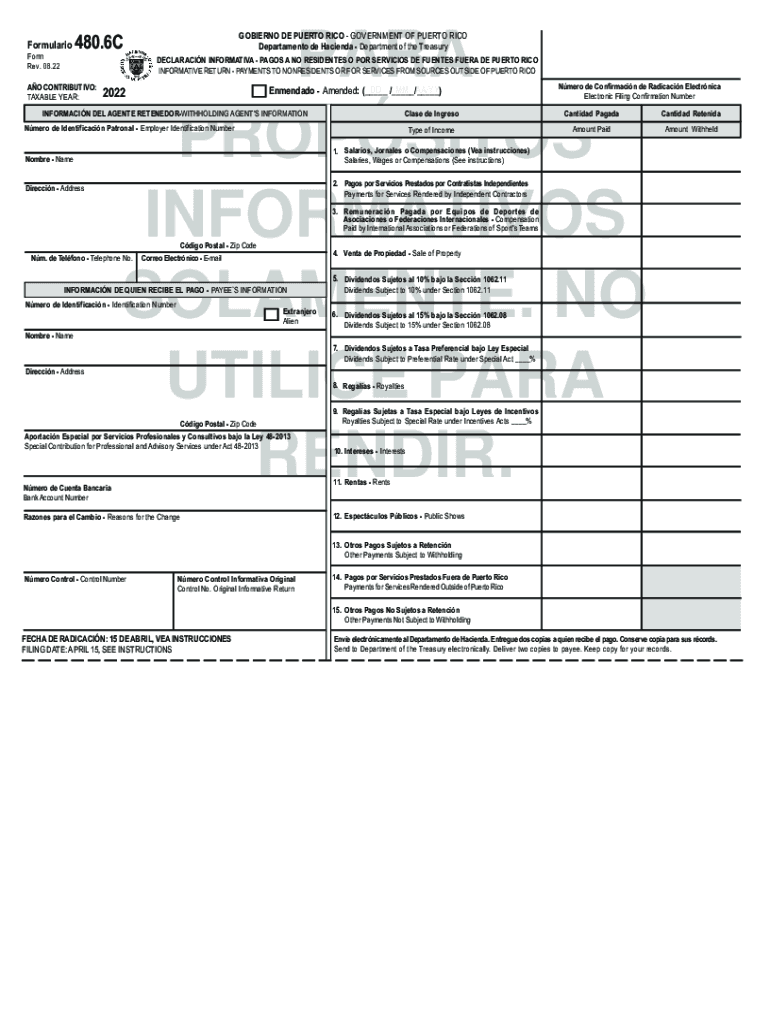

Form 480 6C Instructions - Taxes were withheld on gross income but the actual nonresident. The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:. Se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si. Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. Our composite substitute tax statement includes reporting on payments consisting of. You'll need to sign in or create an account to connect with an expert. My understanding is that 480.6c is only a withholding certificate;

Our composite substitute tax statement includes reporting on payments consisting of. Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. Taxes were withheld on gross income but the actual nonresident. Se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si. The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:. You'll need to sign in or create an account to connect with an expert. My understanding is that 480.6c is only a withholding certificate;

Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. My understanding is that 480.6c is only a withholding certificate; You'll need to sign in or create an account to connect with an expert. Our composite substitute tax statement includes reporting on payments consisting of. Taxes were withheld on gross income but the actual nonresident. The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:. Se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si.

Form 480 9 Printable Printable Forms Free Online

My understanding is that 480.6c is only a withholding certificate; The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:. Taxes were withheld on gross income but the actual nonresident. Our composite substitute tax statement includes reporting on payments consisting of. You'll need to sign in or create an account to.

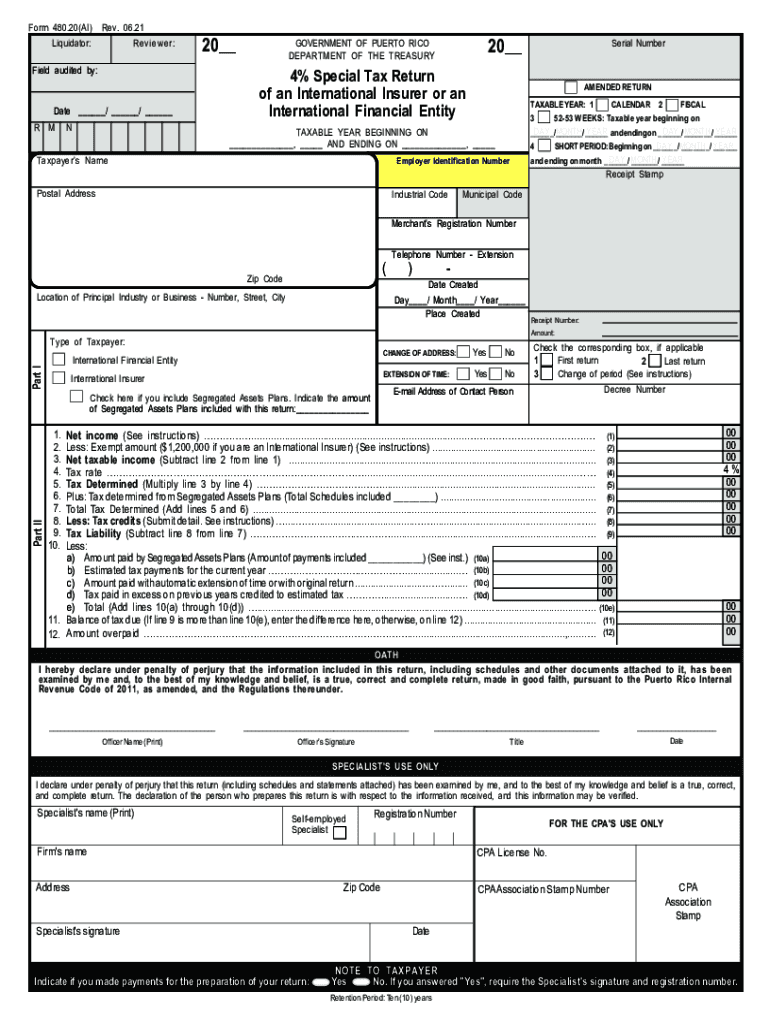

20192024 PR Form 480.20(U) Fill Online, Printable, Fillable, Blank

Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. You'll need to sign in or create an account to connect with an expert. My understanding is that 480.6c is only a withholding certificate; Our composite substitute tax statement includes reporting on payments consisting of. The purpose of this.

2008 Form PR 480.70(OE) Fill Online, Printable, Fillable, Blank pdfFiller

Our composite substitute tax statement includes reporting on payments consisting of. Taxes were withheld on gross income but the actual nonresident. Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. You'll need to sign in or create an account to connect with an expert. My understanding is that.

2021 Form PR 480.30(II) Fill Online, Printable, Fillable, Blank pdfFiller

Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:. My understanding is that 480.6c is only a withholding certificate; Our composite substitute tax statement includes reporting on payments consisting.

2022 Form PR 480.6C Fill Online, Printable, Fillable, Blank pdfFiller

The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:. Se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si. Yes, you will need amend your return to report this puerto rican bank interest as income on your.

IRS Form 4506C Instructions IVES Request for Tax Transcripts

You'll need to sign in or create an account to connect with an expert. The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:. Our composite substitute tax statement includes reporting on payments consisting of. Taxes were withheld on gross income but the actual nonresident. Yes, you will need amend your.

Form 480 6c Fill out & sign online DocHub

My understanding is that 480.6c is only a withholding certificate; Our composite substitute tax statement includes reporting on payments consisting of. The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:. You'll need to sign in or create an account to connect with an expert. Yes, you will need amend your.

Forma 480 Fill out & sign online DocHub

My understanding is that 480.6c is only a withholding certificate; You'll need to sign in or create an account to connect with an expert. Our composite substitute tax statement includes reporting on payments consisting of. Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. Se requerirá la preparación.

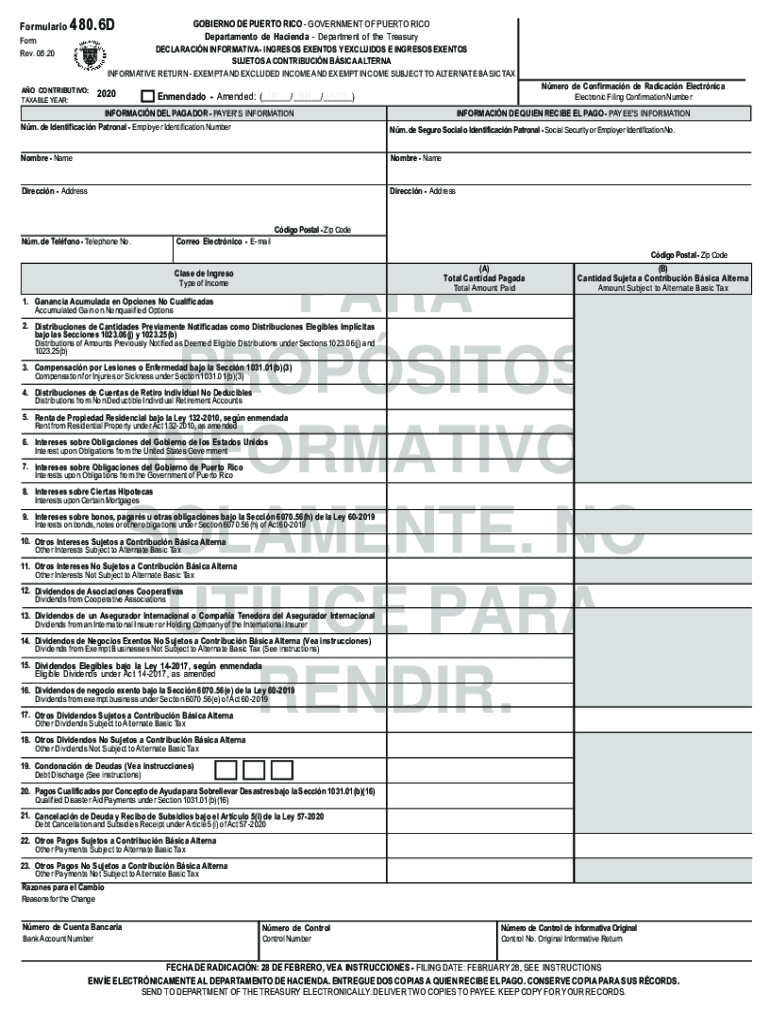

2020 Form PR 480.6D Fill Online, Printable, Fillable, Blank pdfFiller

Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns. Taxes were withheld on gross income but the actual nonresident. You'll need to sign in or create an account to connect with an expert. My understanding is that 480.6c is only a withholding certificate; Our composite substitute tax statement.

Puerto rico form 480 20 instructions Fill out & sign online DocHub

My understanding is that 480.6c is only a withholding certificate; The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:. Taxes were withheld on gross income but the actual nonresident. Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns..

My Understanding Is That 480.6C Is Only A Withholding Certificate;

You'll need to sign in or create an account to connect with an expert. Taxes were withheld on gross income but the actual nonresident. Our composite substitute tax statement includes reporting on payments consisting of. Yes, you will need amend your return to report this puerto rican bank interest as income on your income tax returns.

Se Requerirá La Preparación De Un Formulario 480.6C Para Informar Todos Los Pagos Hechos A Personas No Residentes De Puerto Rico, Tanto Si.

The purpose of this publication is to provide the electronic transfer filing instructions for the following informative returns forms:.