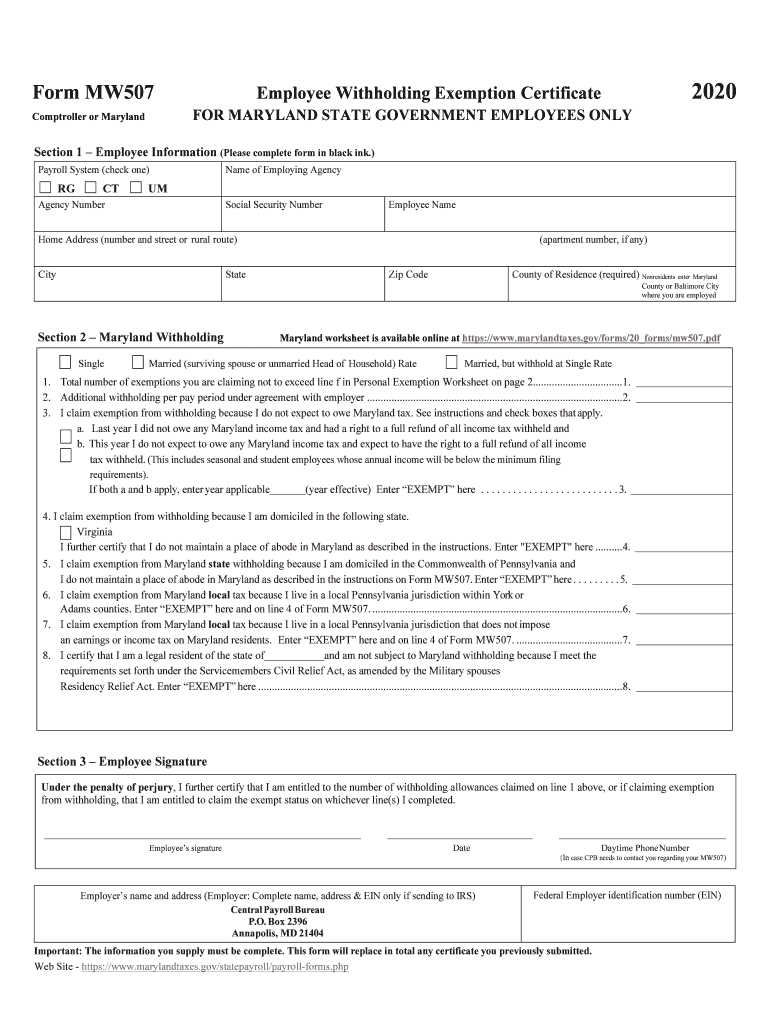

Md Withholding Tax Form - The law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. Maryland income tax withholding for annuity, sick pay and retirement distributions form used by recipients of annuity, sick pay or retirement. Options are available on the new maryland tax connect portal at mdtaxconnect.gov. You will need to access the current maryland employer. This year i do not expect to owe any maryland income tax and expect to have the right to a full refund of all income tax withheld. Consider completing a new form.

The law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. This year i do not expect to owe any maryland income tax and expect to have the right to a full refund of all income tax withheld. Options are available on the new maryland tax connect portal at mdtaxconnect.gov. Consider completing a new form. Maryland income tax withholding for annuity, sick pay and retirement distributions form used by recipients of annuity, sick pay or retirement. Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. You will need to access the current maryland employer.

Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. You will need to access the current maryland employer. This year i do not expect to owe any maryland income tax and expect to have the right to a full refund of all income tax withheld. Consider completing a new form. Options are available on the new maryland tax connect portal at mdtaxconnect.gov. Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. Maryland income tax withholding for annuity, sick pay and retirement distributions form used by recipients of annuity, sick pay or retirement. The law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold.

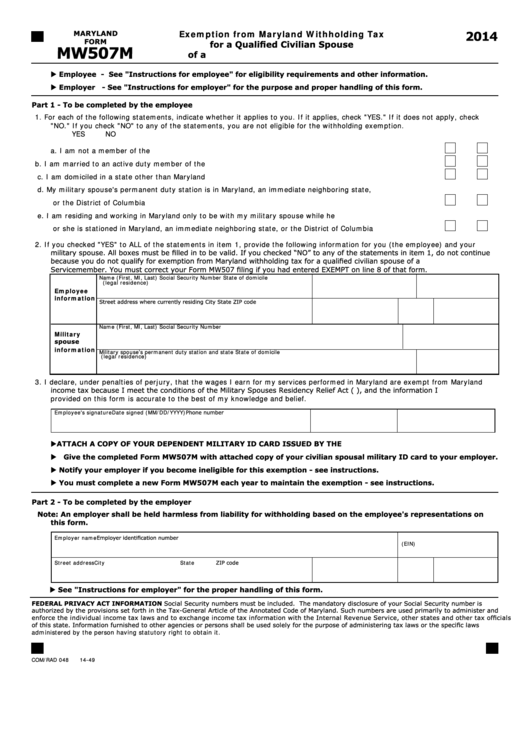

Maryland Withholding Tax Form

Options are available on the new maryland tax connect portal at mdtaxconnect.gov. Consider completing a new form. Maryland income tax withholding for annuity, sick pay and retirement distributions form used by recipients of annuity, sick pay or retirement. This year i do not expect to owe any maryland income tax and expect to have the right to a full refund.

Maryland State Tax Withholding Form

Consider completing a new form. The law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold. You will need to access the current maryland employer. Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. This year i do.

Maryland Tax Withholding Form 2024 Lian Sheena

Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. The law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold. You will need to access the current maryland employer. Complete form mw507 so that your employer can withhold.

Maryland Tax Withholding Form 2024 Lian Sheena

Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. Consider completing a new form. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. This year i do not expect to owe any maryland income tax and expect to have the.

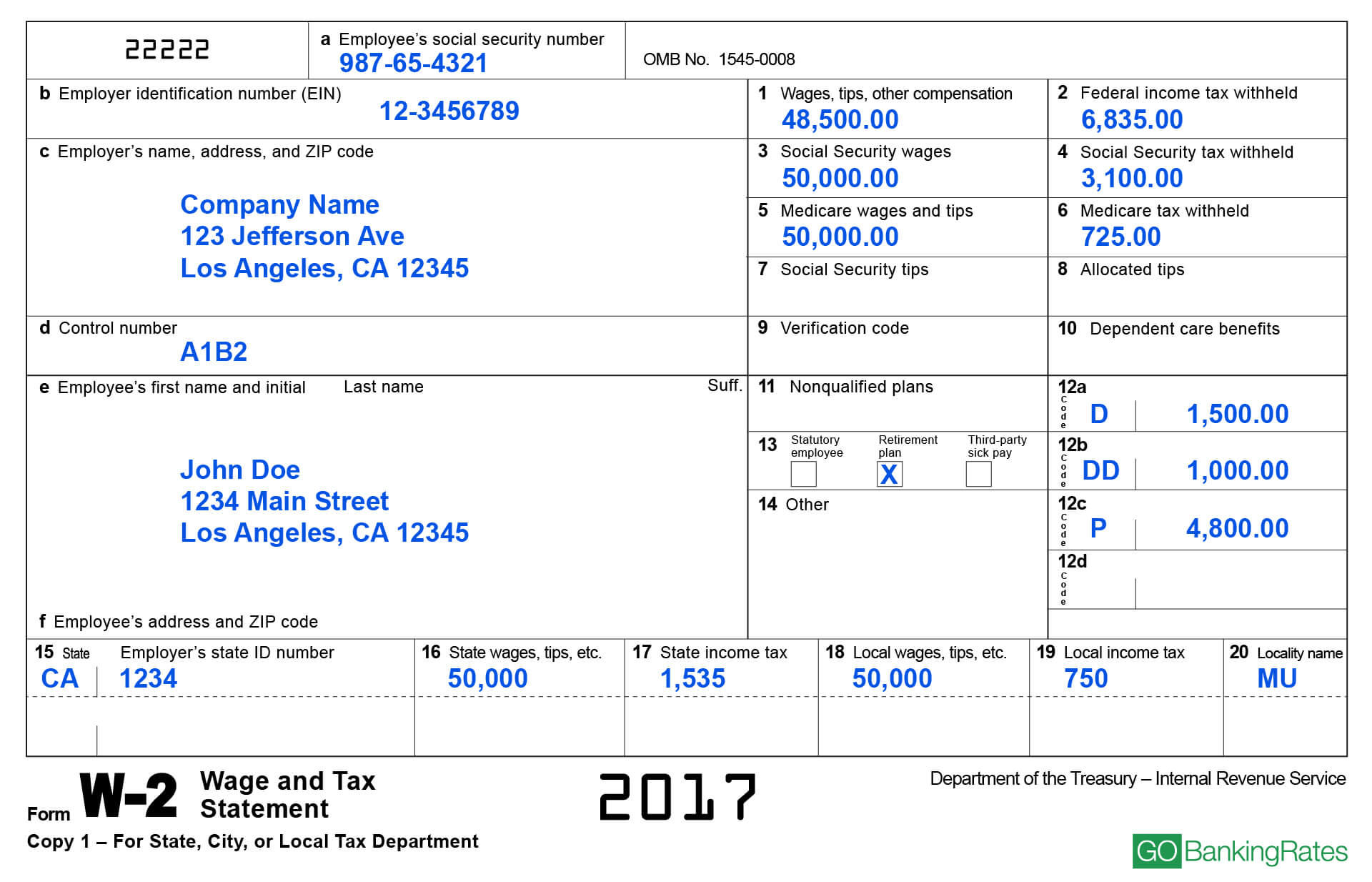

Maryland W4 Form 2024 Dayle Annelise

Consider completing a new form. This year i do not expect to owe any maryland income tax and expect to have the right to a full refund of all income tax withheld. The law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold. Options are available on the new maryland.

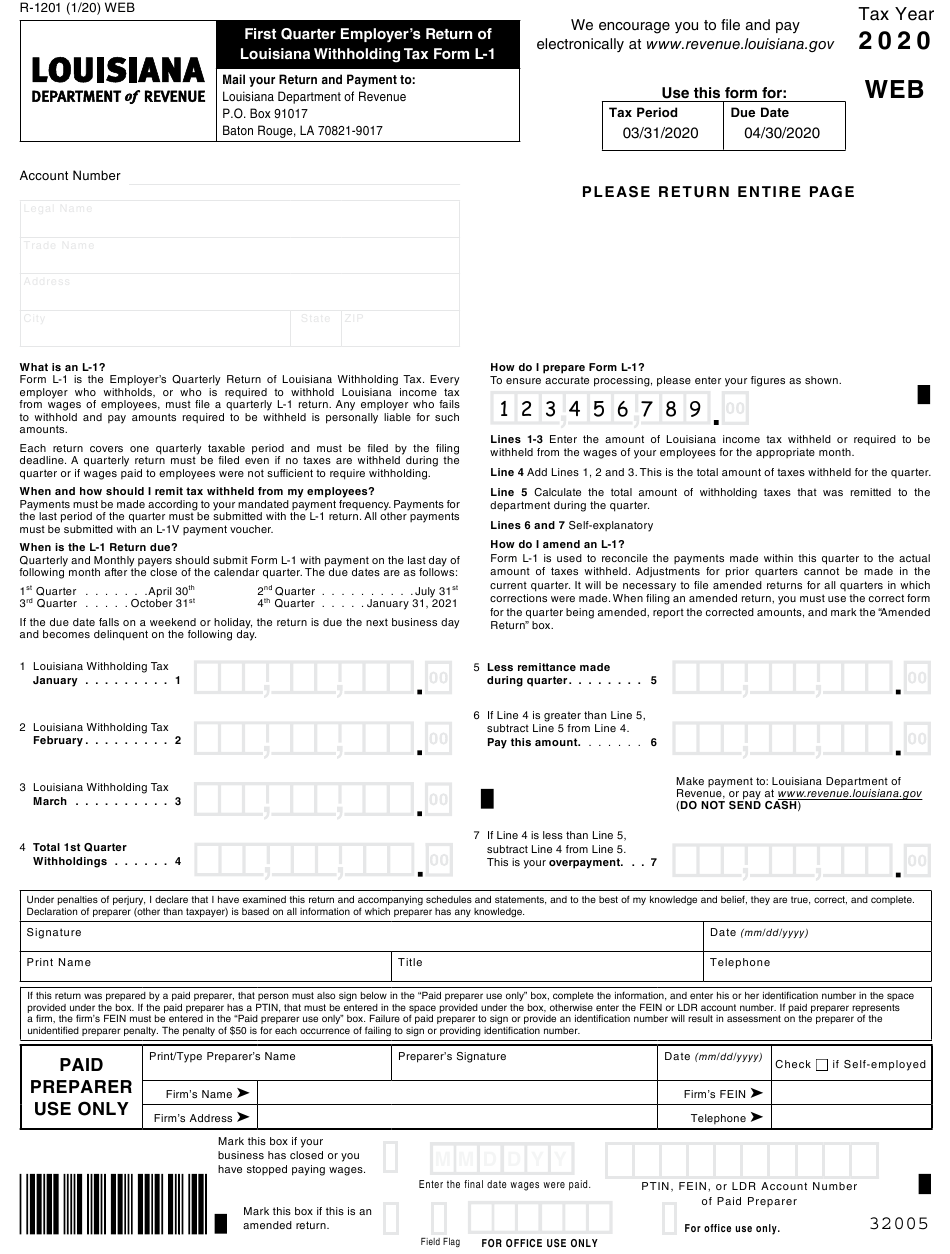

State Withholding Tax Form 2023 Printable Forms Free Online

Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. This year i do not expect to owe any maryland income tax and expect to have the right to a full refund.

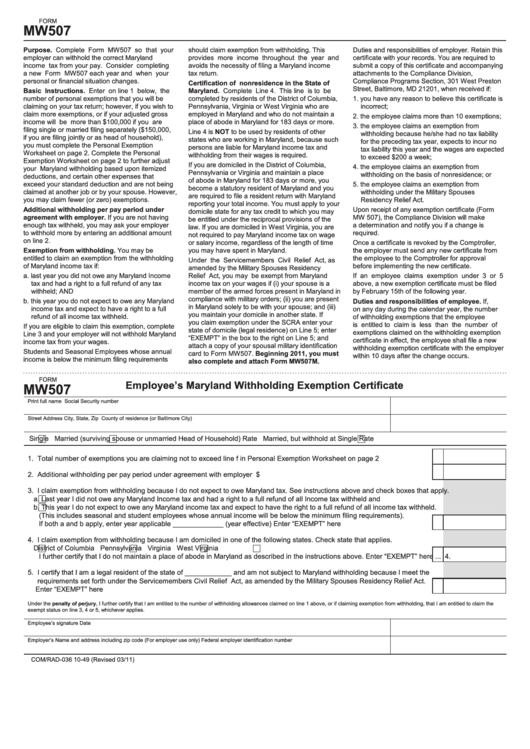

Form Mw507 Employee's Maryland Withholding Exemption Certificate

The law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold. This year i do not expect to owe any maryland income tax and expect to have the right to a full refund of all income tax withheld. Annuity and sick pay request for maryland income tax withholding form used.

WITHHOLDING TAX IN NIGERIA LexPraxis Legal Solicitors

Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. Maryland income tax withholding for annuity, sick pay and retirement distributions form used by recipients of annuity, sick pay or retirement. Consider completing a new form. The law requires that you complete an employee’s withholding allowance certificate so that.

Maryland State Tax Employer Withholding Form

Options are available on the new maryland tax connect portal at mdtaxconnect.gov. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. This year i do not expect to owe any maryland.

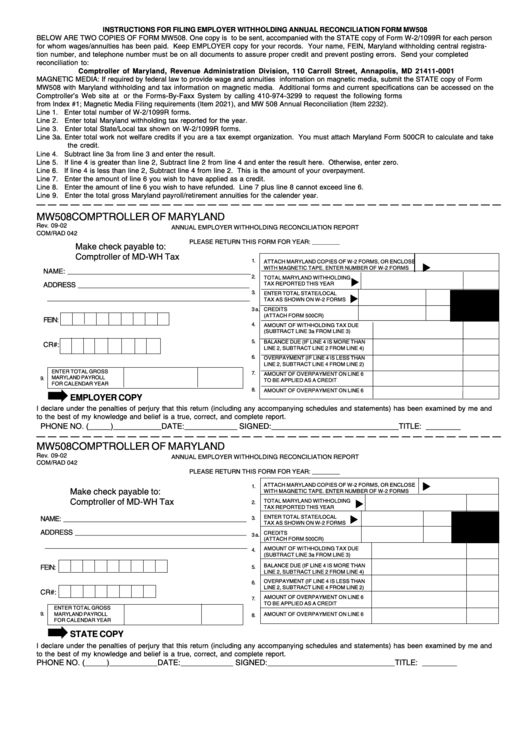

MD MW506R 2019 Fill out Tax Template Online US Legal Forms

The law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold. Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. Consider completing a new form. Maryland income tax withholding for annuity, sick pay and retirement distributions form used.

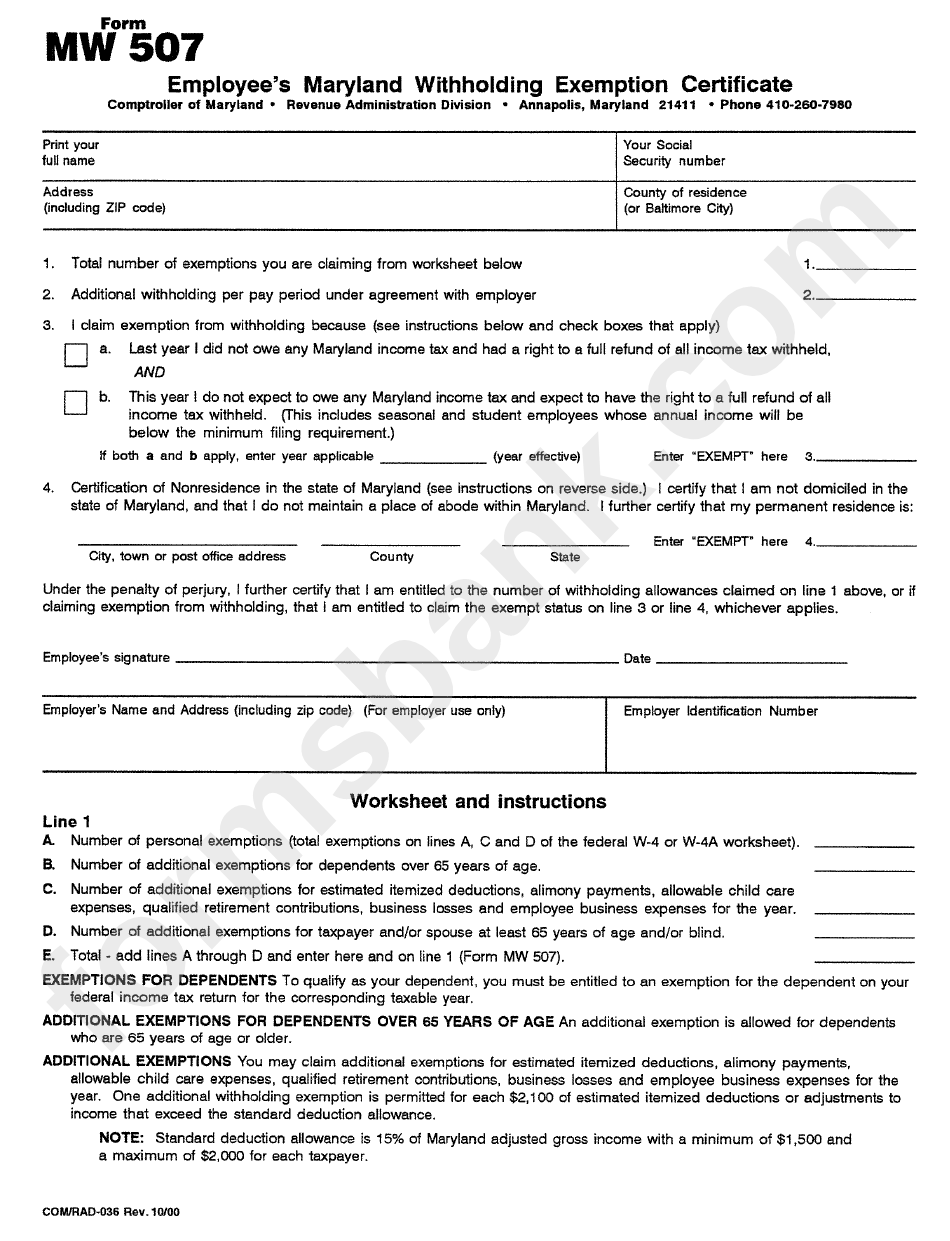

Maryland Income Tax Withholding For Annuity, Sick Pay And Retirement Distributions Form Used By Recipients Of Annuity, Sick Pay Or Retirement.

The law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold. This year i do not expect to owe any maryland income tax and expect to have the right to a full refund of all income tax withheld. Consider completing a new form. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay.

Annuity And Sick Pay Request For Maryland Income Tax Withholding Form Used By Recipients Of Annuity, Sick Pay Or Retirement Distribution.

You will need to access the current maryland employer. Options are available on the new maryland tax connect portal at mdtaxconnect.gov.