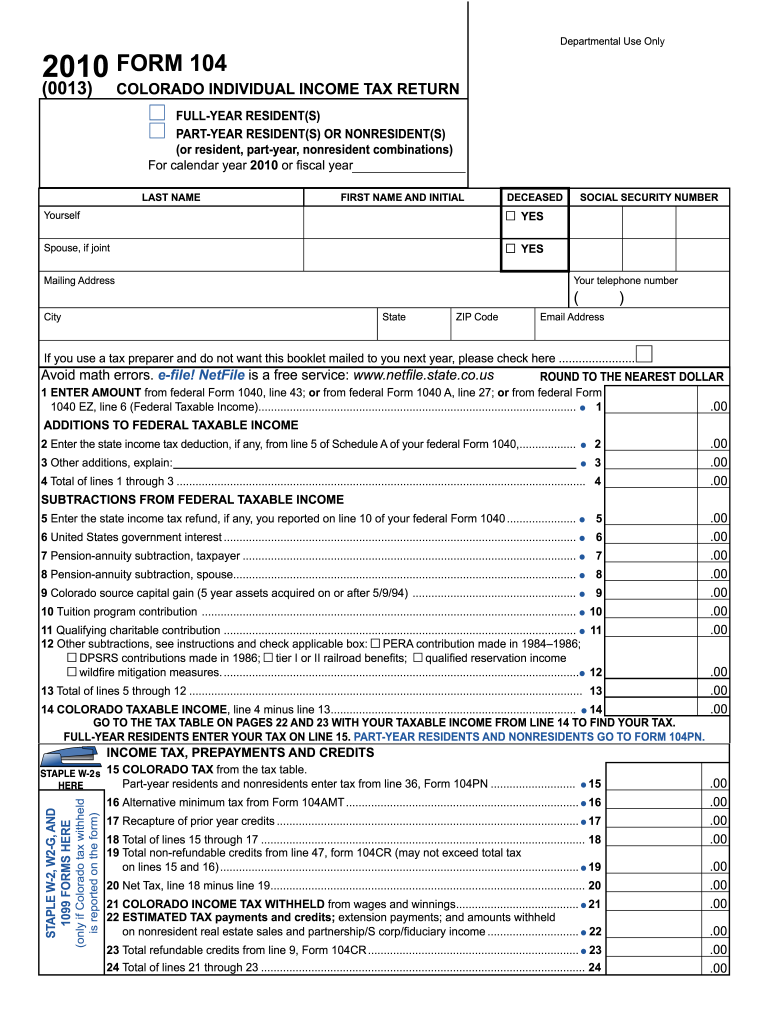

Colorado Tax Return Form - Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. Make sure you protect your personally identifiable information. Generally, you must file a colorado individual income tax return if you are required to file a federal income tax return with the irs for the. Your browser appears to have cookies disabled. You may file by mail with paper forms or efile. Cookies are required to use this site. The forms on this page are fillable and savable (except the instruction booklets). Form 104 is the general, and simplest, income tax return for individual residents of colorado. File your individual income tax return, submit documentation electronically, or apply for a ptc rebate.

Cookies are required to use this site. Make sure you protect your personally identifiable information. Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. Form 104 is the general, and simplest, income tax return for individual residents of colorado. The forms on this page are fillable and savable (except the instruction booklets). Generally, you must file a colorado individual income tax return if you are required to file a federal income tax return with the irs for the. Your browser appears to have cookies disabled. File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. You may file by mail with paper forms or efile.

Your browser appears to have cookies disabled. File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Make sure you protect your personally identifiable information. Generally, you must file a colorado individual income tax return if you are required to file a federal income tax return with the irs for the. Cookies are required to use this site. Form 104 is the general, and simplest, income tax return for individual residents of colorado. You may file by mail with paper forms or efile. The forms on this page are fillable and savable (except the instruction booklets). Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability.

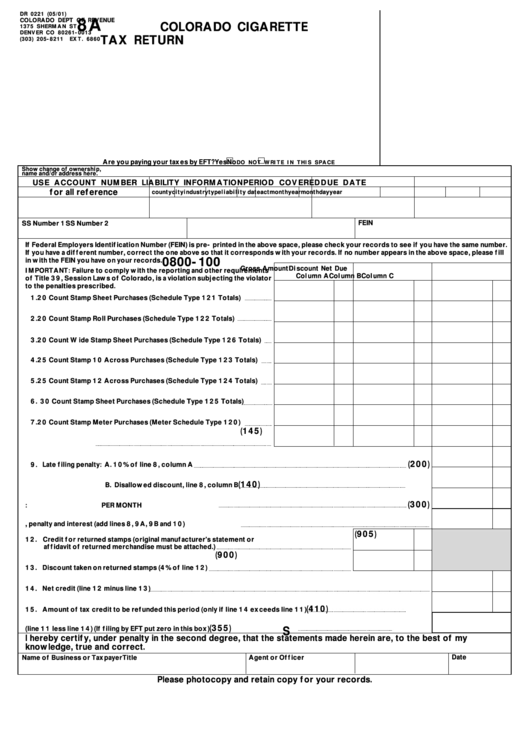

Form 8a Colorado Cigarette Tax Return printable pdf download

Cookies are required to use this site. Your browser appears to have cookies disabled. Form 104 is the general, and simplest, income tax return for individual residents of colorado. Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. The forms.

How to File the Colorado Retail Sales Tax Return (DR 0100) Paper Form

The forms on this page are fillable and savable (except the instruction booklets). Cookies are required to use this site. Form 104 is the general, and simplest, income tax return for individual residents of colorado. File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Make sure you protect your personally identifiable information.

American Tax Return Form 1040, US Individual Tax Return, Working Desk

Cookies are required to use this site. File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Make sure you protect your personally identifiable information. You may file by mail with paper forms or efile. Generally, you must file a colorado individual income tax return if you are required to file a federal income tax.

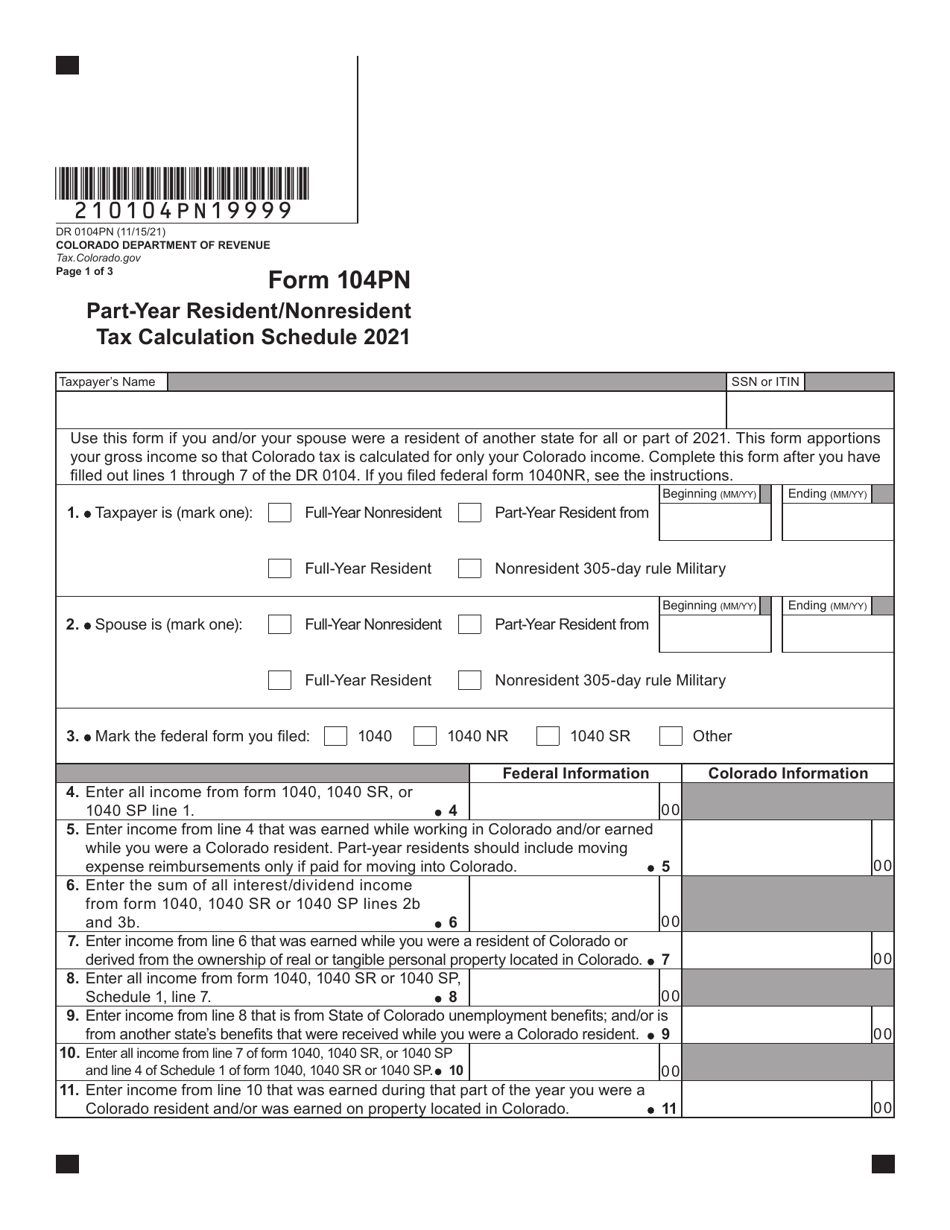

Form DR0104PN 2021 Fill Out, Sign Online and Download Fillable PDF

Your browser appears to have cookies disabled. Cookies are required to use this site. You may file by mail with paper forms or efile. Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. Make sure you protect your personally identifiable.

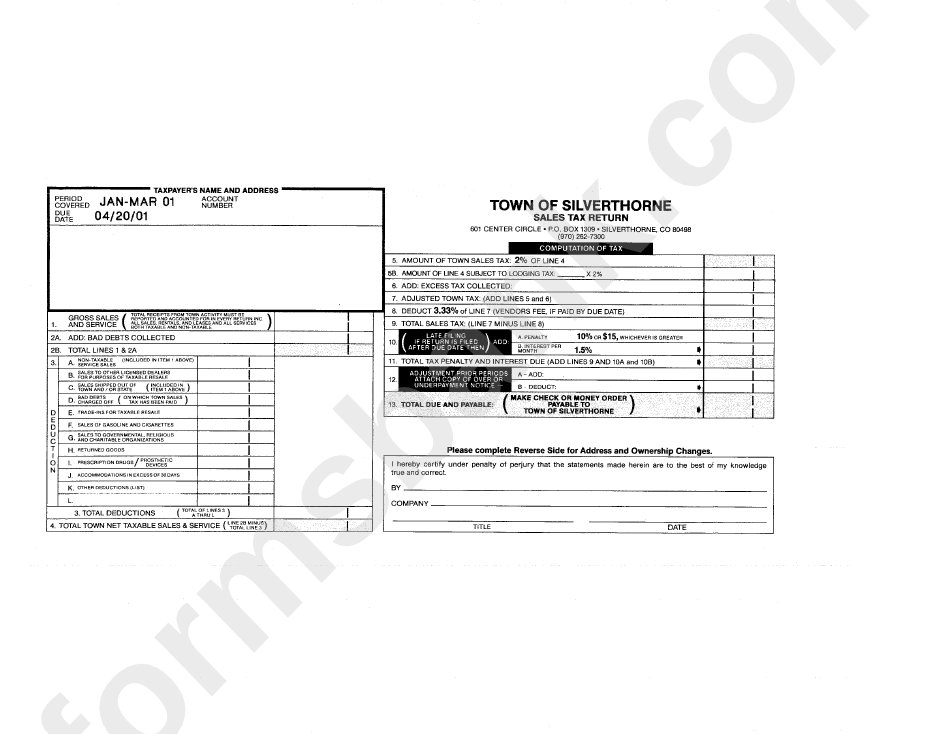

Sales Tax Return Form State Of Colorado printable pdf download

Generally, you must file a colorado individual income tax return if you are required to file a federal income tax return with the irs for the. File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Your browser appears to have cookies disabled. You may file by mail with paper forms or efile. Cookies are.

If your Colorado tax return gets rejected this week don’t freak out. It

Generally, you must file a colorado individual income tax return if you are required to file a federal income tax return with the irs for the. File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. The forms on this page are fillable and savable (except the instruction booklets). Your browser appears to have cookies.

2023 Colorado Estimated Tax Payment Form Printable Forms Free

Your browser appears to have cookies disabled. You may file by mail with paper forms or efile. The forms on this page are fillable and savable (except the instruction booklets). Cookies are required to use this site. Form 104 is the general, and simplest, income tax return for individual residents of colorado.

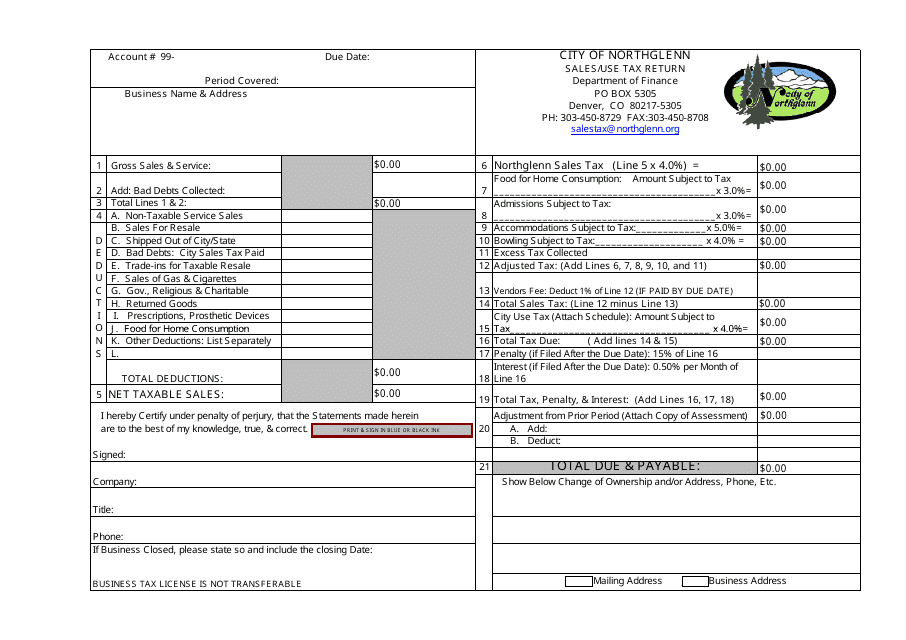

City of Northglenn, Colorado Sales/Use Tax Return Form Fill Out, Sign

Make sure you protect your personally identifiable information. File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Cookies are required to use this site. You may file by mail with paper forms or efile. Form 104 is the general, and simplest, income tax return for individual residents of colorado.

Colorado ends tax breaks for wealthy and big businesses, changes

File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. The forms on this page are fillable and savable (except the instruction booklets). Form 104 is the general, and simplest, income tax return for individual residents of colorado. Colorado residents must file this return if they are required to file an income tax return with.

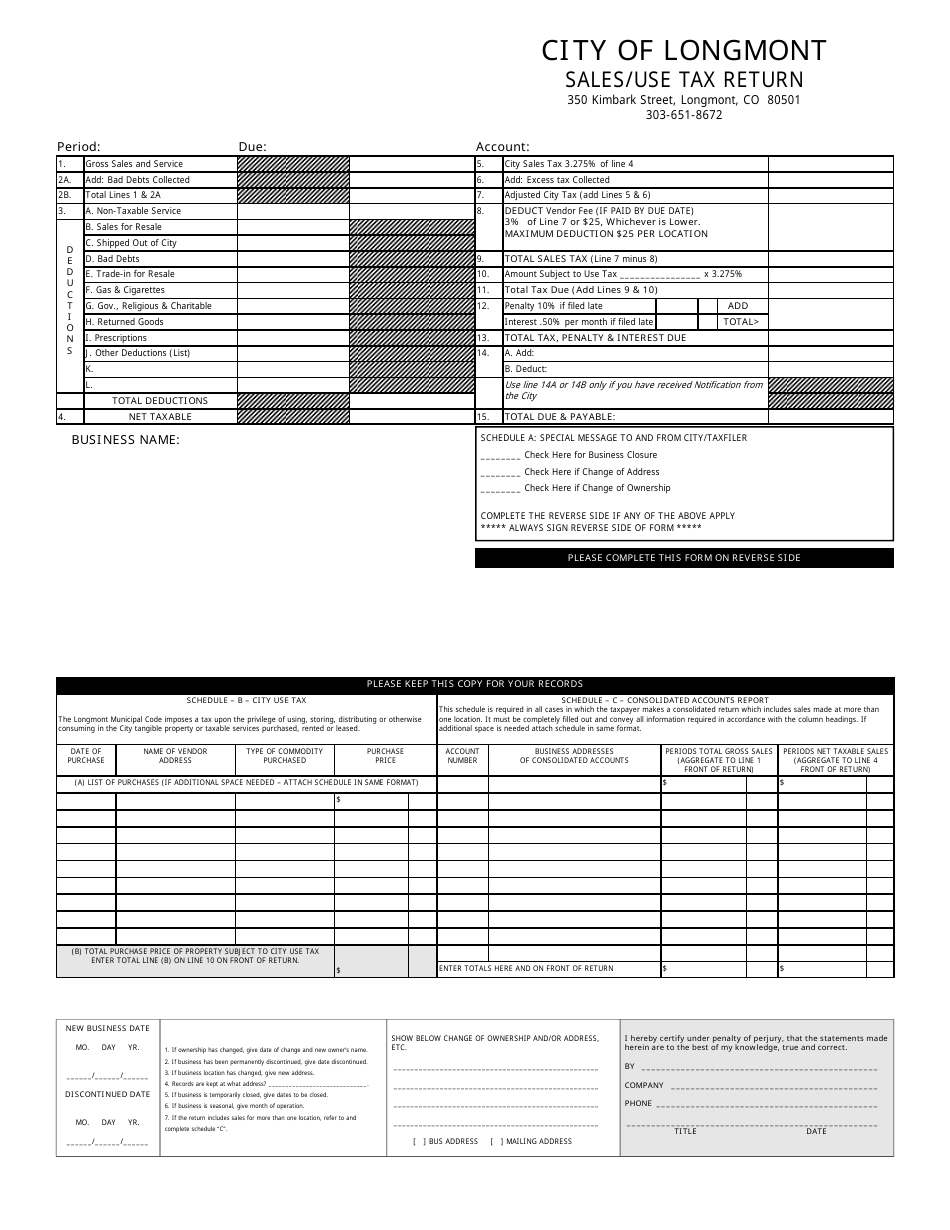

LONGMONT, Colorado Sales/Use Tax Return Form Fill Out, Sign Online

The forms on this page are fillable and savable (except the instruction booklets). You may file by mail with paper forms or efile. Form 104 is the general, and simplest, income tax return for individual residents of colorado. Colorado residents must file this return if they are required to file an income tax return with the irs, even if they.

Cookies Are Required To Use This Site.

Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. The forms on this page are fillable and savable (except the instruction booklets). File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Your browser appears to have cookies disabled.

Make Sure You Protect Your Personally Identifiable Information.

Form 104 is the general, and simplest, income tax return for individual residents of colorado. You may file by mail with paper forms or efile. Generally, you must file a colorado individual income tax return if you are required to file a federal income tax return with the irs for the.