Discharged Debt - In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. To discharge a debt means to eliminate the debtor’s legal obligation to repay it. Learn what discharge (of debts) means in bankruptcy court, when a debtor is no longer liable for their debts, and the lender is no longer. In other words, when a debt is discharged, the.

To discharge a debt means to eliminate the debtor’s legal obligation to repay it. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. In other words, when a debt is discharged, the. Learn what discharge (of debts) means in bankruptcy court, when a debtor is no longer liable for their debts, and the lender is no longer.

Learn what discharge (of debts) means in bankruptcy court, when a debtor is no longer liable for their debts, and the lender is no longer. In other words, when a debt is discharged, the. To discharge a debt means to eliminate the debtor’s legal obligation to repay it. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable.

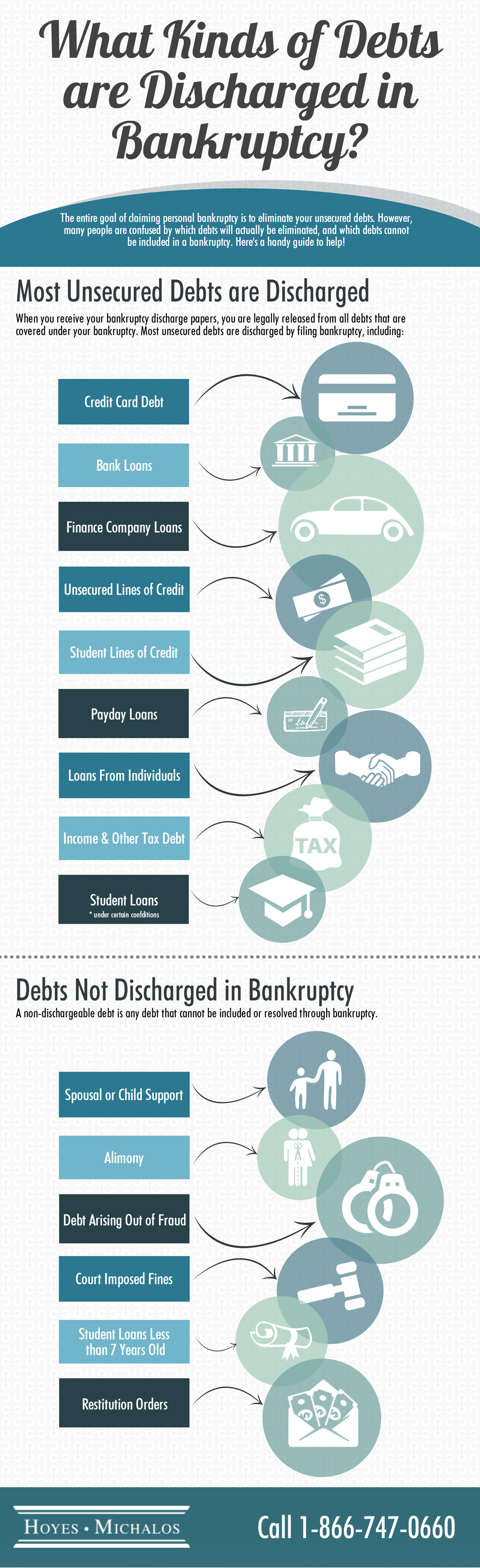

Debts Discharged in Bankruptcy Infographic

In other words, when a debt is discharged, the. Learn what discharge (of debts) means in bankruptcy court, when a debtor is no longer liable for their debts, and the lender is no longer. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. To discharge.

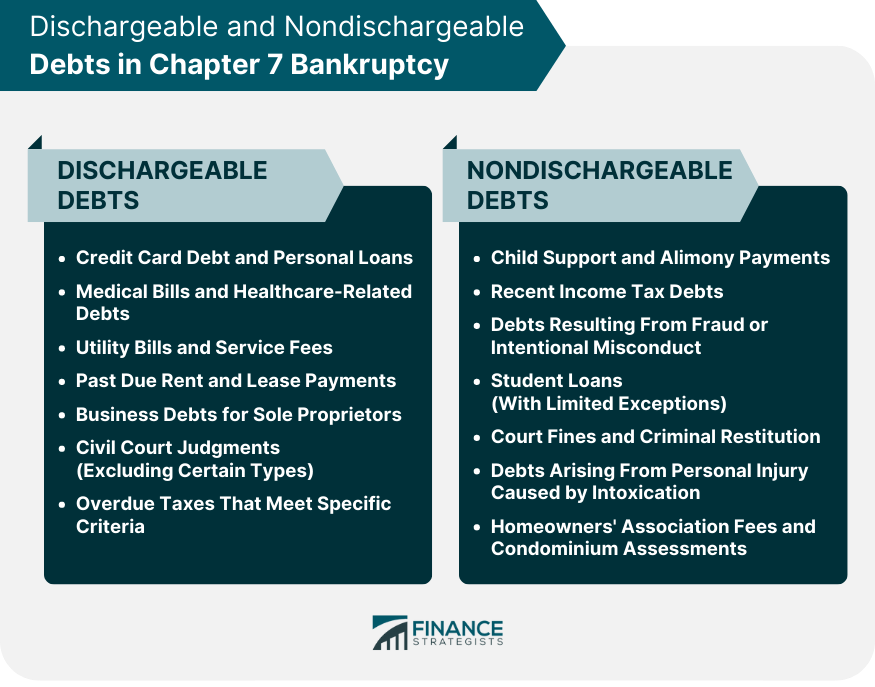

What Debts Are Discharged in Chapter 7 Bankruptcy?

To discharge a debt means to eliminate the debtor’s legal obligation to repay it. Learn what discharge (of debts) means in bankruptcy court, when a debtor is no longer liable for their debts, and the lender is no longer. In other words, when a debt is discharged, the. In general, if your debt is canceled, forgiven, or discharged for less.

How Unemployment Can Help You Discharge Debt? Tech Dreams

In other words, when a debt is discharged, the. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. To discharge a debt means to eliminate the debtor’s legal obligation to repay it. Learn what discharge (of debts) means in bankruptcy court, when a debtor is.

Debt Discharge What it is, How it Works

Learn what discharge (of debts) means in bankruptcy court, when a debtor is no longer liable for their debts, and the lender is no longer. To discharge a debt means to eliminate the debtor’s legal obligation to repay it. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled.

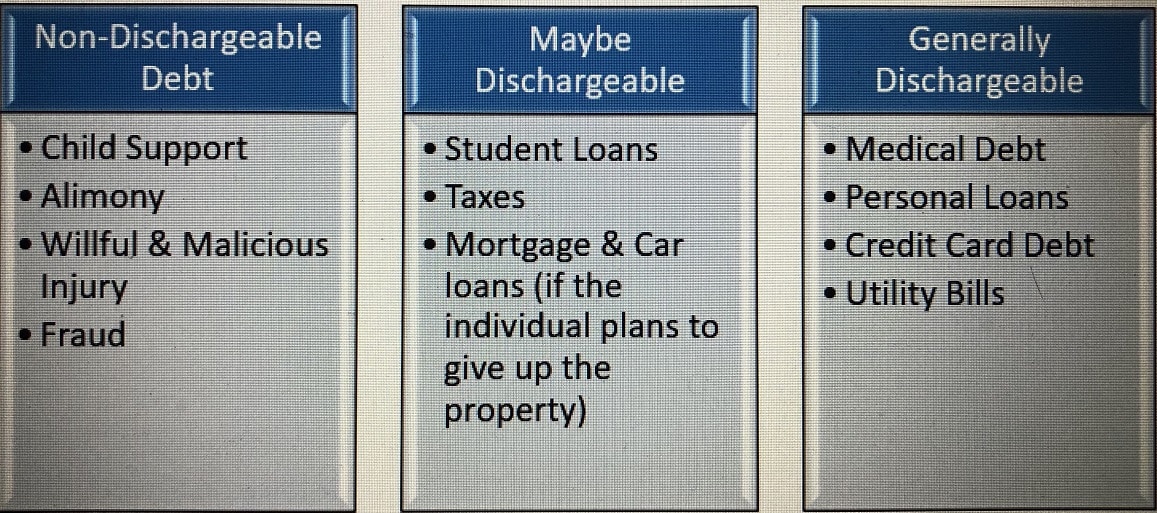

What Types of Debt are Discharged in Bankruptcy

Learn what discharge (of debts) means in bankruptcy court, when a debtor is no longer liable for their debts, and the lender is no longer. In other words, when a debt is discharged, the. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. To discharge.

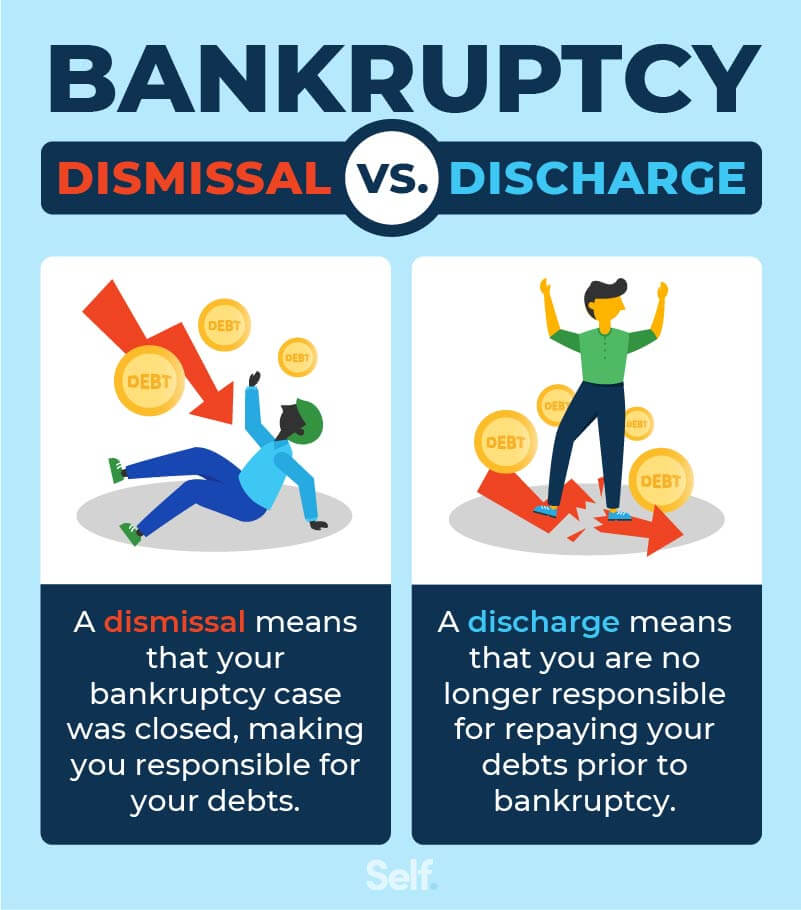

Bankruptcy Dismissal vs. Discharge What's the Difference and How They

In other words, when a debt is discharged, the. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. Learn what discharge (of debts) means in bankruptcy court, when a debtor is no longer liable for their debts, and the lender is no longer. To discharge.

Chapter 7 Bankruptcy 24 Hour Legal Advice Ask A Lawyer Live Chat

Learn what discharge (of debts) means in bankruptcy court, when a debtor is no longer liable for their debts, and the lender is no longer. To discharge a debt means to eliminate the debtor’s legal obligation to repay it. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled.

What Are The Dischargeable Debts In Bankruptcy?

To discharge a debt means to eliminate the debtor’s legal obligation to repay it. Learn what discharge (of debts) means in bankruptcy court, when a debtor is no longer liable for their debts, and the lender is no longer. In other words, when a debt is discharged, the. In general, if your debt is canceled, forgiven, or discharged for less.

Which Debts Are Discharged in Chapter 7 Bankruptcy? Best Bankruptcy

In other words, when a debt is discharged, the. To discharge a debt means to eliminate the debtor’s legal obligation to repay it. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. Learn what discharge (of debts) means in bankruptcy court, when a debtor is.

Discharged Into Debt A Pandemic Update Community Service Society of

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. Learn what discharge (of debts) means in bankruptcy court, when a debtor is no longer liable for their debts, and the lender is no longer. In other words, when a debt is discharged, the. To discharge.

Learn What Discharge (Of Debts) Means In Bankruptcy Court, When A Debtor Is No Longer Liable For Their Debts, And The Lender Is No Longer.

To discharge a debt means to eliminate the debtor’s legal obligation to repay it. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. In other words, when a debt is discharged, the.

:max_bytes(150000):strip_icc()/finalnew-cd2c2367ef8f4fcdaa1e9218acf86c9d.jpg)