Goodwill Tax Receipt Form - Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. Goods or services were not exchanged. It’s easier than ever to track your goodwill donations by eliminating your paper receipts. Learn how to value and deduct your donations to goodwill on your taxes. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. Download a pdf guide, find a donation location, and consult a tax. Once you register, and every time you donate. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax.

Goods or services were not exchanged. Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. It’s easier than ever to track your goodwill donations by eliminating your paper receipts. Download a pdf guide, find a donation location, and consult a tax. Once you register, and every time you donate. Learn how to value and deduct your donations to goodwill on your taxes. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax.

Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. It’s easier than ever to track your goodwill donations by eliminating your paper receipts. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax. Goods or services were not exchanged. Once you register, and every time you donate. Learn how to value and deduct your donations to goodwill on your taxes. Download a pdf guide, find a donation location, and consult a tax.

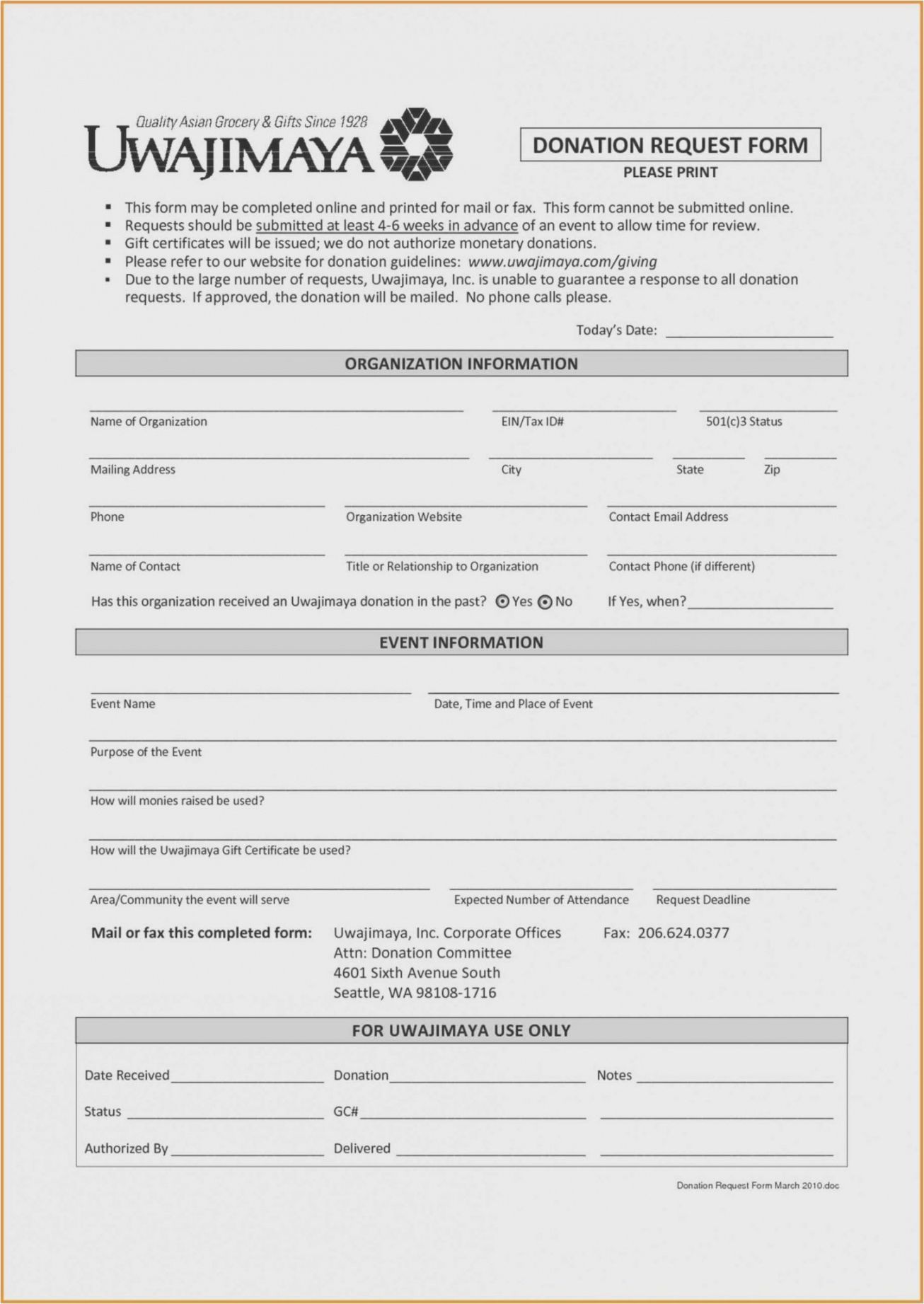

Costum Goodwill Tax Receipt Form PDF Example

If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Learn how to value and deduct your donations to goodwill on your taxes. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. Goodwill is a qualified tax exempt public charity under.

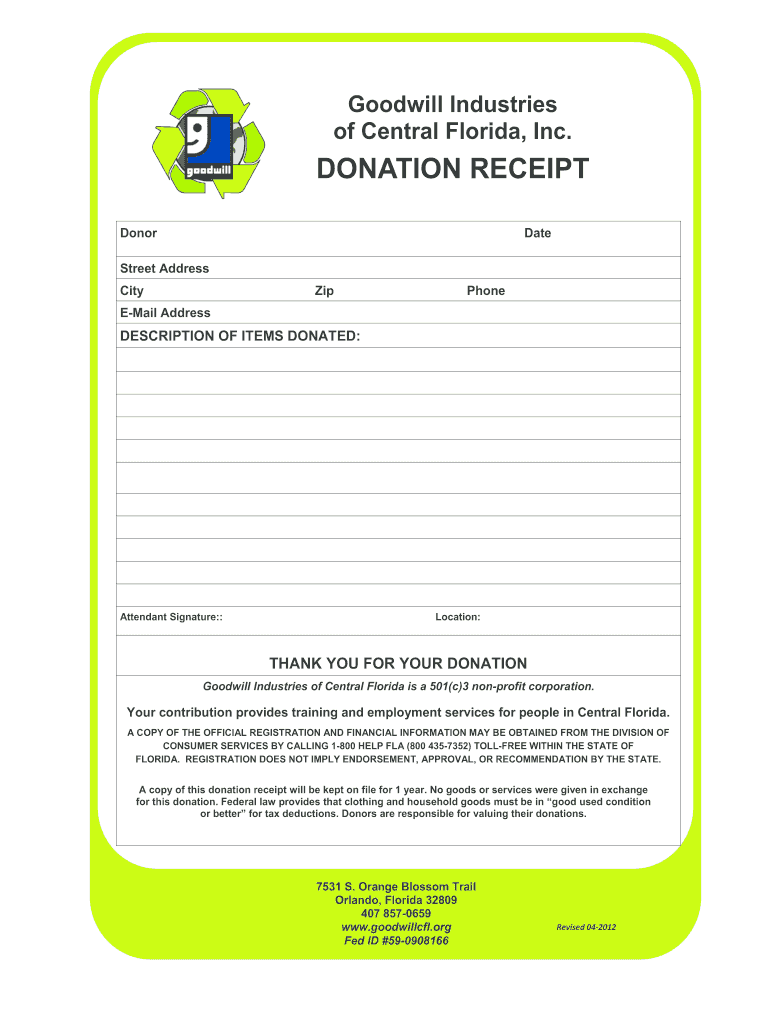

Florida Goodwill Donation Receipt Fill Online, Printable, Fillable

A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax. Download a pdf guide, find a donation location, and consult a tax. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. Goodwill is a qualified tax exempt public charity under section 501(c)(3) of.

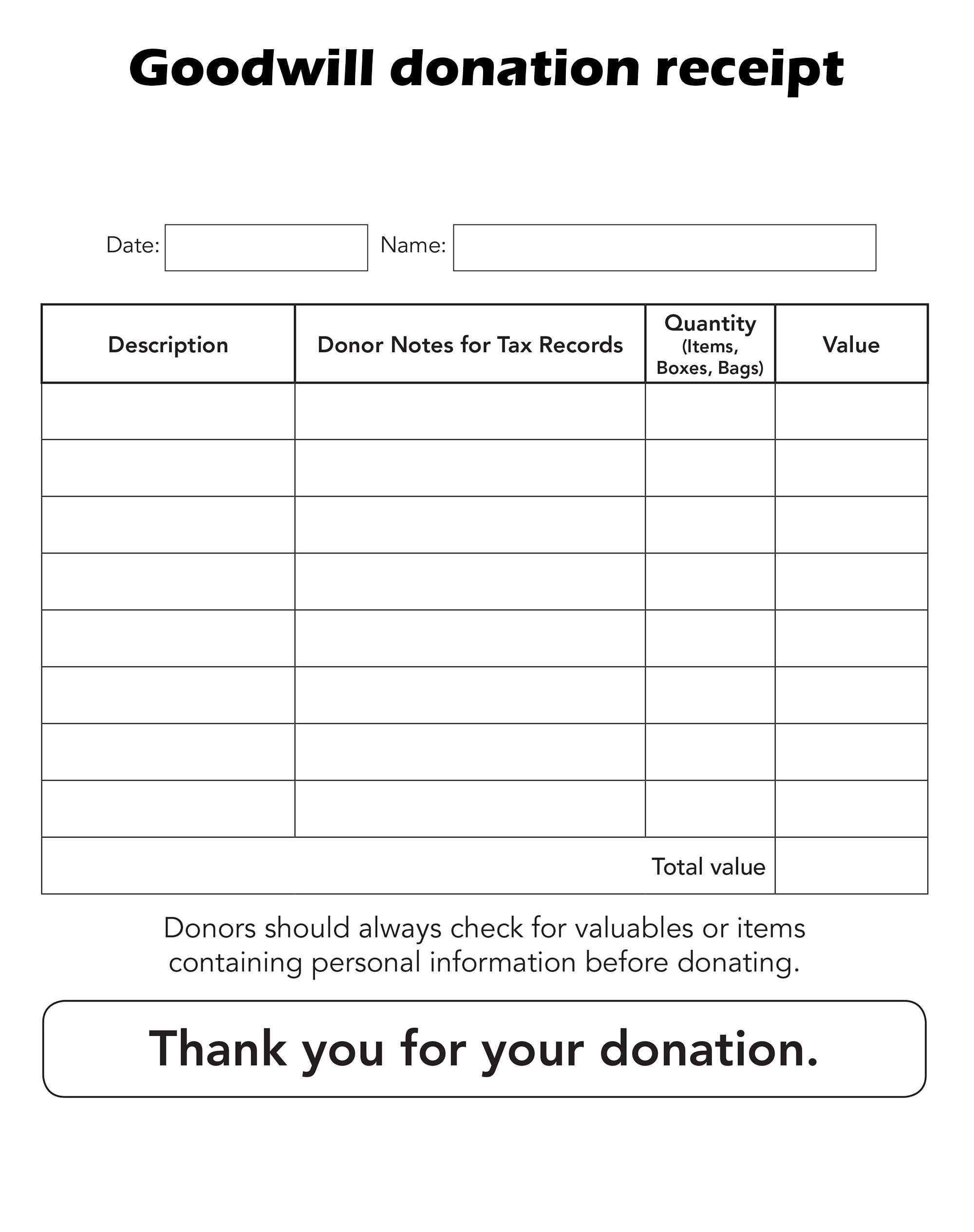

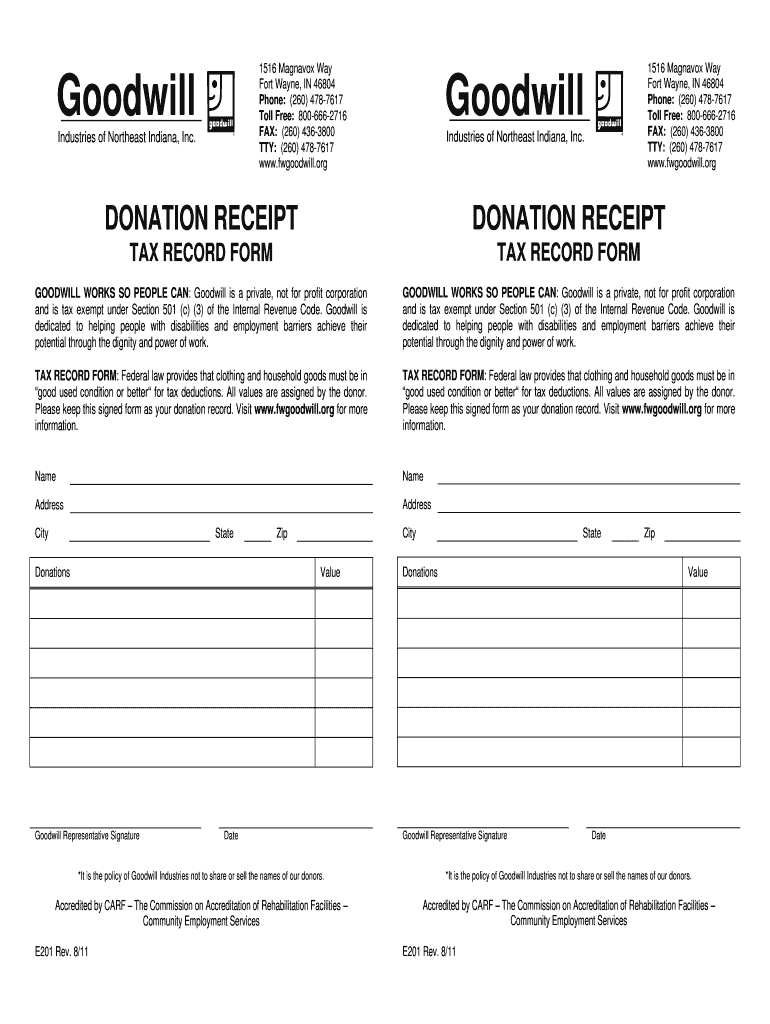

Free Goodwill Donation Receipt Template PDF eForms

It’s easier than ever to track your goodwill donations by eliminating your paper receipts. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax. Goods or services were not exchanged. Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. When you drop off.

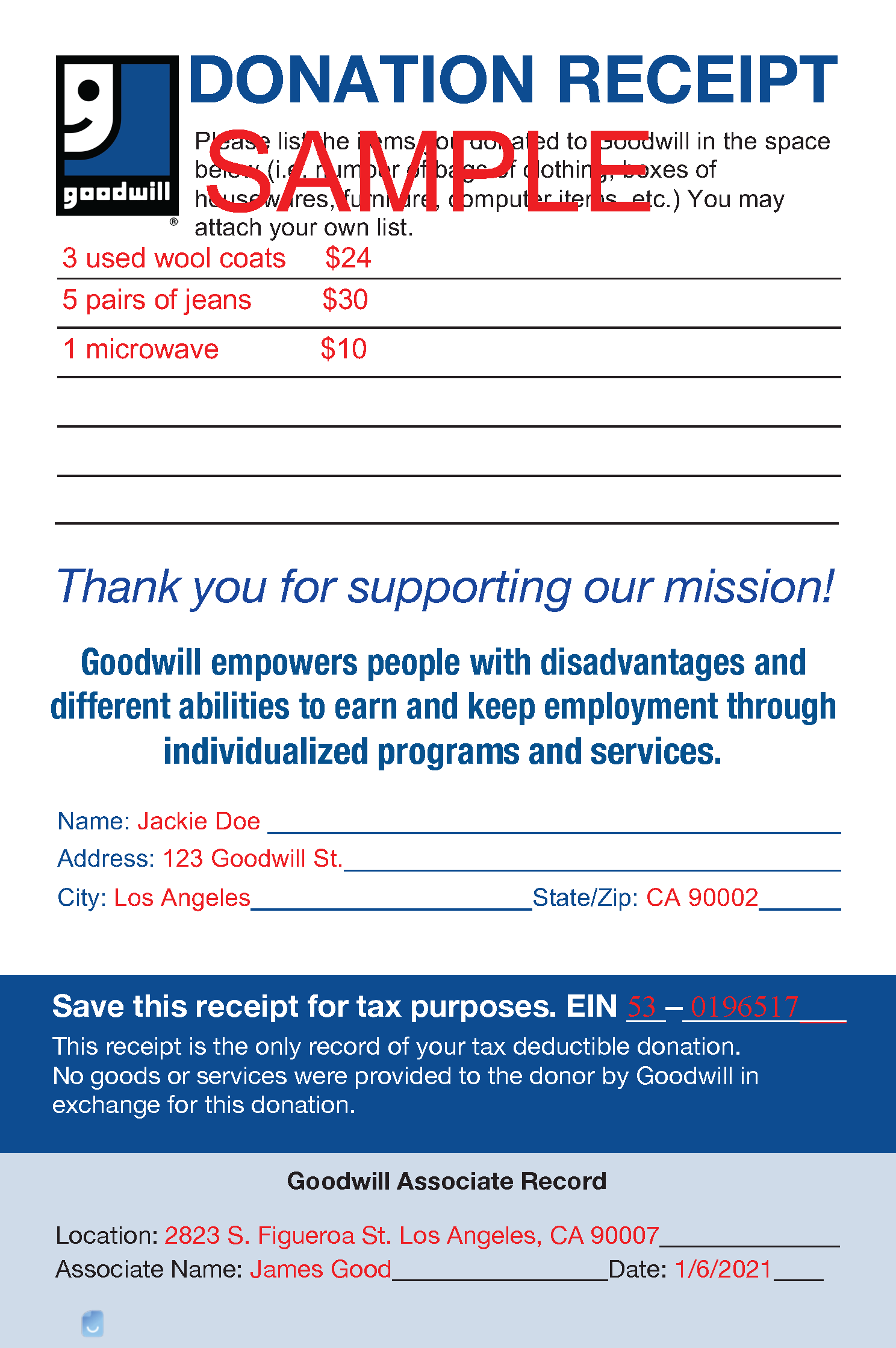

Pdf Printable Goodwill Donation Receipt Printable Templates

Once you register, and every time you donate. Goods or services were not exchanged. Learn how to value and deduct your donations to goodwill on your taxes. Download a pdf guide, find a donation location, and consult a tax. Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code.

Printable Goodwill Donation Receipt

Once you register, and every time you donate. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Goods or services were not exchanged. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax. Download a pdf guide,.

GoodWill Donation Receipt Template Invoice Maker, 40 OFF

If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Learn how to value and deduct your donations to goodwill on your taxes. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax. Goodwill is a qualified tax.

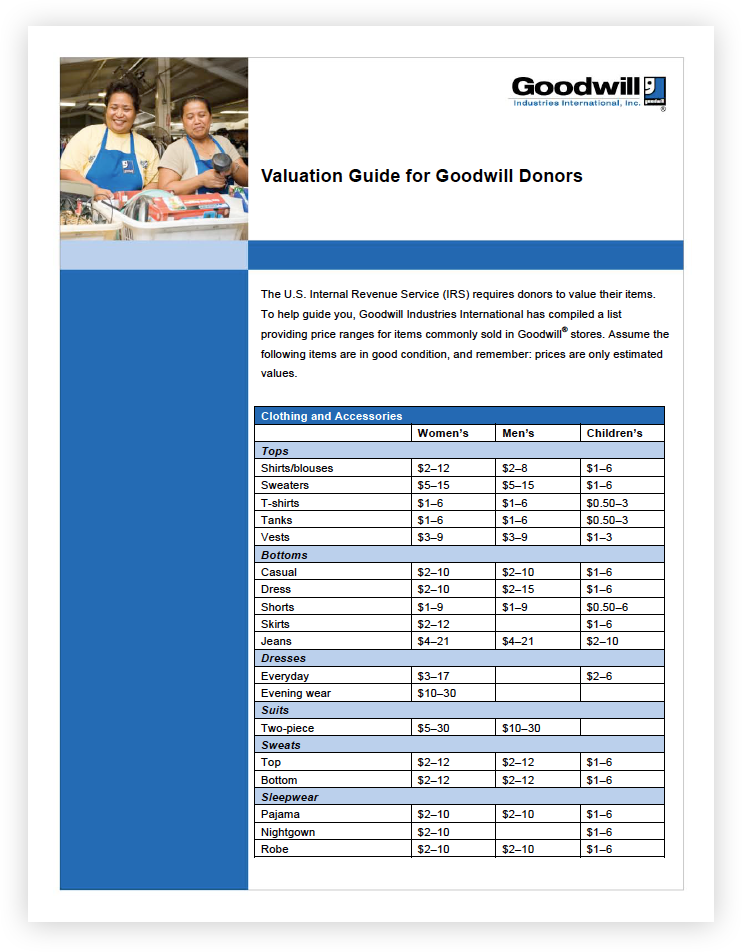

Tax Valuation Guide Goodwill of Southwestern Pennsylvania

If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. It’s easier than ever to track your goodwill donations by eliminating your paper receipts. Download a pdf guide, find a donation location, and consult a tax. Learn how to value and deduct your donations to goodwill on your.

PDF Télécharger goodwill Gratuit PDF

Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. Once you register, and every time you donate. Download a pdf guide, find a donation location, and consult a tax. Learn how to value and deduct your donations to goodwill on your taxes. Goods or services were not exchanged.

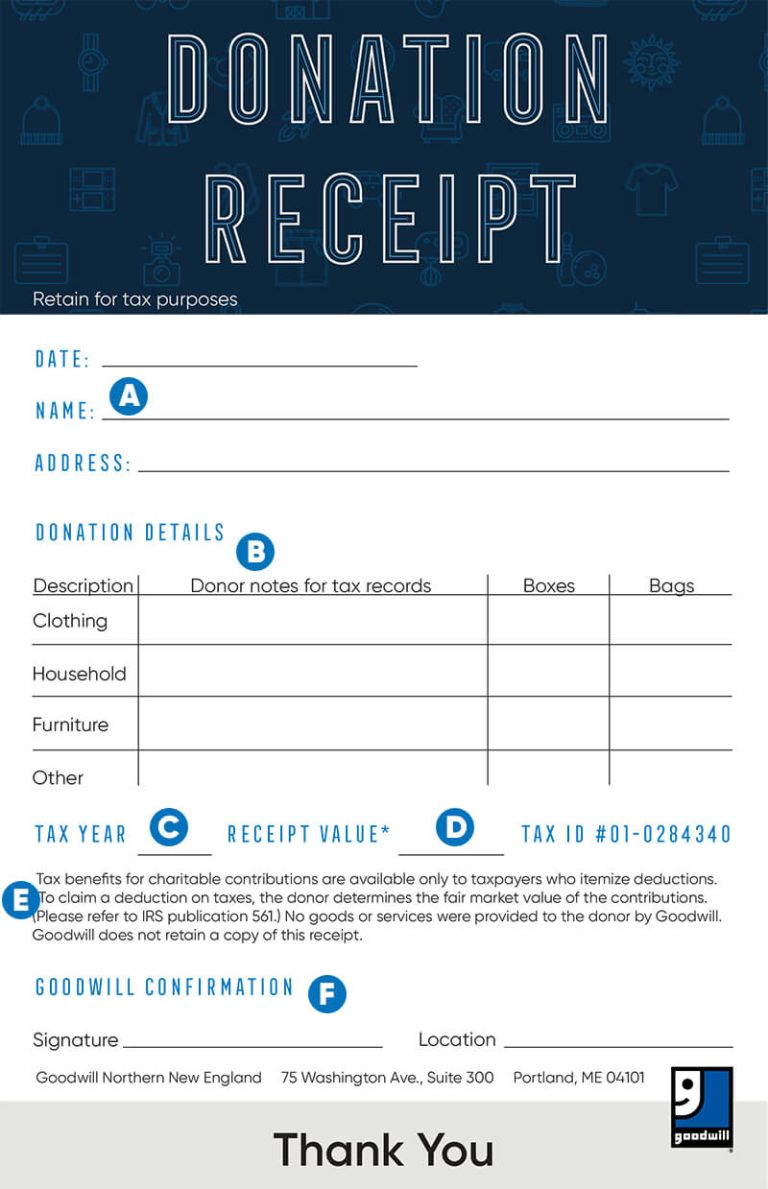

How to fill out a Goodwill Donation Tax Receipt Goodwill NNE

Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. Learn how to value and deduct your donations to goodwill on your taxes. It’s easier than ever to track your goodwill donations by eliminating your paper receipts. Download a pdf guide, find a donation location, and consult a tax. Once you register, and every.

Goodwill Donation Receipt Fill Online Printable Fillable —

It’s easier than ever to track your goodwill donations by eliminating your paper receipts. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax. If you itemize deductions on your federal tax return, you.

When You Drop Off Your Donations At Goodwill, You’ll Receive A Receipt From A Donation Attendant.

Once you register, and every time you donate. Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax.

It’s Easier Than Ever To Track Your Goodwill Donations By Eliminating Your Paper Receipts.

Download a pdf guide, find a donation location, and consult a tax. Learn how to value and deduct your donations to goodwill on your taxes. Goods or services were not exchanged.