A Bond Is Simply A Form Of An Interest Bearing Note - A bond is simply a form. Click here to get an answer to your question: If the market rate of interest is 8% and a corporation's bonds bear. The total interest expense over the entire life of a bond is equal to the sum of the interest payments plus the total discount or minus the total. When the market rate of interest is less than the contract rate for a bond, the bond will sell for a premium. A bond is simply a form of an interest bearing note.

When the market rate of interest is less than the contract rate for a bond, the bond will sell for a premium. If the market rate of interest is 8% and a corporation's bonds bear. Click here to get an answer to your question: A bond is simply a form of an interest bearing note. The total interest expense over the entire life of a bond is equal to the sum of the interest payments plus the total discount or minus the total. A bond is simply a form.

A bond is simply a form. If the market rate of interest is 8% and a corporation's bonds bear. When the market rate of interest is less than the contract rate for a bond, the bond will sell for a premium. Click here to get an answer to your question: A bond is simply a form of an interest bearing note. The total interest expense over the entire life of a bond is equal to the sum of the interest payments plus the total discount or minus the total.

PPT Accounting for Liabilities PowerPoint Presentation, free download

Click here to get an answer to your question: When the market rate of interest is less than the contract rate for a bond, the bond will sell for a premium. A bond is simply a form. If the market rate of interest is 8% and a corporation's bonds bear. The total interest expense over the entire life of a.

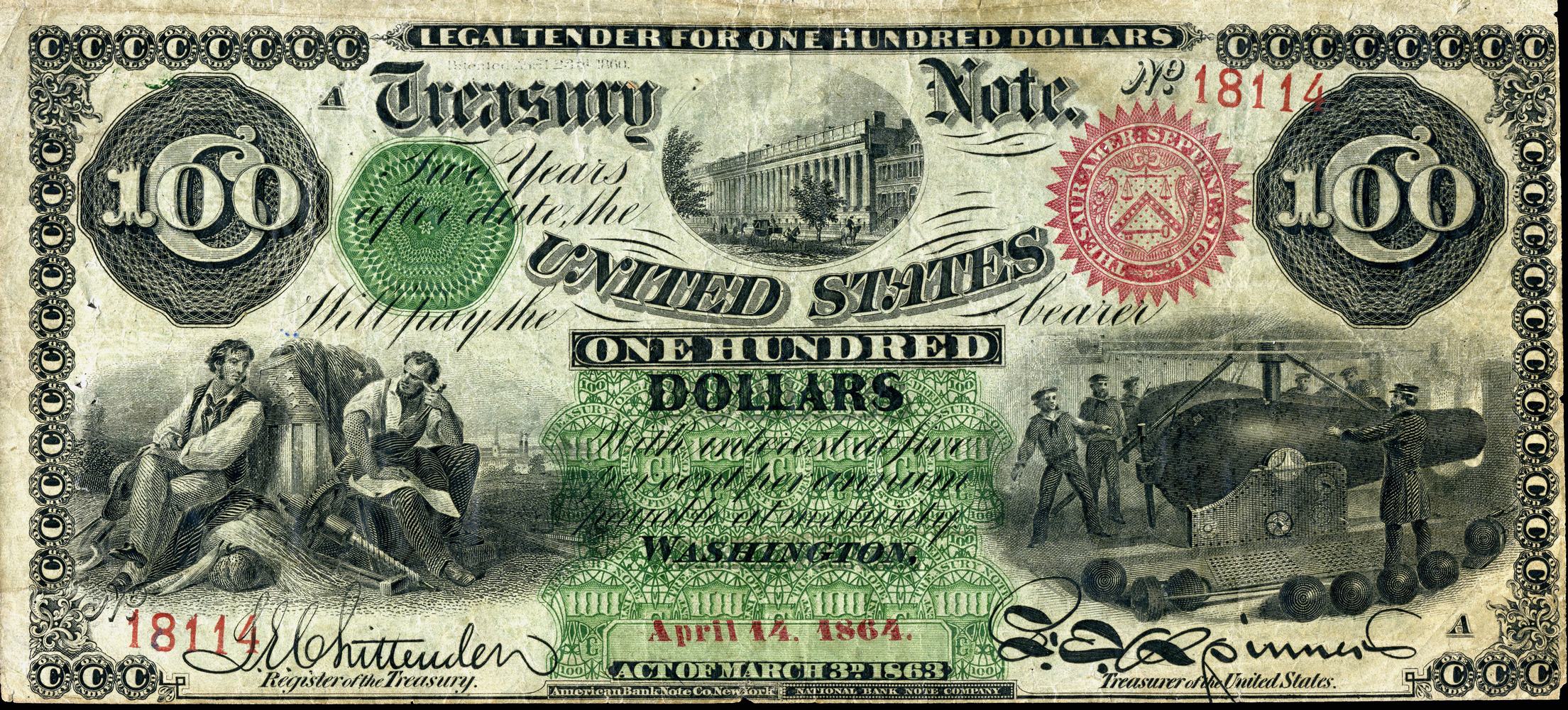

Currency Lesson 18 Interest Bearing Notes 1000 First Series July 17

Click here to get an answer to your question: A bond is simply a form. A bond is simply a form of an interest bearing note. If the market rate of interest is 8% and a corporation's bonds bear. When the market rate of interest is less than the contract rate for a bond, the bond will sell for a.

Solved TrueFalse TI. A bond is simply a form of an interest

When the market rate of interest is less than the contract rate for a bond, the bond will sell for a premium. If the market rate of interest is 8% and a corporation's bonds bear. A bond is simply a form of an interest bearing note. A bond is simply a form. The total interest expense over the entire life.

PPT Excerpt from What the heck is work anyway? by Alexander Kjuerulf

Click here to get an answer to your question: The total interest expense over the entire life of a bond is equal to the sum of the interest payments plus the total discount or minus the total. When the market rate of interest is less than the contract rate for a bond, the bond will sell for a premium. A.

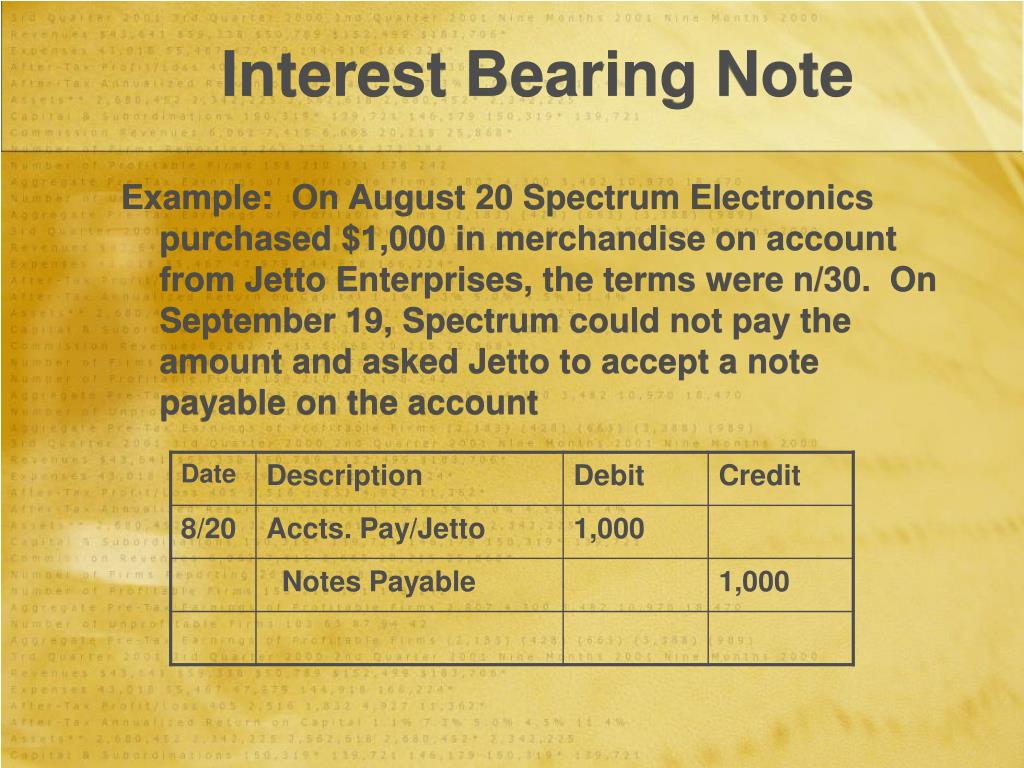

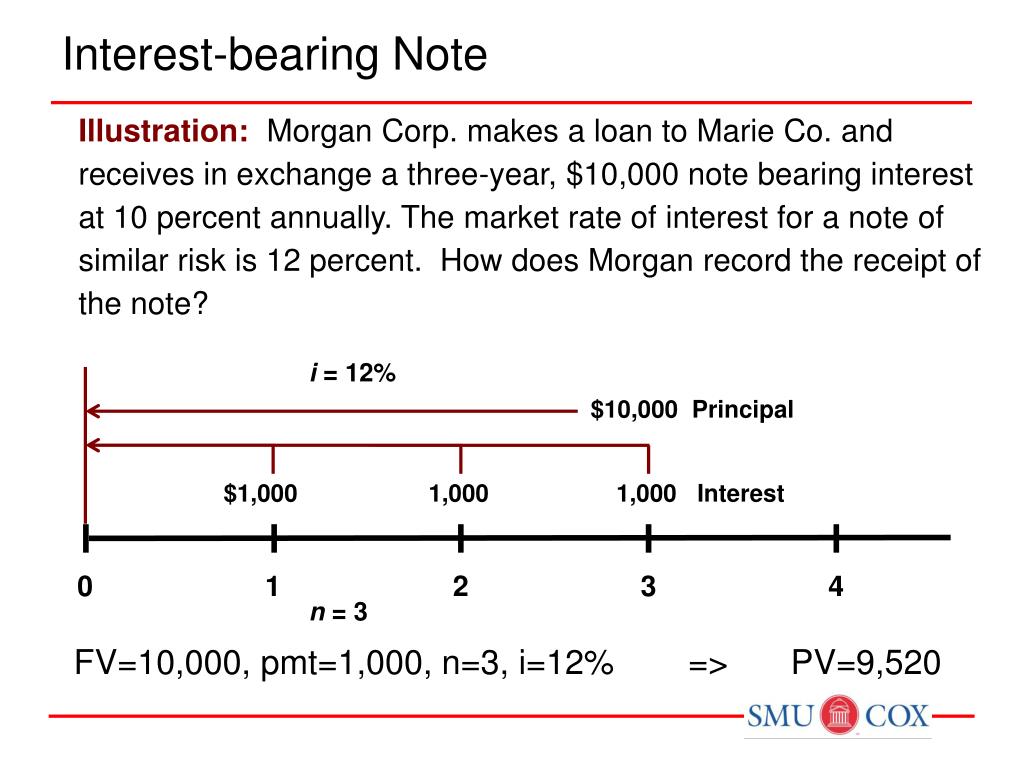

Interest Bearing Notes

When the market rate of interest is less than the contract rate for a bond, the bond will sell for a premium. A bond is simply a form of an interest bearing note. Click here to get an answer to your question: If the market rate of interest is 8% and a corporation's bonds bear. A bond is simply a.

Zero Interest Bearing Note Example YouTube

A bond is simply a form. If the market rate of interest is 8% and a corporation's bonds bear. A bond is simply a form of an interest bearing note. When the market rate of interest is less than the contract rate for a bond, the bond will sell for a premium. The total interest expense over the entire life.

Fr. 202a 50 1861 Interest Bearing Note Very Fine.... Large Size Lot

The total interest expense over the entire life of a bond is equal to the sum of the interest payments plus the total discount or minus the total. If the market rate of interest is 8% and a corporation's bonds bear. A bond is simply a form. Click here to get an answer to your question: When the market rate.

Interest Bearing Notes

A bond is simply a form. When the market rate of interest is less than the contract rate for a bond, the bond will sell for a premium. The total interest expense over the entire life of a bond is equal to the sum of the interest payments plus the total discount or minus the total. A bond is simply.

Bond Amortization Effective Interest Rate Method Wize University

Click here to get an answer to your question: The total interest expense over the entire life of a bond is equal to the sum of the interest payments plus the total discount or minus the total. A bond is simply a form. A bond is simply a form of an interest bearing note. If the market rate of interest.

Are bonds a form of interest bearing notes payable? Leia aqui Is a

When the market rate of interest is less than the contract rate for a bond, the bond will sell for a premium. If the market rate of interest is 8% and a corporation's bonds bear. Click here to get an answer to your question: A bond is simply a form. The total interest expense over the entire life of a.

Click Here To Get An Answer To Your Question:

A bond is simply a form. A bond is simply a form of an interest bearing note. The total interest expense over the entire life of a bond is equal to the sum of the interest payments plus the total discount or minus the total. When the market rate of interest is less than the contract rate for a bond, the bond will sell for a premium.