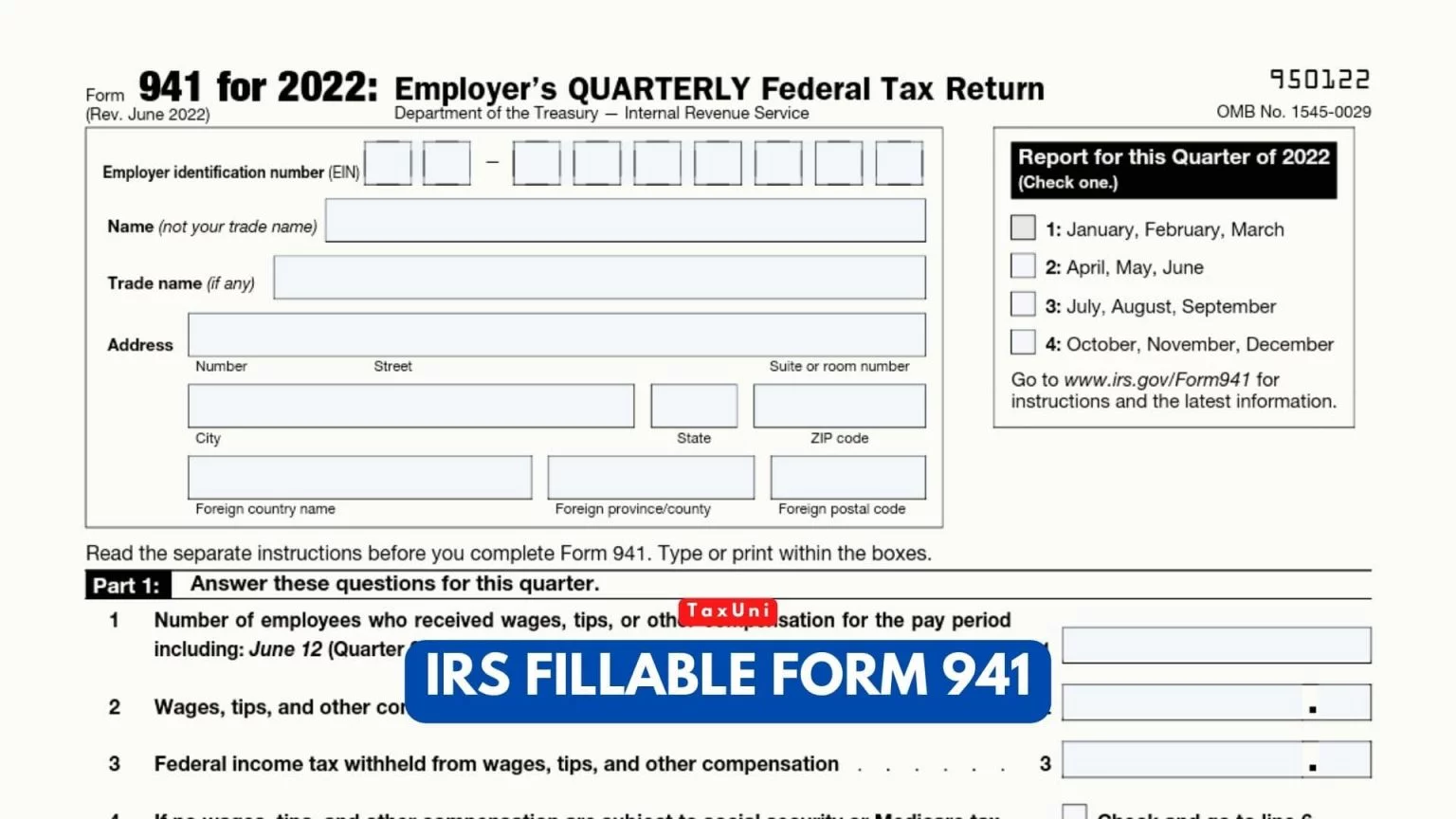

Form 941 2020 - Form 941 employer's quarterly federal tax return. We need it to figure and collect the right. Download and print the official irs form for reporting wages, tips, and taxes for the first quarter of 2020. We ask for the information on form 941 to carry out the internal revenue laws of the united states. Learn how to report and pay taxes withheld from employee's paychecks using form 941. For the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published,. Answer these questions for this quarter. Form 941 (2022) employer's quarterly federal tax return for 2022. Employers who withhold income taxes, social security tax, or medicare. Number of employees who received wages, tips, or other compensation for the pay period.

Find the latest updates, instructions, schedules, and. For the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published,. Download and print the official irs form for reporting wages, tips, and taxes for the first quarter of 2020. We ask for the information on form 941 to carry out the internal revenue laws of the united states. For employers who withhold taxes from employee's. Learn how to report and pay taxes withheld from employee's paychecks using form 941. We need it to figure and collect the right. Number of employees who received wages, tips, or other compensation for the pay period. Employers who withhold income taxes, social security tax, or medicare. Answer these questions for this quarter.

We ask for the information on form 941 to carry out the internal revenue laws of the united states. For the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published,. Find the latest updates, instructions, schedules, and. Form 941 (2022) employer's quarterly federal tax return for 2022. Form 941 employer's quarterly federal tax return. For employers who withhold taxes from employee's. Number of employees who received wages, tips, or other compensation for the pay period. Learn how to report and pay taxes withheld from employee's paychecks using form 941. We need it to figure and collect the right. Download and print the official irs form for reporting wages, tips, and taxes for the first quarter of 2020.

Where To Mail Form 941 With Payment 2024 Lanae Miranda

For employers who withhold taxes from employee's. Find the latest updates, instructions, schedules, and. Employers who withhold income taxes, social security tax, or medicare. Form 941 employer's quarterly federal tax return. Download and print the official irs form for reporting wages, tips, and taxes for the first quarter of 2020.

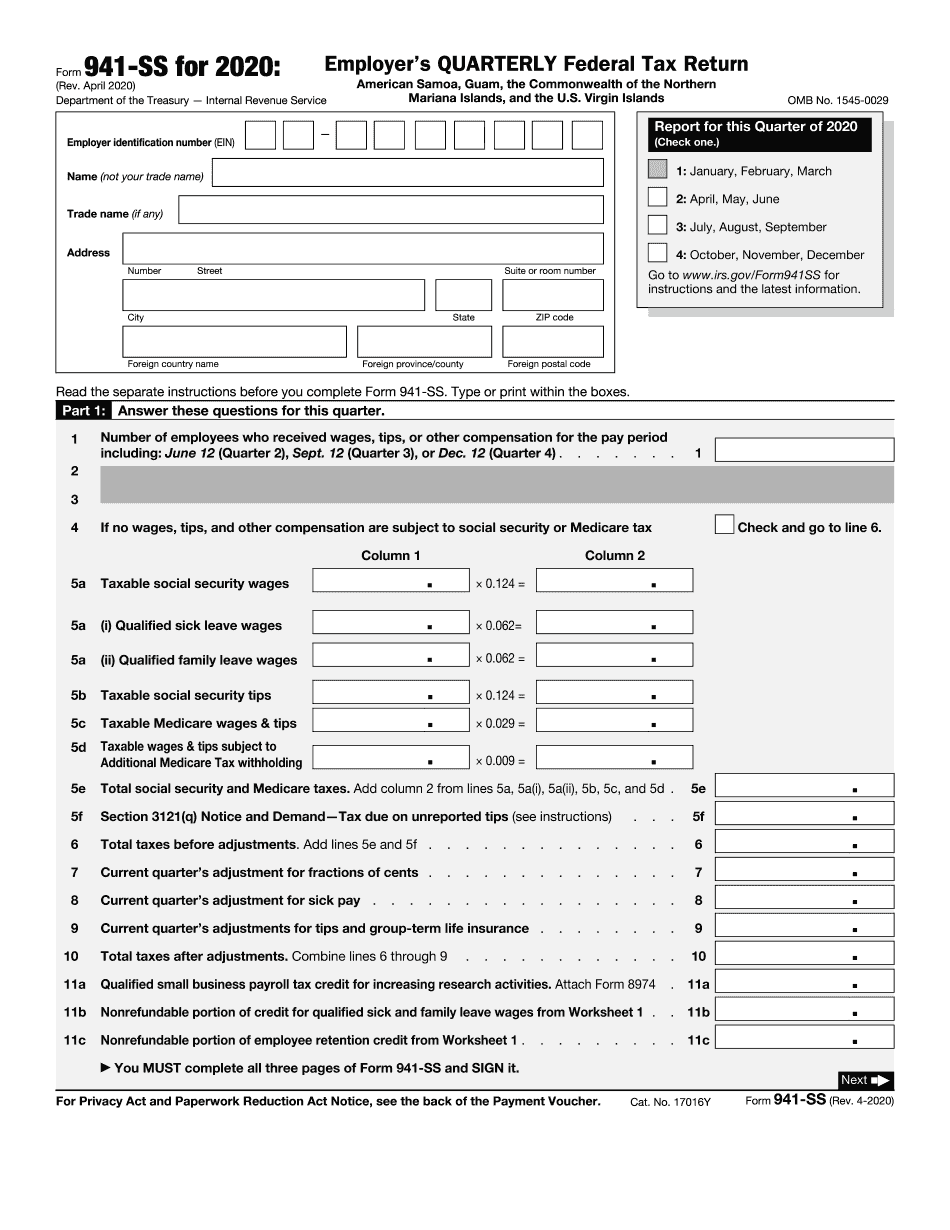

Printable 941 form 2020 Fill out & sign online DocHub

Form 941 employer's quarterly federal tax return. For the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published,. Download and print the official irs form for reporting wages, tips, and taxes for the first quarter of 2020. Form 941 (2022) employer's quarterly federal tax return for 2022. Find the latest.

Irs Form 941 Fillable Fillable Irs Form 941 Pr 2018 2019 Line Pdf

Download and print the official irs form for reporting wages, tips, and taxes for the first quarter of 2020. Number of employees who received wages, tips, or other compensation for the pay period. Find the latest updates, instructions, schedules, and. We ask for the information on form 941 to carry out the internal revenue laws of the united states. We.

Irs Form 941 Fillable Printable Forms Free Online

Download and print the official irs form for reporting wages, tips, and taxes for the first quarter of 2020. Answer these questions for this quarter. For employers who withhold taxes from employee's. Find the latest updates, instructions, schedules, and. Form 941 (2022) employer's quarterly federal tax return for 2022.

941 Form 2020 Pdf Fill Online, Printable, Fillable, Blank pdfFiller

For the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published,. Number of employees who received wages, tips, or other compensation for the pay period. Form 941 (2022) employer's quarterly federal tax return for 2022. Learn how to report and pay taxes withheld from employee's paychecks using form 941. Find.

941 Worksheet 1 Example

Answer these questions for this quarter. Learn how to report and pay taxes withheld from employee's paychecks using form 941. For the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published,. Employers who withhold income taxes, social security tax, or medicare. For employers who withhold taxes from employee's.

941 Fillable 2020 Fill Online Printable Fillable Blank Printable Form

Form 941 employer's quarterly federal tax return. Employers who withhold income taxes, social security tax, or medicare. Form 941 (2022) employer's quarterly federal tax return for 2022. For the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published,. Find the latest updates, instructions, schedules, and.

2022 Q4 tax calendar Key deadlines for businesses and other employers

Number of employees who received wages, tips, or other compensation for the pay period. We need it to figure and collect the right. Learn how to report and pay taxes withheld from employee's paychecks using form 941. We ask for the information on form 941 to carry out the internal revenue laws of the united states. Download and print the.

Form 941 Irs 2023 Printable Forms Free Online

Learn how to report and pay taxes withheld from employee's paychecks using form 941. We need it to figure and collect the right. For the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published,. Employers who withhold income taxes, social security tax, or medicare. We ask for the information on.

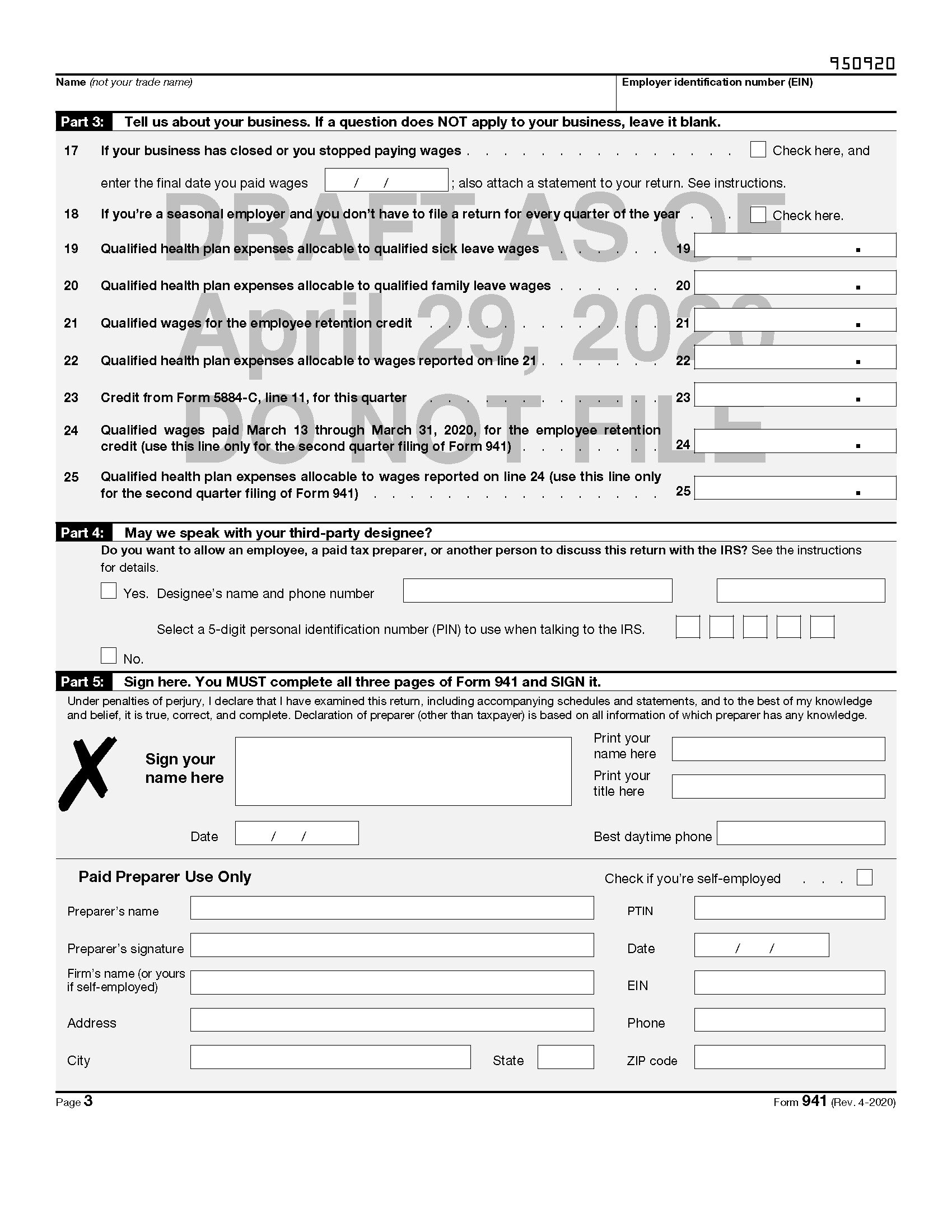

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

Find the latest updates, instructions, schedules, and. For the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published,. We need it to figure and collect the right. Number of employees who received wages, tips, or other compensation for the pay period. Employers who withhold income taxes, social security tax, or.

Find The Latest Updates, Instructions, Schedules, And.

Number of employees who received wages, tips, or other compensation for the pay period. Download and print the official irs form for reporting wages, tips, and taxes for the first quarter of 2020. Form 941 (2022) employer's quarterly federal tax return for 2022. For the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published,.

Form 941 Employer's Quarterly Federal Tax Return.

Answer these questions for this quarter. For employers who withhold taxes from employee's. We ask for the information on form 941 to carry out the internal revenue laws of the united states. We need it to figure and collect the right.

Employers Who Withhold Income Taxes, Social Security Tax, Or Medicare.

Learn how to report and pay taxes withheld from employee's paychecks using form 941.