Nj State Tax Exempt Form - Use tax (prior year form for purchases made on or after jan. 31, 2017) sales and use tax: To claim an exemption from sales tax on the purchase of taxable property or services, the purchaser must provide a fully completed. The new jersey division of taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable.

To claim an exemption from sales tax on the purchase of taxable property or services, the purchaser must provide a fully completed. 31, 2017) sales and use tax: The new jersey division of taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable. Use tax (prior year form for purchases made on or after jan.

To claim an exemption from sales tax on the purchase of taxable property or services, the purchaser must provide a fully completed. Use tax (prior year form for purchases made on or after jan. 31, 2017) sales and use tax: The new jersey division of taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable.

Exemption California State Tax Form 2024

To claim an exemption from sales tax on the purchase of taxable property or services, the purchaser must provide a fully completed. The new jersey division of taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable. 31, 2017) sales and use tax: Use tax (prior year form for purchases made on or after jan.

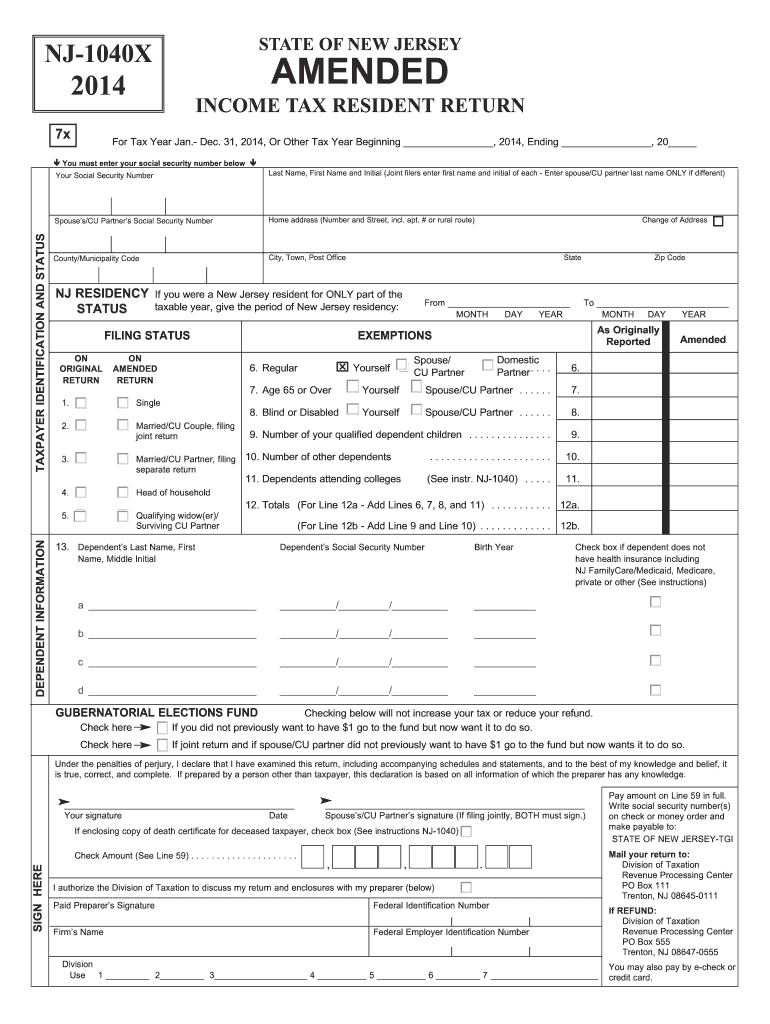

NJ State Tax Form Fill Out and Sign Printable PDF Template airSlate

Use tax (prior year form for purchases made on or after jan. 31, 2017) sales and use tax: To claim an exemption from sales tax on the purchase of taxable property or services, the purchaser must provide a fully completed. The new jersey division of taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable.

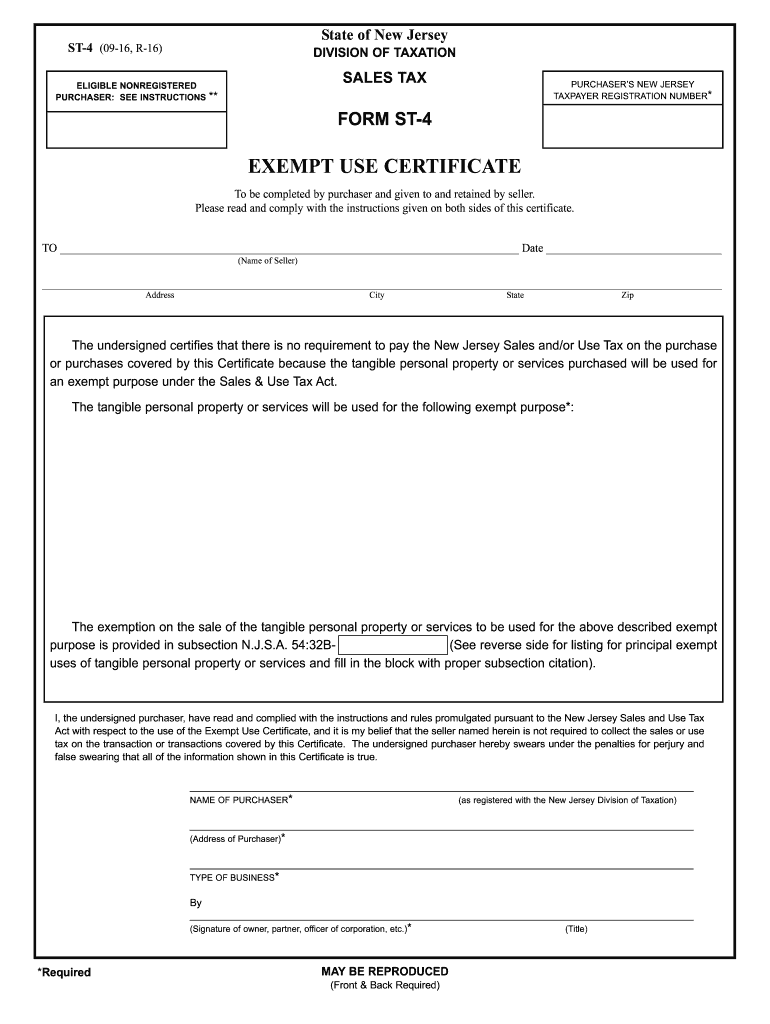

NJ ST4 20162022 Fill out Tax Template Online US Legal Forms

31, 2017) sales and use tax: The new jersey division of taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable. To claim an exemption from sales tax on the purchase of taxable property or services, the purchaser must provide a fully completed. Use tax (prior year form for purchases made on or after jan.

2021 Form NJ REG1E Fill Online, Printable, Fillable, Blank pdfFiller

To claim an exemption from sales tax on the purchase of taxable property or services, the purchaser must provide a fully completed. The new jersey division of taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable. Use tax (prior year form for purchases made on or after jan. 31, 2017) sales and use tax:

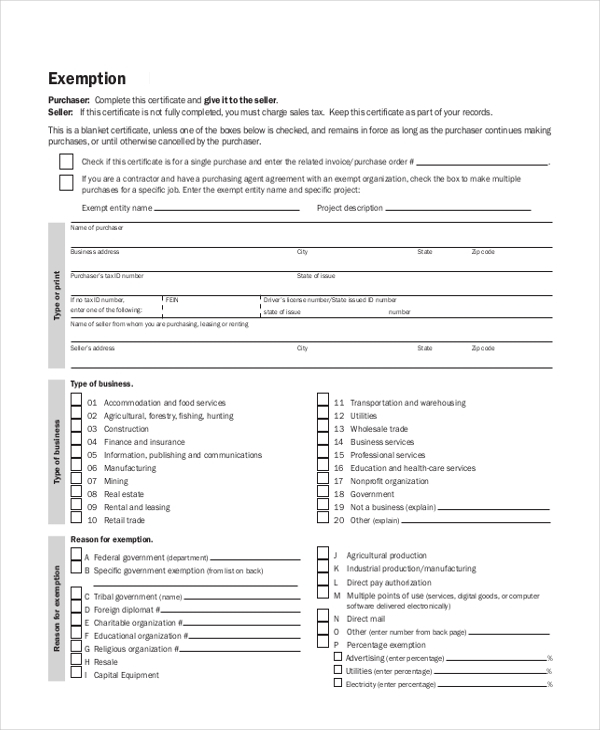

Tax Exempt Form 20202021 Fill and Sign Printable Template Online

31, 2017) sales and use tax: The new jersey division of taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable. Use tax (prior year form for purchases made on or after jan. To claim an exemption from sales tax on the purchase of taxable property or services, the purchaser must provide a fully completed.

Nj Sales Tax Exempt Form

31, 2017) sales and use tax: To claim an exemption from sales tax on the purchase of taxable property or services, the purchaser must provide a fully completed. The new jersey division of taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable. Use tax (prior year form for purchases made on or after jan.

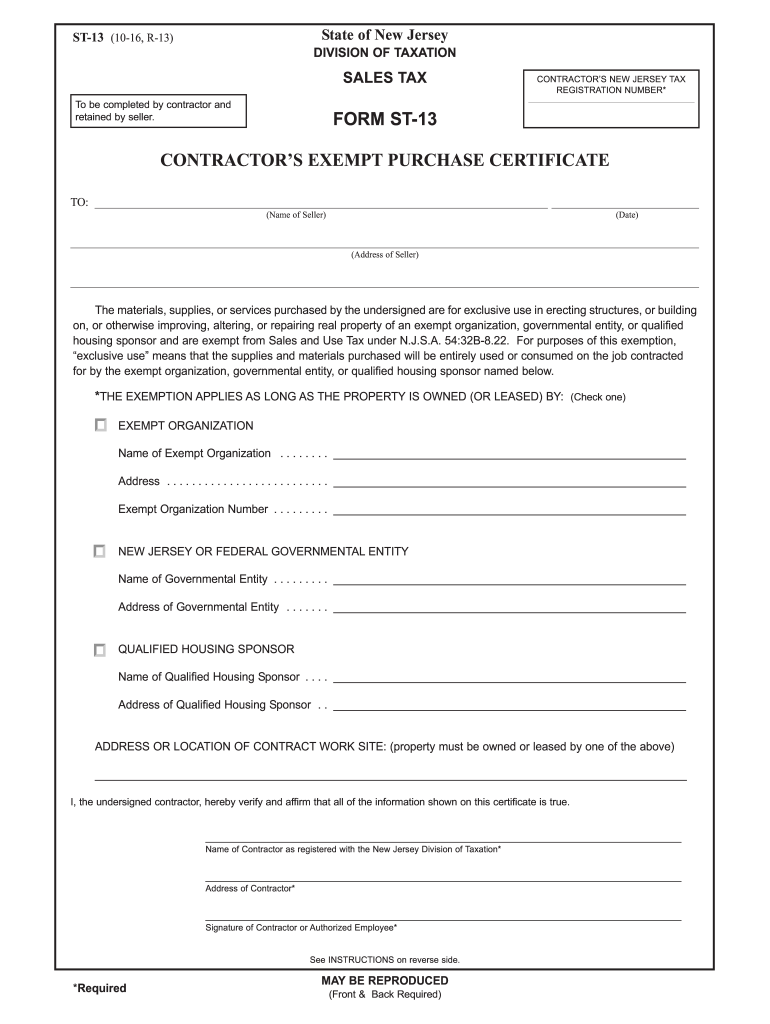

NJ ST13 20162022 Fill out Tax Template Online US Legal Forms

To claim an exemption from sales tax on the purchase of taxable property or services, the purchaser must provide a fully completed. 31, 2017) sales and use tax: The new jersey division of taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable. Use tax (prior year form for purchases made on or after jan.

State Tax Exempt Forms For Federal Employees

31, 2017) sales and use tax: The new jersey division of taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable. To claim an exemption from sales tax on the purchase of taxable property or services, the purchaser must provide a fully completed. Use tax (prior year form for purchases made on or after jan.

Nys State Tax Withholding Form

To claim an exemption from sales tax on the purchase of taxable property or services, the purchaser must provide a fully completed. Use tax (prior year form for purchases made on or after jan. The new jersey division of taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable. 31, 2017) sales and use tax:

Tax Exempt Form TAX

31, 2017) sales and use tax: To claim an exemption from sales tax on the purchase of taxable property or services, the purchaser must provide a fully completed. The new jersey division of taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable. Use tax (prior year form for purchases made on or after jan.

31, 2017) Sales And Use Tax:

Use tax (prior year form for purchases made on or after jan. To claim an exemption from sales tax on the purchase of taxable property or services, the purchaser must provide a fully completed. The new jersey division of taxation issues exemption certificates that allow qualified individuals and businesses to purchase taxable.