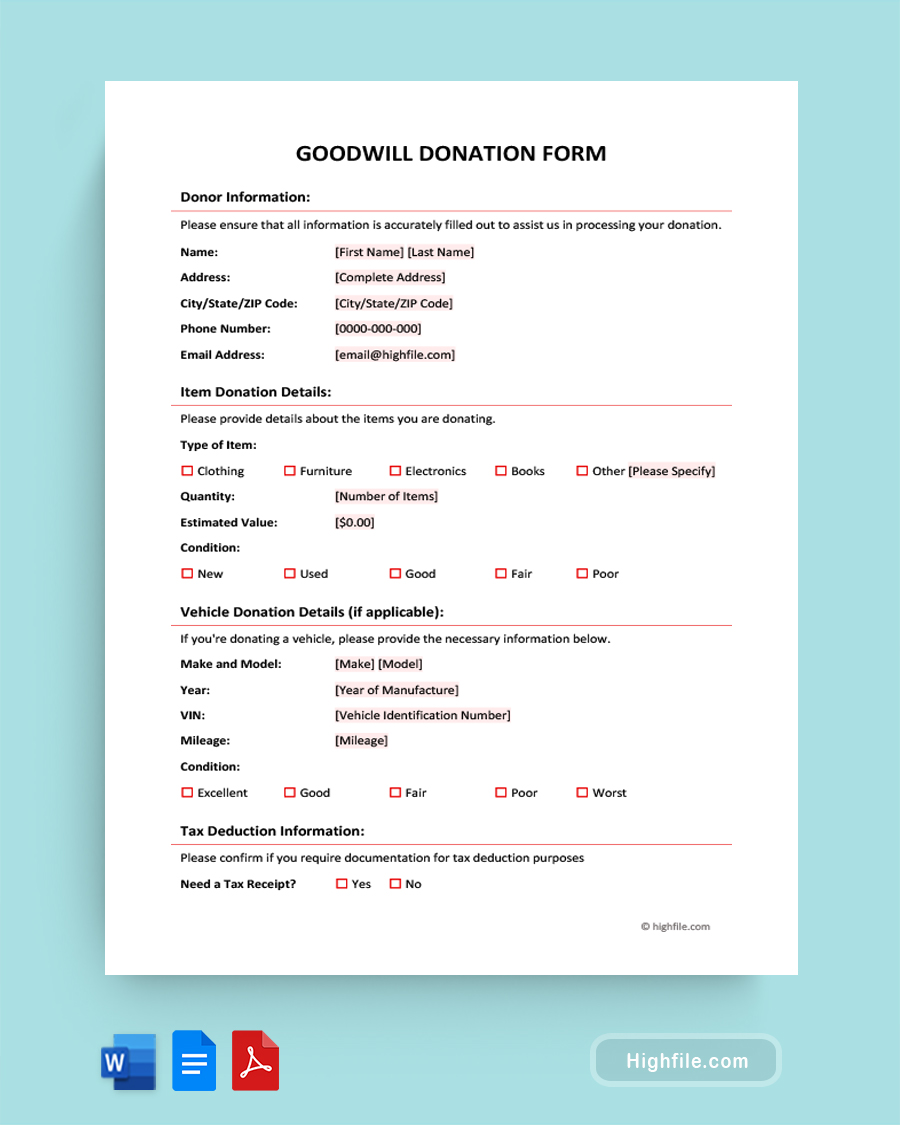

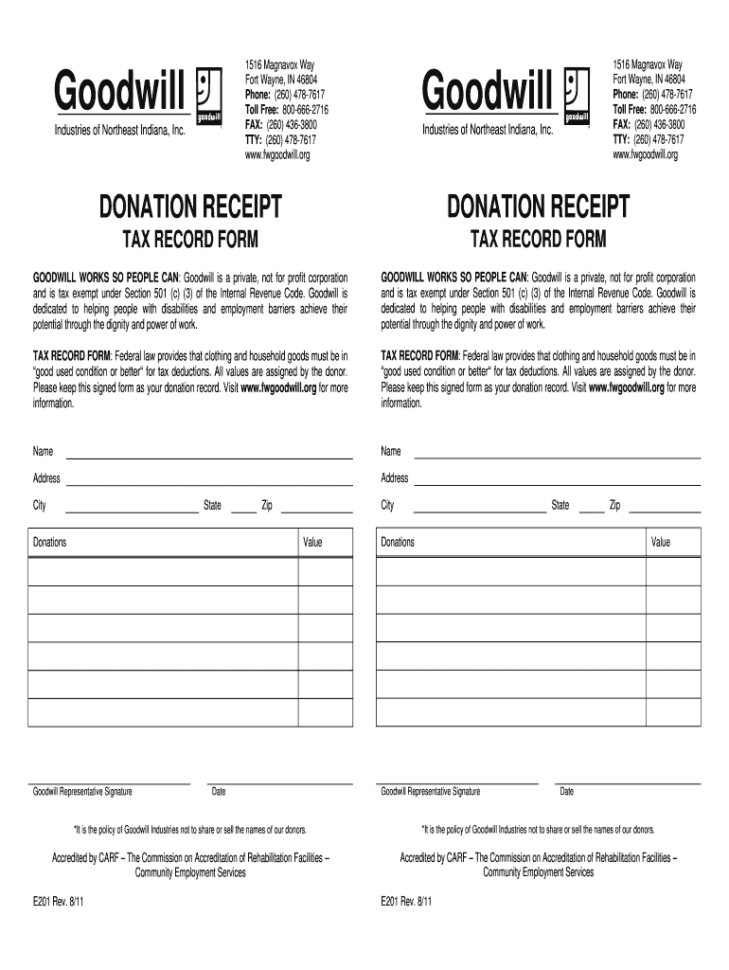

Good Will Donation Form - Use this receipt when filing your taxes. Please consult your personal tax advisor regarding the tax deductibility of your. A donor is responsible for valuing the donated items, and it's. To meet everyone's needs, our template is. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. We've designed our goodwill donation form template to be intuitive, including all the essential fields to make your donation experience a breeze. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Use this receipt when filing your taxes. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor.

If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Use this receipt when filing your taxes. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. A donor is responsible for valuing the donated items, and it's. Use this receipt when filing your taxes. Please consult your personal tax advisor regarding the tax deductibility of your. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. We've designed our goodwill donation form template to be intuitive, including all the essential fields to make your donation experience a breeze. To meet everyone's needs, our template is. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor.

Please consult your personal tax advisor regarding the tax deductibility of your. A donor is responsible for valuing the donated items, and it's. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. To meet everyone's needs, our template is. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. We've designed our goodwill donation form template to be intuitive, including all the essential fields to make your donation experience a breeze. Use this receipt when filing your taxes. Use this receipt when filing your taxes.

Goodwill Donation Form Word PDF Google Docs Highfile

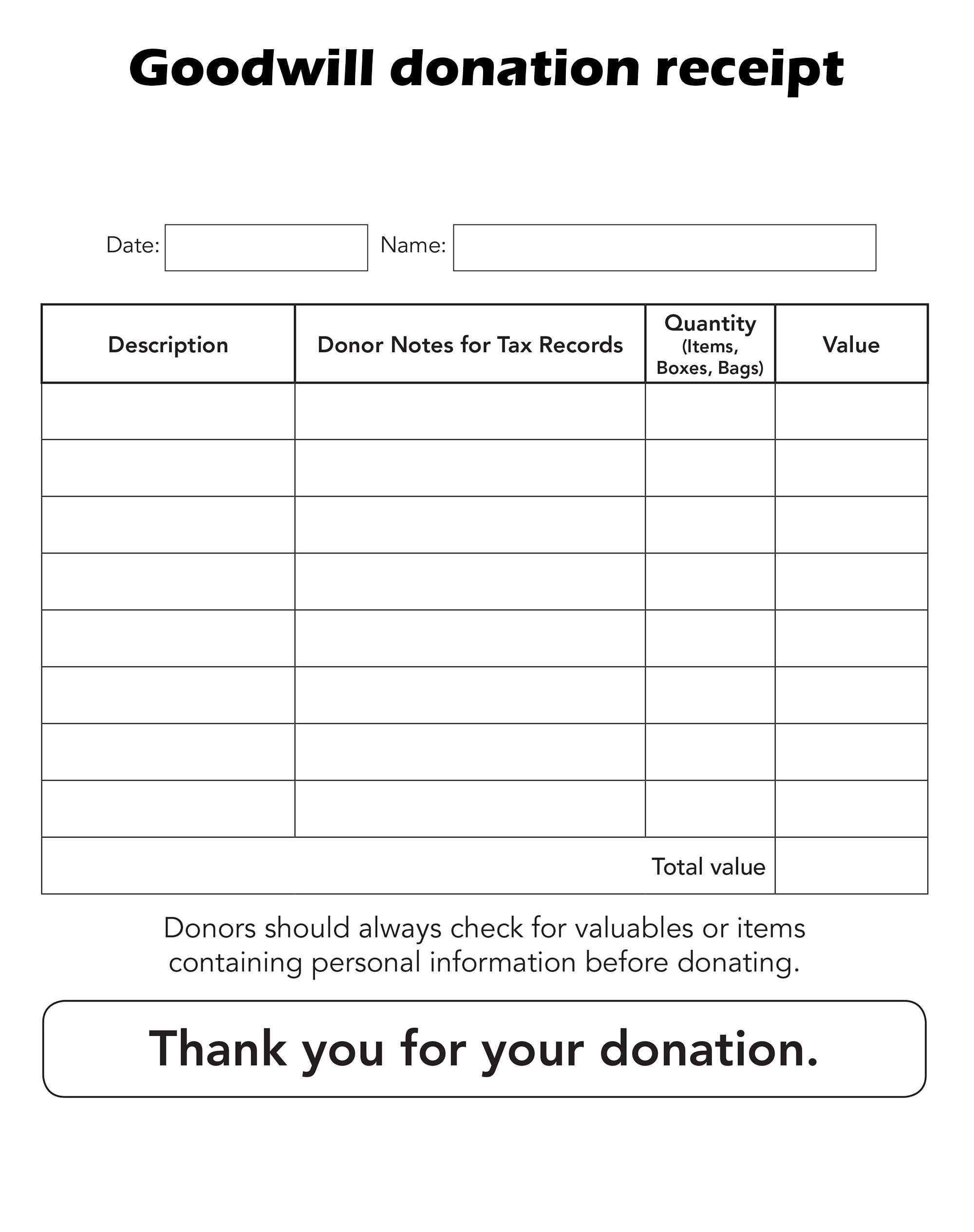

Use this receipt when filing your taxes. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. A donor is responsible for valuing the donated items, and it's. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor. Donor is responsible for written verification.

Free Goodwill Donation Receipt Template PDF eForms

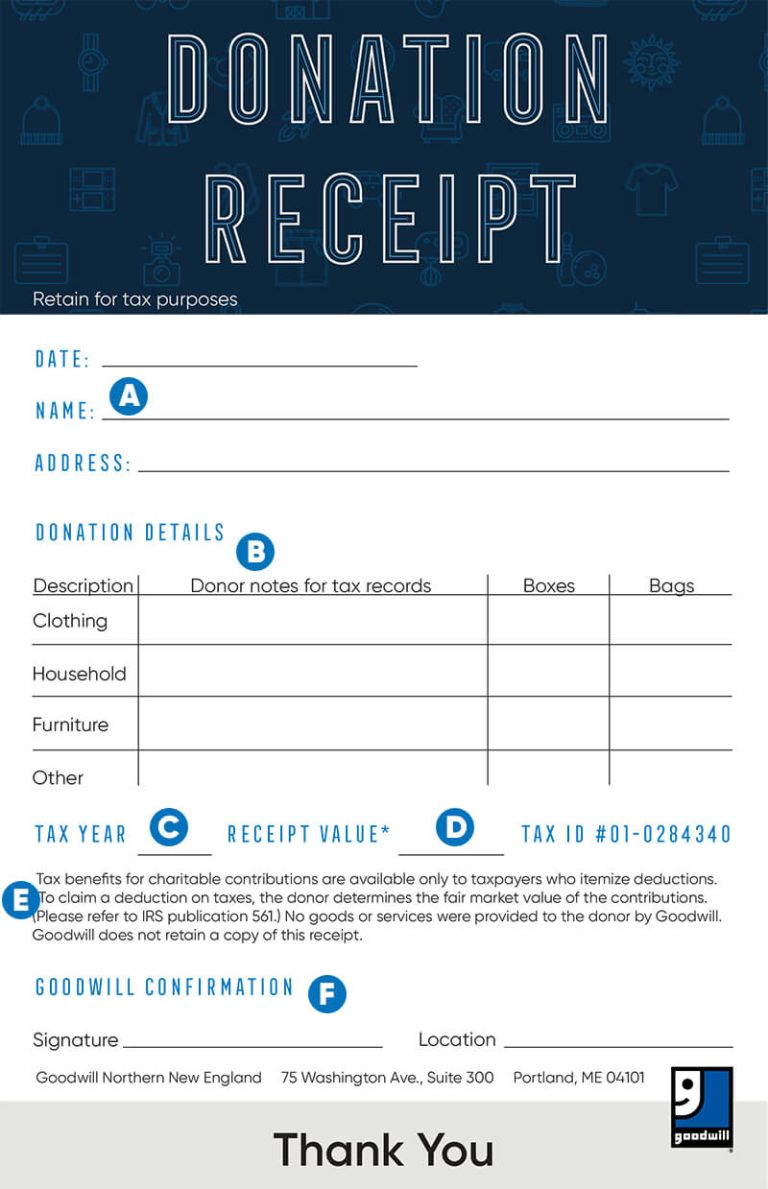

Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor. Please consult your personal tax advisor regarding the tax deductibility of your. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. If you itemize deductions on your federal tax return, you are entitled to claim.

American Red Cross Printable Donation Form Printable Forms Free Online

Use this receipt when filing your taxes. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. A donor is responsible for valuing the donated items, and it's. Use this receipt when.

Donation Printable Form Printable Forms Free Online

A donor is responsible for valuing the donated items, and it's. Please consult your personal tax advisor regarding the tax deductibility of your. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your.

How to fill out a Goodwill Donation Tax Receipt Goodwill NNE

If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. A donation receipt is used.

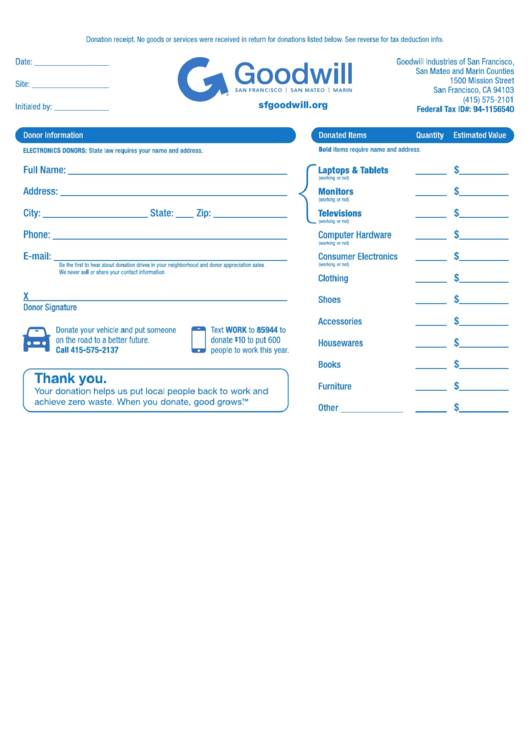

Pdf Printable Goodwill Donation Receipt Printable Templates

A donor is responsible for valuing the donated items, and it's. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. Use this receipt when filing your taxes. To meet everyone's needs, our template is. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor.

Goodwill Donation Receipt Fill Online Printable Fillable —

Use this receipt when filing your taxes. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. Please consult your personal tax advisor regarding the tax deductibility of your. To meet everyone's needs, our template is.

Explore Our Sample of Thrift Store Donation Receipt Template Business

We've designed our goodwill donation form template to be intuitive, including all the essential fields to make your donation experience a breeze. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more..

Goodwill Donation Excel Spreadsheet Google Spreadshee goodwill donation

Use this receipt when filing your taxes. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. Use this receipt when filing your taxes. Internal revenue service, establishing a dollar value on donated items is the responsibility of the donor. Please consult your personal tax advisor regarding the tax deductibility.

Professional Goodwill Tax Receipt Form Word Sample Receipt template

A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. Use this receipt when filing your taxes. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Internal revenue service, establishing a dollar value on donated items is the.

A Donation Receipt Is Used To Claim A Tax Deduction For Clothing And Household Property Itemized On An Individual's Taxes.

We've designed our goodwill donation form template to be intuitive, including all the essential fields to make your donation experience a breeze. Use this receipt when filing your taxes. Donor is responsible for written verification of value for any single item charitable deduction of $500 or more. A donor is responsible for valuing the donated items, and it's.

Internal Revenue Service, Establishing A Dollar Value On Donated Items Is The Responsibility Of The Donor.

Use this receipt when filing your taxes. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Please consult your personal tax advisor regarding the tax deductibility of your. To meet everyone's needs, our template is.