How Do I Get A 8862 Form - Open or continue your return. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Here's how to file form 8862 in turbotax. Taxpayers complete form 8862 and attach it to their tax return if: Sign in to your account and open your return. You can find tax form. Select federal from the left side menu. Once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these credits. Here is how to add form 8862 to your tax return. Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit (ctc), additional.

You can find tax form. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Here's how to file form 8862 in turbotax. Once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these credits. Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit (ctc), additional. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Select federal from the left side menu. Open or continue your return. Here is how to add form 8862 to your tax return. Sign in to your account and open your return.

You can find tax form. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Select federal from the left side menu. Here is how to add form 8862 to your tax return. Sign in to your account and open your return. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these credits. Open or continue your return. Here's how to file form 8862 in turbotax. Taxpayers complete form 8862 and attach it to their tax return if:

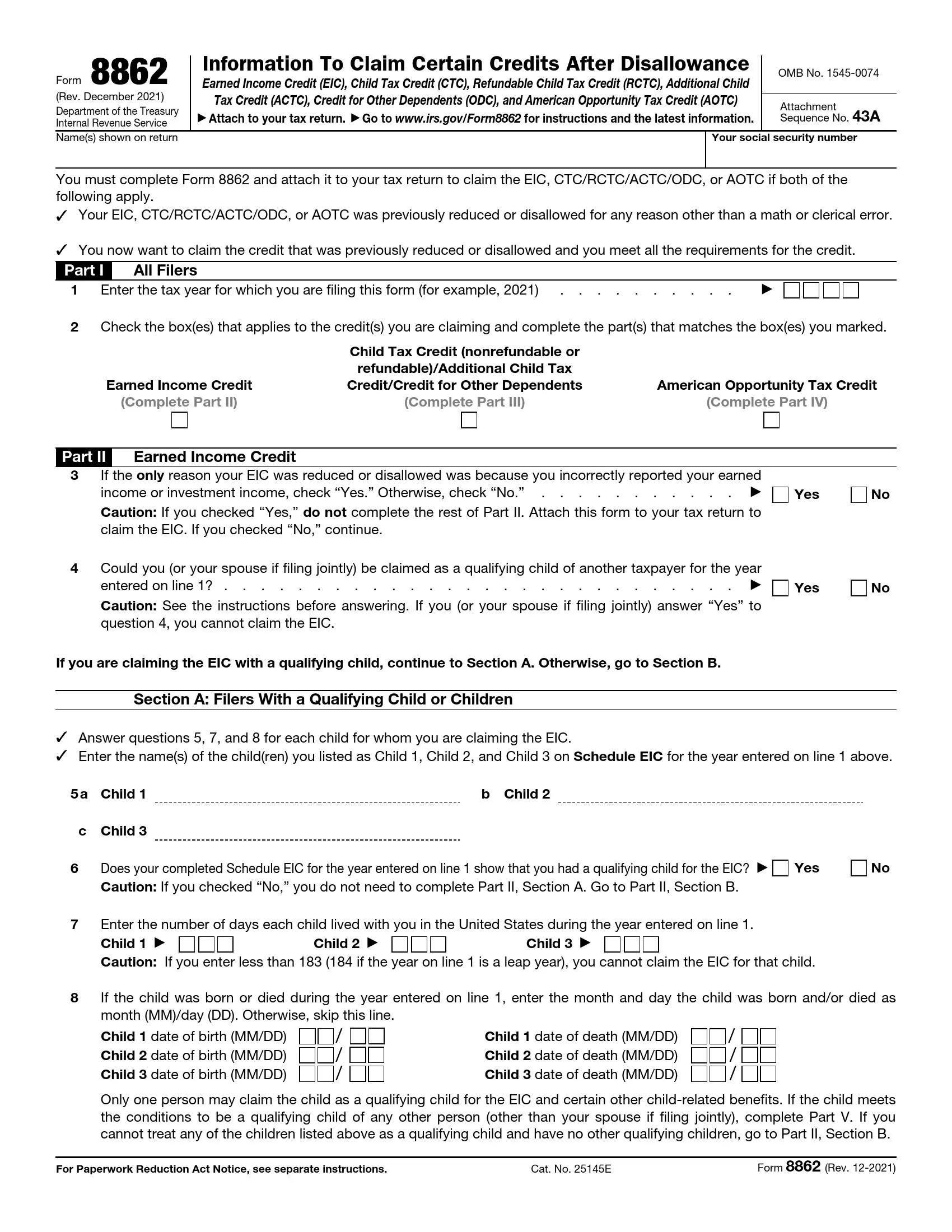

Irs Form 8862 Printable Master of Documents

Sign in to your account and open your return. Select federal from the left side menu. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Open or continue your return. Here's how to file form 8862 in turbotax.

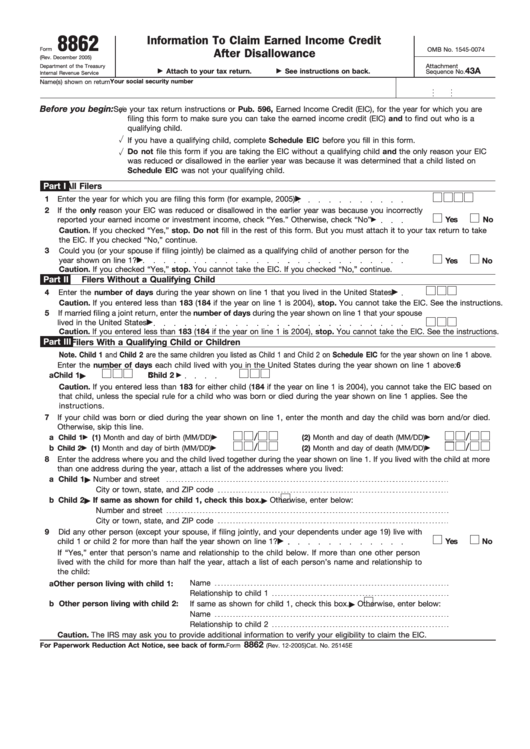

Printable 8862 Form Printable Forms Free Online

Sign in to your account and open your return. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Here's how to file form 8862 in turbotax. You can find tax form. Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit (ctc), additional.

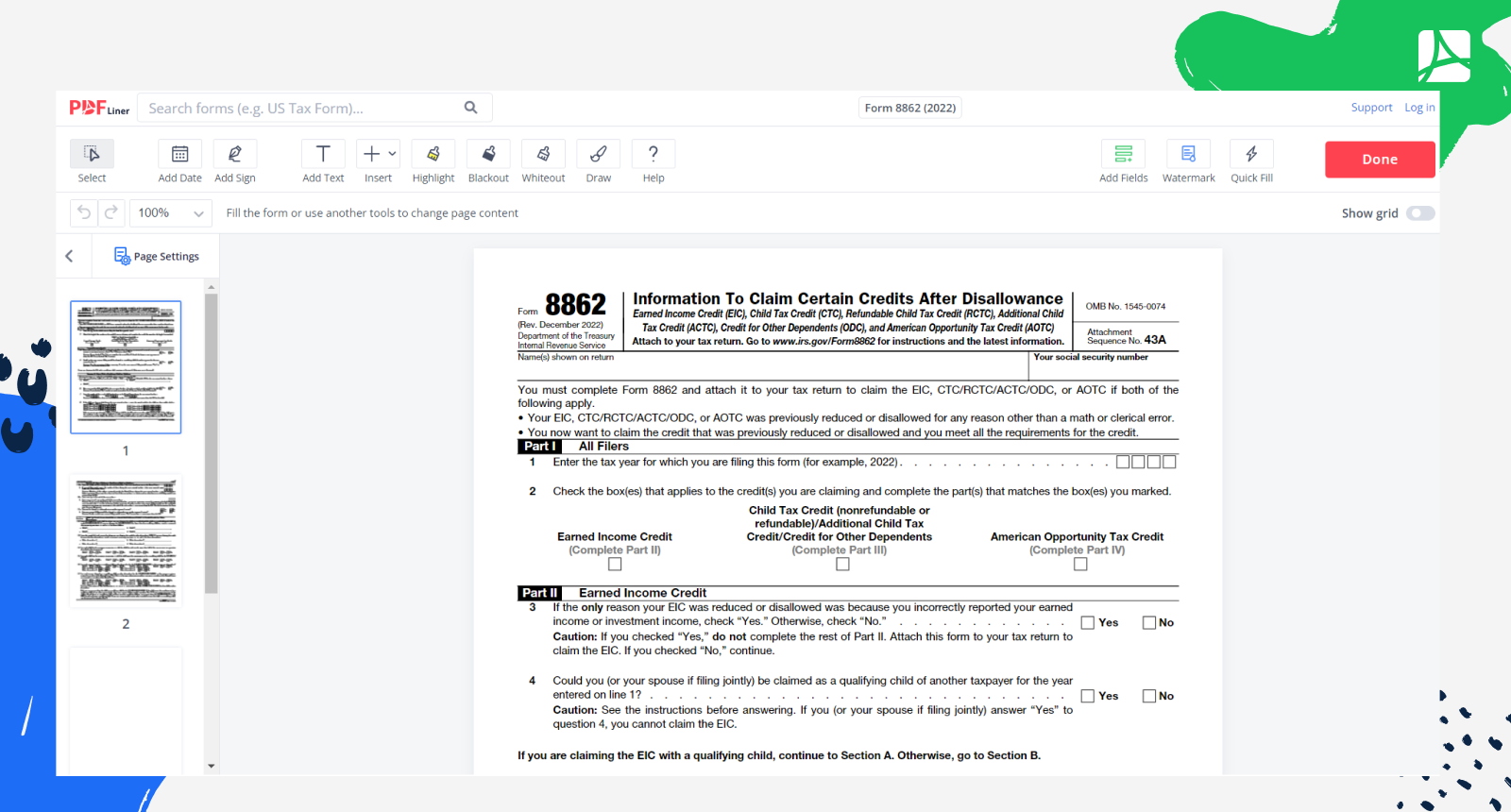

IRS Form 8862 ≡ Fill Out Printable PDF Forms Online

Here is how to add form 8862 to your tax return. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Taxpayers complete form 8862 and attach it to their tax return if: Open or continue your return. Select federal from the left side menu.

Irs Form 8862 Printable Printable Forms Free Online

Here's how to file form 8862 in turbotax. Sign in to your account and open your return. Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit (ctc), additional. Once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these.

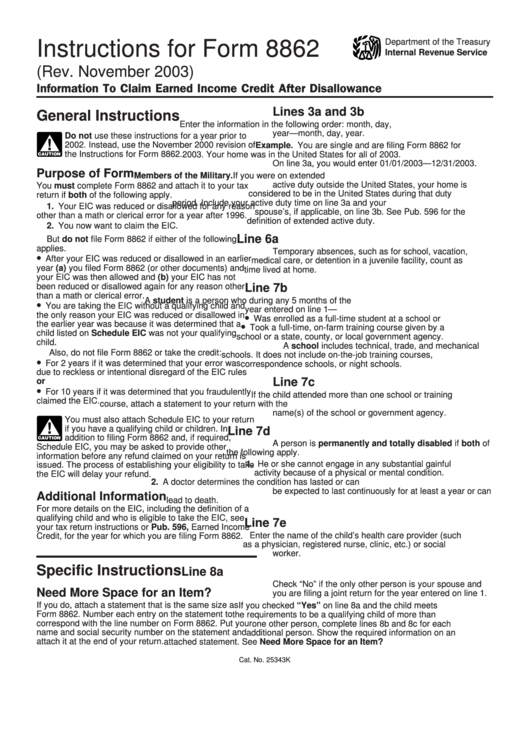

Instructions For Form 8862 Information To Claim Earned Credit

Taxpayers complete form 8862 and attach it to their tax return if: Select federal from the left side menu. You can find tax form. Open or continue your return. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit.

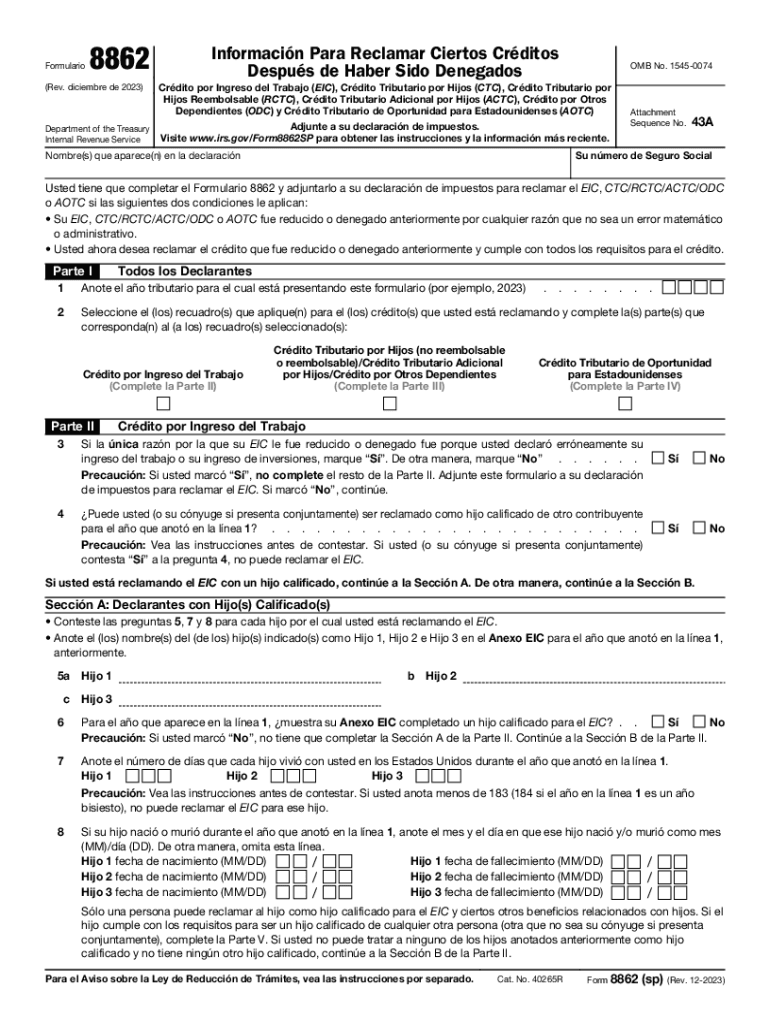

Form 8862 Sp Rev December Information to Claim Earned Credit

Select federal from the left side menu. Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit (ctc), additional. Once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these credits. Here is how to add form 8862 to your.

Form 8862Information to Claim Earned Credit for Disallowance

Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit.

IRS Form 8862 Diagram Quizlet

Taxpayers complete form 8862 and attach it to their tax return if: Here's how to file form 8862 in turbotax. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Once the penalty expires, you’ll need to file form 8862 along with.

Form 8862 IRS Form 8862 PDF blank, sign forms online — PDFliner

Here is how to add form 8862 to your tax return. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Select federal from the left side menu. Once the penalty expires, you’ll need to file form 8862 along with your irs.

IRS Form 8862 walkthrough (Information to Claim Certain Credits After

Here is how to add form 8862 to your tax return. Open or continue your return. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Sign in to your account and open your return. Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit (ctc), additional.

Select Federal From The Left Side Menu.

Sign in to your account and open your return. Here's how to file form 8862 in turbotax. Open or continue your return. You can find tax form.

Form 8862, Information To Claim Earned Income Credit (Eic) After Disallowance Has Been Expanded To Include The Child Tax Credit (Ctc), Additional.

You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these credits. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Here is how to add form 8862 to your tax return.