Nationwide 401K Hardship Withdrawal Form - Save time and file a claim online. If you complete the form and return it to this office with the. If you are invested in a fund that includes a lifetime income payment feature, withdrawals, including rollovers, taken prior to the income. The authority allows up to two approved hardship withdrawals per calendar year. Need to file an insurance or death benefit claim? Download and print the nationwide form you need. • distributions from rollover and roth sources may be subject to an early withdrawal penalty. • expenses incurred or funds. (1) first obtain all other currently available withdrawals (not including loans) from your. To qualify for a 401(k) hardship withdrawal, you must:

• some mutual funds may impose a short term trade. Save time and file a claim online. Need to file an insurance or death benefit claim? • expenses incurred or funds. Download and print the nationwide form you need. If you complete the form and return it to this office with the. (1) first obtain all other currently available withdrawals (not including loans) from your. The authority allows up to two approved hardship withdrawals per calendar year. If you are invested in a fund that includes a lifetime income payment feature, withdrawals, including rollovers, taken prior to the income. To qualify for a 401(k) hardship withdrawal, you must:

• distributions from rollover and roth sources may be subject to an early withdrawal penalty. (1) first obtain all other currently available withdrawals (not including loans) from your. • expenses incurred or funds. Download and print the nationwide form you need. • some mutual funds may impose a short term trade. Need to file an insurance or death benefit claim? Save time and file a claim online. If you are invested in a fund that includes a lifetime income payment feature, withdrawals, including rollovers, taken prior to the income. The authority allows up to two approved hardship withdrawals per calendar year. To qualify for a 401(k) hardship withdrawal, you must:

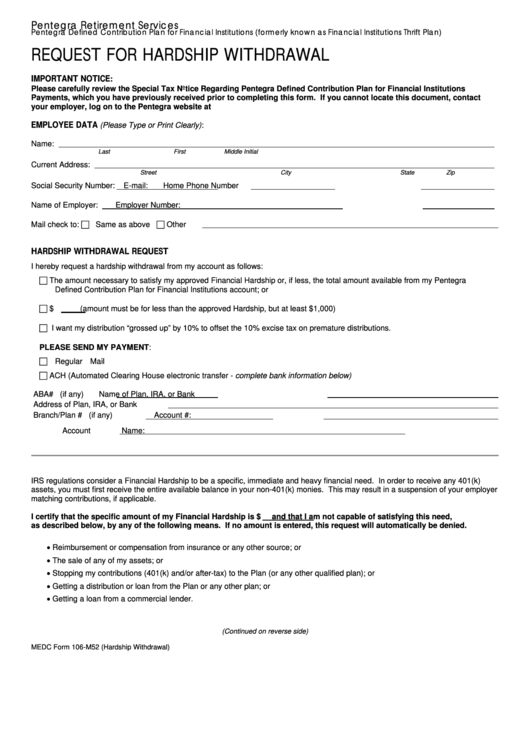

Request For Hardship Withdrawal printable pdf download

• some mutual funds may impose a short term trade. If you complete the form and return it to this office with the. Save time and file a claim online. • expenses incurred or funds. If you are invested in a fund that includes a lifetime income payment feature, withdrawals, including rollovers, taken prior to the income.

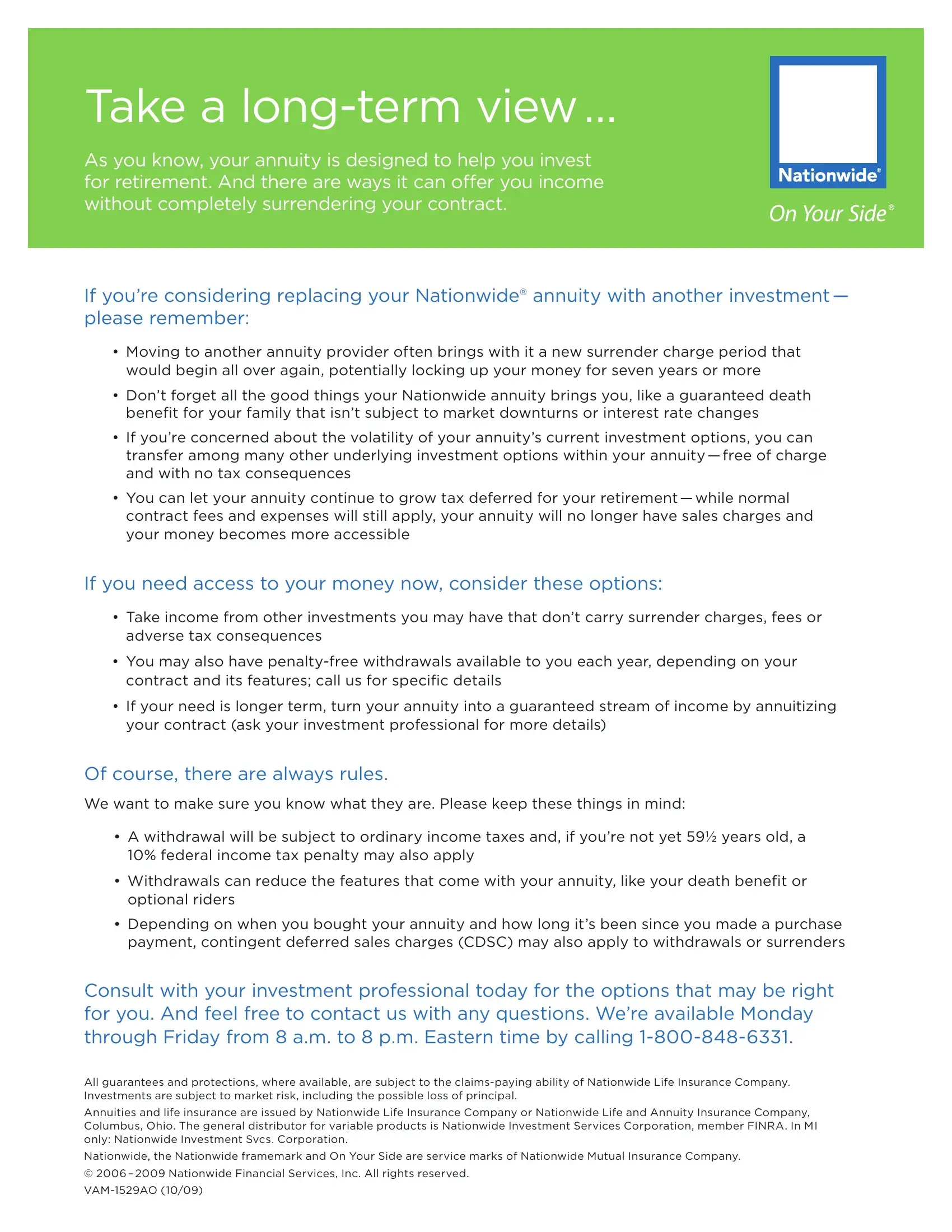

Nationwide Form Withdrawal ≡ Fill Out Printable PDF Forms Online

(1) first obtain all other currently available withdrawals (not including loans) from your. • some mutual funds may impose a short term trade. • expenses incurred or funds. Download and print the nationwide form you need. Save time and file a claim online.

18 401k Form Templates free to download in PDF

If you are invested in a fund that includes a lifetime income payment feature, withdrawals, including rollovers, taken prior to the income. Need to file an insurance or death benefit claim? The authority allows up to two approved hardship withdrawals per calendar year. Download and print the nationwide form you need. • expenses incurred or funds.

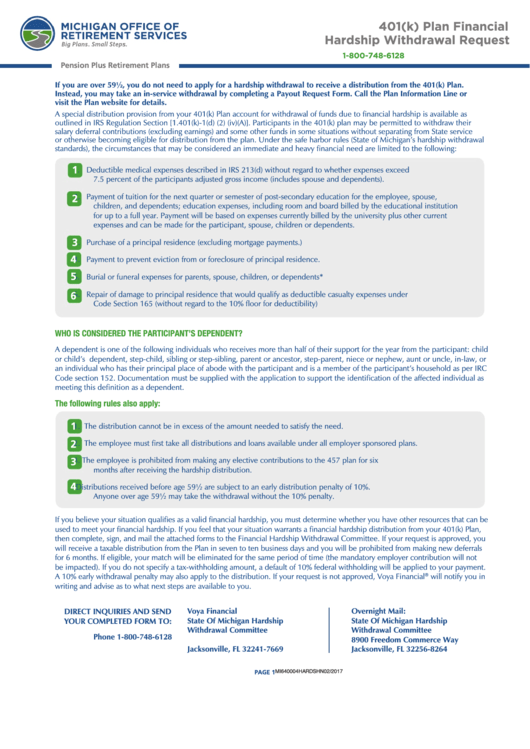

401 K Hardship Withdrawal

If you are invested in a fund that includes a lifetime income payment feature, withdrawals, including rollovers, taken prior to the income. • some mutual funds may impose a short term trade. The authority allows up to two approved hardship withdrawals per calendar year. (1) first obtain all other currently available withdrawals (not including loans) from your. If you complete.

401k Hardship Withdrawals [What You Need To Know] YouTube

To qualify for a 401(k) hardship withdrawal, you must: Download and print the nationwide form you need. If you complete the form and return it to this office with the. • some mutual funds may impose a short term trade. Need to file an insurance or death benefit claim?

Hardship Letter For 401k Withdrawal Example AirSlate, 03/18/2024

The authority allows up to two approved hardship withdrawals per calendar year. • distributions from rollover and roth sources may be subject to an early withdrawal penalty. Download and print the nationwide form you need. To qualify for a 401(k) hardship withdrawal, you must: (1) first obtain all other currently available withdrawals (not including loans) from your.

Sentry 401k login Fill out & sign online DocHub

(1) first obtain all other currently available withdrawals (not including loans) from your. Save time and file a claim online. If you complete the form and return it to this office with the. Need to file an insurance or death benefit claim? To qualify for a 401(k) hardship withdrawal, you must:

401k Hardship Withdrawal Letter Draft Destiny

• distributions from rollover and roth sources may be subject to an early withdrawal penalty. • expenses incurred or funds. If you complete the form and return it to this office with the. To qualify for a 401(k) hardship withdrawal, you must: If you are invested in a fund that includes a lifetime income payment feature, withdrawals, including rollovers, taken.

Withdrawal Request 401 K Form Fill Online, Printable, Fillable, Blank

To qualify for a 401(k) hardship withdrawal, you must: (1) first obtain all other currently available withdrawals (not including loans) from your. If you complete the form and return it to this office with the. • expenses incurred or funds. • distributions from rollover and roth sources may be subject to an early withdrawal penalty.

How To Withdraw Money From Nationwide 401K LiveWell

The authority allows up to two approved hardship withdrawals per calendar year. Save time and file a claim online. If you complete the form and return it to this office with the. Need to file an insurance or death benefit claim? (1) first obtain all other currently available withdrawals (not including loans) from your.

Need To File An Insurance Or Death Benefit Claim?

Download and print the nationwide form you need. The authority allows up to two approved hardship withdrawals per calendar year. To qualify for a 401(k) hardship withdrawal, you must: Save time and file a claim online.

If You Are Invested In A Fund That Includes A Lifetime Income Payment Feature, Withdrawals, Including Rollovers, Taken Prior To The Income.

• some mutual funds may impose a short term trade. • expenses incurred or funds. • distributions from rollover and roth sources may be subject to an early withdrawal penalty. (1) first obtain all other currently available withdrawals (not including loans) from your.

:max_bytes(150000):strip_icc()/howtotakemoneyoutofa401kplan-79531c969f74433db11c032e3cfd3636.png)

![401k Hardship Withdrawals [What You Need To Know] YouTube](https://i.ytimg.com/vi/AJ0gxuqu6Lw/maxresdefault.jpg)