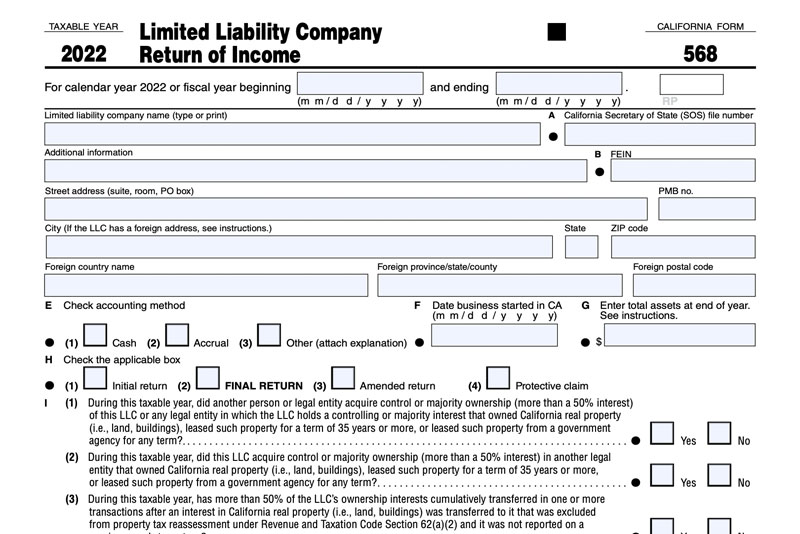

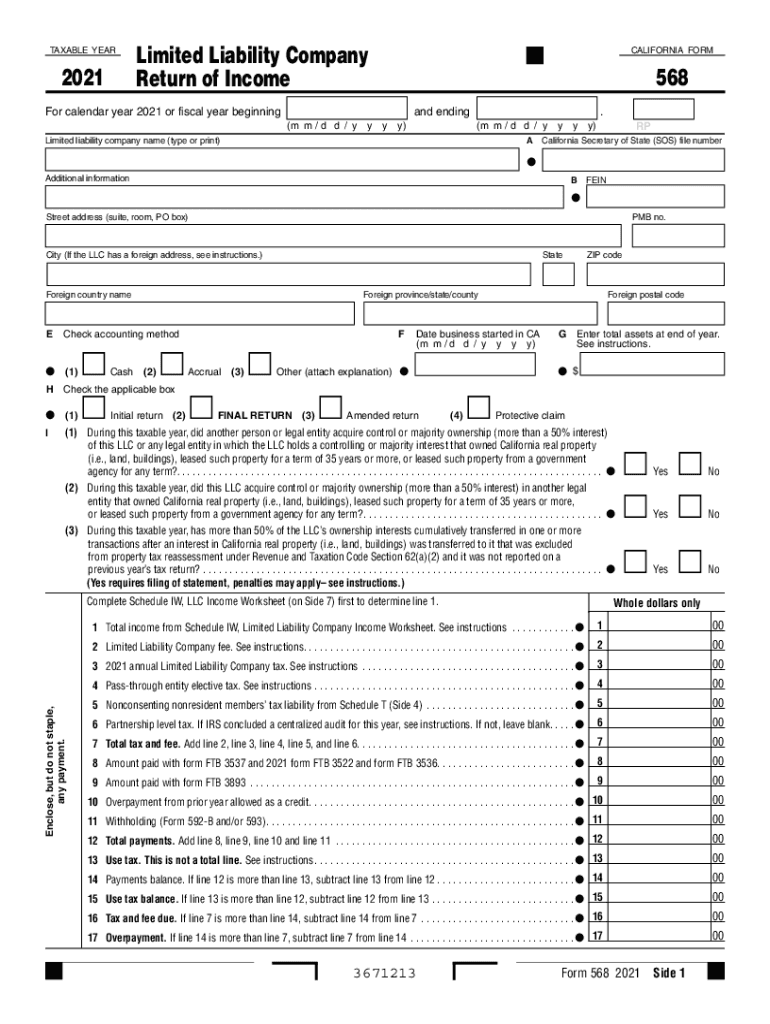

Ca Form 568 Instructions - The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total. References in these instructions are to the internal revenue code. You must file form 568 if your llc is registered in california, even if it isn't actively doing business in california or doesn't have a california source. This allows for fully calculating the return, extensions, filing instructions, and grouping of multiple federal activities into a single limited. 2022 instructions for form 568, limited liability company return of income. California form 568 for limited liability company return of income is a separate state formset. Form 568 is used to report the income and apportionment of a limited liability company (llc) that does business in california and other. It isn't included with the regular.

Form 568 is used to report the income and apportionment of a limited liability company (llc) that does business in california and other. It isn't included with the regular. References in these instructions are to the internal revenue code. You must file form 568 if your llc is registered in california, even if it isn't actively doing business in california or doesn't have a california source. This allows for fully calculating the return, extensions, filing instructions, and grouping of multiple federal activities into a single limited. The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total. California form 568 for limited liability company return of income is a separate state formset. 2022 instructions for form 568, limited liability company return of income.

2022 instructions for form 568, limited liability company return of income. References in these instructions are to the internal revenue code. California form 568 for limited liability company return of income is a separate state formset. You must file form 568 if your llc is registered in california, even if it isn't actively doing business in california or doesn't have a california source. It isn't included with the regular. Form 568 is used to report the income and apportionment of a limited liability company (llc) that does business in california and other. This allows for fully calculating the return, extensions, filing instructions, and grouping of multiple federal activities into a single limited. The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total.

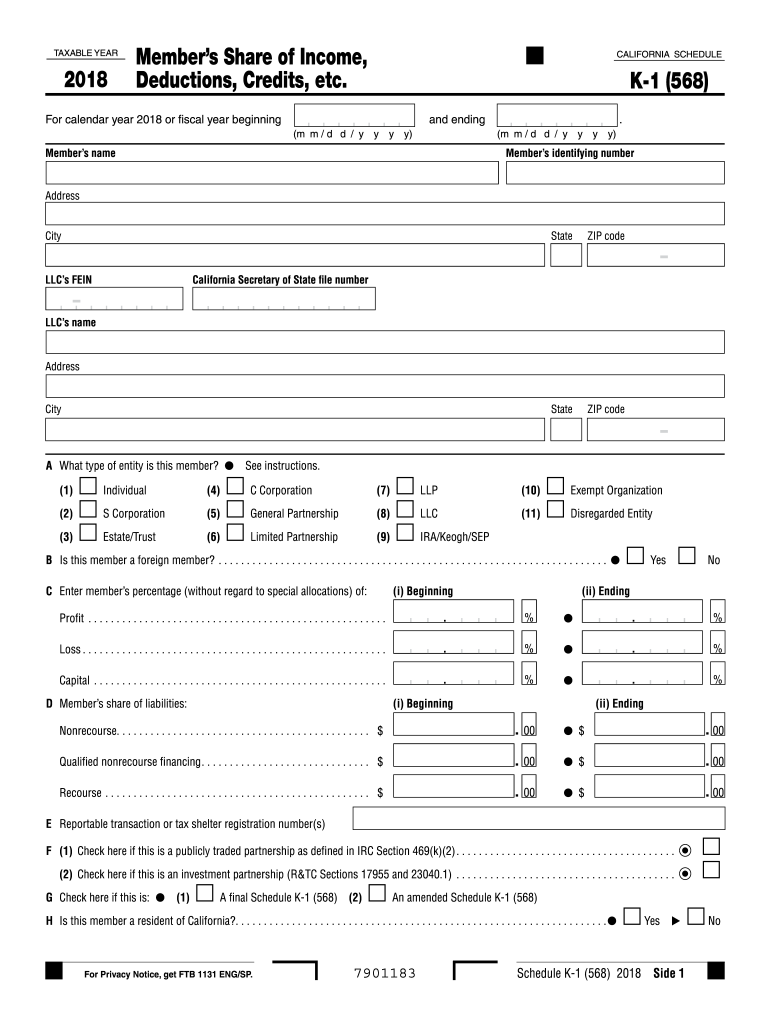

Ca 568 Instructions 20182024 Form Fill Out and Sign Printable PDF

References in these instructions are to the internal revenue code. This allows for fully calculating the return, extensions, filing instructions, and grouping of multiple federal activities into a single limited. It isn't included with the regular. Form 568 is used to report the income and apportionment of a limited liability company (llc) that does business in california and other. California.

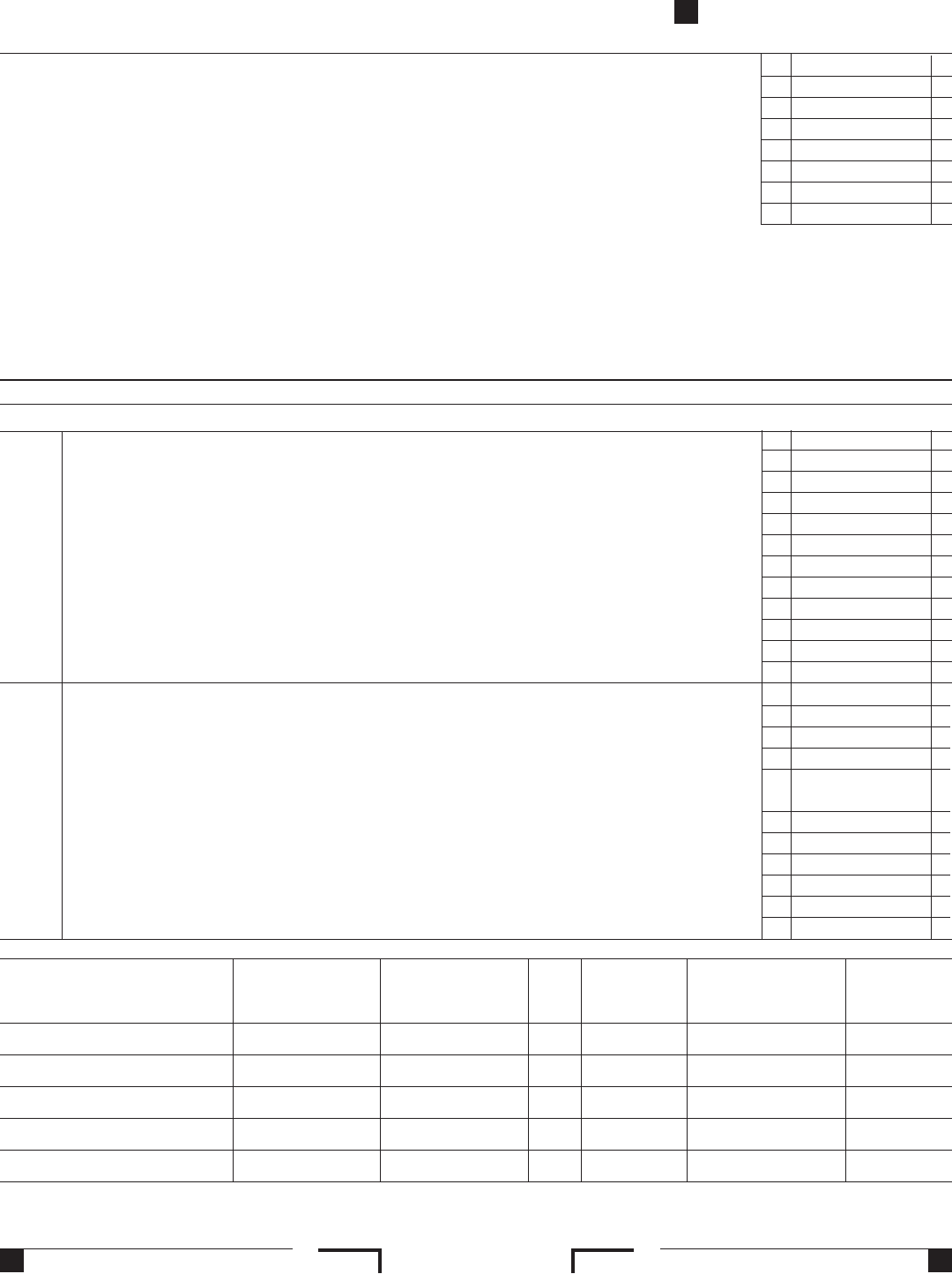

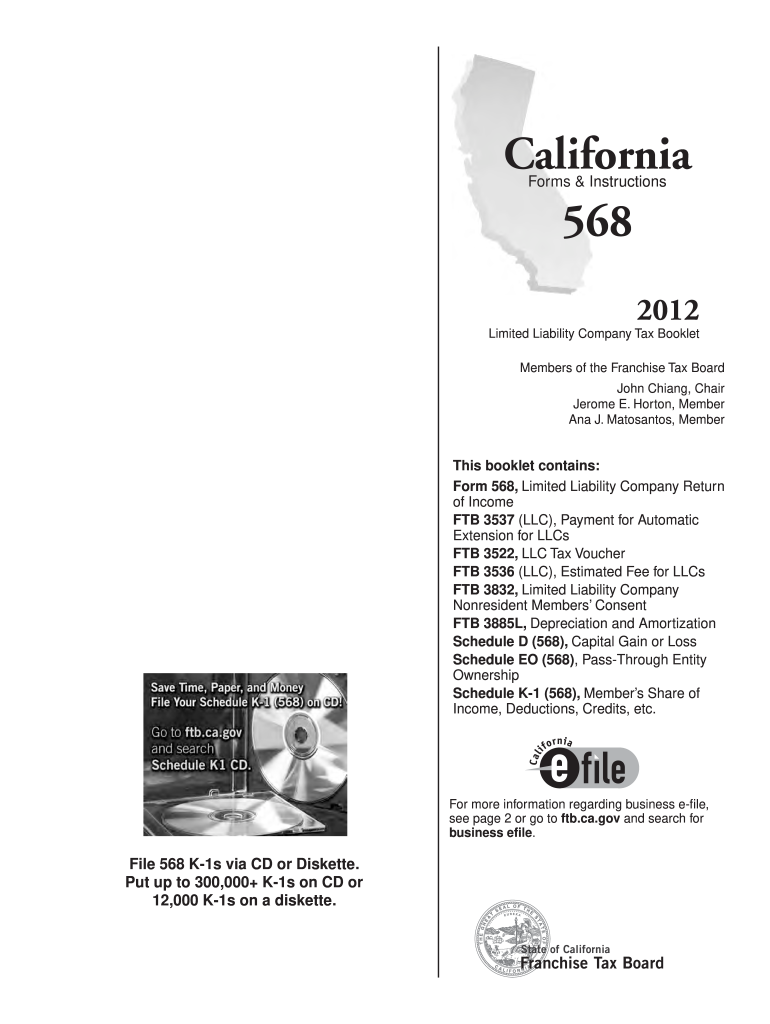

2012 Form 568 Limited Liability Company Return Of Edit, Fill

It isn't included with the regular. You must file form 568 if your llc is registered in california, even if it isn't actively doing business in california or doesn't have a california source. References in these instructions are to the internal revenue code. Form 568 is used to report the income and apportionment of a limited liability company (llc) that.

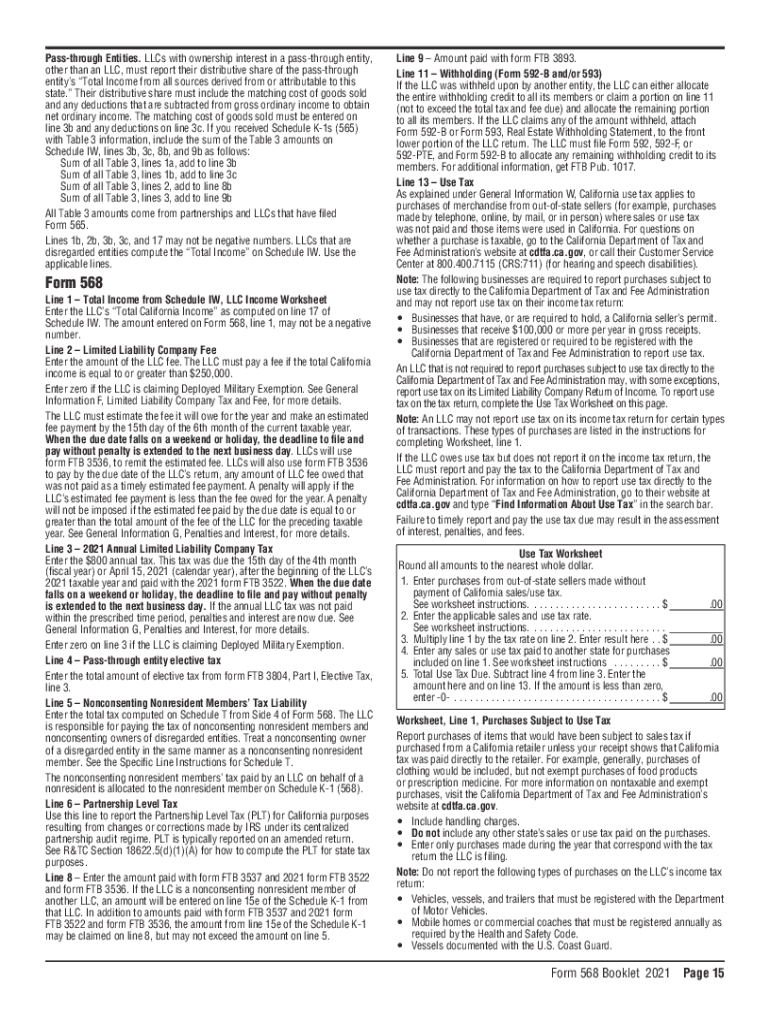

20212024 Form CA FTB 568BK Fill Online, Printable, Fillable, Blank

This allows for fully calculating the return, extensions, filing instructions, and grouping of multiple federal activities into a single limited. It isn't included with the regular. References in these instructions are to the internal revenue code. 2022 instructions for form 568, limited liability company return of income. The llc income worksheet on form 568, page 7 calculates according to the.

Form 568 Instructions 2024 Donni Gaylene

California form 568 for limited liability company return of income is a separate state formset. Form 568 is used to report the income and apportionment of a limited liability company (llc) that does business in california and other. It isn't included with the regular. This allows for fully calculating the return, extensions, filing instructions, and grouping of multiple federal activities.

Fillable Online Generating CA Form 568 in the partnership module of

California form 568 for limited liability company return of income is a separate state formset. The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total. You must file form 568 if your llc is registered in california, even if it isn't actively doing business in california or.

Ca 568 Instructions 20182024 Form Fill Out and Sign Printable PDF

It isn't included with the regular. You must file form 568 if your llc is registered in california, even if it isn't actively doing business in california or doesn't have a california source. California form 568 for limited liability company return of income is a separate state formset. References in these instructions are to the internal revenue code. This allows.

Instructions For Form 568 Limited Liability Company Return Of

References in these instructions are to the internal revenue code. California form 568 for limited liability company return of income is a separate state formset. The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total. 2022 instructions for form 568, limited liability company return of income. This.

Blank 2016 Ca Form 568 Fill Out and Print PDFs

The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total. California form 568 for limited liability company return of income is a separate state formset. This allows for fully calculating the return, extensions, filing instructions, and grouping of multiple federal activities into a single limited. Form 568.

Form 568 Instructions 2024 Donni Gaylene

California form 568 for limited liability company return of income is a separate state formset. References in these instructions are to the internal revenue code. It isn't included with the regular. This allows for fully calculating the return, extensions, filing instructions, and grouping of multiple federal activities into a single limited. You must file form 568 if your llc is.

2023 Form 568 Printable Forms Free Online

Form 568 is used to report the income and apportionment of a limited liability company (llc) that does business in california and other. It isn't included with the regular. The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total. You must file form 568 if your llc.

2022 Instructions For Form 568, Limited Liability Company Return Of Income.

References in these instructions are to the internal revenue code. The llc income worksheet on form 568, page 7 calculates according to the form 568 instructions booklet and is based on everywhere, total. This allows for fully calculating the return, extensions, filing instructions, and grouping of multiple federal activities into a single limited. California form 568 for limited liability company return of income is a separate state formset.

You Must File Form 568 If Your Llc Is Registered In California, Even If It Isn't Actively Doing Business In California Or Doesn't Have A California Source.

Form 568 is used to report the income and apportionment of a limited liability company (llc) that does business in california and other. It isn't included with the regular.