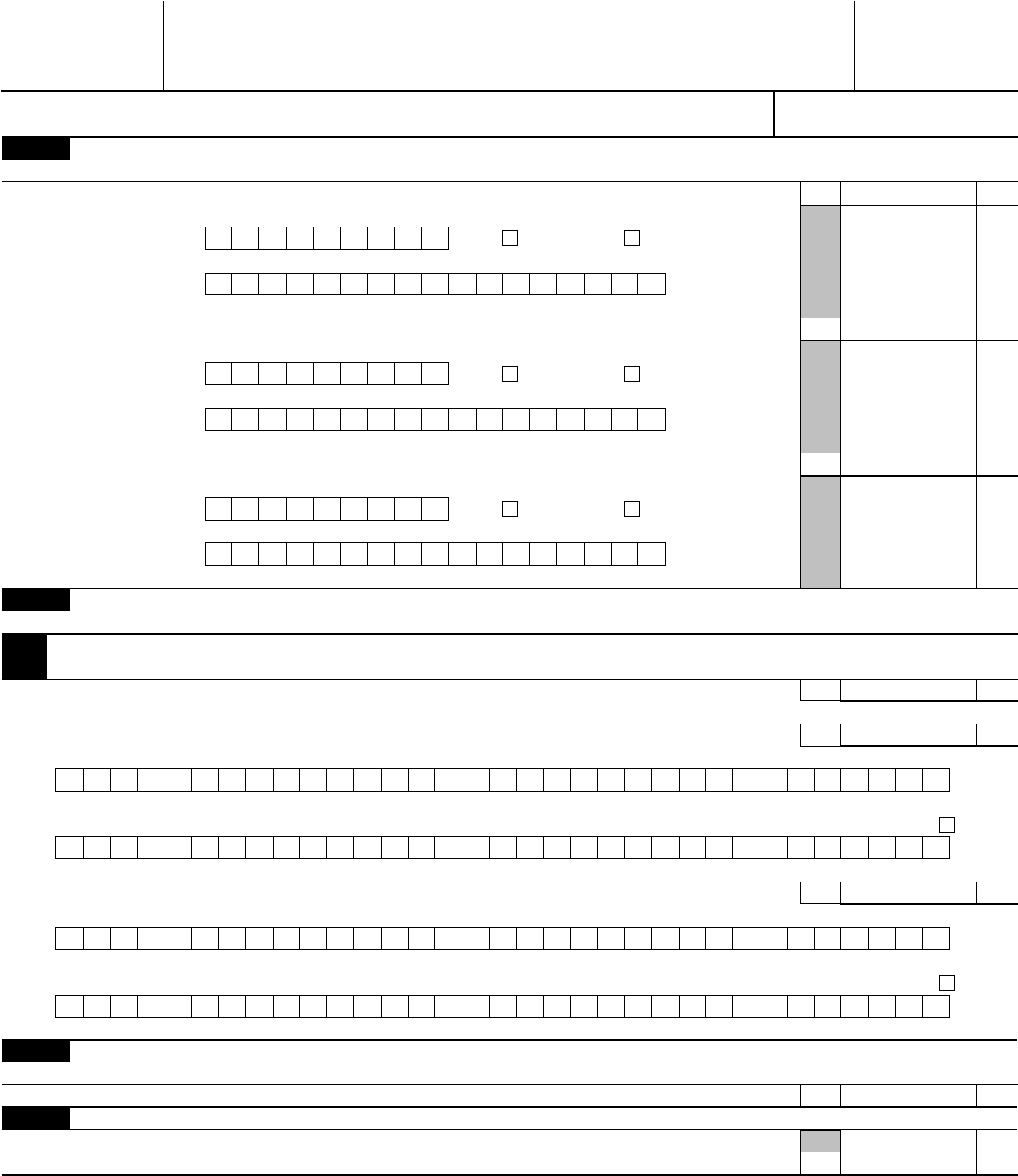

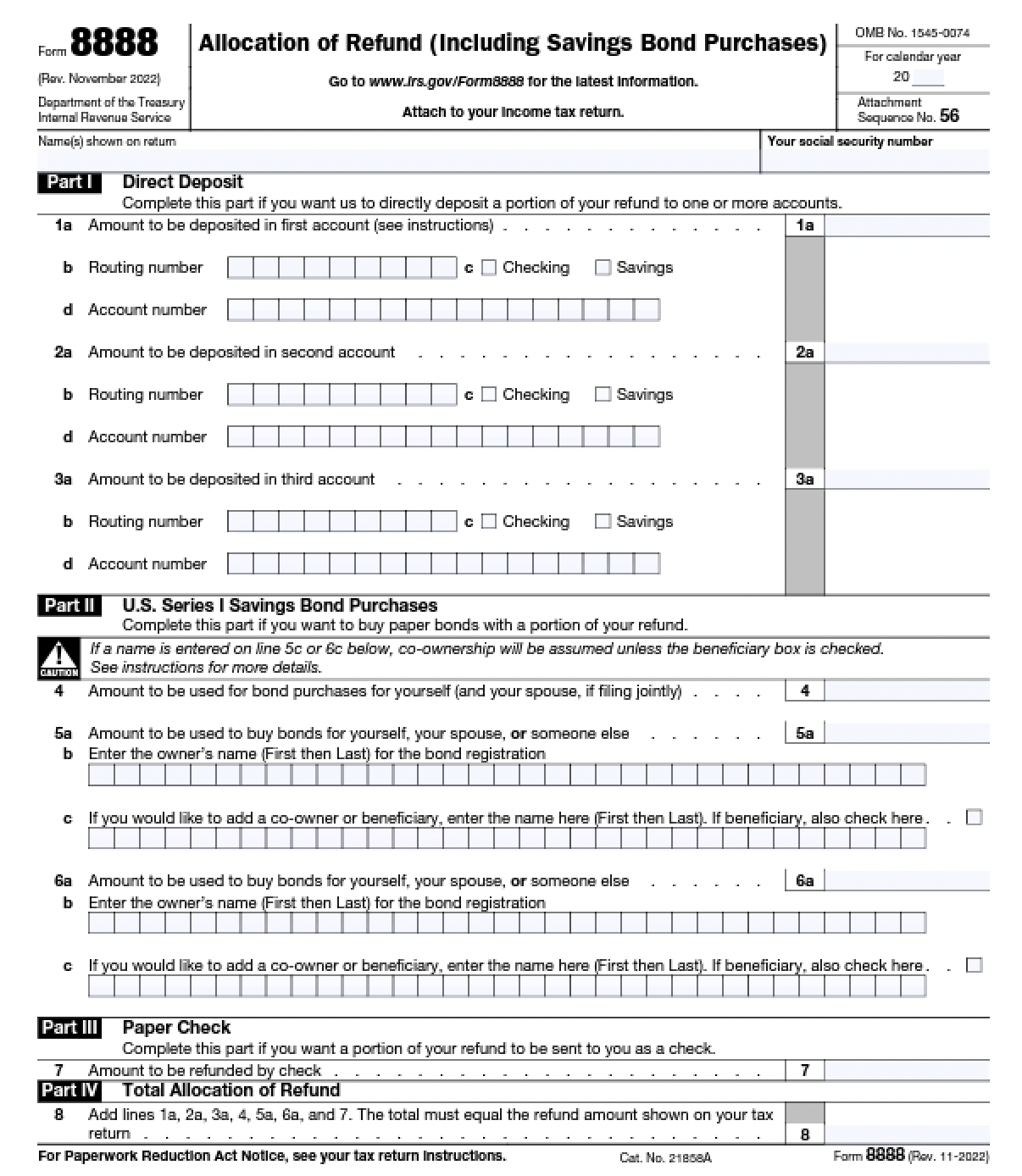

Form 8888 Allocation Of Refund - The form will be updated as needed. Add lines 1a, 2a, 3a, 4, 5a, 6a, and 7. The total must equal the refund amount shown on your tax return. Learn how to use form 8888 to allocate your tax refund to one or more accounts or buy up to $5,000 in paper series i savings bonds. Form 8888, allocation of refund (including savings bond purchases) is automatically generated by turbotax when you. Form 8888 has been converted from annual revision to continuous use. You want to use at least. To split your refund into multiple direct deposit accounts or purchase a savings bond, follow these simple steps:

Add lines 1a, 2a, 3a, 4, 5a, 6a, and 7. The total must equal the refund amount shown on your tax return. You want to use at least. To split your refund into multiple direct deposit accounts or purchase a savings bond, follow these simple steps: Form 8888 has been converted from annual revision to continuous use. Form 8888, allocation of refund (including savings bond purchases) is automatically generated by turbotax when you. The form will be updated as needed. Learn how to use form 8888 to allocate your tax refund to one or more accounts or buy up to $5,000 in paper series i savings bonds.

The form will be updated as needed. You want to use at least. To split your refund into multiple direct deposit accounts or purchase a savings bond, follow these simple steps: The total must equal the refund amount shown on your tax return. Form 8888, allocation of refund (including savings bond purchases) is automatically generated by turbotax when you. Form 8888 has been converted from annual revision to continuous use. Add lines 1a, 2a, 3a, 4, 5a, 6a, and 7. Learn how to use form 8888 to allocate your tax refund to one or more accounts or buy up to $5,000 in paper series i savings bonds.

2016 Form 8888 Edit, Fill, Sign Online Handypdf

Form 8888, allocation of refund (including savings bond purchases) is automatically generated by turbotax when you. Add lines 1a, 2a, 3a, 4, 5a, 6a, and 7. You want to use at least. Form 8888 has been converted from annual revision to continuous use. Learn how to use form 8888 to allocate your tax refund to one or more accounts or.

How to Easily Transfer Your Tax Refund into Your 529 MEFA

To split your refund into multiple direct deposit accounts or purchase a savings bond, follow these simple steps: You want to use at least. Form 8888 has been converted from annual revision to continuous use. The total must equal the refund amount shown on your tax return. Form 8888, allocation of refund (including savings bond purchases) is automatically generated by.

8888 Total Refund Per Computer 20222024 Form Fill Out and Sign

Add lines 1a, 2a, 3a, 4, 5a, 6a, and 7. You want to use at least. To split your refund into multiple direct deposit accounts or purchase a savings bond, follow these simple steps: Form 8888, allocation of refund (including savings bond purchases) is automatically generated by turbotax when you. The form will be updated as needed.

IRS Form 8888 Instructions Allocation of Tax Refund

Learn how to use form 8888 to allocate your tax refund to one or more accounts or buy up to $5,000 in paper series i savings bonds. Form 8888, allocation of refund (including savings bond purchases) is automatically generated by turbotax when you. The form will be updated as needed. The total must equal the refund amount shown on your.

Form 8888 Allocation of Refund (Including Savings Bond Purchases

Form 8888, allocation of refund (including savings bond purchases) is automatically generated by turbotax when you. To split your refund into multiple direct deposit accounts or purchase a savings bond, follow these simple steps: You want to use at least. Learn how to use form 8888 to allocate your tax refund to one or more accounts or buy up to.

Form 8888 Allocation of Refund (Including Savings Bond Purchases

To split your refund into multiple direct deposit accounts or purchase a savings bond, follow these simple steps: Add lines 1a, 2a, 3a, 4, 5a, 6a, and 7. The total must equal the refund amount shown on your tax return. The form will be updated as needed. You want to use at least.

IRS Form 8888 Download Fillable PDF or Fill Online Allocation of Refund

To split your refund into multiple direct deposit accounts or purchase a savings bond, follow these simple steps: Learn how to use form 8888 to allocate your tax refund to one or more accounts or buy up to $5,000 in paper series i savings bonds. The total must equal the refund amount shown on your tax return. Add lines 1a,.

IRS Form 8888 Instructions Allocation of Tax Refund

Add lines 1a, 2a, 3a, 4, 5a, 6a, and 7. Form 8888 has been converted from annual revision to continuous use. The form will be updated as needed. You want to use at least. To split your refund into multiple direct deposit accounts or purchase a savings bond, follow these simple steps:

Form 8888 Allocation of Refund Including Savings Bond Purchases Stock

The form will be updated as needed. You want to use at least. Form 8888 has been converted from annual revision to continuous use. Learn how to use form 8888 to allocate your tax refund to one or more accounts or buy up to $5,000 in paper series i savings bonds. Add lines 1a, 2a, 3a, 4, 5a, 6a, and.

Form 8888 Allocation of Refund (Including Savings Bond Purchases

You want to use at least. The form will be updated as needed. The total must equal the refund amount shown on your tax return. To split your refund into multiple direct deposit accounts or purchase a savings bond, follow these simple steps: Form 8888 has been converted from annual revision to continuous use.

To Split Your Refund Into Multiple Direct Deposit Accounts Or Purchase A Savings Bond, Follow These Simple Steps:

Learn how to use form 8888 to allocate your tax refund to one or more accounts or buy up to $5,000 in paper series i savings bonds. Form 8888 has been converted from annual revision to continuous use. Form 8888, allocation of refund (including savings bond purchases) is automatically generated by turbotax when you. Add lines 1a, 2a, 3a, 4, 5a, 6a, and 7.

The Form Will Be Updated As Needed.

The total must equal the refund amount shown on your tax return. You want to use at least.