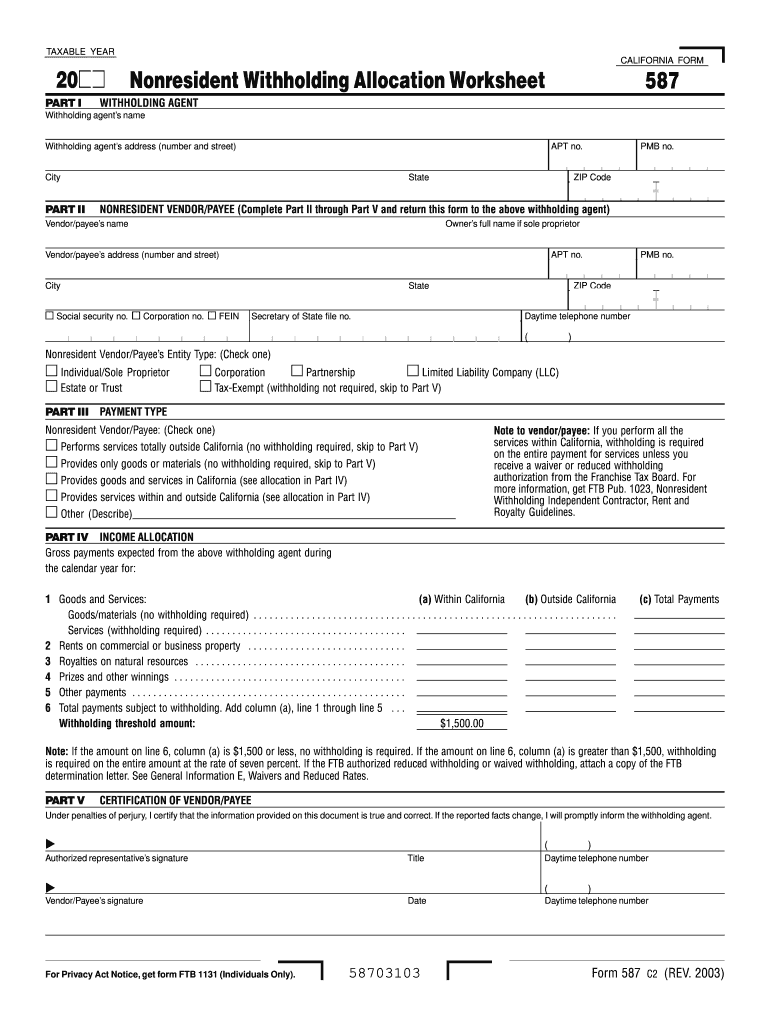

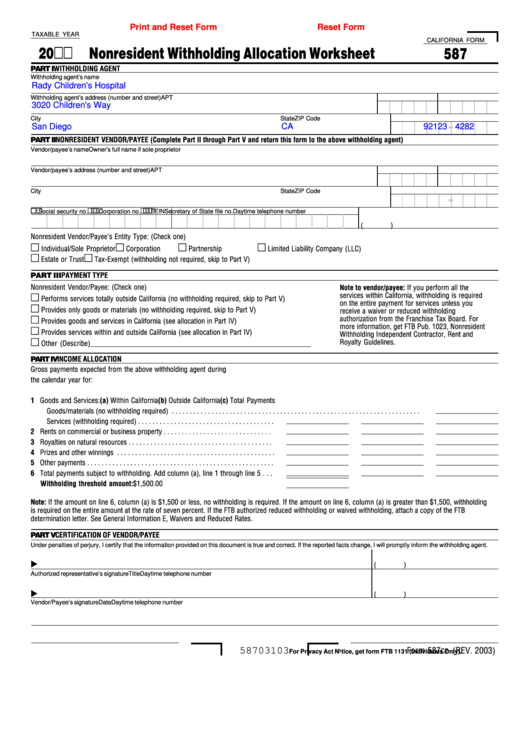

Ca Form 587 - Find out who is a. # the payee is a. Use form 587 if any of the following apply: This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb. Use form 593, real estate withholding statement. Signed form 587 is accepted in good faith. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. # you sold california real estate.

Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb. Use form 593, real estate withholding statement. Signed form 587 is accepted in good faith. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. Find out who is a. # the payee is a. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. Use form 587 if any of the following apply:

Find out who is a. Use form 593, real estate withholding statement. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. Use form 587 if any of the following apply: This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. # you sold california real estate. Signed form 587 is accepted in good faith. # the payee is a.

Picture of Folge 587

This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. Signed form 587 is accepted in good faith. # the payee is a. Use form 593, real estate withholding statement. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income.

FT 587

# you sold california real estate. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. Use form 587 if any of the following apply: Find out who is a.

2023 Form 587 Printable Forms Free Online

# the payee is a. # you sold california real estate. Signed form 587 is accepted in good faith. Find out who is a. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes.

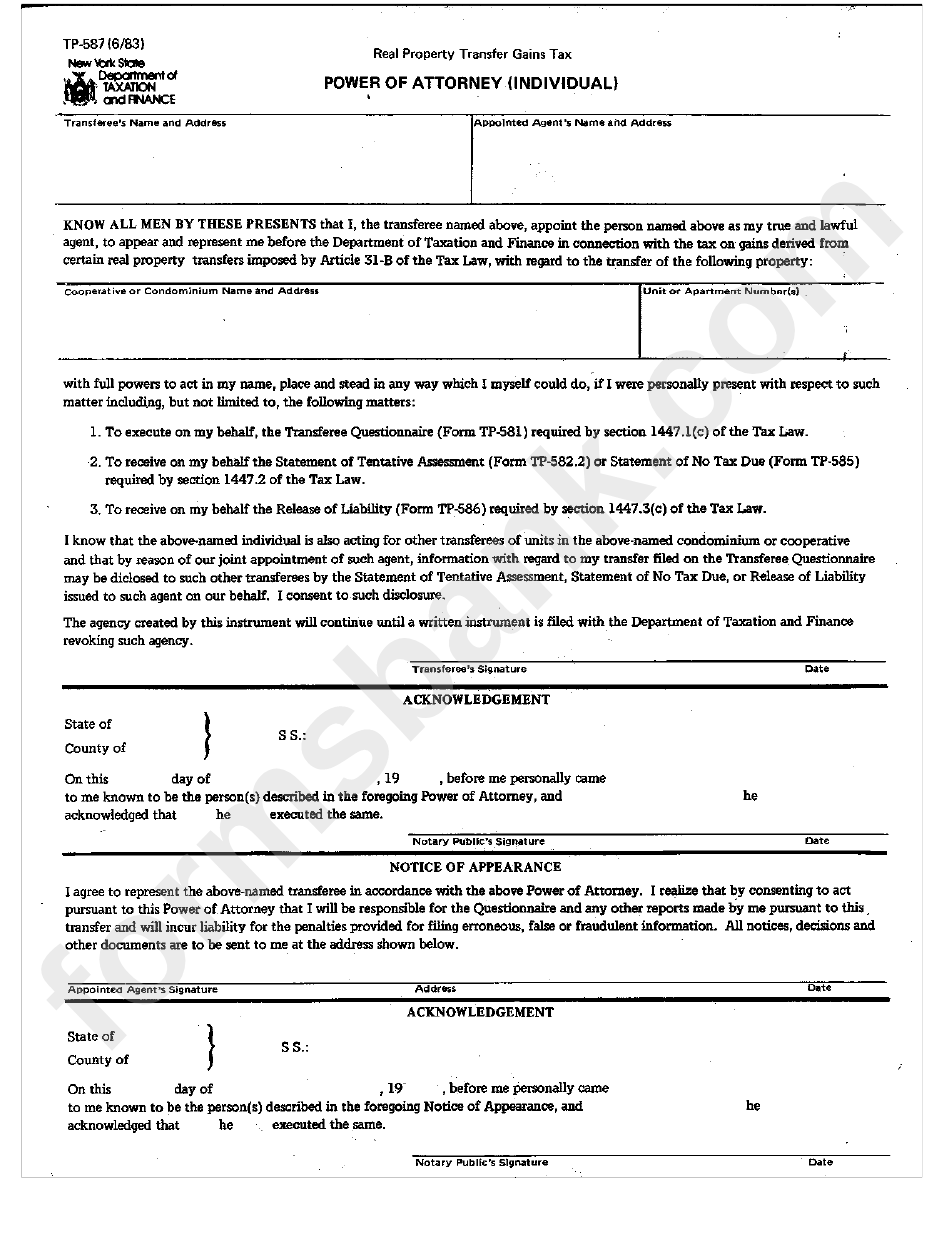

Form Tp587 Real Property Transfer Gains Tax Power Of Attorney

This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. Use form 587 if any of the following apply: Retain the completed form 587 for your records for a minimum of four years and.

Fillable Form 587 Nonresident Withholding Allocation Worksheet

# you sold california real estate. Use form 593, real estate withholding statement. Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. Use form 587, nonresident withholding allocation worksheet, to determine.

2011 CA Form 587 Fill Online, Printable, Fillable, Blank pdfFiller

Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb. Use form 593, real estate withholding statement. # the payee is a. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. # you sold california real estate.

Form Pc 587 ≡ Fill Out Printable PDF Forms Online

Use form 587 if any of the following apply: Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. # you sold california real estate. This form is used by nonresident payees.

Picture of Folge 587

Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. # you sold california real estate. Signed form 587 is accepted in good faith. Use form 593, real estate withholding.

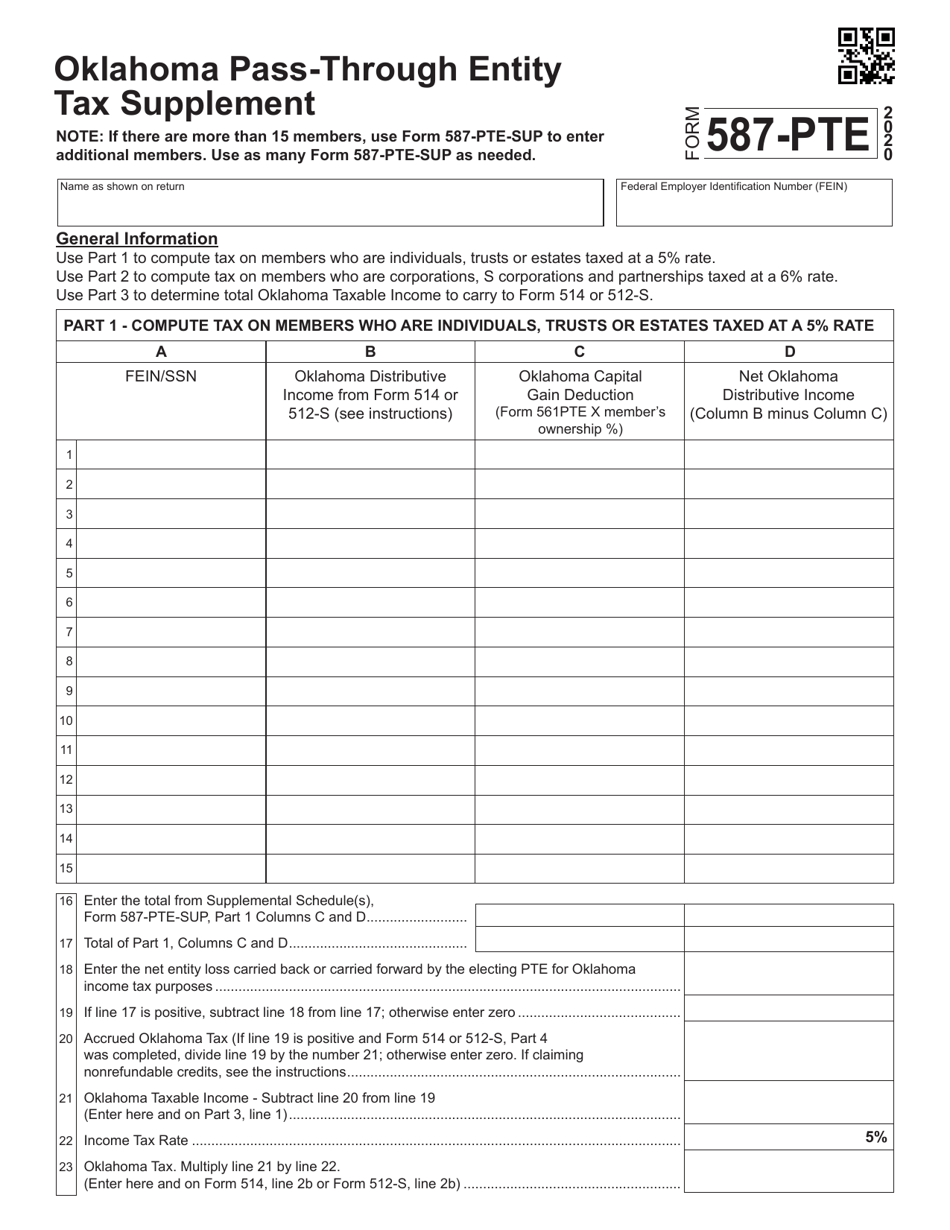

Form 587PTE Download Fillable PDF or Fill Online Oklahoma PassThrough

# you sold california real estate. Use form 587 if any of the following apply: Signed form 587 is accepted in good faith. Use form 593, real estate withholding statement. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes.

A Complete Overview of SMTP Port 25, Port 465, and Port 587 How To

# you sold california real estate. # the payee is a. Find out who is a. Use form 587 if any of the following apply: Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board.

This Form Is Used By Nonresident Payees And Withholding Agents In California To Calculate And Report Withholding Taxes.

Use form 587 if any of the following apply: # the payee is a. Signed form 587 is accepted in good faith. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income.

Use Form 593, Real Estate Withholding Statement.

# you sold california real estate. Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board.