Form 2441 Provider Ssn - Be sure to put your name and social security number (ssn) on the statement. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. You must complete and attach form 2441, child and dependent care expenses to your tax return. In this situation, all the lines on line 1 of form 2441 must be. Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have (such as the. If they still refuse to provide an ein or ssn, send your provider a w. When a childcare provider will not give you a ssn or tax id.

In this situation, all the lines on line 1 of form 2441 must be. If they still refuse to provide an ein or ssn, send your provider a w. Be sure to put your name and social security number (ssn) on the statement. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have (such as the. You must complete and attach form 2441, child and dependent care expenses to your tax return. Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other. When a childcare provider will not give you a ssn or tax id. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have.

If they still refuse to provide an ein or ssn, send your provider a w. When a childcare provider will not give you a ssn or tax id. You must complete and attach form 2441, child and dependent care expenses to your tax return. In this situation, all the lines on line 1 of form 2441 must be. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other. Be sure to put your name and social security number (ssn) on the statement. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have (such as the.

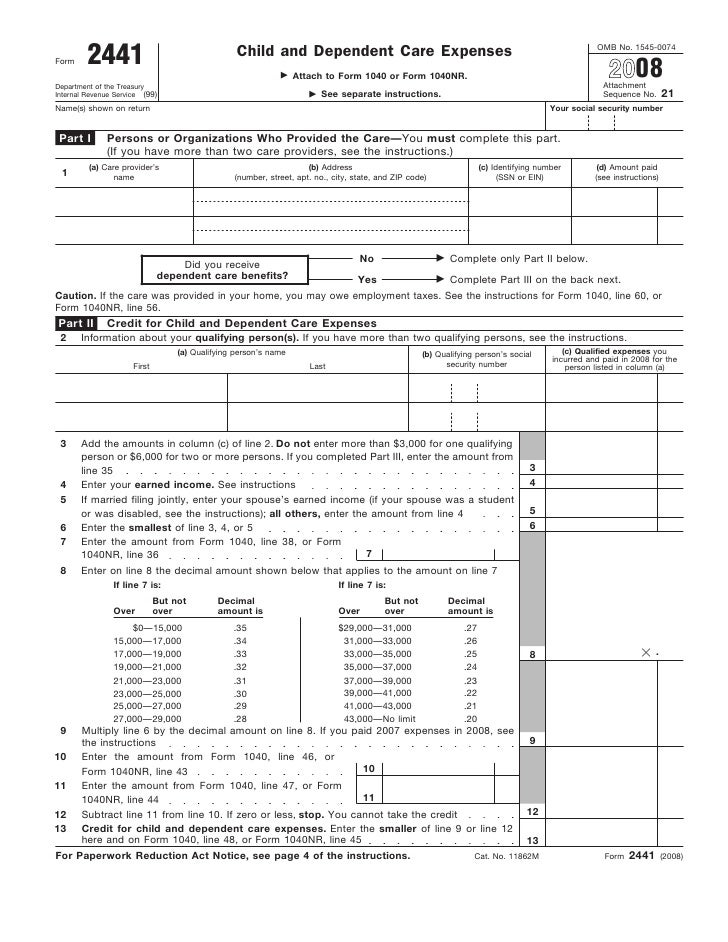

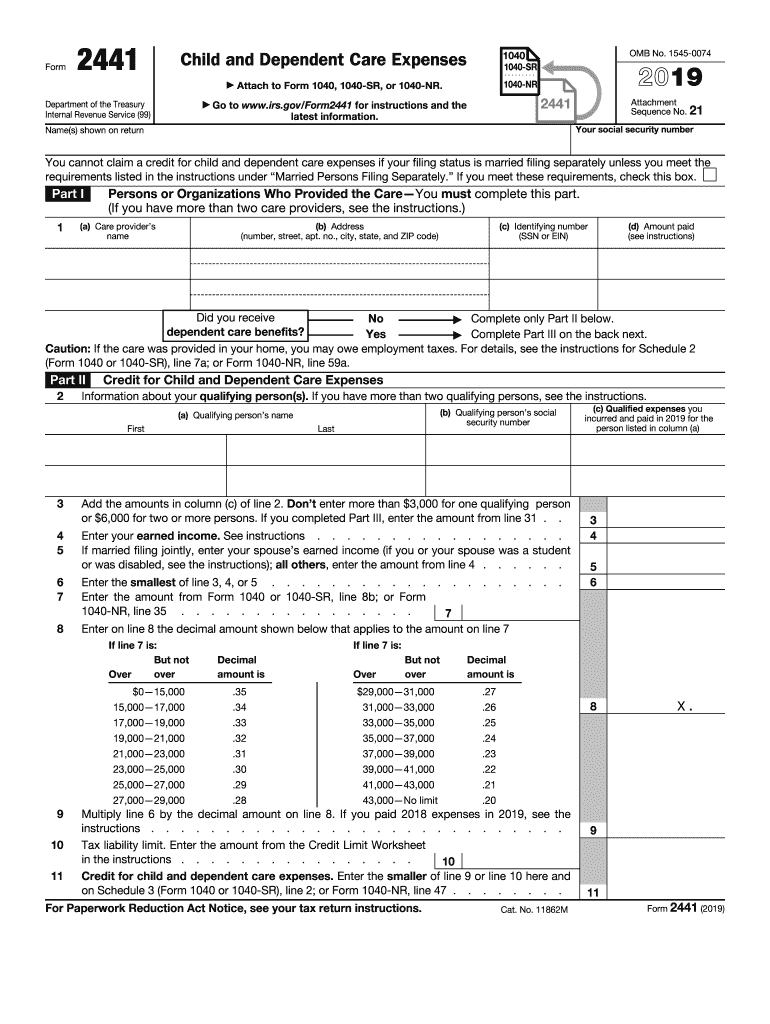

Form 2441Child and Dependent Care Expenses

If they still refuse to provide an ein or ssn, send your provider a w. Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. When a childcare provider.

Filling form 2441 Children & Dependent Care Expenses Lendstart

Be sure to put your name and social security number (ssn) on the statement. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have (such as the. If they still refuse to provide an ein or ssn, send your provider a w. If the provider refuses to give you their.

Form 2441 YouTube

You must complete and attach form 2441, child and dependent care expenses to your tax return. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other. When a childcare.

Form 2441 Fill out & sign online DocHub

If they still refuse to provide an ein or ssn, send your provider a w. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have (such as the. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. You must.

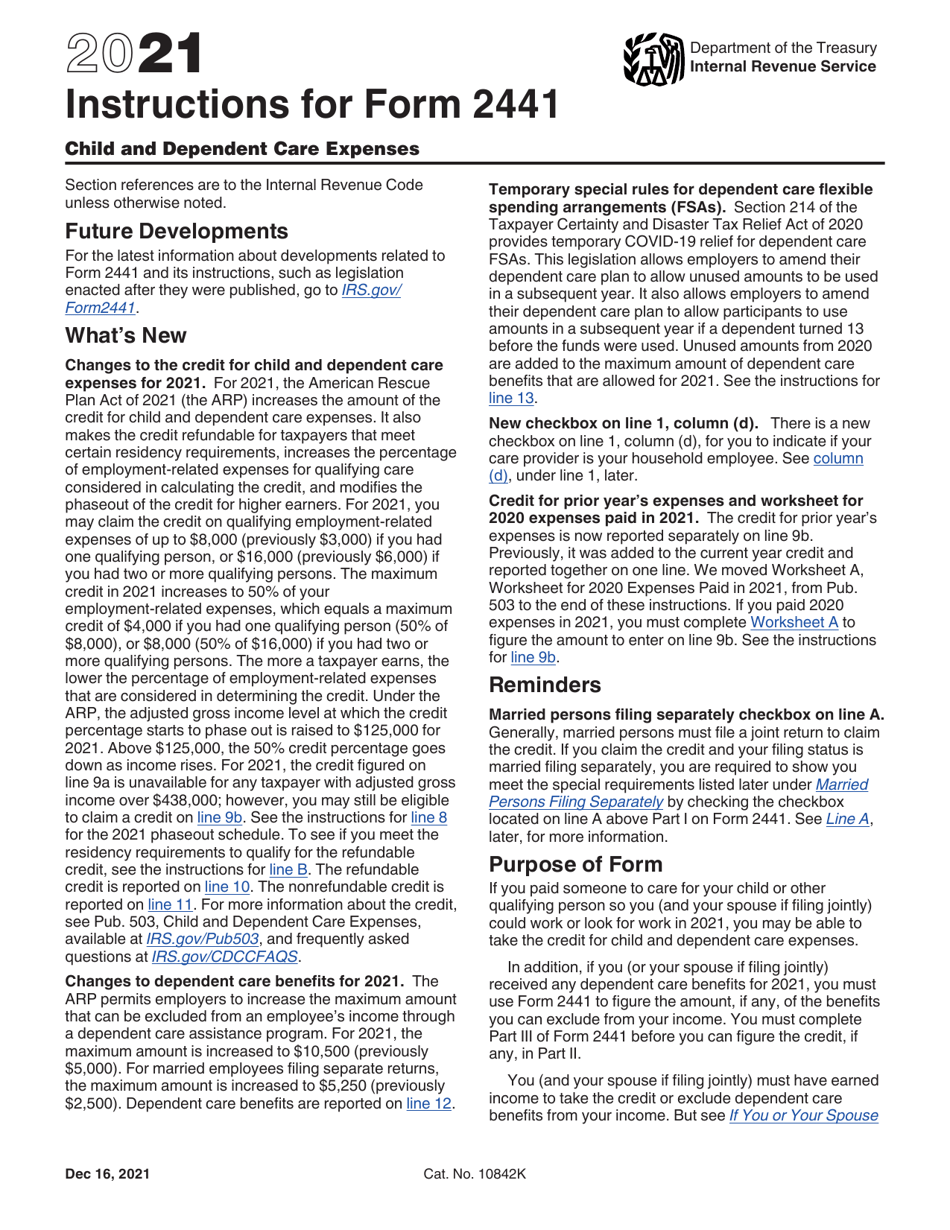

Download Instructions for IRS Form 2441 Child and Dependent Care

If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have (such as the. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. When a childcare provider will not give you a ssn or tax id. If they still refuse.

Filing the form 2441 YouTube

When a childcare provider will not give you a ssn or tax id. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have (such as the. If they still refuse to provide an ein or ssn, send your provider a w. In this situation, all the lines on line 1.

Form 2441 20222023 Fill online, Printable, Fillable Blank

In this situation, all the lines on line 1 of form 2441 must be. If they still refuse to provide an ein or ssn, send your provider a w. When a childcare provider will not give you a ssn or tax id. You must complete and attach form 2441, child and dependent care expenses to your tax return. Learn how.

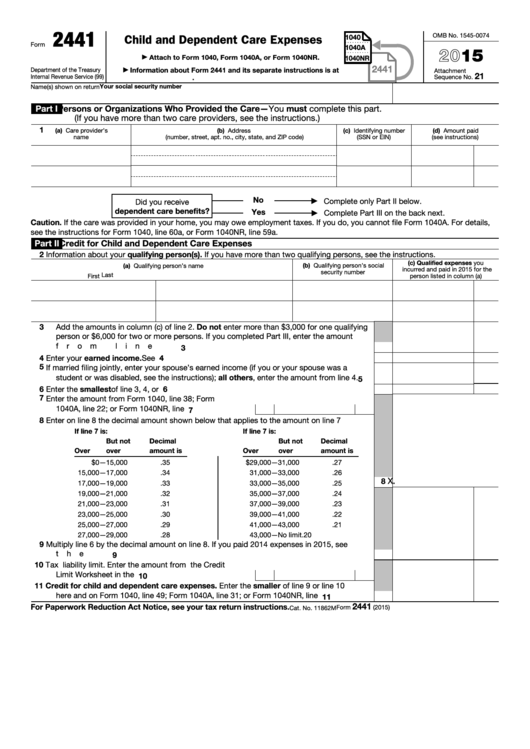

Fillable Form 2441 Child And Dependent Care Expenses 2015 printable

Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other. In this situation, all the lines on line 1 of form 2441 must be. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have (such as the. You must.

All About IRS Form 2441 Nasdaq

Be sure to put your name and social security number (ssn) on the statement. In this situation, all the lines on line 1 of form 2441 must be. When a childcare provider will not give you a ssn or tax id. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you.

Filing Tax Form 2441 Child and Dependent Care Expenses Reconcile Books

Be sure to put your name and social security number (ssn) on the statement. When a childcare provider will not give you a ssn or tax id. If they still refuse to provide an ein or ssn, send your provider a w. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information.

In This Situation, All The Lines On Line 1 Of Form 2441 Must Be.

Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. When a childcare provider will not give you a ssn or tax id. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have (such as the.

You Must Complete And Attach Form 2441, Child And Dependent Care Expenses To Your Tax Return.

If they still refuse to provide an ein or ssn, send your provider a w. Be sure to put your name and social security number (ssn) on the statement.