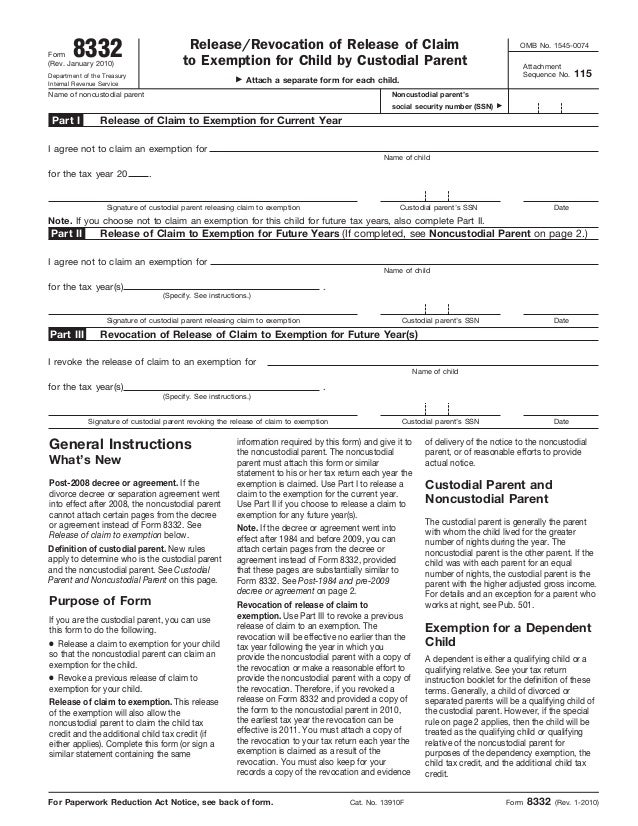

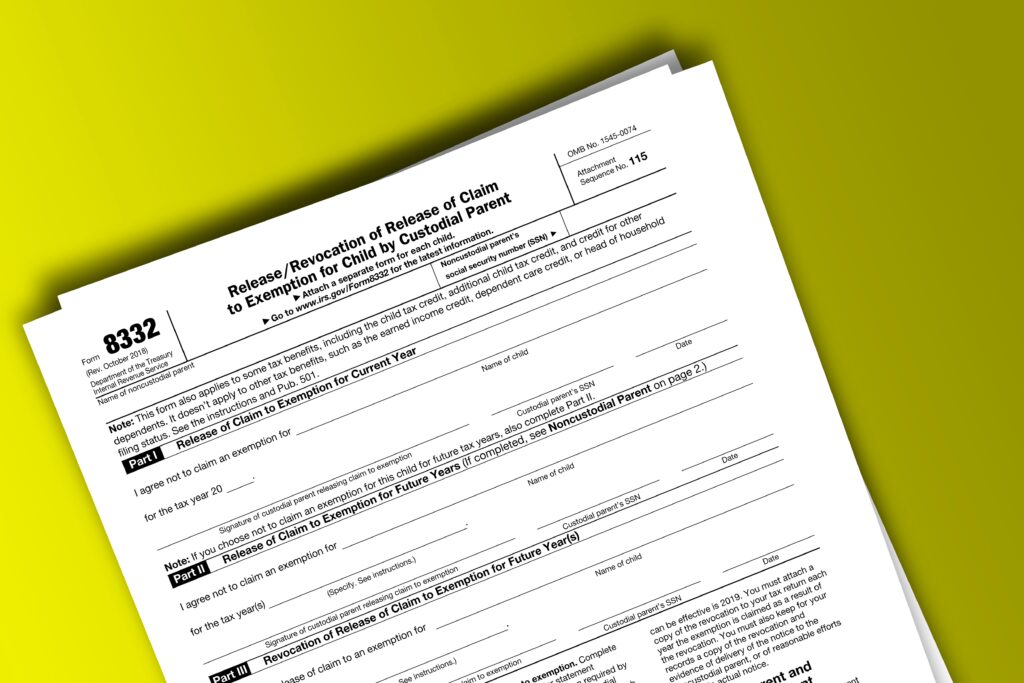

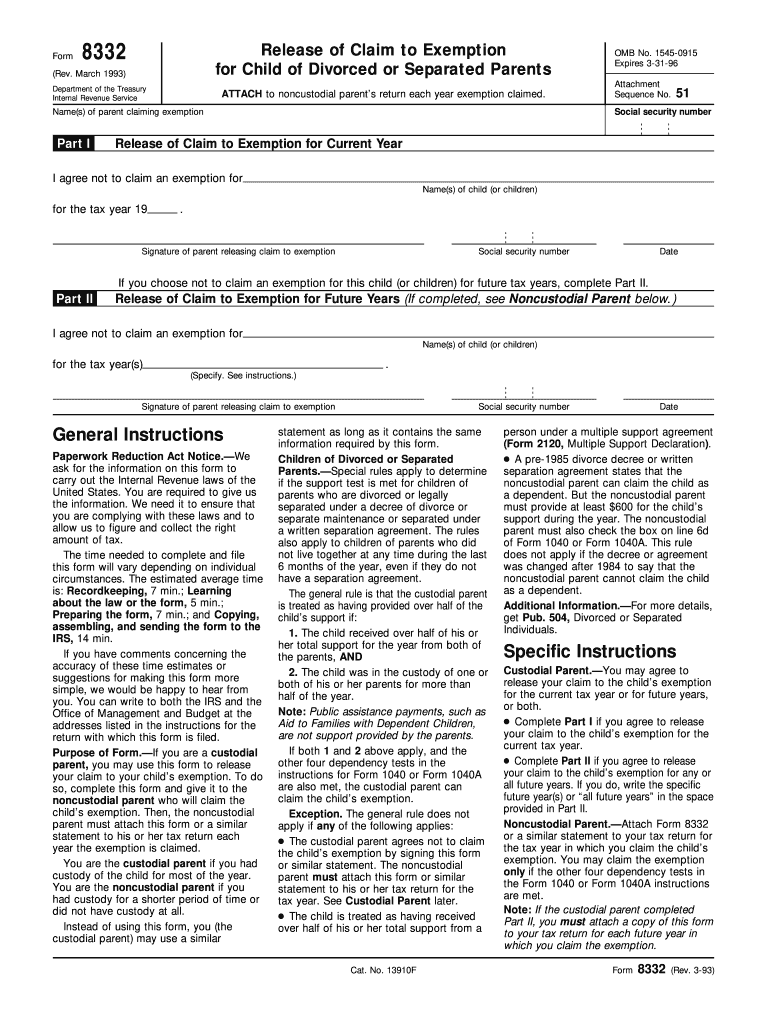

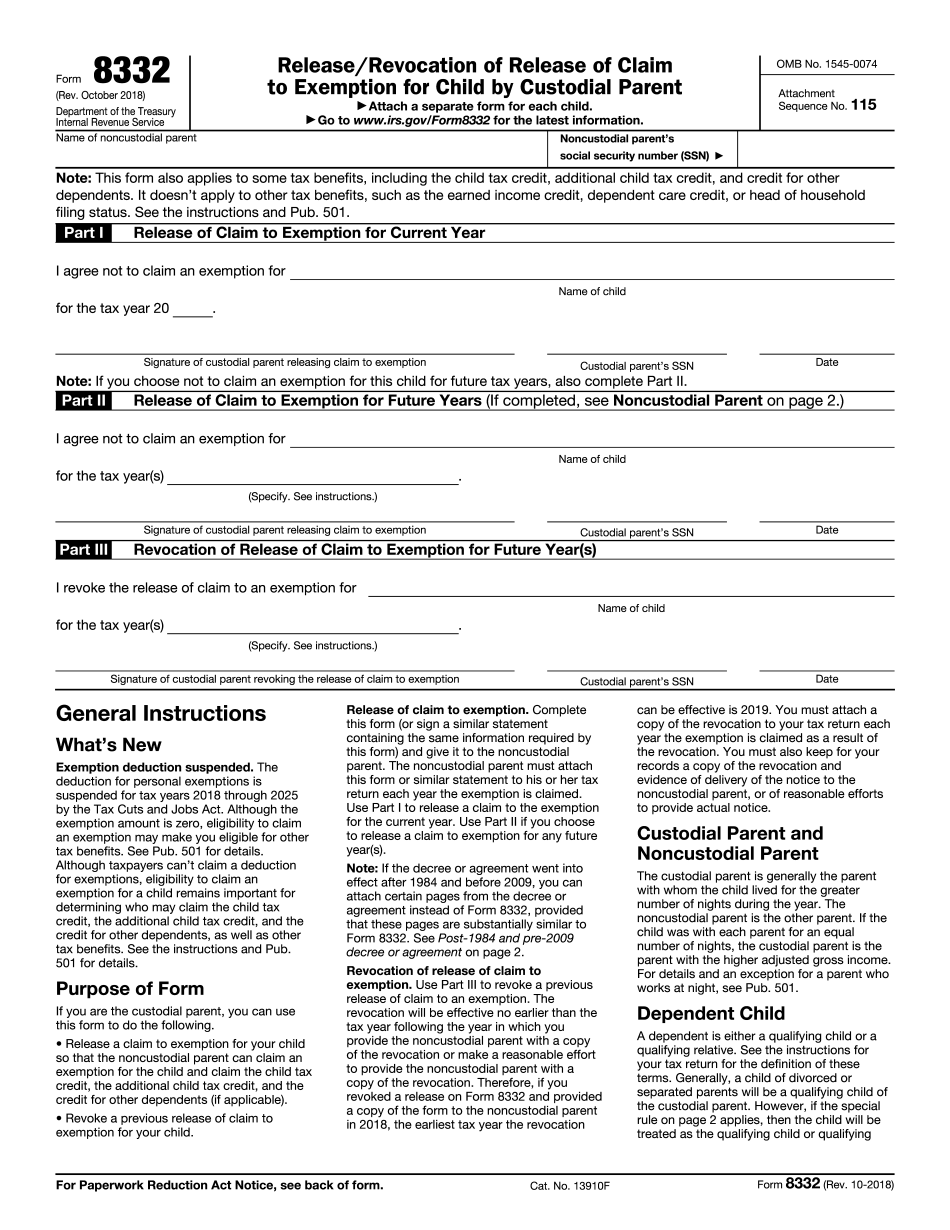

Irs Form 8332 Instructions - Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on. Release of claim to exemption for current. See form 8453 and its instructions for more details. This revocation takes effect in the tax year following the year the. The change may go in either direction: According to the irs, a separate form 8332 is filed for each child. How do i complete irs form 8332? When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. There are three parts to form 8832: Electronically, you must file form 8332 with form 8453, u.s.

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on. Release of claim to exemption for current. When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. The custodial parent can revoke a previous release of the exemption claim by completing part three of form 8332. See form 8453 and its instructions for more details. Electronically, you must file form 8332 with form 8453, u.s. The change may go in either direction: According to the irs, a separate form 8332 is filed for each child. This revocation takes effect in the tax year following the year the. There are three parts to form 8832:

The change may go in either direction: When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. How do i complete irs form 8332? Release of claim to exemption for current. This revocation takes effect in the tax year following the year the. See form 8453 and its instructions for more details. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on. According to the irs, a separate form 8332 is filed for each child. There are three parts to form 8832: Electronically, you must file form 8332 with form 8453, u.s.

Form 8332 Fillable Printable Forms Free Online

How do i complete irs form 8332? The change may go in either direction: Electronically, you must file form 8332 with form 8453, u.s. According to the irs, a separate form 8332 is filed for each child. When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption.

IRS Form 8332 Instructions A Guide for Custodial Parents

Electronically, you must file form 8332 with form 8453, u.s. The custodial parent can revoke a previous release of the exemption claim by completing part three of form 8332. How do i complete irs form 8332? Release of claim to exemption for current. The change may go in either direction:

Irs Gov Printable Forms

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on. How do i complete irs form 8332? There are three parts to form 8832: The custodial parent can revoke a previous release of the exemption claim by completing part three of form 8332. When a custodial.

IRS Form 8332 Instructions Release of Child Exemption

How do i complete irs form 8332? When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. There are three parts to form 8832: Release of claim to exemption for current. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates,.

Tax Forms In Depth Tutorials, Walkthroughs, and Guides

The custodial parent can revoke a previous release of the exemption claim by completing part three of form 8332. This revocation takes effect in the tax year following the year the. When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. Electronically, you must file form 8332 with form 8453,.

IRS Form 8332 Explained Claiming Dependents and Benefits

How do i complete irs form 8332? The custodial parent can revoke a previous release of the exemption claim by completing part three of form 8332. Release of claim to exemption for current. This revocation takes effect in the tax year following the year the. When a custodial parent files their taxes, they may use form 8332 to change which.

IRS 8332 1993 Fill out Tax Template Online US Legal Forms

The change may go in either direction: According to the irs, a separate form 8332 is filed for each child. How do i complete irs form 8332? Release of claim to exemption for current. When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption.

A brief guide on filing IRS Form 8332 for release of dependency exemption

There are three parts to form 8832: The change may go in either direction: Electronically, you must file form 8332 with form 8453, u.s. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on. Release of claim to exemption for current.

Irs Form 8832 Fillable Form Printable Forms Free Online

There are three parts to form 8832: Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on. The change may go in either direction: How do i complete irs form 8332? This revocation takes effect in the tax year following the year the.

Electronically, You Must File Form 8332 With Form 8453, U.s.

There are three parts to form 8832: See form 8453 and its instructions for more details. When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. Release of claim to exemption for current.

According To The Irs, A Separate Form 8332 Is Filed For Each Child.

The custodial parent can revoke a previous release of the exemption claim by completing part three of form 8332. How do i complete irs form 8332? The change may go in either direction: This revocation takes effect in the tax year following the year the.