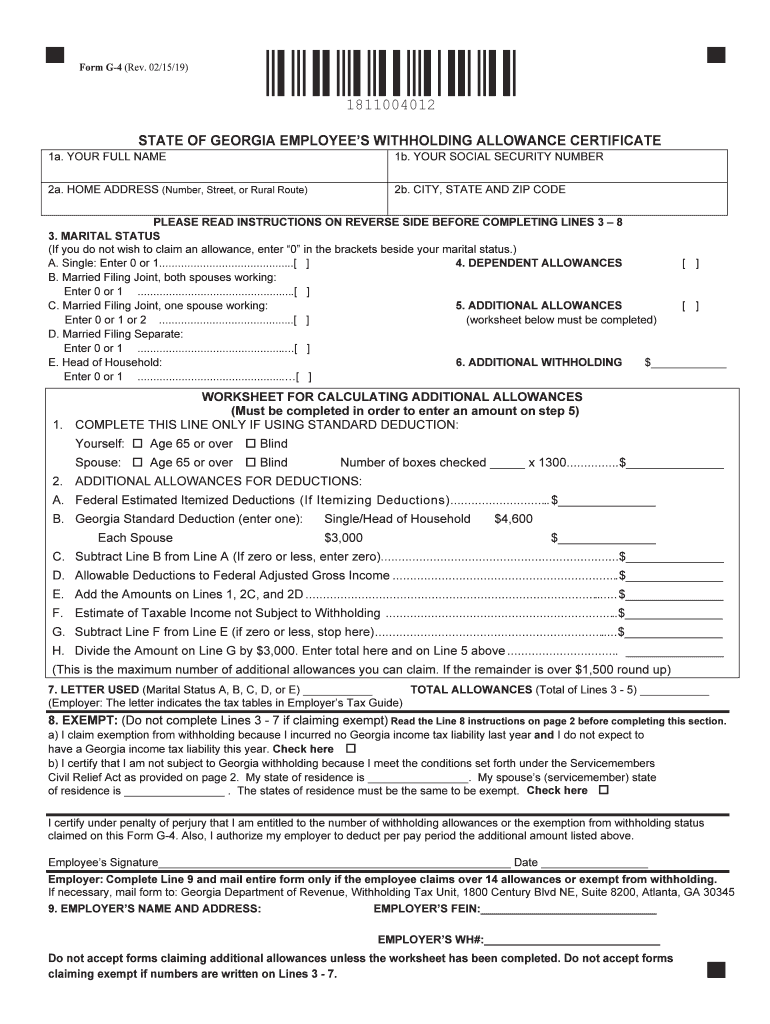

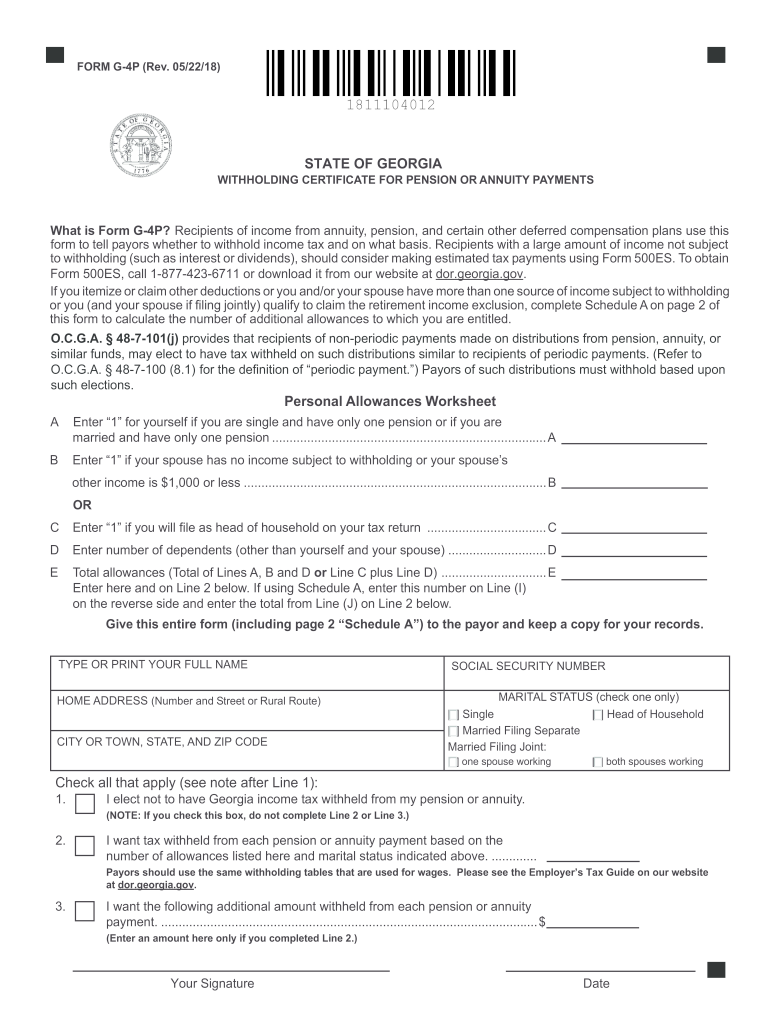

Georgia State Tax Withholding Form - Complete line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding. Employers must withhold georgia state income tax from employees’ wages based on the. This form is available from the georgia department of. An email was sent to email addresses on record. The forms will be effective with the first paycheck.

This form is available from the georgia department of. An email was sent to email addresses on record. The forms will be effective with the first paycheck. Complete line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding. Employers must withhold georgia state income tax from employees’ wages based on the.

Complete line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding. This form is available from the georgia department of. An email was sent to email addresses on record. The forms will be effective with the first paycheck. Employers must withhold georgia state income tax from employees’ wages based on the.

Tax Withholding Form G4

This form is available from the georgia department of. Employers must withhold georgia state income tax from employees’ wages based on the. Complete line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding. An email was sent to email addresses on record. The forms will be effective with the first paycheck.

Missouri Tax Bracket 2024 Loren Raquela

Complete line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding. An email was sent to email addresses on record. The forms will be effective with the first paycheck. This form is available from the georgia department of. Employers must withhold georgia state income tax from employees’ wages based on the.

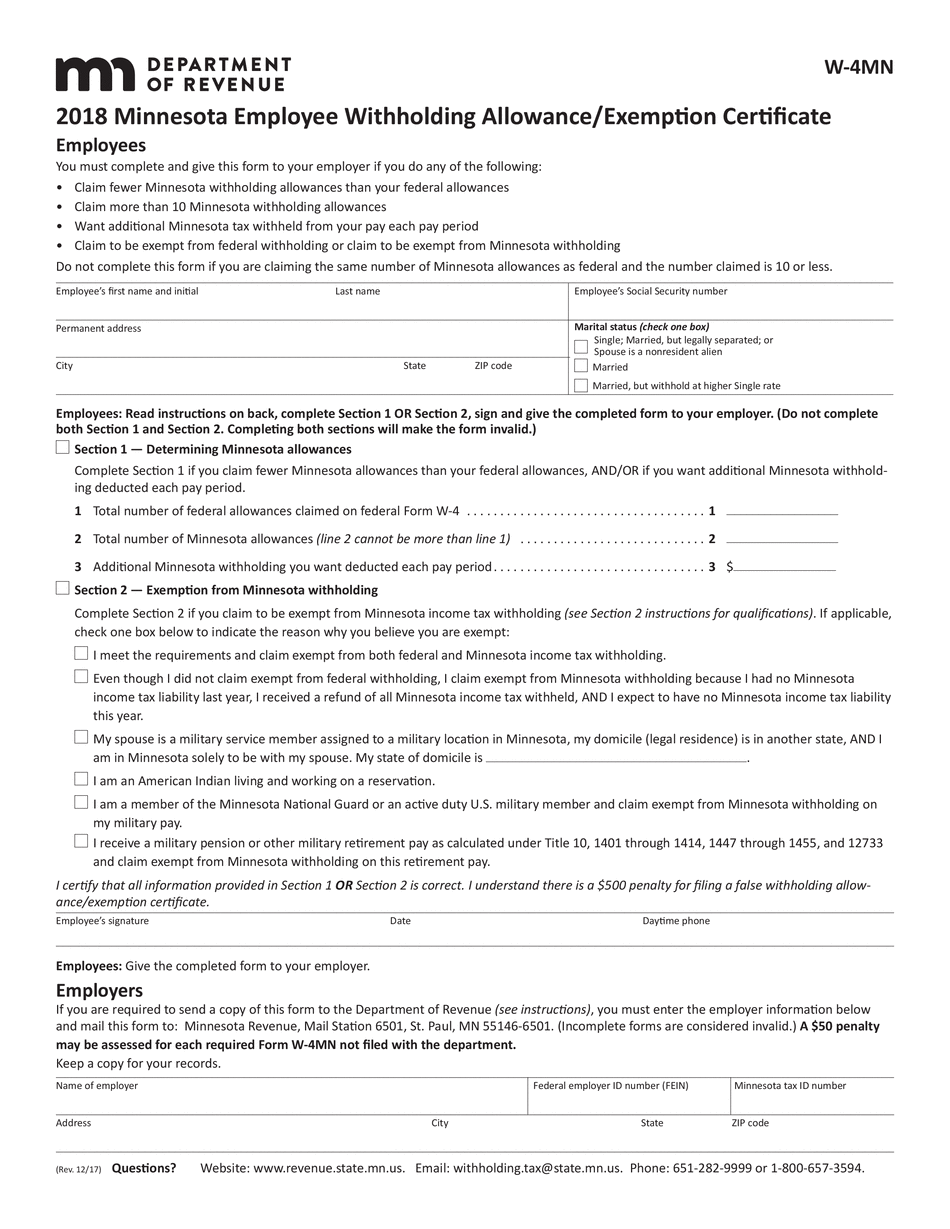

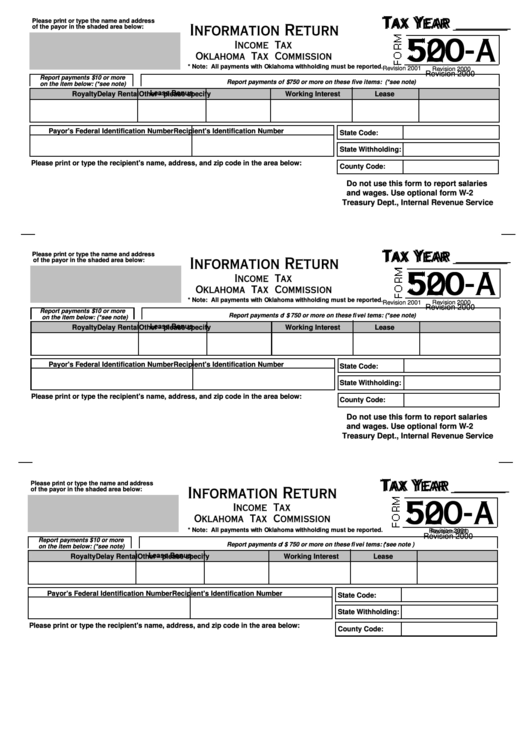

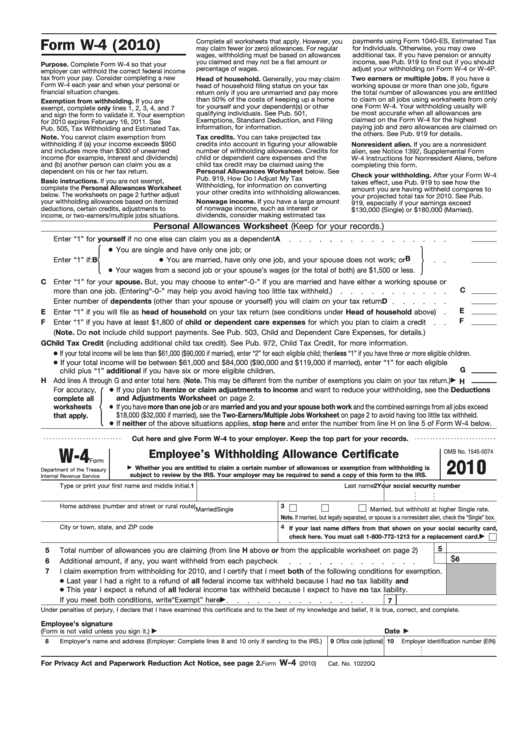

State Tax Withholding Form For Employees

Employers must withhold georgia state income tax from employees’ wages based on the. The forms will be effective with the first paycheck. Complete line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding. This form is available from the georgia department of. An email was sent to email addresses on record.

State Tax Withholding Form Images

An email was sent to email addresses on record. Employers must withhold georgia state income tax from employees’ wages based on the. This form is available from the georgia department of. The forms will be effective with the first paycheck. Complete line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding.

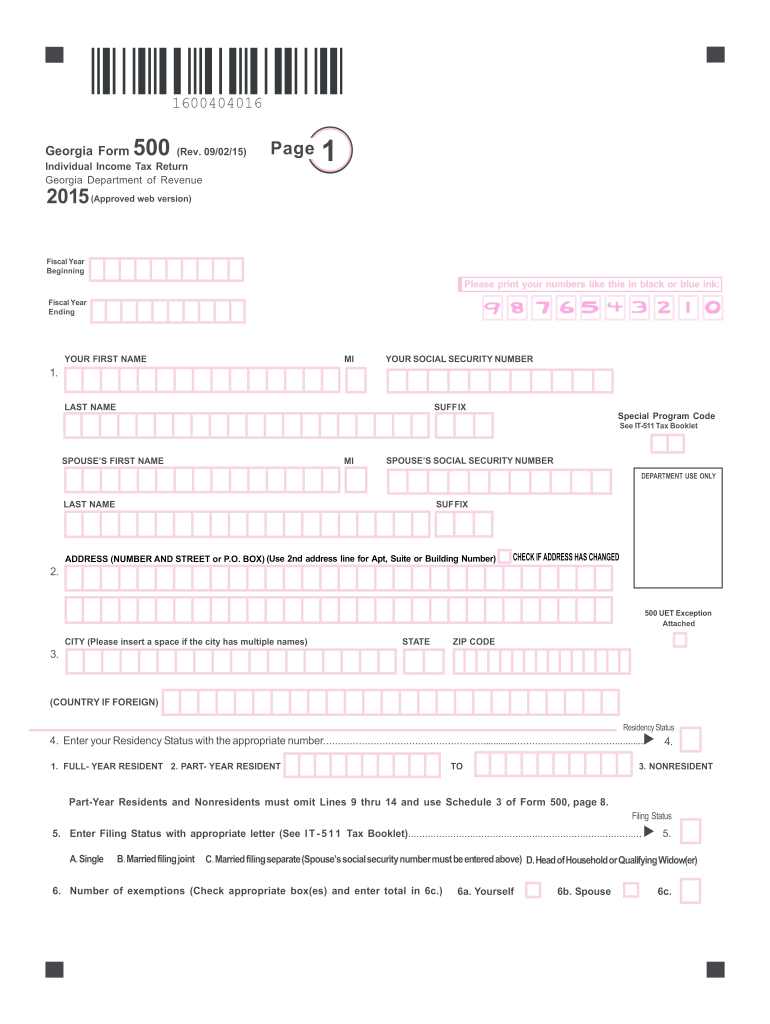

2015 form Fill out & sign online DocHub

Complete line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding. An email was sent to email addresses on record. The forms will be effective with the first paycheck. Employers must withhold georgia state income tax from employees’ wages based on the. This form is available from the georgia department of.

North Carolina State Tax Rates 2024

An email was sent to email addresses on record. Employers must withhold georgia state income tax from employees’ wages based on the. This form is available from the georgia department of. Complete line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding. The forms will be effective with the first paycheck.

State Tax Forms Printable Printable Forms Free Online

An email was sent to email addresses on record. Complete line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding. This form is available from the georgia department of. The forms will be effective with the first paycheck. Employers must withhold georgia state income tax from employees’ wages based on the.

2024 Ga Tax Form Fae Kittie

The forms will be effective with the first paycheck. Employers must withhold georgia state income tax from employees’ wages based on the. An email was sent to email addresses on record. Complete line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding. This form is available from the georgia department of.

2023 State Tax Withholding Form Printable Forms Free Online

The forms will be effective with the first paycheck. This form is available from the georgia department of. Complete line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding. Employers must withhold georgia state income tax from employees’ wages based on the. An email was sent to email addresses on record.

State Tax Withholding Form Images

Employers must withhold georgia state income tax from employees’ wages based on the. The forms will be effective with the first paycheck. Complete line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding. This form is available from the georgia department of. An email was sent to email addresses on record.

Employers Must Withhold Georgia State Income Tax From Employees’ Wages Based On The.

An email was sent to email addresses on record. The forms will be effective with the first paycheck. Complete line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding. This form is available from the georgia department of.