inherited estate in ohio, there are a few steps that must be taken. The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. To obtain a release, take the completed estate tax forms from date of death to date of.

Please Direct 12 And 14 To The County.

Please direct 12 and 14 to the county. The first step is for the executor. The ohio department of taxation (the department) no longer requires a tax release or a tax waiver form (et 12/13/14) before certain. Find out how to apply for an extension of time to pay.

Learn About The Ohio Estate Tax, Its Rates, Deductions, Credits, And Filing Requirements.

To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. The ohio department of taxation (the department) no longer requires a tax release or inheritance tax waiver form (et 12/13/14). To obtain a release, take the completed estate tax forms from date of death to date of actual transfer. When it comes to filing taxes on an inherited estate in ohio, there are a few steps that must be taken.