Columbus Oh Income Tax Forms - We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). For options to obtain paper forms from the ohio department of taxation: In ohio, you need to pay your income and school taxes as you earn money throughout the year. Ohio tax forms will no longer be available. You can still obtain a paper tax form the following ways: All forms,instructions, and applicable tax codes for columbus and all. We strongly recommend you file and pay with our new online tax portal, crisp. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. If you don’t pay enough, you might owe the 2210. Click here to download paper forms;

Ohio tax forms will no longer be available. Click here to download paper forms; It is quick, secure and convenient! It is quick, secure and convenient! You can still obtain a paper tax form the following ways: We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. The ohio department of taxation. In ohio, you need to pay your income and school taxes as you earn money throughout the year. If you don’t pay enough, you might owe the 2210.

In ohio, you need to pay your income and school taxes as you earn money throughout the year. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). If you don’t pay enough, you might owe the 2210. We strongly recommend you file and pay with our new online tax portal, crisp. All forms,instructions, and applicable tax codes for columbus and all. The ohio department of taxation. Click here to download paper forms; You can still obtain a paper tax form the following ways: It is quick, secure and convenient! Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax.

Columbus, OH By Gender 2024 Update Neilsberg

It is quick, secure and convenient! Click here to download paper forms; In ohio, you need to pay your income and school taxes as you earn money throughout the year. For options to obtain paper forms from the ohio department of taxation: It is quick, secure and convenient!

Columbus, OH Median Household By Race 2024 Update Neilsberg

We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). We strongly recommend you file and pay with our new online tax portal, crisp. It is quick, secure and convenient! You can still obtain a paper tax form the following ways: In ohio, you need to pay your income and school taxes as you earn.

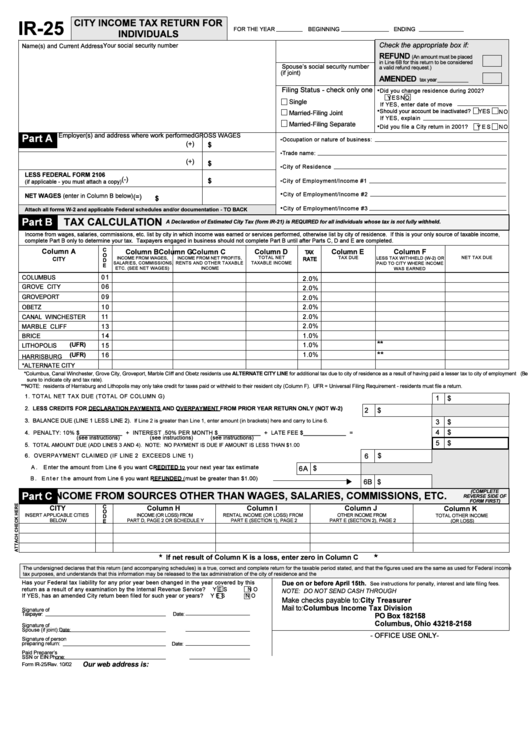

Form Ir25 City Tax Return For Individuals City Of Columbus

In ohio, you need to pay your income and school taxes as you earn money throughout the year. It is quick, secure and convenient! For options to obtain paper forms from the ohio department of taxation: The ohio department of taxation. Ohio tax forms will no longer be available.

Tax Individual Forms Download

It is quick, secure and convenient! Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. We strongly recommend you file and pay with our new online tax portal, crisp. If you don’t pay enough, you might owe the 2210. We strongly recommend you.

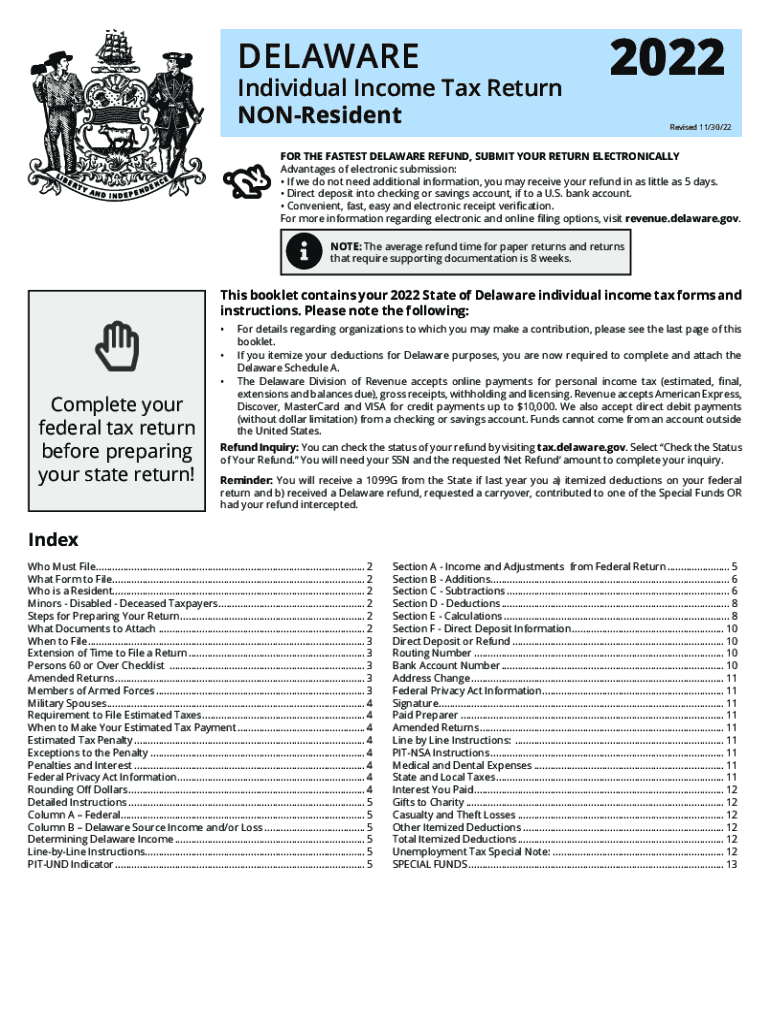

Delaware Taxes 20222024 Form Fill Out and Sign Printable PDF

If you don’t pay enough, you might owe the 2210. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. The ohio department of taxation. In ohio, you need to pay your income and school taxes as you earn money throughout the year. Ohio.

Efiling Tax Returns for Senior Citizens Guidelines

Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. All forms,instructions, and applicable tax codes for columbus and all. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). In ohio, you need to pay your income and.

Personal Tax Forms Available Parker Memorial Library

Click here to download paper forms; If you don’t pay enough, you might owe the 2210. Ohio tax forms will no longer be available. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). For options to obtain paper forms from the ohio department of taxation:

PPT Tax Services in Columbus, OH PowerPoint Presentation, free

Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. You can still obtain a paper tax form the following ways: We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). Click here to download paper forms; It is.

Ohio politicians push regressive tax system while shedding crocodile

If you don’t pay enough, you might owe the 2210. You can still obtain a paper tax form the following ways: It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). In ohio, you need to pay your income and school taxes as you earn money throughout the year.

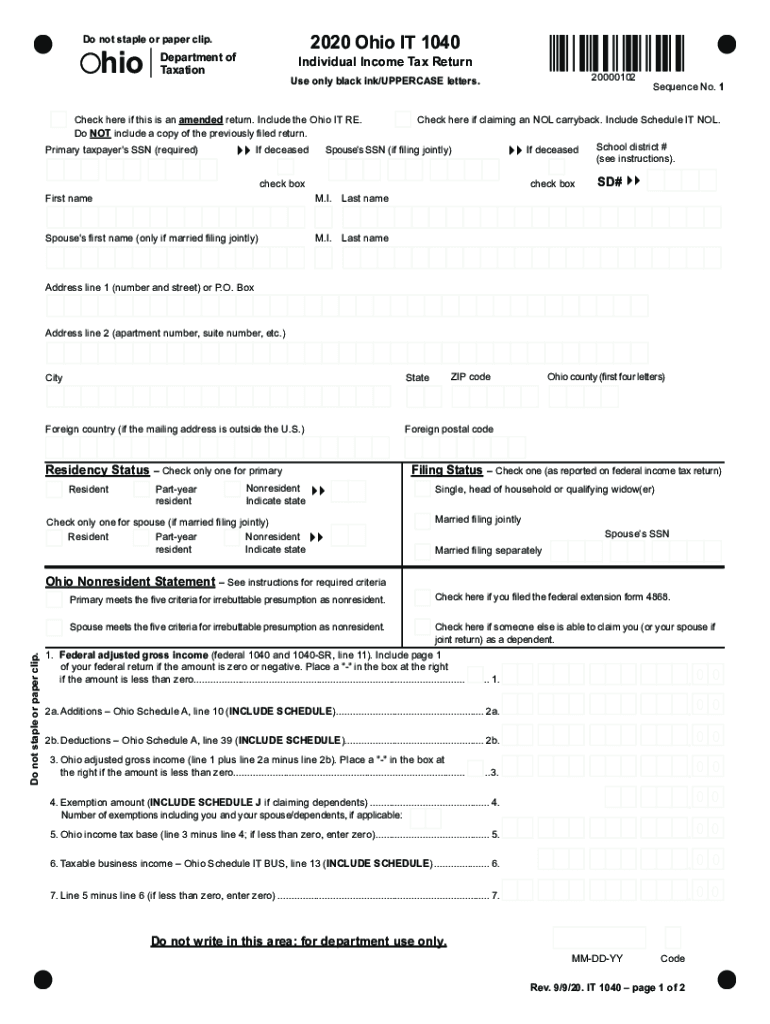

Ohio State Tax S 20202024 Form Fill Out and Sign Printable PDF

In ohio, you need to pay your income and school taxes as you earn money throughout the year. It is quick, secure and convenient! The ohio department of taxation. For options to obtain paper forms from the ohio department of taxation: It is quick, secure and convenient!

The Ohio Department Of Taxation.

It is quick, secure and convenient! Click here to download paper forms; If you don’t pay enough, you might owe the 2210. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov).

We Strongly Recommend You File And Pay With Our New Online Tax Portal, Crisp.

Ohio tax forms will no longer be available. In ohio, you need to pay your income and school taxes as you earn money throughout the year. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. For options to obtain paper forms from the ohio department of taxation:

It Is Quick, Secure And Convenient!

All forms,instructions, and applicable tax codes for columbus and all. You can still obtain a paper tax form the following ways: