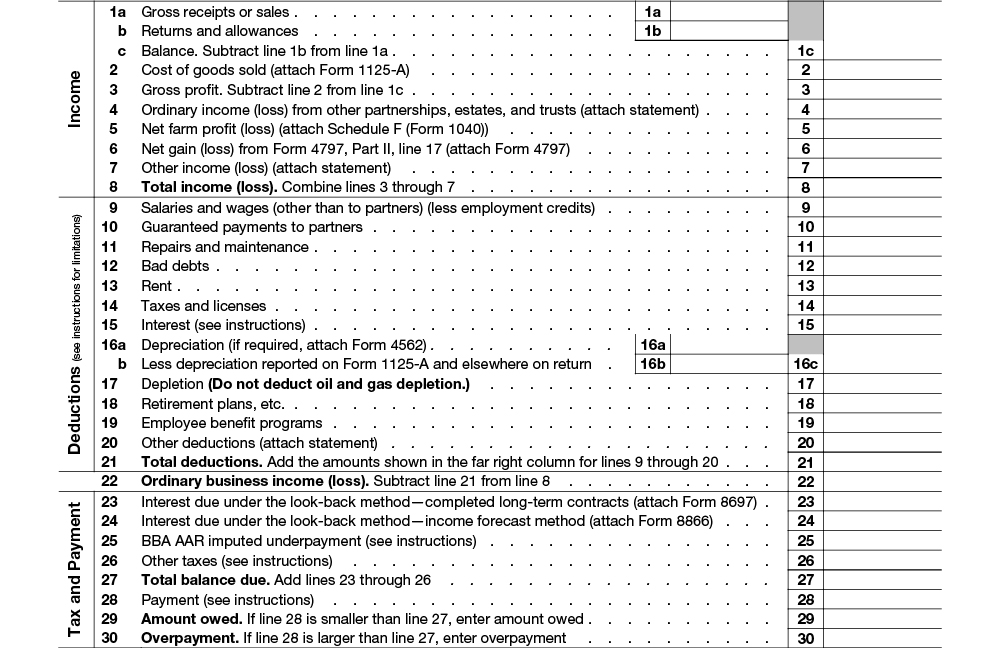

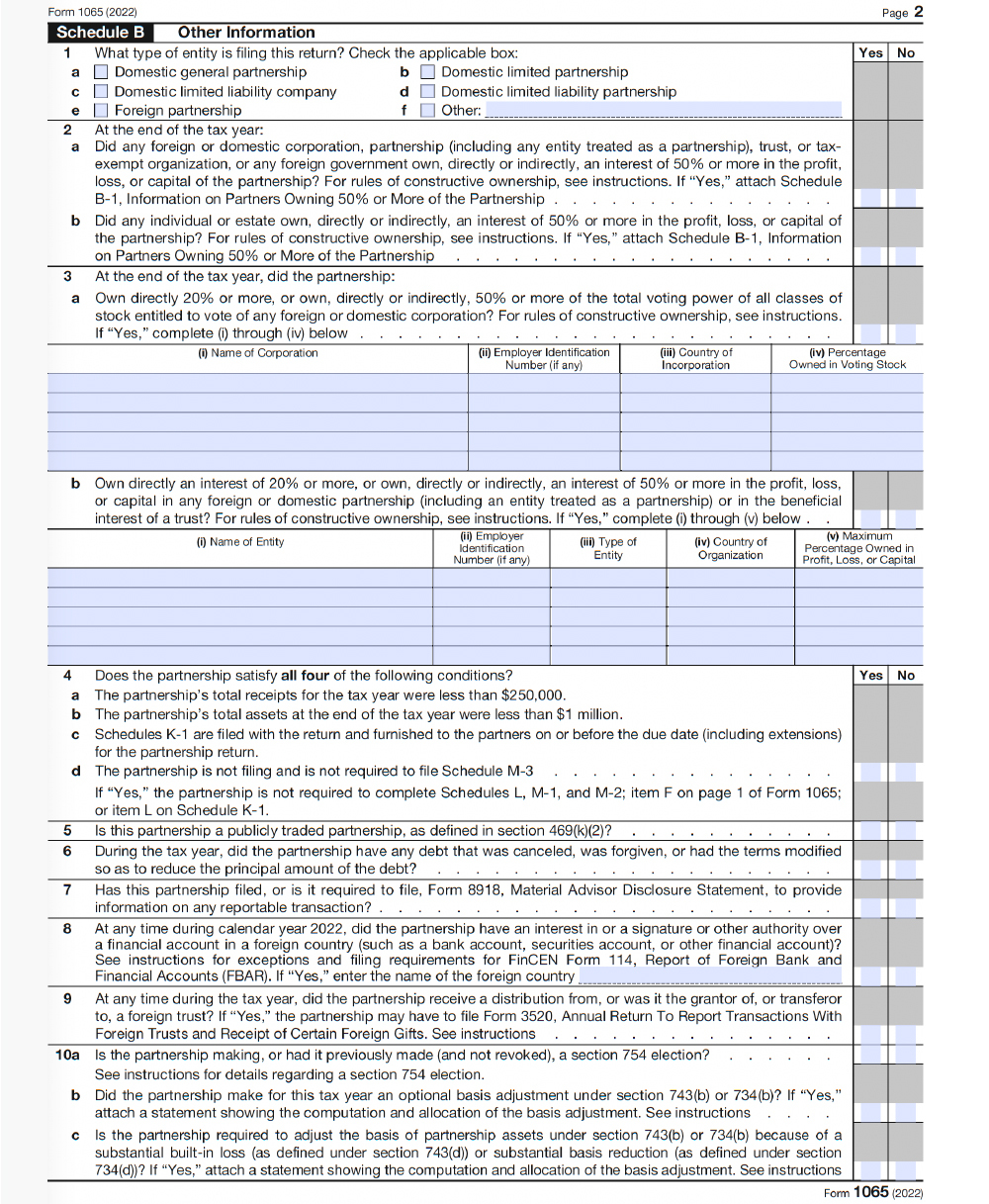

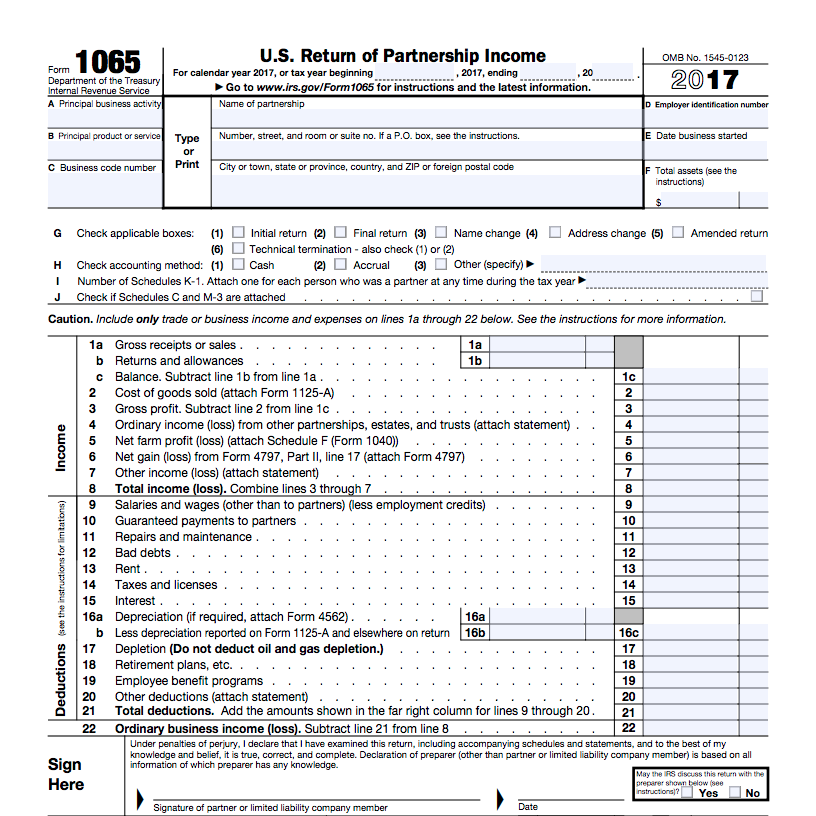

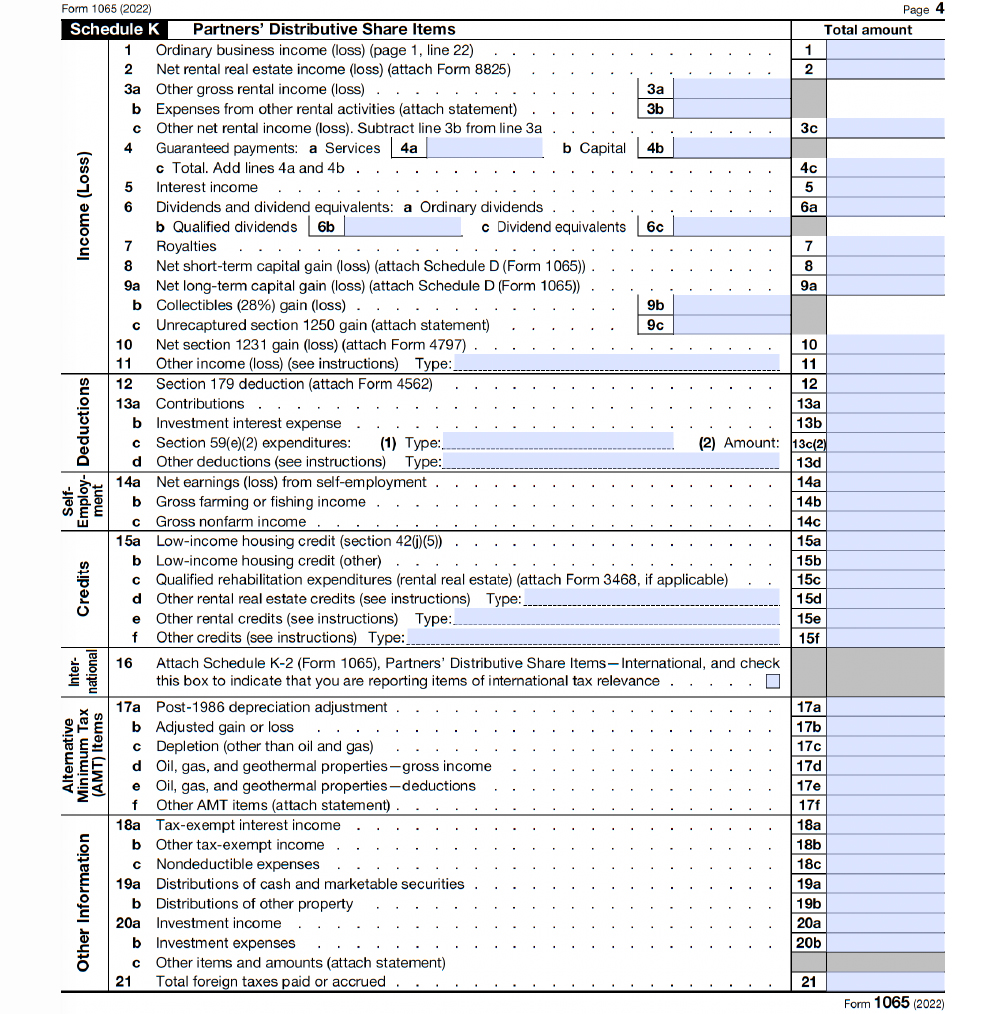

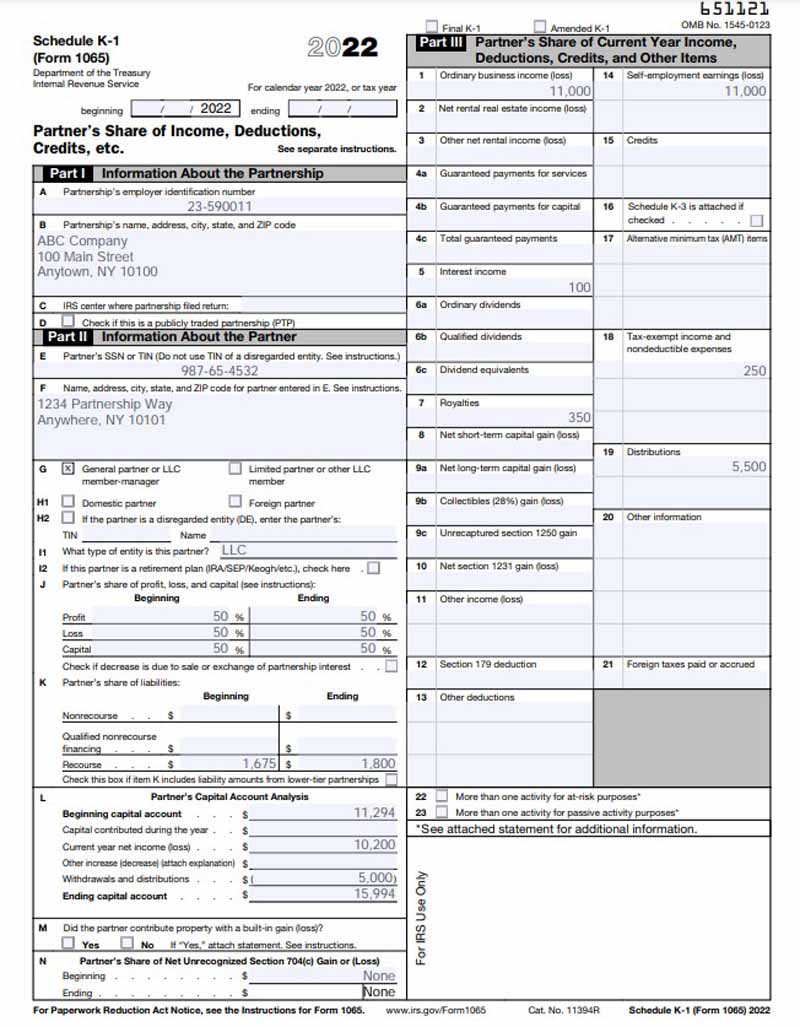

Form 1065 Box 20 Code Z Stmt - The form has box 20 codes a,n,z, ah with stmt mentioned against them. Amounts reported in box 20, code z is the information needed by a partner/taxpayer to claim the qualified business income deduction. If the partnership has investment income or other investment expense, it'll report your share of these items in box 20 using codes a and b. Based on the form 1065 instructions (page 29), for items that can't be reported as a single dollar amount, enter the code and an asterisk (*) in. The detailed statements (k3) are also accompanied but it not clear what.

Amounts reported in box 20, code z is the information needed by a partner/taxpayer to claim the qualified business income deduction. The detailed statements (k3) are also accompanied but it not clear what. The form has box 20 codes a,n,z, ah with stmt mentioned against them. If the partnership has investment income or other investment expense, it'll report your share of these items in box 20 using codes a and b. Based on the form 1065 instructions (page 29), for items that can't be reported as a single dollar amount, enter the code and an asterisk (*) in.

The form has box 20 codes a,n,z, ah with stmt mentioned against them. Based on the form 1065 instructions (page 29), for items that can't be reported as a single dollar amount, enter the code and an asterisk (*) in. The detailed statements (k3) are also accompanied but it not clear what. If the partnership has investment income or other investment expense, it'll report your share of these items in box 20 using codes a and b. Amounts reported in box 20, code z is the information needed by a partner/taxpayer to claim the qualified business income deduction.

Form 1065 Due Date 2024 Matti Shelley

If the partnership has investment income or other investment expense, it'll report your share of these items in box 20 using codes a and b. The form has box 20 codes a,n,z, ah with stmt mentioned against them. The detailed statements (k3) are also accompanied but it not clear what. Based on the form 1065 instructions (page 29), for items.

Fillable Online Schedule K1 Form 1065 Box 20 Fax Email Print pdfFiller

The detailed statements (k3) are also accompanied but it not clear what. Amounts reported in box 20, code z is the information needed by a partner/taxpayer to claim the qualified business income deduction. Based on the form 1065 instructions (page 29), for items that can't be reported as a single dollar amount, enter the code and an asterisk (*) in..

Form 1065 Extended Due Date 2024 Emili Inesita

If the partnership has investment income or other investment expense, it'll report your share of these items in box 20 using codes a and b. Amounts reported in box 20, code z is the information needed by a partner/taxpayer to claim the qualified business income deduction. Based on the form 1065 instructions (page 29), for items that can't be reported.

IRS Form 1065 Overview & StepbyStep Guide by Richard Nickson Issuu

Based on the form 1065 instructions (page 29), for items that can't be reported as a single dollar amount, enter the code and an asterisk (*) in. If the partnership has investment income or other investment expense, it'll report your share of these items in box 20 using codes a and b. Amounts reported in box 20, code z is.

2022 IRS Form 1065 Schedule K1 Walkthrough YouTube

Based on the form 1065 instructions (page 29), for items that can't be reported as a single dollar amount, enter the code and an asterisk (*) in. The form has box 20 codes a,n,z, ah with stmt mentioned against them. The detailed statements (k3) are also accompanied but it not clear what. If the partnership has investment income or other.

Rubber Hitting The Road On New Partnership Audit Regime Your Tax

If the partnership has investment income or other investment expense, it'll report your share of these items in box 20 using codes a and b. The form has box 20 codes a,n,z, ah with stmt mentioned against them. Based on the form 1065 instructions (page 29), for items that can't be reported as a single dollar amount, enter the code.

2023 Form 1065 Printable Forms Free Online

The form has box 20 codes a,n,z, ah with stmt mentioned against them. Amounts reported in box 20, code z is the information needed by a partner/taxpayer to claim the qualified business income deduction. The detailed statements (k3) are also accompanied but it not clear what. Based on the form 1065 instructions (page 29), for items that can't be reported.

What is a Schedule K1 Tax Form, Meru Accounting

The detailed statements (k3) are also accompanied but it not clear what. Based on the form 1065 instructions (page 29), for items that can't be reported as a single dollar amount, enter the code and an asterisk (*) in. If the partnership has investment income or other investment expense, it'll report your share of these items in box 20 using.

4.5 Corequisite Percentages and Taxes, Ratios, Proportions and

Amounts reported in box 20, code z is the information needed by a partner/taxpayer to claim the qualified business income deduction. Based on the form 1065 instructions (page 29), for items that can't be reported as a single dollar amount, enter the code and an asterisk (*) in. The detailed statements (k3) are also accompanied but it not clear what..

2023 Form 1065 Printable Forms Free Online

The detailed statements (k3) are also accompanied but it not clear what. Based on the form 1065 instructions (page 29), for items that can't be reported as a single dollar amount, enter the code and an asterisk (*) in. The form has box 20 codes a,n,z, ah with stmt mentioned against them. If the partnership has investment income or other.

Based On The Form 1065 Instructions (Page 29), For Items That Can't Be Reported As A Single Dollar Amount, Enter The Code And An Asterisk (*) In.

If the partnership has investment income or other investment expense, it'll report your share of these items in box 20 using codes a and b. The form has box 20 codes a,n,z, ah with stmt mentioned against them. Amounts reported in box 20, code z is the information needed by a partner/taxpayer to claim the qualified business income deduction. The detailed statements (k3) are also accompanied but it not clear what.